Earlier this week I was at the Clean Energy Council’s Queensland Energy Summit in Brisbane. In one of his trademark cryptic posts, Paul shared a chart from a presentation by CleanCo’s Rimu Nelson, which showed how the operating profiles of Wivenhoe and Swanbank E have shifted since CleanCo took the reins.

This prompted us to want to have a closer look into the longer term trend. So in this note, we’ll briefly examine the bidding and operational behaviour of these two assets across three broad periods:

- 2016 to 2018: CS Energy/Stanwell ownership. These were the years immediately prior to CleanCo’s formation, with Wivenhoe and Swanbank E managed within larger portfolios and often underutilised.

- 2019 to 2021: The transition period. CleanCo officially took control of both assets on the 31st of October 2019. The following couple of years were a bedding-in phase, with the new entity building its retail book, signing PPAs, etc.

- 2022 to 2024: More typical CleanCo operations. We can see that by this stage CleanCo had begun to establish more of a gentailer model, using Swanbank and Wivenhoe in a manner more consistent with its gentailer strategy and renewable contracting mandate.

A brief history

CleanCo was established in late 2019 as a government-owned gentailer with a stated mandate: to increase competition in the Queensland market and support renewable energy development. The entity was formed by transferring several assets from CS Energy and Stanwell’s hands, including the Wivenhoe Pumped Hydro Facility, the Swanbank E Gas Power Station, and three smaller facilities (Barron Gorge Hydro Power Station, Kareeya Hydro Power Station and its related Koombooloomba Station)

In the years prior to this transfer, both Wivenhoe and Swanbank E were often underutilised. Swanbank E was mothballed by then-owner Stanwell for roughly three years from early 2015 to late 2017, while Wivenhoe in the same period was frequently idle or running at very low utilisation by then-owner CS Energy — both of those outcomes were largely a function of each company’s larger portfolio strategy. The creation of CleanCo was intended to reorient the use of these assets.

Operational and bidding changes at Wivenhoe

The 570MW Wivenhoe Pumped Hydro Facility was transferred into CleanCo’s hands from CS Energy on the 31st of October, 2019.

