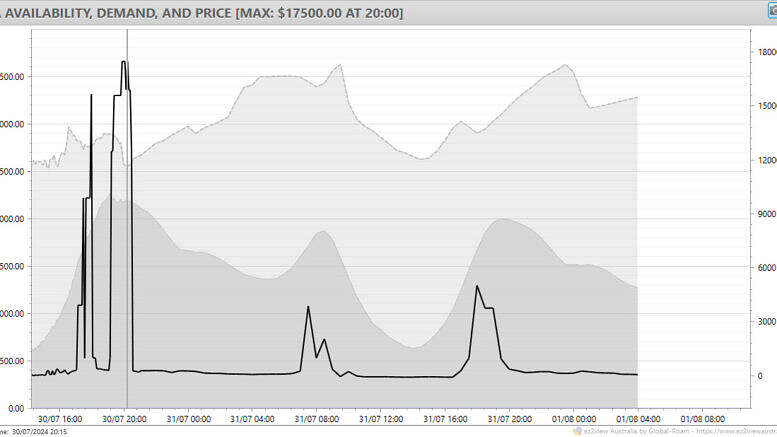

A possible repeat of yesterday evening’s high prices has commenced again on the 30th July 2024.

Yesterday’s high prices were noted at the time here on WattClarity and reflections on the rarity of the event posted by Dan Lee in “How rare are simultaneous price spikes in all five NEM regions, like what we saw last night?”.

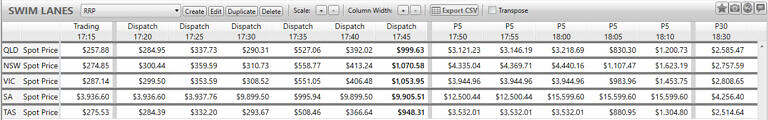

At 17:10

This time, SA is the first region to breach 1000 $/MWh.

In the 17:10 dispatch interval the SA energy price hit 3,936.60 $/MWh. In that interval renewable resources were contributing 237 MW to the market demand of 1,563 MW. Gas powered generators were making up the lion’s share.

We observed the Heywood interconnector was constrained to flow at 25 MW (importing from VIC to SA) via constraint VS_050_DYN bound (dynamic headroom appeared to be actively lowering the limit to 25) meaning reduced support from VIC supply resources.

At 17:45

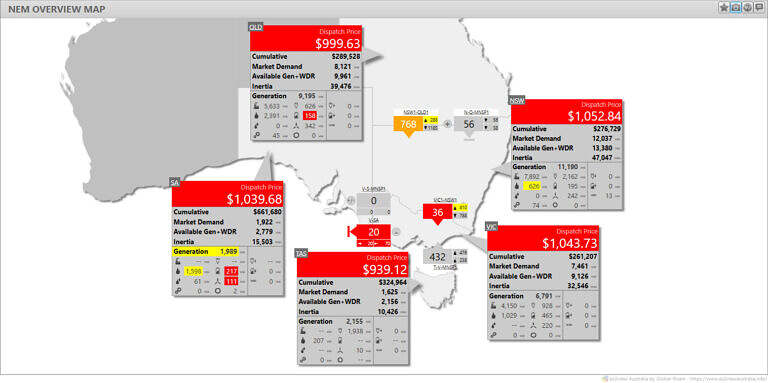

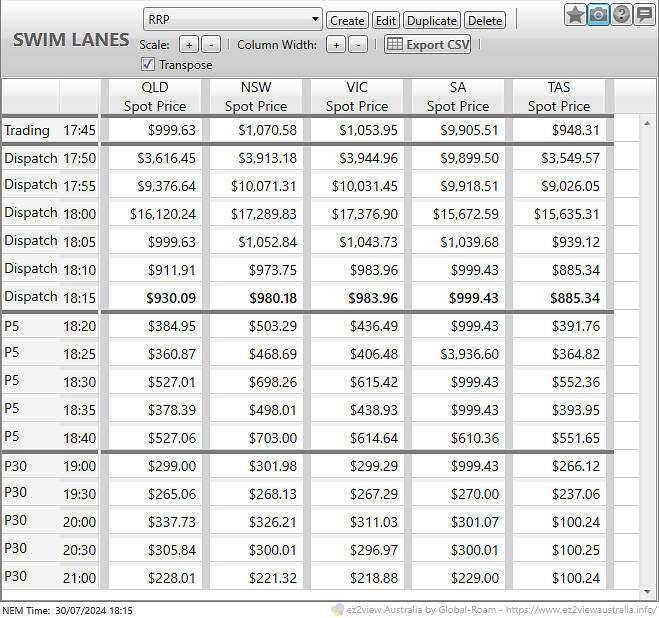

At the time of writing, in the 17:45 interval, SA prices remain high and prices in NSW and VIC have joined the higher end (> 1,000 $/MWh). The P5 predispatch prices continue to threaten other regions.

