A brief look back at SA region prices and market activity in the NEM in the evening of the 2nd July 2025.

Earlier on the 2nd, we’d noted that the outlook for high prices in SA was driving a high cumulative price. To the point where the threshold might be hit, triggering administered pricing.

Later, in the evening around 6pm (NEM time) the outlook had softened, prices were high but the outlooks weren’t looking quite as extreme.

Yet, as late as interval 23:05 the market was still dispatching above 14,500 $/MWh!

The applicable CPT is $1,823,600. SA ended up reaching $1,576,239.12.

If we had been in the previous financial year, the old CPT of $1,573,700 would have been tripped.

Prices and bids

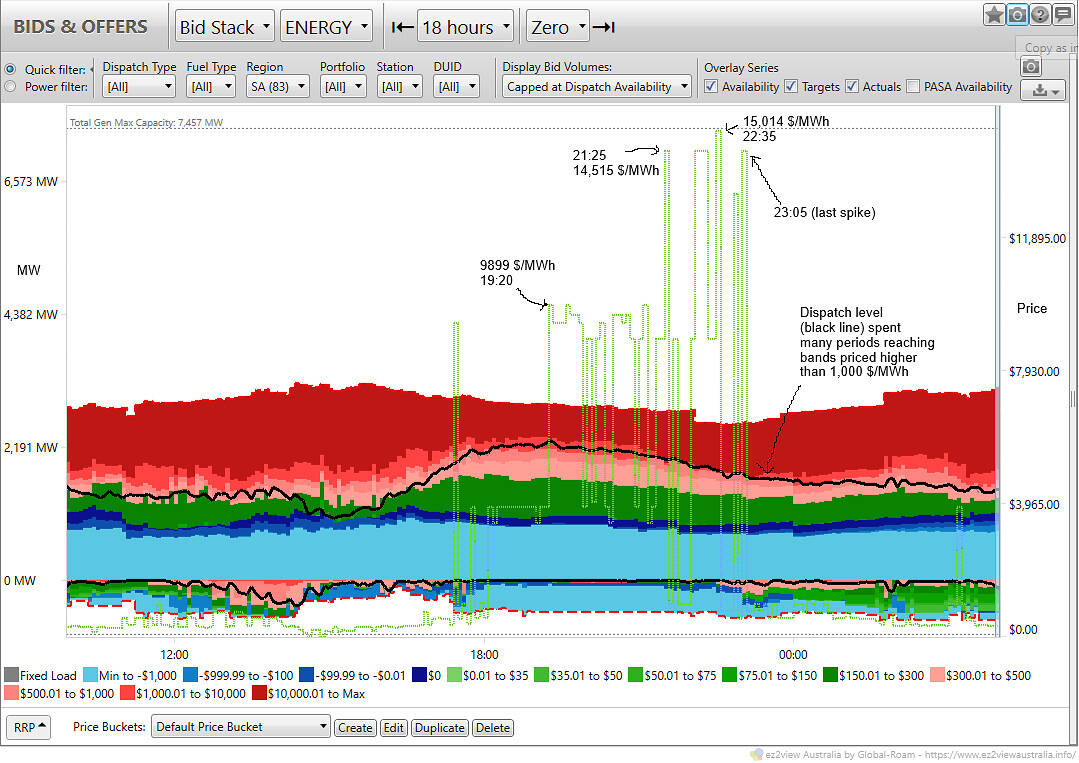

The early price spike happened in interval 17:30 (9,387 $/MWh), and with the last spike at 23:05, the period lasted 5.5 hours.

The prices, overlaid with bids (capped at dispatch availability) are presented below:

