Key takeaways:

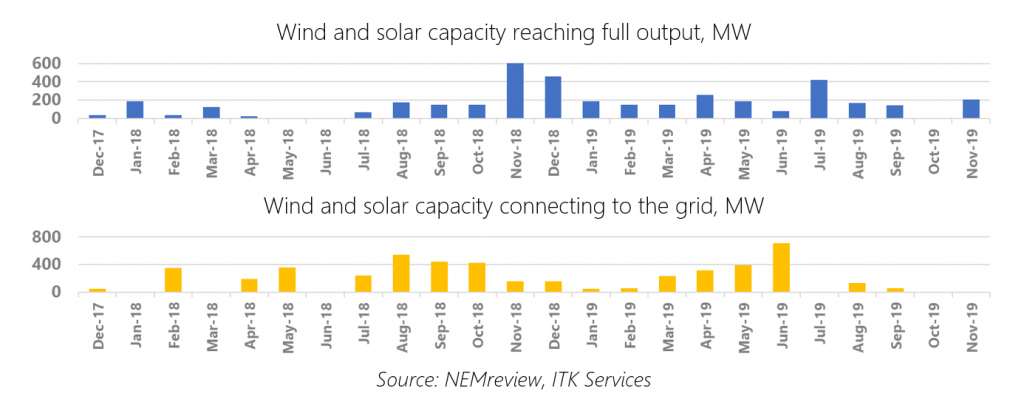

- Commissioning activity has been strong in 2019 – lots of new capacity has hit full output, with ramp-up and testing periods for completed projects on a par with previous years

- But recent commissioning is slower than we anticipated: wind projects currently progressing though the process are taking longer than average

- Grid connections have slowed down, with 1 GW less energised this year compared to last

- Construction is not the problem – physical build times seem to be speeding up, especially for solar

- That leaves us with grid connection problems, most likely due to the sheer scale of activity facing both network service providers and the market operator

- We therefore expect a slower schedule for the 4.8 GW currently under construction – but it is coming

Background

The recent growth in utility scale renewables in Australia has clearly been a massive success: 5.4 GW connected over the past three years is good going, and at ITK we continue to emphasise to clients how this is pushing down wholesale electricity prices.

However, the pointy end of project development has been clouded by a lot more negativity over recent months than we remember seeing for a while. There are longer term concerns: MLFs, future market redesign and, dare we say it, federal energy policy are all keeping people awake at night. But over the nearer term, with a large stock of projects under construction, the anecdotal chat has been around difficulties connecting to the grid.

So using our detailed knowledge of renewable projects and with the help of NEMreview’s unparalleled data set we decided to dig in and see what’s going on.

Commissioning stays strong, but connections drop

We estimate that 2 GW of wind and solar capacity has been fully commissioned in 2019. Estimating this is not as easy as it may sound, as we rarely get official confirmation of the commissioning date of a project. So we use NEM Review’s project level production data to estimate when each project is operating at an unrestricted level. Typically we consider a plant to be unrestricted if it’s output level is consistently at or above 85% of notional capacity (although this will vary by season for solar).

Commissioning performance in 2019 has been on a par with the previous year’s total of 2.1 GW. And while we saw no new capacity fully commissioned in October, over 200 MW has been commissioned in November as Finley solar farm in New South Wales and Clermont solar farm in Queensland have both hit their straps. This makes November the fourth largest month for commissioning over the past two years.

So far, so good. But what about new connections (energisaions) to the grid, and why the October hiatus in commissioning?

In contrast to commissioning performance, energisations are well down on last year. So far, 1.9 GW of wind and solar has been energised, so we can safely conclude that grid connections will be no match for the 2.9 GW connected in a record breaking 2018. However, on the plus side 2019 has still featured the busiest single month for grid connections, with a stunning 708 MW connected in June.

The slow-down in new projects is most apparent in the monthly data, with nothing connected in October or November, and in fact only 188 MW energised in the second half of the year (so far).