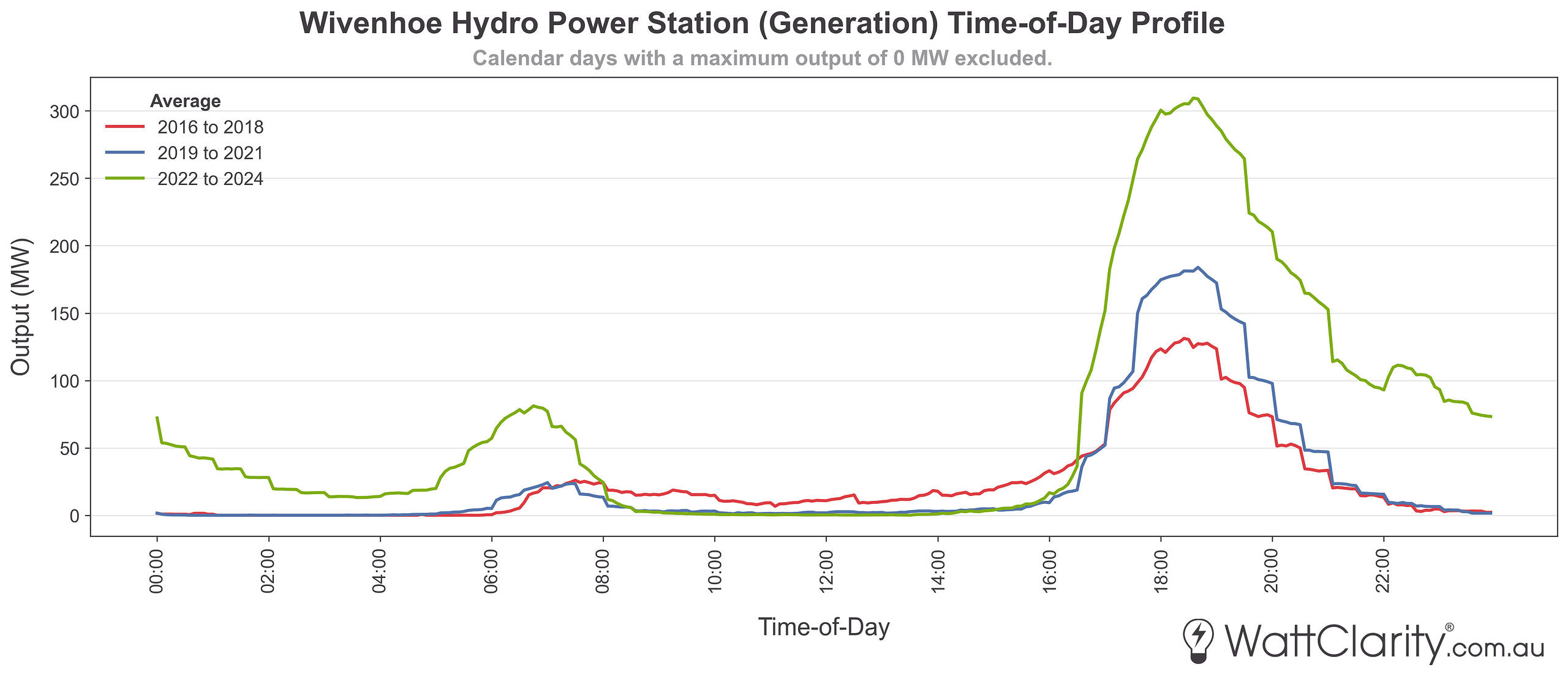

In the chart below, we see the time-of-day profile for the generating-side of the station. Days where both generating units were not operating have been excluded from the averages.

The morning and evening peaks in Wivenhoe’s generating profile have become more pronounced.

Source: NEMreview

The time-of-day generating profile shows a clear increase in evening output, and a small bump up in morning output, particularly from 2022.

