That’s a question we have been asked, on a number of fronts (and which we had been asking ourselves). So we’ve been doing a bit of digging, in amongst a number of other projects we’ll talk more about later.

In doing this, we’ve been very conscious of the “what would otherwise have been” challenge that dogs any number of challenging questions facing the energy sector at present, and very much present in this one as well. Please take this into account in thinking through what’s posted before – and also the general “never enough hours in the day” challenge that leads to these posts not being as clear (or as short) as they should really be.

1) Production from intermittent supplies (wind) in SA is being curtailed

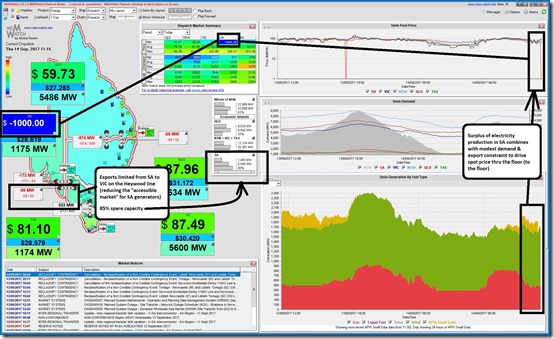

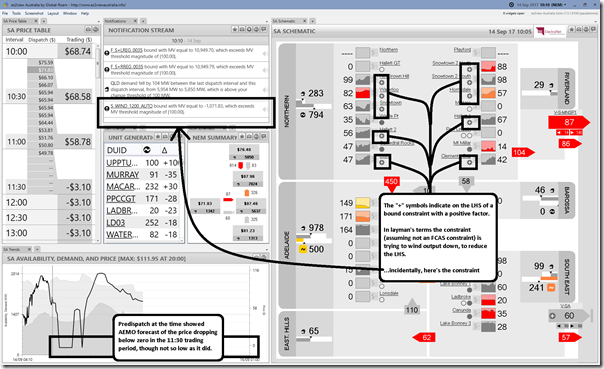

Yesterday (Thursday 14th September) I posted this snapshot from our NEM-Watch entry level dashboard on social media (e.g. Twitter) to highlight another occasion when a surplus of electricity production from wind and gas-fired plant in South Australia were combining to drive the price to the Market Price Floor of –$1,000/MWh:

This occurred a number of times through the day, and was not really a surprise given the disproportionate* number of wind projects incentivised to build in SA over the past 10 years because of factors such as:

1. a more streamlined & stable planning process; and

2. a better wind resource – leading to forecasts* for higher (unconstrained) yield – hence:

(a) better LGC revenues; and

(b) assumptions of* better “black” revenue because of the historically higher “all hours” price in SA.* I have already posted about a “wind correlation penalty” suffered by wind farmers across South Australia (using Infigen as an example).

Increasing curtailment will create a double-whammy (i.e. lower spot prices and lower volumes) that wind farmers in South Australia will suffer and probably did not factor into their business case for the project.

I’ll post more on what I see the root causes of this and link in here later…

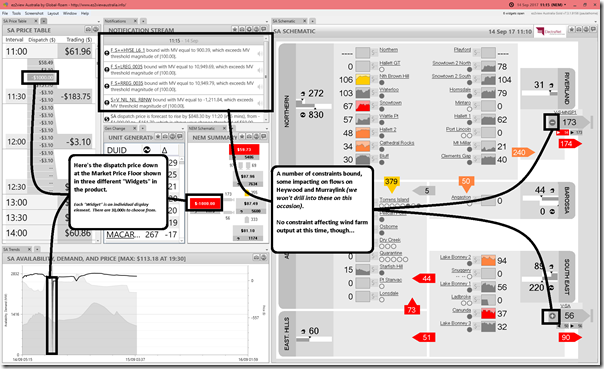

The dispatch interval I caught above in real time was the 11:15 dispatch interval (so 10:45 in Adelaide). A little later in the day, I used the Time-Travel** feature in ez2view software to produce the following, more detailed view of what was happening within South Australia at the time:

As noted on the snapshot of 11:15, there were constraints bound – but these were affecting flows east on Heywood (and other things), but not winding down output on the wind farms. A combination of the limitation of flow east and the high (unconstrained) wind production in SA drove prices down to the price floor.

