We spent two days this week at the inaugural National Electricity Market Development (NEMDEV) conference in Brisbane.

With around 250 participants, the conference brought together an unusually well-balanced mix of academics and industry practitioners. As the newest addition to Australia’s energy conference circuit, it actually offered a refreshing and pleasing change — less corporate slide decks and product promotions, and more genuine analysis and nuanced debate about the future direction of the energy system.

The conference covered too much ground for any single summary to do it justice, so instead, this article draws out three broad recurring themes that seemed to echo throughout the two days.

Winter will always come — and gas is the sticking point

A recurring theme throughout the conference was how the electricity system — and gas-powered generation (GPG) in particular — will cope with the firming requirements and transmission constraints associated with deep winter peaks, especially across the southern half of the market. Several speakers also discussed the gas production and procurement challenges involved in sustaining that role.

Across multiple presentations, we saw various modelled outcomes of how extended cold, dark, and still periods would impact a renewables-dominant grid. The broad consensus was that gas will remain critical for the foreseeable future, as existing long-duration storage technologies are either commercially unviable or lack the depth needed to fully replace it. Yet, the role of gas is becoming increasingly difficult to sustain.

In his presentation, Energy Edge’s Josh Stabler recreated David Osmond’s well-known modelling exercise — now dubbed the “Osmond Model” — to illustrate just how challenging it would be to eliminate gas (or the category labelled ‘other’ in the model) without vast quantities of long-duration storage — on the order of 400 hours.

Iberdrola’s Joel Gilmore described gas as “the nicotine patch of the energy transition” — a temporary but necessary aid to help manage withdrawal from fossil fuels. He suggested that introducing a form of shadow price on gas-fired generation would make little difference to short-term dispatch or pricing outcomes, but could make investment in firming capacity more palatable for investors navigating the energy transition.

On the gas supply side, UQ’s David Close highlighted that conventional gas production in Victoria is almost guaranteed to decline by the 2030s, and will not be replaced. Pipeline constraints already limit flows from Queensland, while new supply options are politically and economically fraught. He also pointed to shortcomings in AEMO’s planning documents: while Australia may mathematically have enough total peak-day supply to meet east coast demand alongside Queensland’s LNG exports, we are not on track to deliver the right volumes where and when they’re needed — particularly in the south during cold, still winter days.

Rising costs for wind and transmission need to shape our decision making

Another dominant thread was the rising cost of delivering the energy transition, particularly in wind development and transmission build-out.

Powerlink’s Paul Simshauser presented a research paper co-authored with Joel Gilmore, “The Counterfactual Scenario: Are Renewables Cheaper?”. The work highlighted a not commonly acknowledged reality — that the growth of variable renewable energy (VRE) has increased consumer bills — despite what political narratives suggested. However, it argued that the wholesale component of retail tariffs would have been even higher had new investment instead come from coal and gas.

Several speakers noted that the industry is once again facing a “wall of capex” — not only for generation and storage, but also for transmission and distribution infrastructure. As EnergyAustralia’s Mark Collette reminded the audience, these network upgrades represent regressive costs that ultimately flow through to customers.