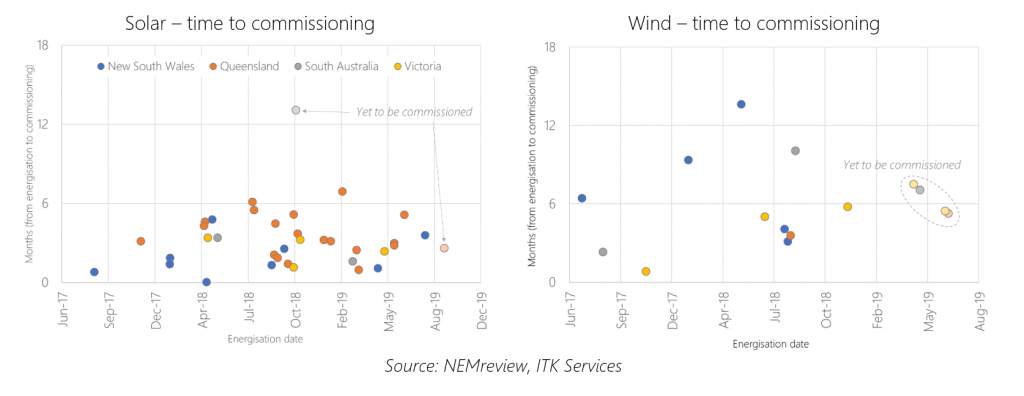

This is our first clue to what happened in October. On average over the past two and a half years, it has taken 3.3 months for a solar farm to progress through the commissioning process, and 5.6 months on average for a wind farm. With the absence of new connections in July 2019, it should probably be no surprise that no capacity reached full output in October, three months later. And with no grid connections in October and November, we can probably expect a quiet January and February from a commissioning perspective.

But we saw a major surge in energisations in June 2019, which has to ramp up to full capacity at some point – so is the commissioning process slowing down?

Despite the wide range of commissioning performances, the trend for solar is downwards for most states – Queensland, which of course has the largest number of utility solar plants, is experiencing slightly faster average commissioning timeframes in 2019 than the previous year. The same is true for South Australia and Victoria, although the much smaller sample sizes make it hard to draw concrete conclusions. Projects in New South Wales have experienced longer testing periods on average for this year compared to last, but both projects fully commissioned in 2019 were still done in well under 4 months.

Despite the wide range of commissioning performances, the trend for solar is downwards for most states – Queensland, which of course has the largest number of utility solar plants, is experiencing slightly faster average commissioning timeframes in 2019 than the previous year. The same is true for South Australia and Victoria, although the much smaller sample sizes make it hard to draw concrete conclusions. Projects in New South Wales have experienced longer testing periods on average for this year compared to last, but both projects fully commissioned in 2019 were still done in well under 4 months.

Wind plants take longer to move through the commissioning process than solar, most likely due to their larger average capacity, and the nature of bringing individual turbines online. Since June 2017 wind commissioning timeframes have ranged from under one month up to 14 months. And while new wind project commissionings have been few and far between compared to solar, the second half of 2018 saw several projects come in well under this average.

But a key issue here is the time it is taking to commission wind plants which have been energised in 2019 but not yet commissioned. Four wind plants – with a combined capacity of almost 1 GW – are currently progressing through commissioning, all of which are either close to or have already exceeded the average wind testing period (as calculated using the number of days from energization to the time of writing).

So while the commissioning process seems to be having only a limited impact on solar project capacity reaching the market, it is having a more acute impact on wind. And given the larger average size of wind projects, this is showing up in the commissioning data. Longer testing periods for wind help explain why the June spike in energisations is not yet flowing through into full capacity in the NEM.

Grid connection is the challenge

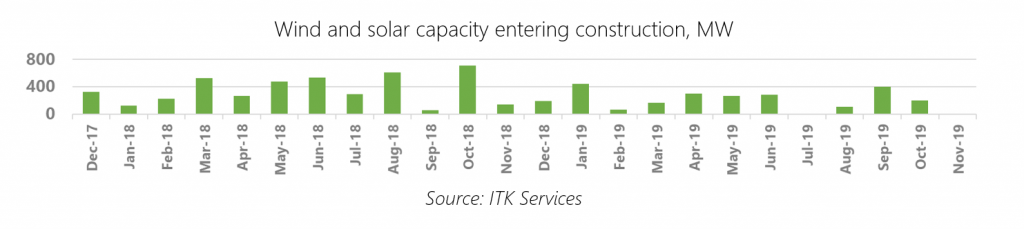

But why has energised capacity dropped off so much in the second half of the year? Project construction certainly hasn’t dried up: we estimate 4.8 GW of utility wind and solar is currently being built, which is equal to the total capacity connected to the grid over the past 2 years.

Construction activity has slowed down: 2.2 GW of new capacity entered construction in 2019 compared to the staggering 4.2 GW in 2018. But 2 GW+ in a year still strikes us as a healthy growth rate.

Construction activity has slowed down: 2.2 GW of new capacity entered construction in 2019 compared to the staggering 4.2 GW in 2018. But 2 GW+ in a year still strikes us as a healthy growth rate.

(We need to add another caveat here. Estimating construction start dates is a dark art, as there are various different triggers we can use, and relatively few public announcements. We consider a contractor’s notice-to-proceed (NTP) as sufficient, although in reality actual work on the ground may not occur for several months. And preparatory tasks conducted under an ‘early works’ arrangement muddies the data waters for us – we do not include it as construction, although we recognize that it can speed up the actual build time once NTP has been given.)