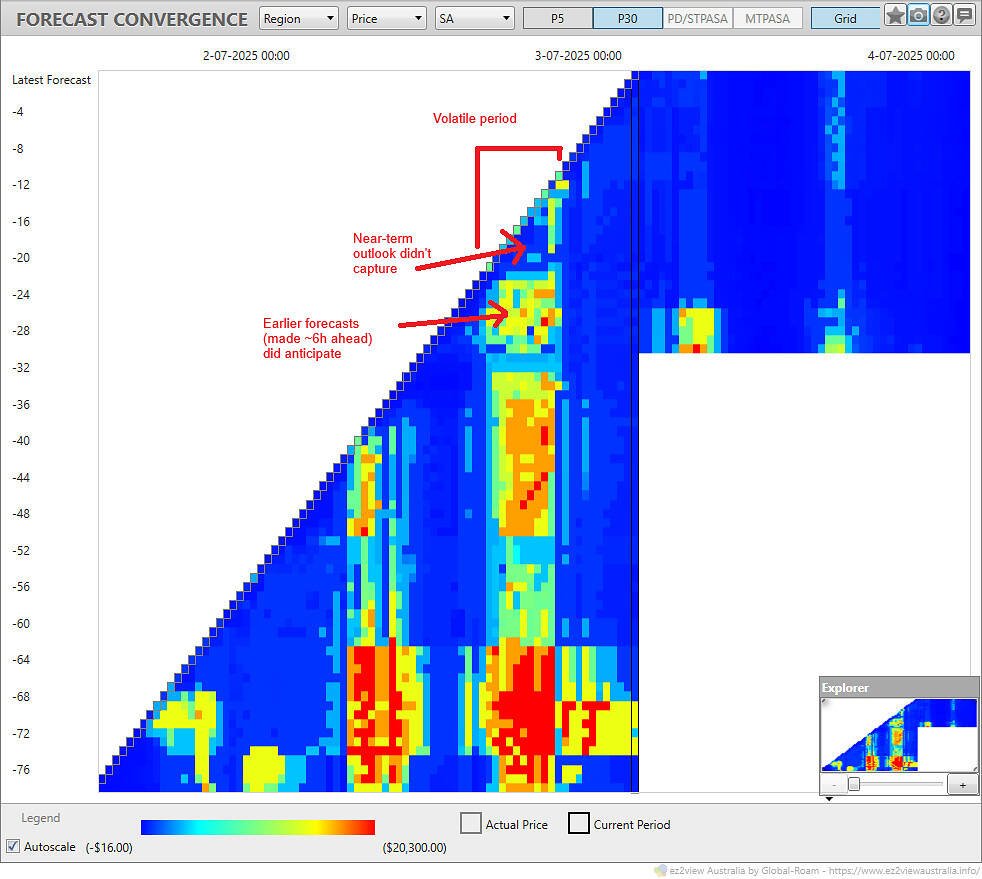

Price outlooks were uncertain

Interestingly, the price outlooks, leading up to the volatile period went through some change. They softened from the higher levels projected earlier in the day.

These (chart below) are the 30-minute predispatch price outlooks. Read vertically to see how the forecast for a specific interval changed over time.

Constraints involved

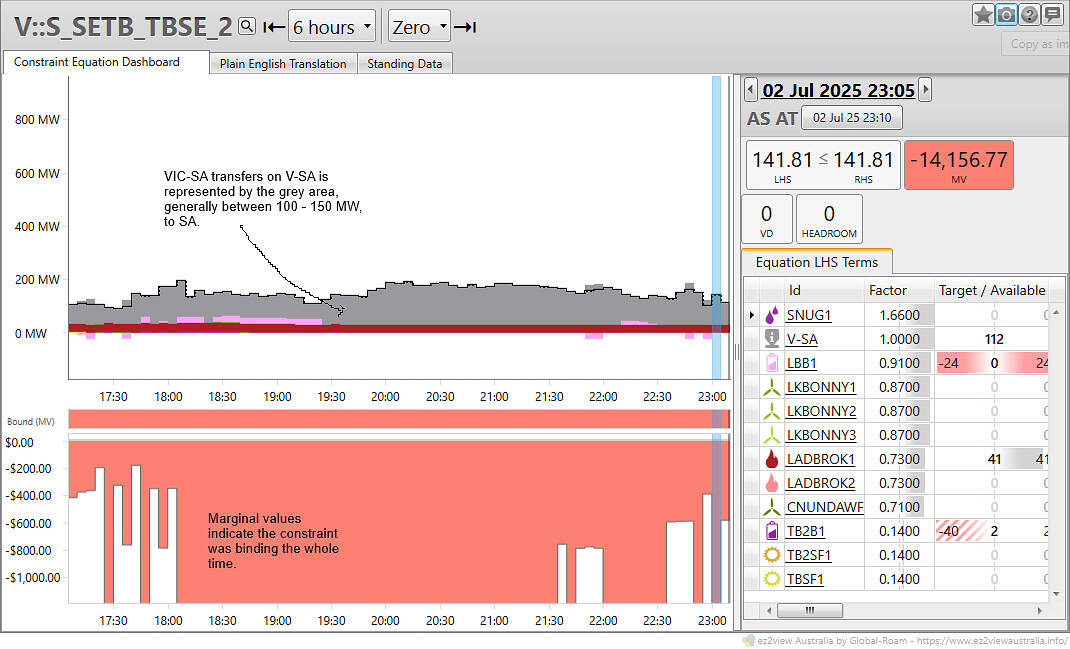

The outage of one South East to Tailem Bend 275kV line had been noted as likely to play a role in the supply and demand balance this week. Over the volatile period interconnector exports were limited to manage transient stability as part of the outage’s constraint set.

Flow in the direction of VIC to SA couldn’t contribute much more than 100 to 150 MW most of the time. The key constraint limiting the interconnectors was V::S_SETB_TBSE_2

Of course, there’d be much more to unpick time permitting.

We haven’t looked at battery storage levels, rebids, performance by fuel type, or whether other constraints were involved, to name a few aspects. Perhaps at a later date…

Be the first to comment on "Volatile price period runs over 5 hours on 2 July 2025 in SA"