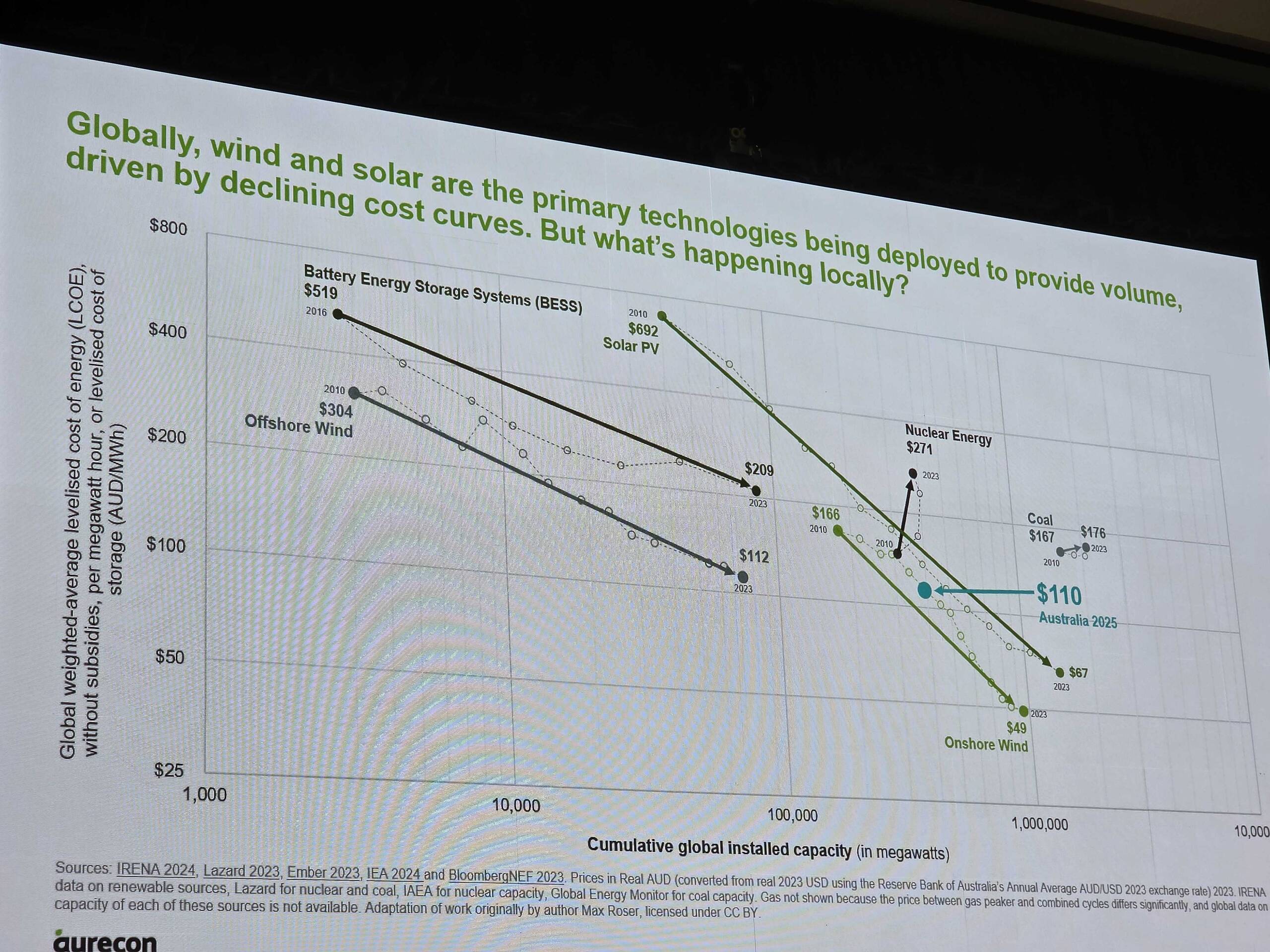

Paul Gleeson of Aurecon highlighted that, while global onshore wind costs continue to decline (in real terms) as installed capacity increases, this trend is largely driven by developments in China. In contrast, Australian costs have not yet followed the same steep trajectory.