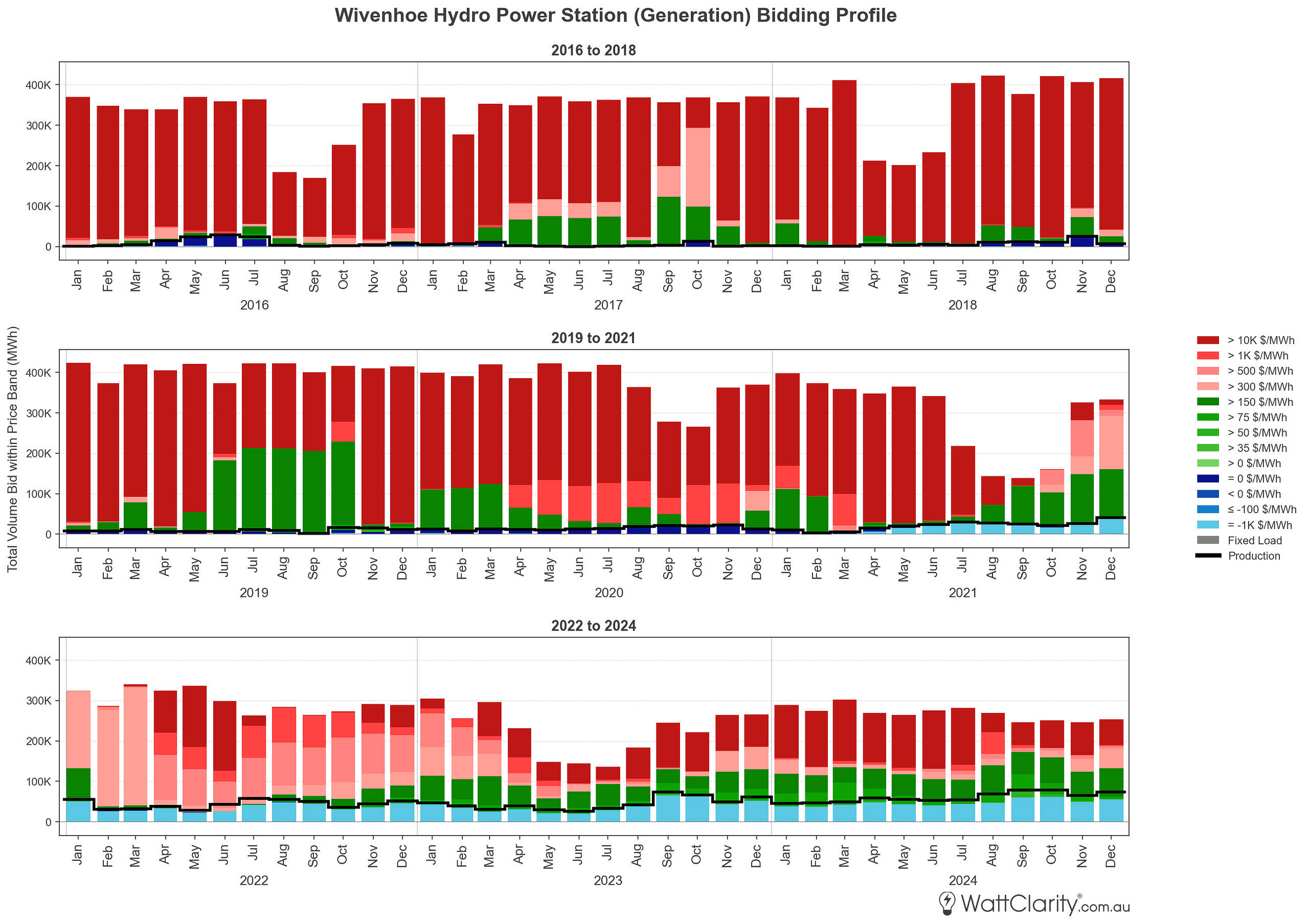

Using data from our GSD2024, below we see the aggregated volume of generation bids within 14 different price bands over those three periods. The overall amount of production/generation is overlaid in the black stepped line series.

CleanCo have progressively moved more volume to lower price bands, including at the market floor.

Note: Data is aggregated for the two generating units of the station (W/HOE#1 and W/HOE#2)

Source: GSD 2024 Data Extract

Production has progressively increased, accompanied by a clear shift in bidding strategy. A greater share of total volume once concentrated above $10,000/MWh (dark red) has increasingly been offered at lower prices, with a significant portion now regularly offered at negative prices or at the market-floor (light blue). As we can also see, the total volume offered is lower between 2022 and 2024, which is representative of lower overall availability at the station.