Price outlook from the 17:45 dispatch interval.

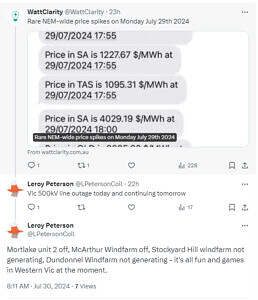

Noted earlier today via X, was an outage on a VIC 500kV transmission line and low output or offline status of some VIC wind farms.

At this stage, it appears the Moorabool – Mortlake No.2 500kV line was the outage referenced in the tweet above. The relevant constraint set V-MLMO (Out = Moorabool to Mortlake (MLTS-MOPS) No. 2 500 kV line) was invoked from 06:00 to 19:00 today.

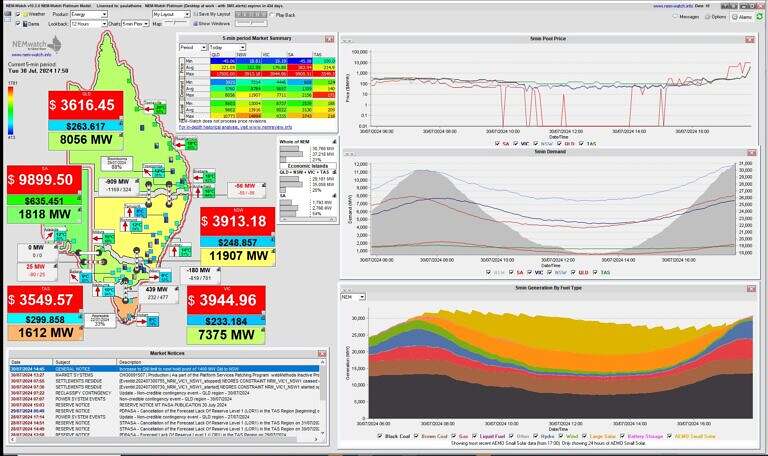

At 17:50

We’ve captures the state of the market using NEMWatch.

NEMWatch at 17:50

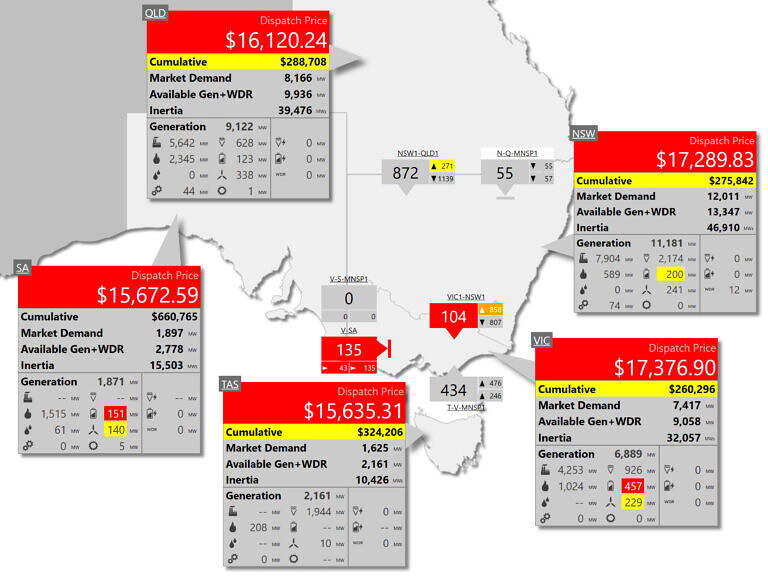

At 18:00

Surely some kind of price record has been nudged?