July and November 2019 are the only months over the past two years that have featured no construction starts for wind and solar. But with such a large stock of projects currently being built, and significant construction activity in the final quarter of 2018, perhaps construction delays are responsible for the slowdown in connections.

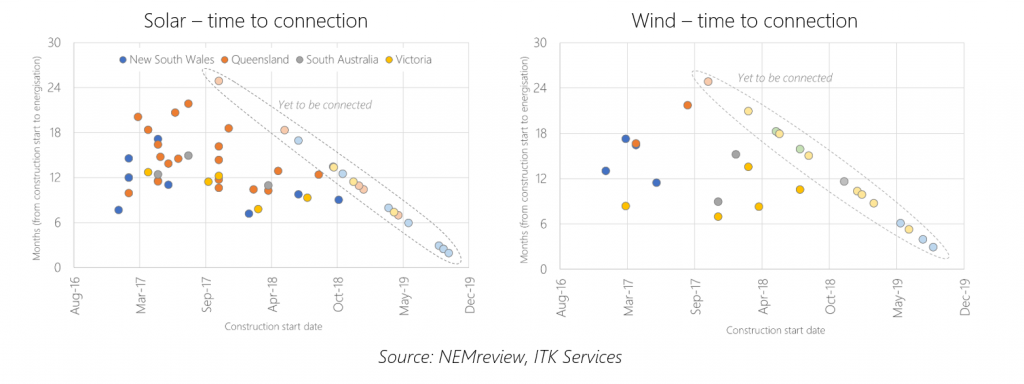

On average since the beginning of 2017, it has taken 13 months to get a solar farm from the start of construction to energization (bearing in mind our earlier point about the difficulty in estimating accurate construction start dates). The absolute minimum has been seven months, with the maximum an eye-watering 22 months. Of the 35 connected solar plants we’re looking at over the period in question, 15 were constructed and connected in under a year.

In general solar construction timeframes have been getting faster in all states, which is perhaps no surprise given how fast construction contractors in Australia had to get up the learning curve. Projects that commenced construction in 2017 took an average of 14 months to be built and connected; this fell to 9 months for projects that started in 2018.

However, none of the projects which have started construction in 2019 have yet been energised. There are currently 20 utility scale projects under construction, and the average construction time so far has been 9.5 months. This is already longer than the average for projects completed in 2018, and we need to remember that the 2019 average is dragged down by a selection of projects that were started very recently. Of the 20, six have already taken longer than 13 months, with three projects either approaching or exceeding 18 months.

The story is similar for wind. The average construction time for completed wind projects in our sample is 12 months – surprisingly, faster than solar. But projects currently under construction that are yet to be energised are lagging well behind this average. The average construction period to date for wind plants currently being built is already 12.6 months. And if we look at projects which commenced in 2018 (accounting for 1.5 GW of capacity), the average build time blows out to 17 months.

Is construction really taking longer for the current crop of projects? For solar, we suspect not. We can observe build times for recent plants such as Beryl, Finley, and Numurkah of approximately 9 months, along with similar performances for some solar farms completed in 2018. So while we acknowledge that each project is unique and will face it’s own specific challenges, we see little reason why physical completion for an average project should extend beyond 12 months.

This leaves us with grid connection problems. Solar projects are entering construction – albeit at a slower pace – and there is some evidence to suggest construction times are getting quicker. But proponents are struggling to get them connected.

Wind is perhaps more complicated – some of the projects currently being built are very large, which may influence average construction times. It probably should not be surprising that construction at the 530 MW Stockyard Hill wind farm has taken 18 months to date, when the 435 MW Coopers Gap project took 22 months to complete.

With wind accounting for such a large slab of current construction projects – 2.9 GW, or 60% of the total – and with a larger average wind project size compared to solar (191 MW compared to 98 MW) – we suggest that wind project construction times, plus solar grid connection problems, are the primary reasons for the current slowdown in energisations.

What about the near-term outlook? Get in touch if you would like to talk specifics. We forecast 5.8 GW of projects that are either under construction or otherwise committed to development, and we apply construction and commissioning timeframes that are informed by our analysis of current project performance. Most of this capacity will come online gradually over the next 18 months, with a strong focus on Victorian wind, and New South Wales solar.

And what impact will this new supply have on price? Well that’s one for another time, but if you can’t wait, drop us a line at ITK to discuss how we can help you understand the future of the NEM.

——————————————-

About our Guest Author

|

Ben Willacy is a consultant and analyst at ITK Services.

Ben has 18 years experience in global energy sector analysis, with experience across renewables, oil and gas, and coal. He co-founded Sustainable Energy Research Analytics (SERA), creating and maintaining the SERA Tracker product providing data and analysis on Australian wind and solar developments. Prior to this, Ben led Wood Mackenzie’s global coal supply team. You can find Ben on LinkedIn here. |

Leave a comment