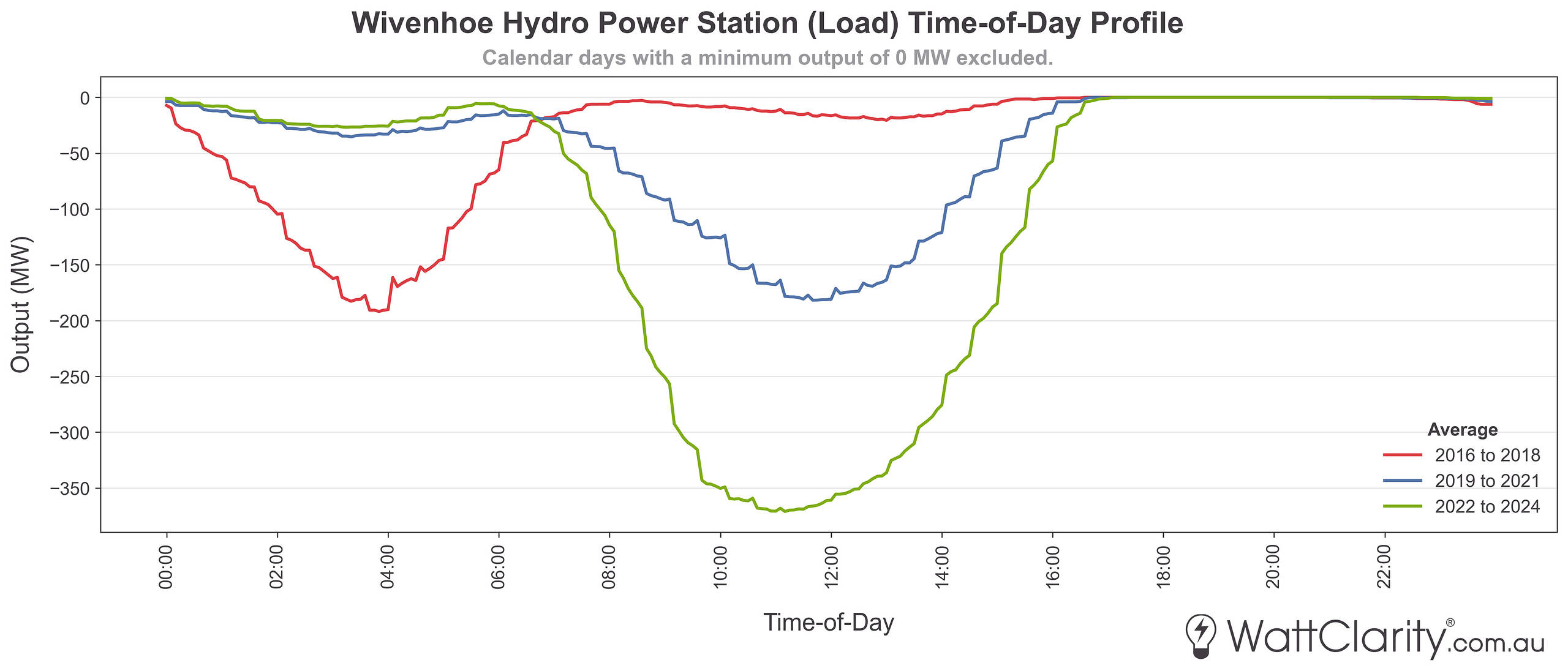

On the pumping side, the profile has shifted from predominantly overnight consumption between 2016 and 2018, to more daytime operation since the CleanCo takeover, reflective also of the shift in the QLD region’s price dynamics as utility-scale and rooftop PV have driven daytime prices lower.

Given the change in operations, and changes in pricing dynamics, Wivenhoe has increased its pumping during daylight hours.

Note: Data is aggregated for the two load units of the station (PUMP1 and PUMP2)