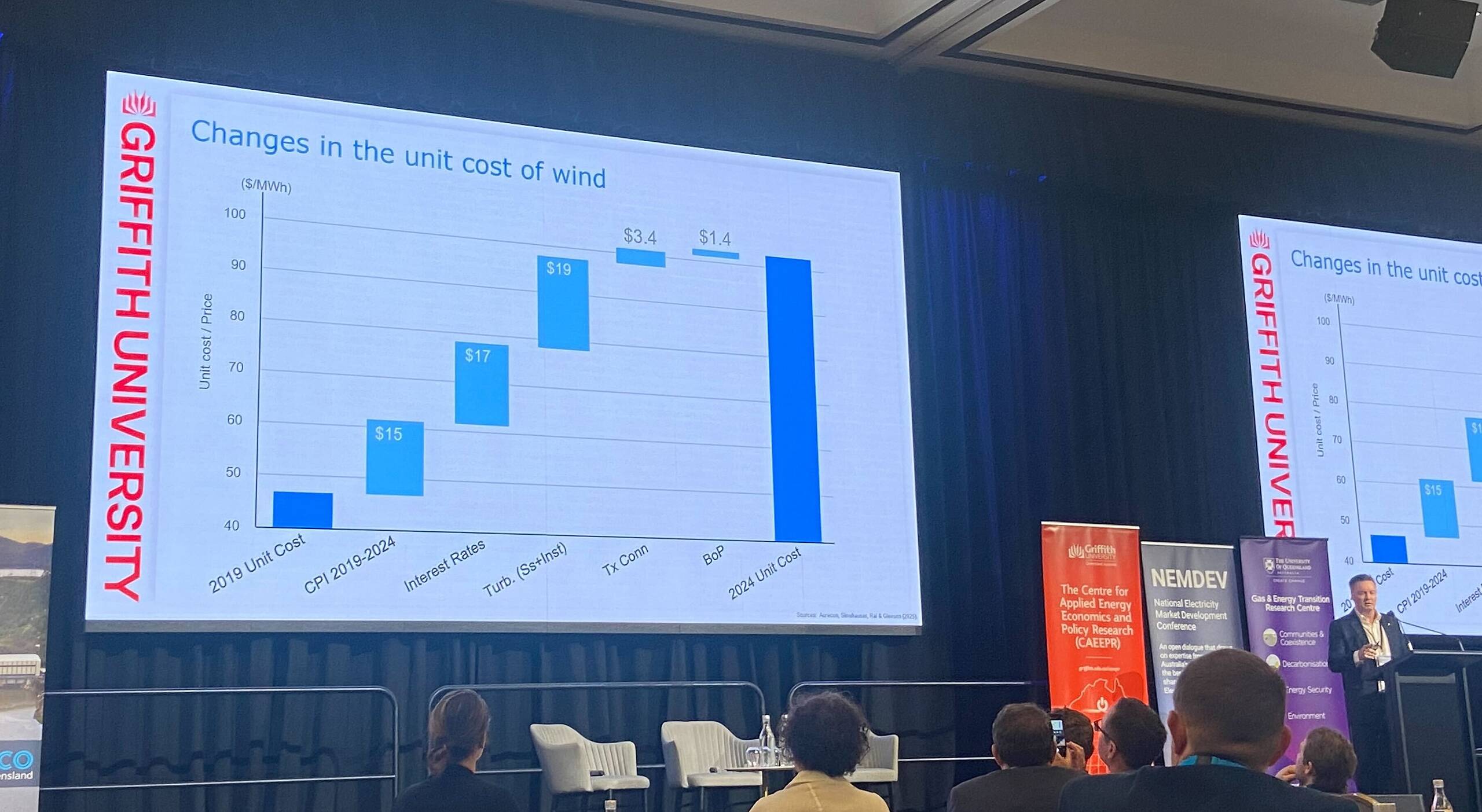

Paul Simshauser showed how local wind projects costs (in nominal terms) have risen sharply since 2019, driven by inflation, higher interest rates, and turbine supply costs.

Paul Simshauser highlighted that transmission augmentation plans are being scaled back as costs soar from around $3–4 million per kilometre in pre-COVID years, to closer to $10 million per kilometre now. His advice: prioritise renewables closer to existing backbone infrastructure rather than chasing distant resource quality. Or in his words: “As an industry, we have to stop doing expensive stuff as quickly as we can. Don’t fall in love with projects, fall in love with serving people.”

It was a reminder that Australia’s transition is colliding with real-world cost pressures faster than expected.

As reforms advance, operational challenges are emerging

The second day of the conference had more focus on the reform agenda.

Tim Nelson outlined progress on the Nelson Review, which is re-examining the NEM’s wholesale signals. He was followed by fellow panel member Phil Hirschhorn, who walked through some of the proposed Electricity Services Entry Mechanism (ESEM) contracts, showing back-casted results of how each contract would have applied across South Australia’s wind fleet between 2019 and 2024, demonstrating the benefits of the additional hedging suite.

Our own Paul McArdle closed the conference with a talk spanning data, operations, and policy. His core message was that we should be careful about which debates we choose to focus our time on as an industry. He showed that over the past five years, the frequency of coal unit trips has barely increased — contrary to public perception — while large collective “off-target” deviations from semi-scheduled wind and solar farms have risen more than sixfold, with a growing impact on frequency management. Yet, these emerging operational challenges are not being discussed — or planned for — with the urgency they deserve.

The takeaway from the day was that whilst the reform agenda is racing to catch up with the market’s lived reality, the operational challenges of today’s electricity system are evolving just as quickly.

–

If the goal of NEMDEV was to bridge the gap between research and industry, it succeeded. The discussion was rigorous and occasionally provocative (kudos to Bruce Mountain for bringing the latter), and it was encouraging to see a conference willing to engage in genuine, nuanced debate, rather than recycling the same high-level talking points.

A big thank you to Griffith University’s Centre for Applied Energy Economics and Policy Research and The University of Queensland’s Gas & Energy Transition Research Centre — including David Close, Magnus Söderberg, Lucia Stan, Connor Pound, and Olivia Lambert — for organising one of the most enjoyable and worthwhile conferences in recent years.

Thanks for the great coverage Dan – always a pleasure to read your summaries.

Cheers,

Dave

A great summary of NEMDEV 2025.

Thanks Dan