** We’ve had a number of clients refer to ez2view as “NEM-watch on steroids”, and we can understand why.

In the “SA Schematic” widget above:

1) individual dots are units – they are coloured in if running, hollow if not. If subject to bound constraints, a “+” or “-“ symbol is shown (see the Heywood and Murraylink indicators) to show the sign of the LHS factor. Click through here [LINK TO COME] for a general explainer on how constraints work.

2) if we were looking at a prior Trading Day (or for clients pointed to their own MMS, including their Private Data in real time) the “$” symbols would light up to indicate a change in bids.

In Time-Travel, the display reflects market conditions at that time, including market forecasts that existed at that time (e.g. the P5 and P30 predispatch forecasts shown here).

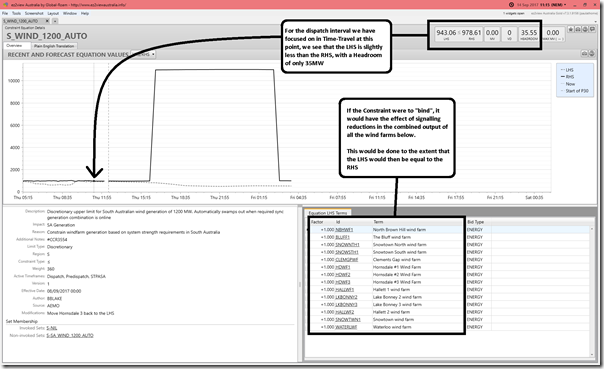

At this (11:15) dispatch interval, a view of the Constraint Equation details widget for the “S_WIND_1200_AUTO” constraint shows that it was had a small headroom (i.e. was not bound, but close):

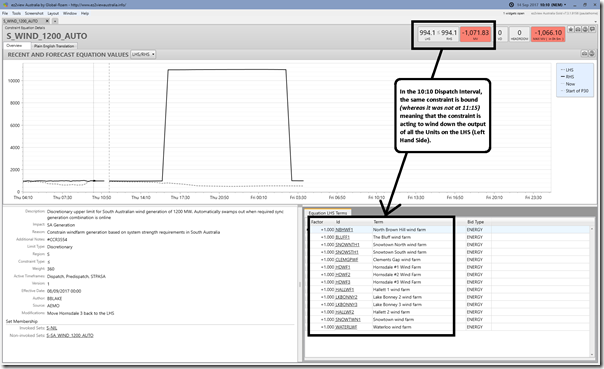

However there were a number of other dispatch intervals through the day when the wind farms were constrained down – such as the sampled instance here of the 10:10 dispatch interval on the same day (note the title bar changes colour to help highlight a different point in time):

Winding the other currently opened ez2view window back to the 10:10 dispatch interval reveals the way in which the constrained output at displayed wind farms are displayed:

A key point to note, here, is that the wind farms are producing less in the 2nd image (i.e. at 10:10) than they were in the first image (i.e. 11:15), and this is partly as a result of the AEMO curtailment. This reduced output has been one of the factors that will have contributed to a higher dispatch price in this second image. Sacrificing volume for a better price outcome (and hence better revenue) is something the other Scheduled Generators have long known about.

2) Wind farms are dispatchable!?

It seems that “dispatchable” generation was one of the “terms of the week”, last week in the fishbowl that resembles the energy sector.

(a) This has largely come off the back of the AEMO’s advice to the Government on “dispatchable capacity” released last week;

(b) Full marks to the Government on actually seeking this sort of plain-speaking advice from the AEMO in the first place (and for the AEMO in writing something in plainer English that has a chance of cutting through the toxic fog of vitriol that’s emerged from the slanging match ping-ponging from both ends of the Emotion-o-meter).