Source: NEMreview

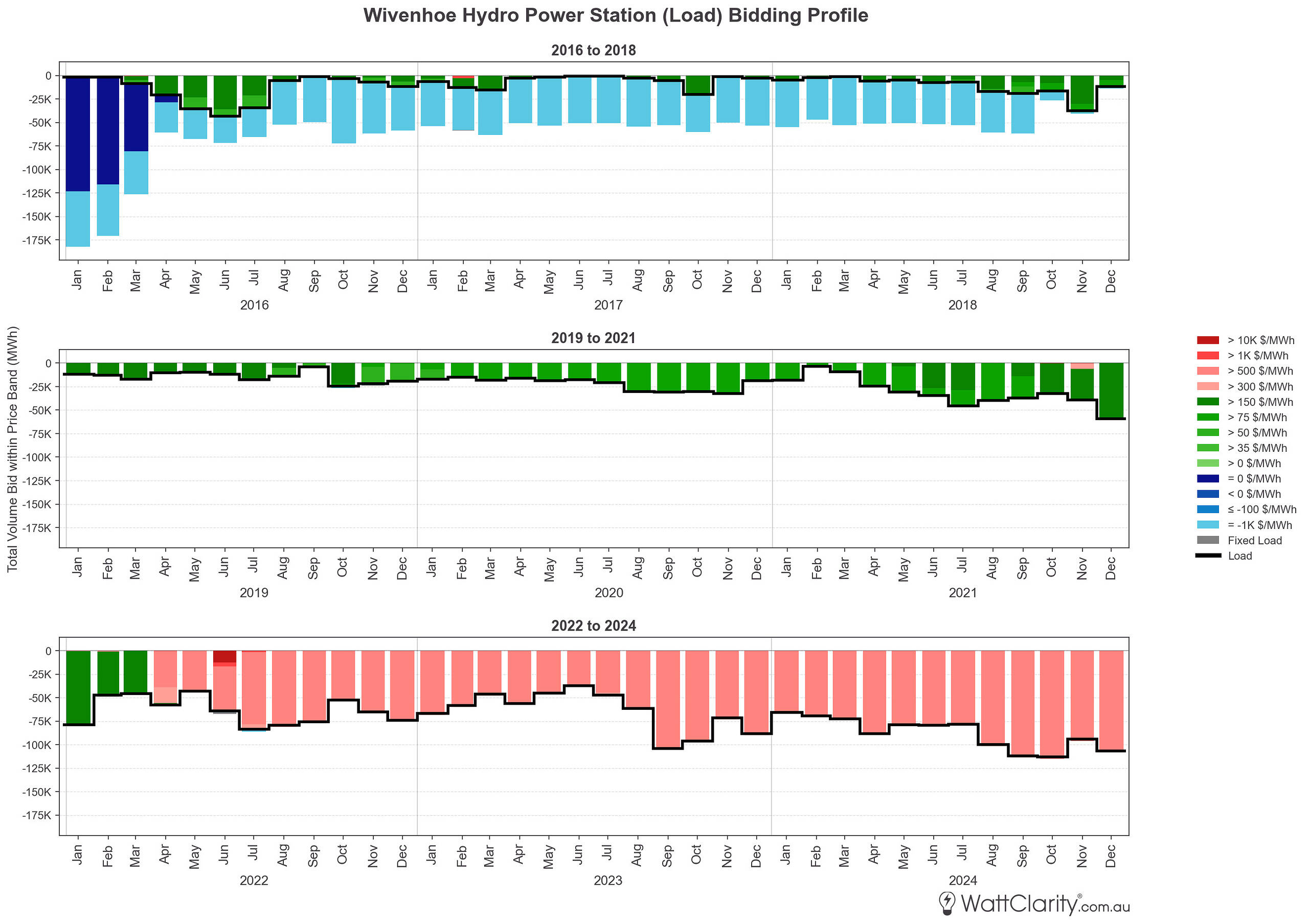

Pumping bids have also shifted. Previously, much of the volume was offered at negative prices (for a load, this represents a greater unwillingness to consume). Between 2019 and 2021, offered volumes began to shift into higher bands, with now much of the station’s volume offered in excess of $500/MWh.

From blue to green to red territory, Wivenhoe has increased its willingness to pump over time.

Source: GSD 2024 Data Extract

Operational and bidding changes at Swanbank E

The 385MW Swanbank E Power Station was transferred into CleanCo’s hands from Stanwell Corporation, also on the 31st of October, 2019.

