Opportunity cost is a crucial yet sometimes overlooked and even misunderstood concept, which has a significant impact on wholesale electricity prices.

This is the first in a series of three posts that explain how the economic concept of opportunity cost affects wholesale electricity prices – that is, how fuel and operating limits cause wholesale electricity prices to be higher or lower than variable cost and why this causes the bids or offer prices of some resources to be a function of every other bid and offer in the market.

In this first post, I will show how generators in the NEM operate in line with this concept in their spot trading activities, whether they are familiar with it or not. In the next post, I’ll list the ways in which opportunity cost plays an increasingly important role in forming wholesale prices as the transition deepens. Finally, the insights in the first two posts have policy implications, which I’ll talk about in my third and final post.

Please note that I’ve included a list of published articles and a webpage in my sources section at the end of the post that provide more detail on the topics covered.

Simple models of electricity markets omit opportunity cost

A simplified explanation of how competitive wholesale markets for electricity work in a 20th century context (ie at the time electricity markets began) posits that generators price their generating capacity according to variable cost – the cost of their fuel. At the bottom of the offer stack (equivalent to a supply curve) is variable renewable energy, then comes brown coal, then black, then gas and lastly distillate-fuelled generating units. The implication of this model is that the price of electricity in any trading interval should be equal to the cost of fuel of the marginal generator dispatched to produce it (this being how wholesale prices are determined).

Like many explanatory models, this one presents an ideal set of circumstances that oversimplifies reality. It suggests that, under ideal conditions (ie perfect competition), the generators require compensation equal to holding fuel at cost. However, no market experiences ideal conditions and the operation of suppliers are inevitably subject to operational constraints and uncertainty about current and future prospects, which conspire to require them to submit offer prices that diverge from variable cost at times. However, despite competition being weak enough to profitably do so, there are conditions when it is efficient (ie it is also in consumers’ interest) for generation to be priced above (or below) variable cost.

In fact, looking at it the other way, it is efficient for generators to offer their generating capacity at variable cost only if they:

- have low variable costs (ie low enough in the stack that infra-marginal rents recover all their fixed costs)

- are never short (or expect to be short) of fuel

- are never switched off or are capable of ramping up to full output in one dispatch interval and ramping down from full output and switching off in a single dispatch interval.

Note that actions to reduce demand are also based on consideration of opportunity cost. To be efficient, the opportunity cost of demand flex is equal to the value of the activity aided by electricity and this value often increases the longer demand is being held back (stores of domestic hot water in an electrically heated cylinder, for example).

The value of the next best alternative

So, what exactly is opportunity cost? In essence, opportunity cost is the value (expressed in monetary cost) of the next best alternative you forgo when you make a choice between different options. For instance, if I am at home and decide to go to the shops, then I have implicitly chosen to give up the experience I would have if I stayed at home.

Knowing myself well(!), I might make the choice to go to the shops because I figured I would be happier doing this than my alternatives. The opportunity cost of using my time to go shopping is the happiness I would have derived from doing the next best alternative activity at home. You can check out the youtube video in my sources (below) as it provides three examples that help explain the concept.

The short-run marginal cost of any good or service is based on opportunity cost. In the last section, I described the conditions under which the opportunity cost of a generator is efficiently and profitably equal to its variable cost. That is, the generator has already deployed the capital and other means of production to generate electricity and has plenty of fuel and operating capability such that its only rational choice is whether or not to expend the cost of its fuel to produce electricity. However, this leaves plenty of scope for opportunity costs to diverge from variable cost.

Evidence of opportunity cost in the NEM

I have prepared two charts that demonstrate how opportunity cost affects offers and prices in the NEM.