(c) However F for “Fail” to the Government*** for dropping the perspective within a week and going back to tired old workhorse terms such as “baseload” that should surely be retired soon, along with the old power stations that the term was used to describe.

*** Frequent readers will know that I have a very jaundiced view of the way in which the energy sector, and its vexed challenges, has been horribly let down by our political class for 10 years or longer. Those who attended my presentation at the Clean Energy Summit will understand a bit more.

I will post more about this at a later date and link in here.

I write this small tangent merely to point out (as was noted to me also) that the wind farms are technically “dispatchable”, to a certain degree, given that they have been dispatched down plenty of times in the past couple months. I suspect that AEMO had in mind a greater amount of controllability and regularity in their use of the term in the document linked above, however.

The main take-away is that I (and others) might use three terms interchangeably – “constrained down”, “dispatched down”, and “curtailed”.

3) Why are wind farms being constrained (i.e. dispatched down)?

Rather than get bogged down in more of an answer here in this post, I have published a brief linked post here that might start to answer that question.

4) How are they being constrained?

Again, I’ll flag today that I will add in later a more focused explainer [LINK TO COME] and link to it here. In the meantime, some of the details above should help, to some extent.

5) How much wind product has been curtailed

As noted above, there is always a “what would otherwise have been?” question that is inherent in any question of this nature.

This is particularly tricky for wind production as (because of their “Semi-Scheduled” nature), they produce whatever they can, when they can, except when AEMO needs to wind them back through constraints like this one. Inherent in this is that it’s essentially AEMO that has ultimate responsibility for working out what the possible production from the wind farms might be capable of (though wind farmers are required to submit data to AEMO’s AWEFS system to help make this happen).

Hence there is really some challenge in understanding what a wind farm might have been capable of delivering had it not been constrained – it’s not the volume the wind farm bid to the market, for instance, as the Semi-Scheduled arrangements allow them to effectively be a bit “lazy” in their bid volumes (i.e. putting the onus on the AEMO to work out what their “real” capability is). Hence it’s taken us a bit of grappling to come up with a logic what (we think) works reasonably well, though is certainly not perfect. If you contact me offline (tel +61 7 3368 4064), I’d be interested to explore your ideas for other potential methods of determining this?

5a) A trended view of curtailment

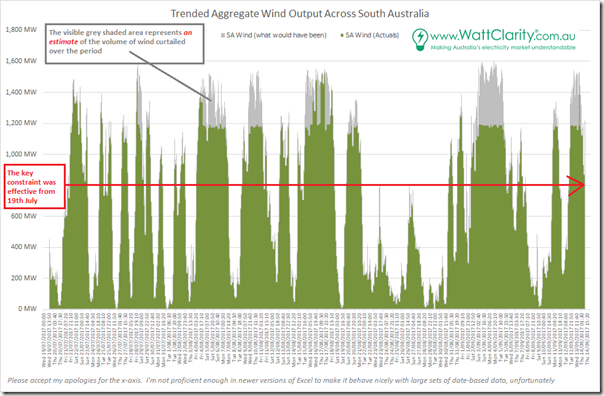

We picked the 19th July to begin this analysis as it was on this day that the “S-SA_WIND_1200_AUTO” constraint set (containing the “S_WIND_1200_AUTO” constraint equation) became effective – though note that this is a little arbitrary, as constrained output was happening on occasions before that (though June was a bad month, for other reasons). With a 19th July start date, this meant that the 8 week “anniversary” passed on Wednesday 13th September. Given the questions we’ve received recently (and the fact that we’ve other things to focus on for a while), I thought it would be timely to review what’s happened.

