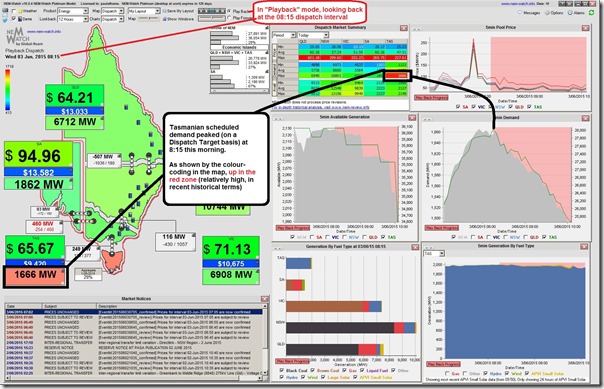

Given our ongoing interest to many things related to electricity demand (including how cool weather impacted “summer” peak demand in Tasmania) it did not pass our notice that Tasmanian demand, over the last few mornings, has crept up towards the red zone – as seen here in this snapshot from NEM-Watch earlier:

In contrast to the other regions on the map (all in the green zone) we can see the Tasmanian demand relatively high (up to 1666MW), in historical terms.

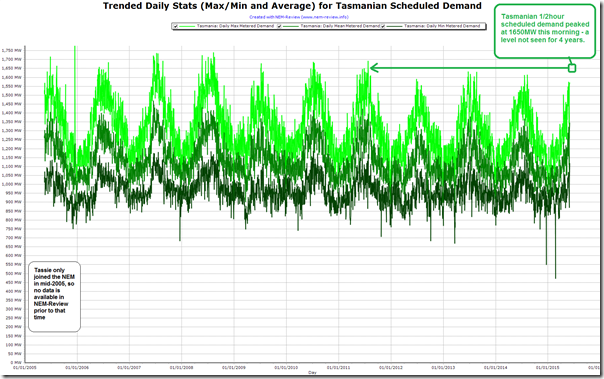

Powering up NEM-Review, all we have time to do this morning is generate this trend of daily demand patterns over 10 years of NEM history for the Tasmanian region:

This chart uses Trading (half-hourly data). In the chart we can see that the scheduled demand in Tasmania has not exceeded 1650MW since 2 half-hours in winter 2011. Looking at what happened this morning on the same basis (i.e. using half-hourly data) we see Tasmanian demand for the 08:30 trading period was 1650MW.

Hence, early this winter we have seen Tasmanian demand peak at levels not seen for 4 years.

There’s been a fascinating sequel to this high Tasmanian demand. On Thursday I recall the Victorian spot gas price hit $10/GJ during a cold snap, and peak power prices up to about $90/MWhr. There was an almost complete absence of gas peaking generation across SA, Tas, Vic and NSW. Wind was a strong contributor, providing up to 1000 MW each in SA and Vic, and peaking being provided almost entirely by hydro, despite very low dam levels at 2 of Tasmania’s largest power stations. The only gas units operating over this period were Osborne and a couple of units simmering at Torrens Island.

Then on Sunday a fire shut down SA’s Northern power station, but its contribution wasn’t missed because there was about 1000 MW of wind power in SA. This was more than the market could absorb, because there were extended periods of negative power prices in SA on Sunday afternoon and much of the Monday public holiday. Surprisingly, during this period of negative power prices there was minimal export of power to Victoria. Is a failure of the market bidding process ?

Thanks Malcolm

Yes, it has been interesting to watch (but unfortunately no time to post more, this time).

Cheers

Paul