Earlier on 27th February 2025 (i.e. today) we noted the media release that ‘AEMC updates market price cap for 2025-26’, in which the determination was:

1) The Market Price Cap increases to $20,300/MWh from 1st July 2025

2) and with it, the Cumulative Price Threshold increases to $1,823,600/MWh

We promptly updated our WattClarity Glossary page about the ‘Market Price Cap’ and noted that these increases were more than initially recommended in the 2022 Reliability Standard and Settings Review.

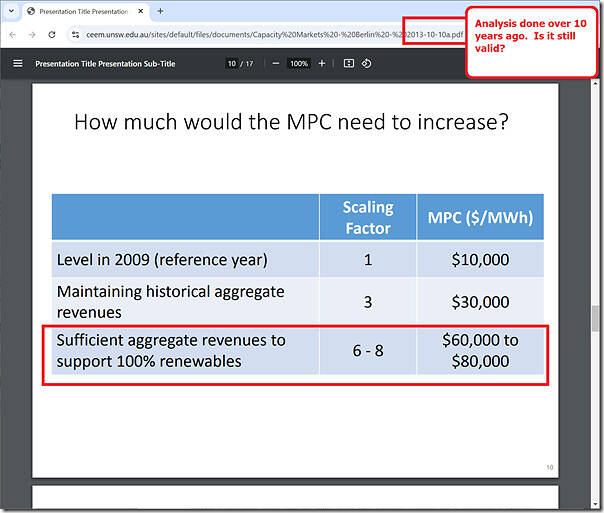

But then an internal conversation sprang up (gifting me the title ‘up, up and away’), which made me think it was probably worth a short article about this increase – and it also occurred to me to link to this analysis from over 10 years ago at the UNSW that suggested (based on modelling way back then*) that the Market Price Cap might need to be* multiples still higher to achieve close to 100% renewables:

It was also mentioned here in 2015. Of course (*) many caveats about modelling that:

1) Was done so long ago;

2) Without considering such newer additions as the Capacity Investment Scheme** which would hopefully help to deliver some of the otherwise missing revenue driving the MPC so much higher

** despite:

(a) considerations we’ve noted before (such as on 2nd March 2024 and on 29th April) that the lion’s share of the uptick in headline capacity numbers are related to VRE and not Firming

(b) and the deliberate exclusion of technology that still needs to be there to match supply and demand.

… but the headline here is that we should not be so surprised when MPC ratchets up considerably each year. That’s the path we’ve signed onto.

It would certainly be interesting to perform another study on this since we now know the impact of distributed PV means yesrly grid demand increases are closer to 0%.

It is also interesting that the 2015 study mentions that 20 to 50% of revenue is earned in the top 20 days of the year, and now we know most of that is in the 5 hours between 4pm and 9pm.

Thanks Paul, as always.

Where does the number finally selected come from, do you know? Is there a financial model somewhere that tries to predict how often we’ll bat the MPC and how much revenue will acrrue during those outlier events and this is meant to be assumed that generators can bank on that equivalent to a capacity payment?

When I write that, it seems convoluted…but I’m not sure I’m wrong (definitely not sure I’m right either).

Cheers,

Dave

Up, up and away … Market Price Cap to increase by $2,800/MWh (or 16%)

Hi Paul, so what does that mean for consumers?

Also, big picture, what is your opinion as to whether the price of electricity, paid by the consumer, will be more or less under a 100% renewables scenario?

Cheers