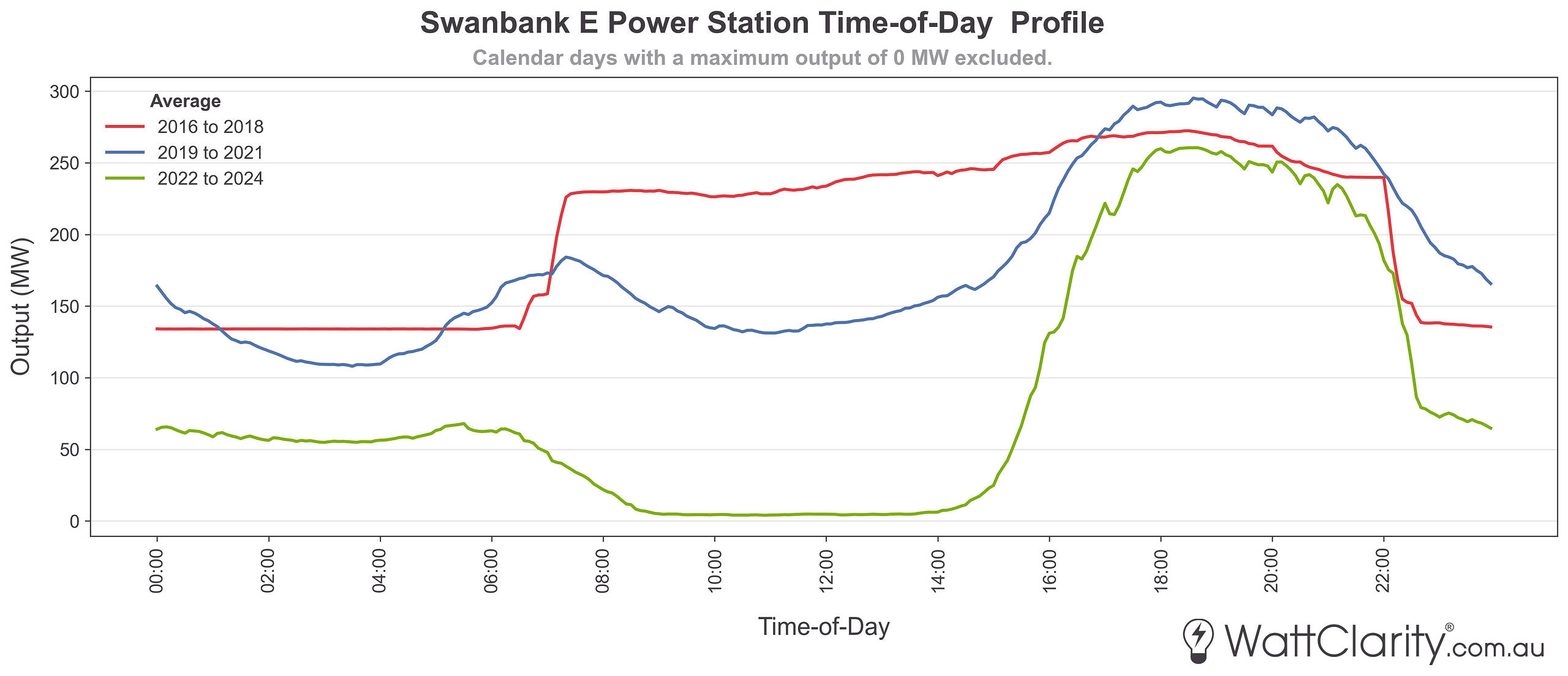

As mentioned, the plant had been mothballed until November 2017 and has since experienced several extended outages. Days where the unit was offline have been excluded from the averages shown in the chart below.

Swanbank E has slowly transitioned from a baseload to peaking/firming role.

Source: NEMreview

The output profile above illustrates Swanbank E’s evolution, and move into a more ‘two-shifting’ approach. Between 2016 and 2018, Swanbank E ran with relatively steady output, often resembling mid-merit or even baseload operation when online. During the transition years, operation became more variable, with evidence of morning reductions and sharper evening ramps — somewhat mirroring the duck curve. From 2022, Swanbank E has rarely operated during daylight hours, instead running as a peaking unit focused on late-afternoon/evening price spikes.