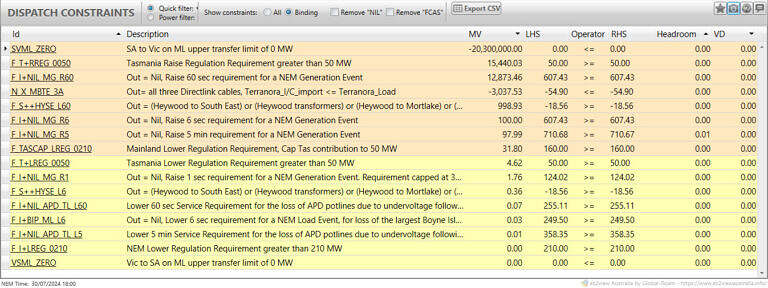

The constraints binding for the 18:00 dispatch interval will be of interest.

In this interval contingency raise (60s) hit $12,873.46 in all regions. Raise regulation in TAS reached $15,538.02.

At 18:05

Some reprieve.

At 18:15

Some may be anticipating the tide has turned.

Later

Later, after many would have called it a night and headed off to cook dinner, the 19:15 interval in SA saw prices hit 12,500.44 $/MWh.

That wasn’t the end of it though.

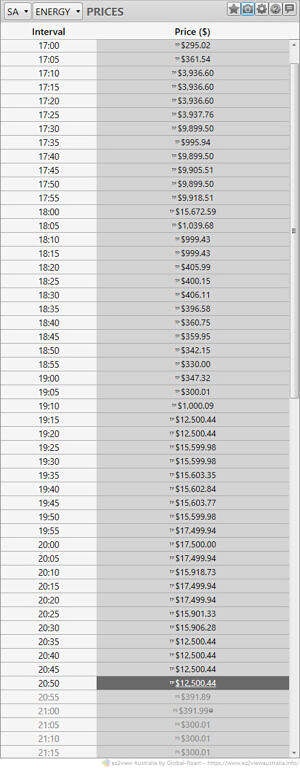

From 19:15 until [to be confirmed, but at least until 20:15] SA prices were above 12,500 $/MWh.

At 20:15

At 20:15 the SA price was 17,499.94.

Earlier at 20:00 the price had hit 17,500 $/MWh – the market price cap.

At 20:17

We note market notice 117509 alerts to an actual LOR1 in SA:

MARKET NOTICE 117509 ________________________________________________________________________________________________ Notice ID 117509 Notice Type ID LRC/LOR1/LOR2/LOR3 Notice Type Description MARKET Issue Date Tuesday, 30 July 2024 External Reference Actual Lack Of Reserve Level 1 (LOR1) in the SA region - 30/07/2024 ________________________________________________________________________________________________ AEMO ELECTRICITY MARKET NOTICE Actual Lack Of Reserve Level 1 (LOR1) in the SA region - 30/07/2024 An Actual LOR1 condition has been declared under clause 4.8.4(b) of the National Electricity Rules for the SA region from 2000 hrs. The Actual LOR1 condition is forecast to exist until 2030 hrs The capacity reserve requirement is 450 MW The minimum capacity reserve available is 404 MW Manager NEM Real Time Operations

At 20:35

Prices remain elevated in SA. The current energy price for the interval is 12,500.44 $/MWh.

At 20:43

The Actual LOR1 condition in SA is cancelled at 20:40 with market notice 117510.

At 20:50

Price remain elevated in SA at 12,500.44 $/MWh.

Using ez2view, I used the ‘small font’ setting to view the complete set of intervals to-date on my screen:

At 20:55

SA price: 379.98 $/MWh. Heywood interconnector is constrained, transferring 25 MW into SA. Wind output has picked up to 386 MW (initial MW in the 21:00 interval, up from 363 MW in the interval prior). Market demand remains relatively high at 2,108 MW when moving to the 21:00 interval.

Bowen said it would be fine.

I wonder if he hears the mob forming out the front yet, pitchforks and torches to the front.

Is the battery in SA flat yet? It’s supply proportion of the local grid has fallen from 6% to 1.5%. Is it being kept partially charged to allow for a black start?

Due to the extension leads from Vic being out or seriously limited, SA is operating like an island. And if you’re exposed to the going rates. OUCH.

Glad Bowen has plans for the rest of us that don’t look like an extension of SA’s current woes. /s

Hi Ian, you might have already seen it, but if not we posted a follow up looking at bids by ‘fuel type’ on the 31st, looking back at the evening of the 30th. Your observation on the battery storage sector that evening seems to be supported by our initial review.

https://wattclarity.com.au/articles/2024/07/an-initial-pass-over-energy-bids-during-price-volatility-of-30th-july-2024/