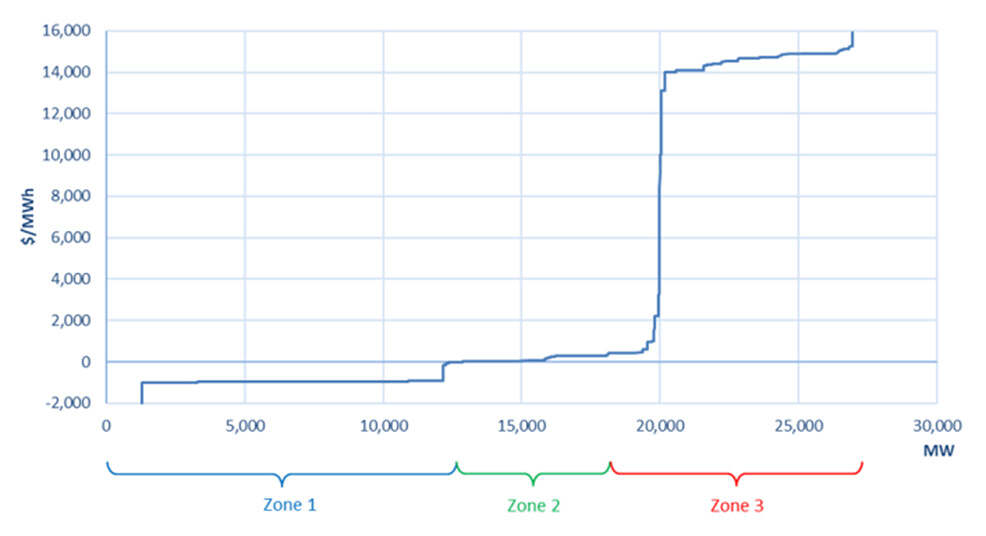

The first chart (see below) provides a snapshot of the offer stack in Victoria. It doesn’t much matter when it was taken as the offer stack has a similar profile at other times and in other regions. The number of MW offered and the share of MW in each of the three price zones varies from day to day and region to region but the features of the profile remain the same.

Chart 1: Shape of the generation offer stack in Victoria on 16 March 2022

Source: NEM data

I’ve defined pricing zone 2 as the range of offer prices between zero and an amount ($300/MWh, which would have seemed conservative until the middle of 2022!) intended to cover most variable costs considered by a simplified economic model of an electricity market. Note that the offered quantity of generation in this zone is the lowest (less than 20% of total MW offered in this interval). I appreciate the data is two years’ old but will provide an update in a later post.

By identifying the zone where offers may be directly related to variable cost, offers in the other two price zones (by definition) are not based on variable costs. Prices of offers in Zone 1 are below zero and in this interval they make up a little less than half the total MW offered. Prices of offers in Zone 3 are above $300/MWh and they make up a little over one-third of the total quantity offered in this interval. This means that just over 80% of offers in this interval are not priced in a range that would reasonably reflect variable costs of generating electricity!

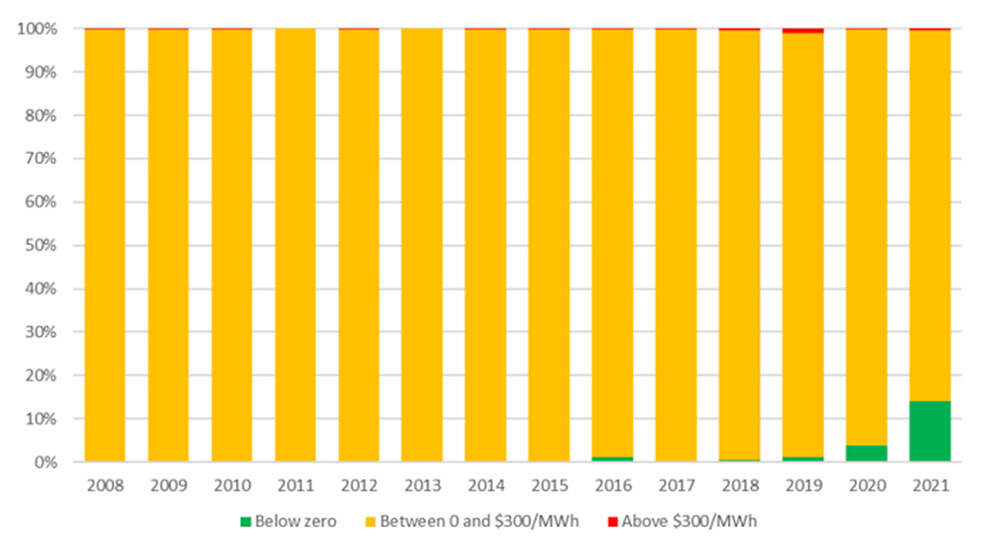

Now take a look at the second chart, which shows the share of wholesale prices in each of the three zones in Victoria every year since 2008 up to 2021.