During this period:

31st July Here’s a brief post on 31st July I made about another instance of prices down at the price floor (but a reminder about high FCAS prices). 5th August I posted briefly on 5th August about one particular instance where outputs were constrained Other times There are a couple interesting incidents we know about that we might (if time permits) include as Case Studies and link in here. The effect of this particular constraint equation can be seen in the two trends superimposed on the one chart below – the green shows wind (actual output) whilst the grey shows an estimate of “what might have otherwise been”, except for the binding of that constraint equation:

As noted a number of times before on WattClarity, output from aggregate wind has varied markedly – down to practically 0MW for a number of periods and up to almost 1,600MW (noting the peak of 1,540MW seen on 26th April).

5b) Aggregate volume curtailed, over 8 weeks (from 19th July to 13th September)

Summing up the area of the grey area visible in the chart (note that it’s not exactly a midnight-to-midnight range) above provides an approximation that there have been 65,746 MWh of possible wind production curtailed over an 8 week period.

.

5c) Putting this curtailment into context

This 65,746MWh of wind-powered electricity that could not be produced compares to other metrics for South Australia over the same period as shown in the following table:

Data set Aggregate Volume Percentage SA Wind (what would otherwise have been) 1,073,611 MWh This averages to 799 MW constant output for 24 x 7 x 8 weeks.

The wind curtailed represents 6.1% of this volume – not a trivial amount. SA Wind (actual) 1,007,865 MWh This averages to 750 MW constant output for 24 x 7 x 8 weeks – or, to put it another way.

Or, to put it another way, the curtailment represents 49 MW of constant output (or a 140 MW wind farm at 35% capacity factor).

The wind curtailed represents 6.5% of this volume. So production could have been 6.5% higher.

SA “Operational Demand” volume I’LL COME BACK TO THIS AND UPDATE LATER TO BE ADDED Unfortunately that’s all I have time to post about today on this topic…

Great analysis Paul. Based on your estimate, LGC spot revenue foregone for those wind farms is roughly $5.2 million! This, plus increased SA spot prices for consumers makes it an expensive constraint for those involved. Be interesting to see what a cost-benefit analysis of the (seemingly arbitrary) constraint would show…

If the wind farm owners are waiting for AEMO to change these arbitrary rules in their favour, they will be waiting a long time because AEMO is under so much other pressure from government. Instead they should contribute and fund a trial, possibly with ARENA support, as Hornsdale wind farm are doing to test the new big battery and the wind farm’s capacity to offer FCAS. It is only through the dedicated short term resources of a trial that there will be enough evidence to convince AEMO that a new set of operating rules will work.

At the time some of the more recent wind farm investments received financial close, there was an AEMO/Electranet project to increase the SA-Vic capacity of the Heywood inter-connector to 650 MW. Yet AEMO continue to impose a 500 MW constraint, citing frequency problems. So they haven’t delivered on their project. Any other contractor would be in legal problems for under-delivery.

The 1200 MW rule is perhaps a boon for wind farms, because although their volume is constrained prices remain strong, whereas without the rule the SA market prices would crash because of the 500 MW Heywood link constraint.

One would hope that with more batteries in SA to maintain frequency AEMO would relax the 1200 MW rule, and allow the Heywood inter-connector to operate at the promised 650 MW, or perhaps even its line thermal capacity of 1150 MW.

You could use non-scheduled wind as a proxy for SS output. The old non-scheduled WFs are less productive though.

Wind farms are both downward and upward dispatchable. On short time scales, a curtailed wind farm can be confident of its ability to move its output up. Likewise for solar PV.

The term “dispatchable” used to (by default) refer to the ability to “dispatch” units to run or not run on command. The term was developed when all generating units had constant access to fuel. The wind energy’s co-opting of the term and bastardizing it’s ,meaning by parsing it from the concept of system adequacy contribution was clever but immoral in intent and in practice. Private enterprise excused from morality is cancerous and ruinous to societies.

This is useful in understanding the constraint. While noting the lost LGC revenue above, I’m curious as to how many of the constrained half hours occur in the wee-early hours, given SA is notorious for having the wind blowing overnight when demand is at minimum. As such how many have actually prevented generation at what would have been low (or even negative) energy price?