The NEM was awoken from its slumber yesterday by high temperatures in SA, which increased demand and (with the assistance of transmission constraints and generator bidding) led to the price rising to VOLL for a number of dispatch intervals.

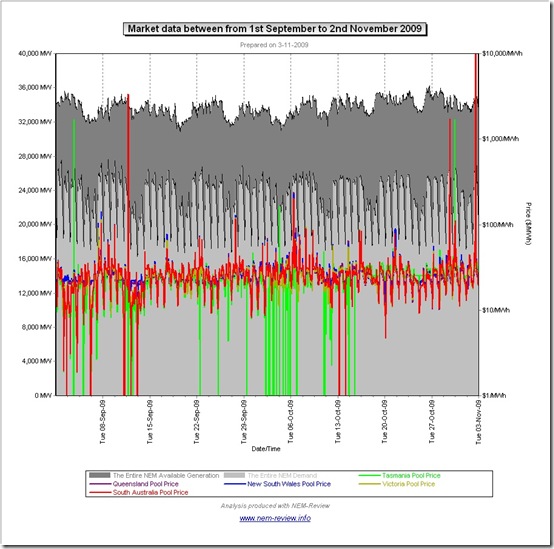

The following NEM-Review chart shows raw trading prices over the spring months (to date), highlighting how prices have been relatively subdued (with a large number of prices dropping below $0/MWh in Tasmania).

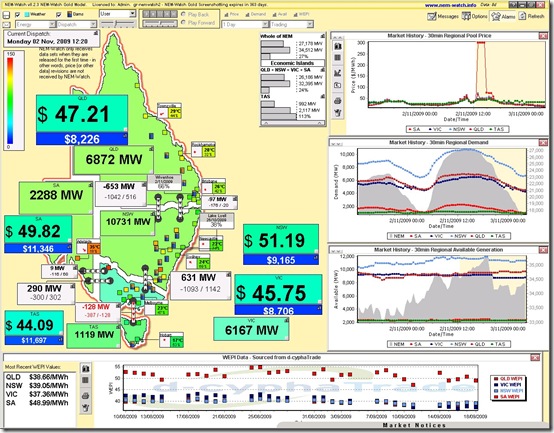

As seen in NEM-Watch, the temperature in Adelaide had hit 35 degrees by 12:20 NEM time (12:50 SA time, with daylight savings). Demand was reasonably subdued, compared to the all-time maximum demand for SA (you can see this in the colour-coding, with green being in the mid-range of the scale).

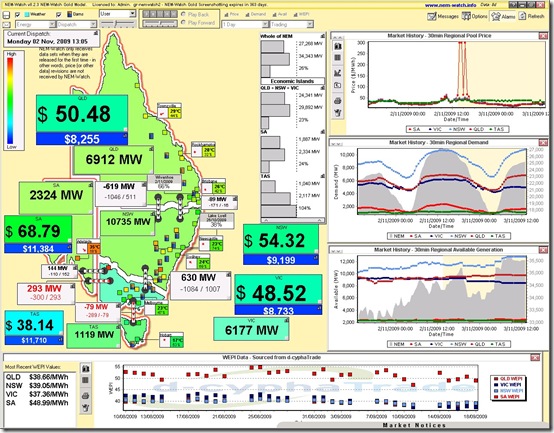

We see that (at 13:05) the Heywood interconnector into SA was constrained (shown as red in NEM-Watch) and that, as a result, the SA region was “economically islanded”. At this point in time, NEM-Watch shows the IRPM in the SA Economic Island to be a healthy 24%.

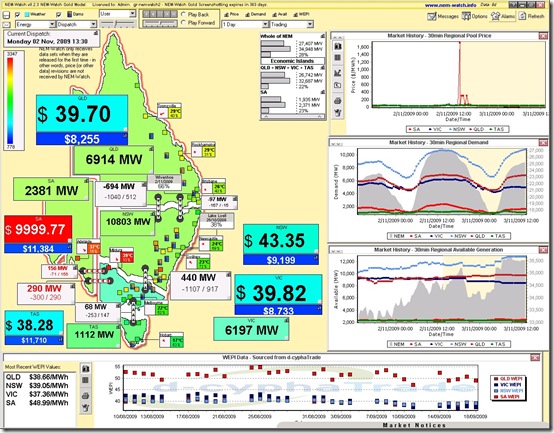

At 13:30, the Murraylink interconnection is also constrained. Coincident with this, the price spiked to VOLL in SA for the first time that day.

Note that the IRPM of the SA Economic Island was still a healthy 23% (with a surplus generation of 436MW (i.e. 2,371MW – 1,935MW) available and unused.

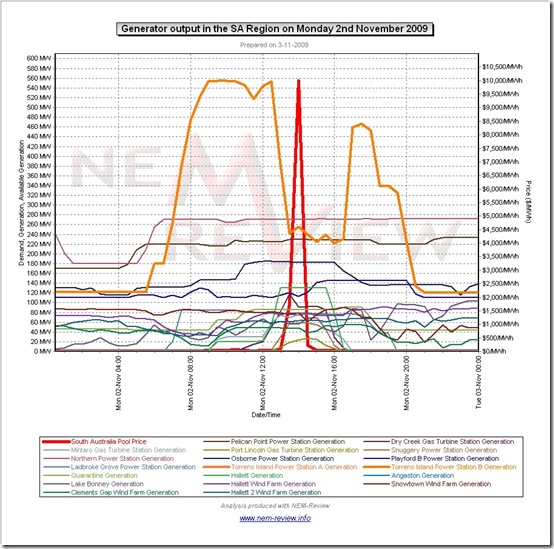

As can be seen in the NEM-Review chart below, a large drop in output at the Torrens B station (without a corresponding drop in station availability) points to some opportunistic bidding behaviour.

In particular, note that the reduction was of the order of 340MW (out of a total of the 440MW shown above to be surplus to demand).

Quite a coincidence, then, that we just posted (last week) about the benefits of curtailability in the NEM. We know that our South Australian clients were curtailed for this price spike, hence making savings in the $100,000’s (just for turning off over a ½ hour period).

Leave a comment