Chart 2: Share of wholesale prices in Victoria in each pricing zone

Source: NEM data

The first thing of note from this chart is that offers priced in Zone 2 (variable cost zone) set prices most of the time – over 95% of the time before 2021. The second thing of note is that, since 2018, following a large influx of new renewable (solar and wind) generation, the incidence of prices below (not above) variable cost has been rising.

The conclusion from an examination of these two charts is that wholesale prices in the NEM tend to be within a zone consistent with the variable costs of thermal generating units, despite offered quantities in this zone being less than 20% of the total quantity of generation offered. At face value, it appears remarkable that prices conform with the simplified model despite the poor odds!

Note that offer prices well above and below the expected price have little impact on the outcome – the further away they are, the more market conditions have to change to force a reconsideration of the offer. In essence, prices at the bottom of the stack are set primarily to ensure a generating unit is dispatched, given expected market prices. It follows then that prices at the top of the stack are set primarily to ensure a generating unit remains in reserve, given expected market prices. However, if demand or supply changes enough to shift market prices into zones 1 or 3, then we should expect offers to change, accordingly. For more information about the dynamics of bidding in the NEM, I recommend reading Professor George Yarrow’s paper provided in the sources below.

Also, consistent with the narrative around the increasing share of zero-variable cost renewable generation in the NEM, we can see that the spread of prices in the NEM suggests opportunity costs have more often caused the short-run marginal cost of electricity to be below variable cost.

Finally, note that Chart 1 can be generalised to define the three offer and pricing zones for any electricity market:

- Zone 2, comprising quantities offered in the zone of prices that encompass variable cost, that is, between a low price threshold (eg zero) and a high price threshold at the cost of the highest priced fuel used to generate electricity

- Zone 1, comprising quantities offered below the low price threshold defined for Zone 2 (ie zero)

- Zone 3, comprising quantities offered above the high price threshold defined for Zone 2.

In my next post, I will provide a variety of reasons why generators are offering generation at prices that diverge from variable cost and explain why this it is efficient for them to do so.

Sources

Short run marginal cost – Technical paper, Adam McHugh, ERAWA, 11 January 2008

Opportunity cost – the road not taken, EconClips on Youtube, 14 June 2018

Bidding in energy-only wholesale electricity markets – Professor George Yarrow,

assisted by Dr Chris Decker, written for AEMC, Nov 2014

Water is valuable: the allocation of water and other resources in the New Zealand electricity market, Diana Tam with Prof. Lew Evans, June 2013

Structure matters – storage in electricity markets, David Andrés-Cerezo and Natalia Fabra, December 2020

This post was originally published on LinkedIn. Reproduced here with permission.

=================================================================================================

About our Guest Author

|

Greg Williams is a Principal Policy Advisor at the Australian Renewable Energy Agency (ARENA).

You can view Greg’s LinkedIn profile here. |

Pleasing to see commentary and encouragement of understanding of bidding practice, and in particular, uderstanding that plant dispatch directed on the basis of simple variable (e.g. fuel) costs mdels cannot efficently sustain operations. A generator’s minimum bid is the price below which the generator will be losing value. A loss of cash by bidding below fuel cost in one interval may however be anticipated as a risk investment in being ready to generate more profitably in the next or a later interval. Conversely a bid above the minimum runs the risk of missing out a profitable dispatch. To manage these risks, the generator needs to anticipate the system demands and the likely behavior of competing sources.

Good to see commentary and encouragement of understanding of bidding practice. In particular, plant dispatch directed on the basis of simple (e.g. fuel) costs cannot efficently sustain operations. A generator’s minimum bid is the price below which the generator will be losing value. A loss of cash by bidding below fuel cost in one interval may however be anticipated as a risk investment in being ready to generate more profitably in the next or a later interval. Conversely a bid above the minimum runs the risk of missing out a profitable dispatch. To manage these risks, the generator needs to anticipate the system demands and the likely behavior of competing sources.

I look foraward to seeing the next instalment