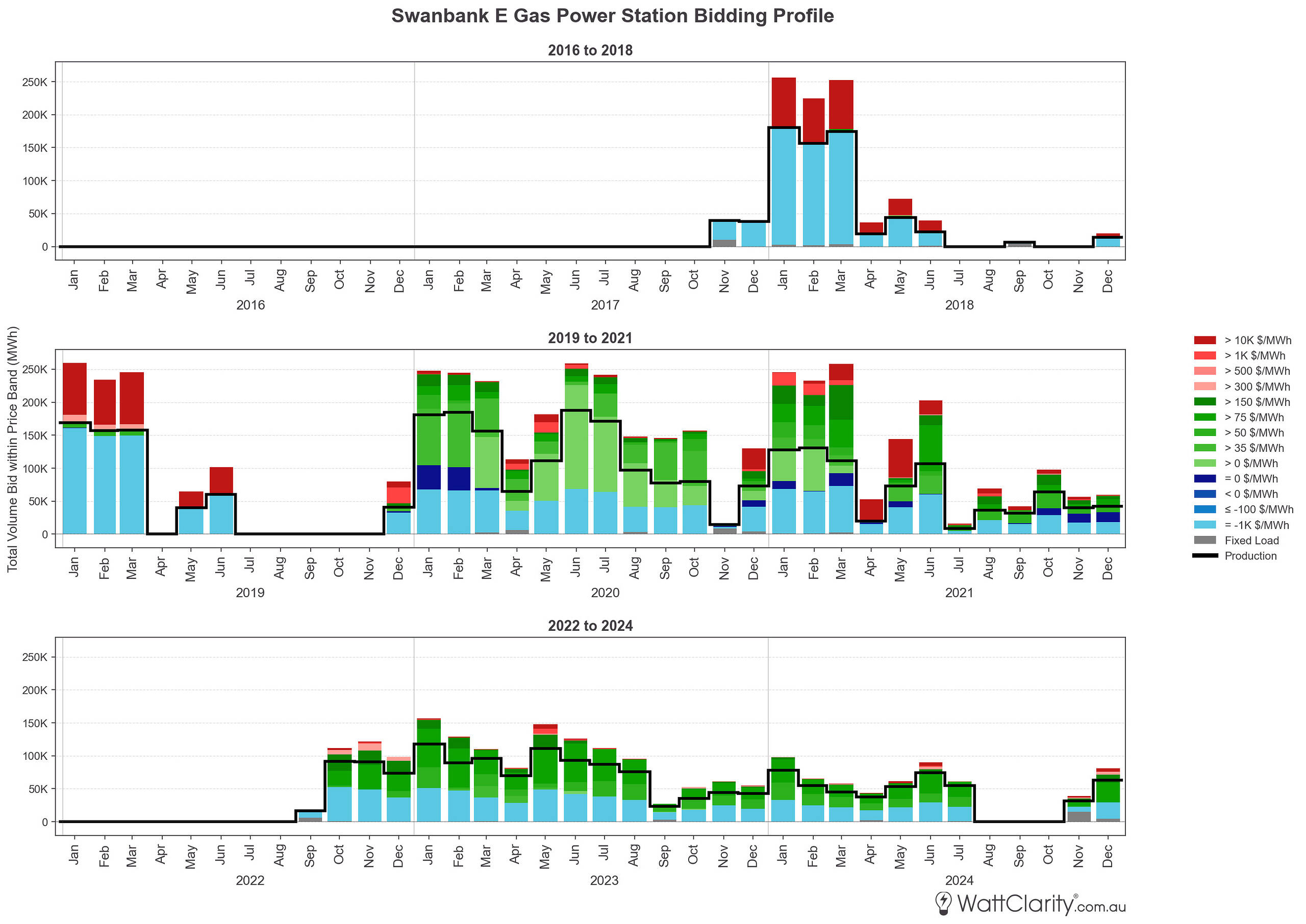

The station’s aggregated bidding data demonstrates the change in strategy.

Typical offered volumes at Swanbank E were redistributed following CleanCo’s takeover.

Source: GSD 2024 Data Extract

Under Stanwell’s ownership, between 2016 and 2018 the unit was largely offline, but when it did run, much of its volumes were bid at the market floor to secure continuous dispatch, with the remainder placed near the market cap. Following CleanCo’s takeover, volumes were progressively reallocated, particularly into mid-merit bands, reflecting the station’s transition into a peaking role. Since late 2022, overall production has been on a slow but steady overall downward trend, which may be representative of fewer occasions of overnight operations.

Be the first to comment on "A clean break: Wivenhoe and Swanbank operating profiles pre and post CleanCo takeover"