This morning we came across an article by Colin Packham in The Australian that alluded to a rule change proposal from the AEMO aimed at reforming how the NEM’s various compensation schemes operate.

The rule change was submitted late last month and in short, the AEMO is proposing changes to better align and streamline the compensation frameworks that apply during directions, administered pricing, and market suspension events. The proposal is explicitly framed around lessons from the June 2022 market suspension, where overlapping and inconsistent compensation arrangements created uncertainty for participants.

Background

During the June 2022 energy crisis, the coexistence of multiple, overlapping compensation schemes created material uncertainty around cost recovery and real-time operational incentives relating to unit availability. This uncertainty is widely seen as having partly contributed to added complexity to the AEMO’s task of ‘keeping the lights on’. That said, it is also worth noting that AEMO itself identified at least nine discrete factors that contributed to the supply–demand stress, and resulting price volatility, during this period.

Back in September 2022, I wrote an article attempting to estimate the “total cost of keeping the lights on” during this period, based on preliminary figures from the various compensation schemes at the time. Two years later, by September 2024, claims under those schemes appear to have had been finalised, with the following outcomes:

- The AEMC awarded a total of $35.7m in Administered Pricing Compensation.

- The AEMO awarded a total of $18.3m in Directions Compensation.

- The AEMO awarded a total of $94.8m in Suspension Pricing Compensation.

In total, this amounts to $148.8 million paid across the three schemes for June 2022.

To keep these figures in perspective to day-to-day market mechanisms, it is worth recalling that in the earlier article we estimated that approximately $6.57 billion flowed through the spot and FCAS markets (i.e. non-compensation streams) over the same month.

Proposed Rule Change

At a high level, the proposal is to replace the current patchwork of separate rules with a single, consolidated compensation framework administered by the AEMO. This would standardise eligibility, timeframes, claim thresholds, and the types of costs that can be recovered, while also implementing recommendations from the AEMC’s 2024 compensation frameworks review — including allowing opportunity costs across all compensation categories and using a consistent approach to preliminary compensation.

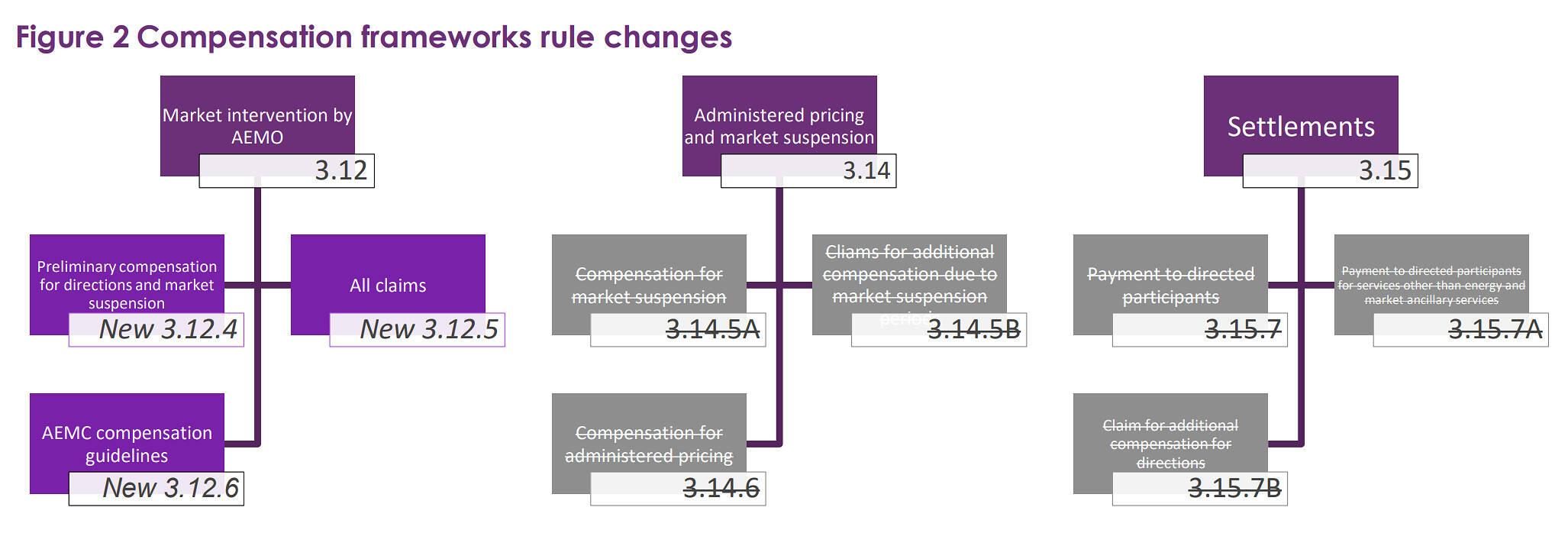

The NER clauses to be removed or added under this rule change proposal.

Source: AEMO

The proposal would introduce new NER clauses to cover preliminary compensation, claims processes, and updated compensation guidelines, with preliminary compensation for both directions and market suspension events calculated using a technology-specific VWAP-based methodology (with adjustments for fixed costs). By unifying the governance, simplifying claims, and making compensation more predictable during interventions, AEMO argues the changes would restore confidence in market participation during future stress events, reduce administrative burden, and support more orderly operation of the power system. The executive summary from the AEMO stated:

“The rule change is also forward looking, seeking to minimise the complexity of the compensation framework given the changing nature of claims due to the energy transition.

For instance, AEMO is issuing new and different directions, such as directions to battery energy storage systems to both import and consume electricity and to generators to synchronise with the energy system without exporting.

This rule change seeks to reduce the complexity of any claims that result from these directions”

The rule change is still marked at pending on the project’s homepage on the AEMC website, and no timeline of consultation or determination has been announced as of today.

Be the first to comment on "AEMO propose rule change to reform compensation frameworks"