Editor’s Note: Back on 13th September 2022, another guest author on WattClarity, James Allan, posted ‘The Case for Hourly Renewable Energy Certificates’.

(a) We were happy to publish James’ ideas here as they could potentially address some of the issues we have seen emerging in the current methods of support for ‘Anytime/Anywhere Energy’.

(b) However in this article here from guest author Tom Geiser (which was originally published here on LinkedIn, and is reproduced here with Tom’s permission), we saw that Tom had flagged some challenges with this potential approach – hence we are also happy to also share these thoughts here on WattClarity.

——————-

Author’s Disclaimer: This is my personal opinion and bears no representation of my employer.

There a pretty neat idea going around where corporations want to measure the fraction of renewable energy they have purchased in real-time. This is a good stretch goal to have in addition to regular emissions reduction because it gets people to contract portfolios of assets that approximate what we will want in a world powered mostly by renewable energy. In effect, we get to see the interaction of a cluster of assets as an experiment within the safety of the wider system. Note that there is no additional emissions reduction with this philosophy – the atmosphere doesn’t care if you reduced emissions on the other side of the world or in the wrong timezone. Rather, the buyer gets a better hedge, supports infrastructure that supplies their facilities locally, and counters some of the whataboutism that occurs when people enter into vanilla PPAs. Great!

The value of real-time renewables comes at the contracting stage when the portfolio is designed. However, there still needs to be a follow up on the success of the design, so what of the accounting?

Google and Microsoft are proponents for real-time renewables, and are promoting renewable energy certification with granular timestamps on the certificate. The rationale is that anyone can trade to get the right amount of certificates for each interval of time. The EU has bought into the idea and is trying to legislate it despite it being rejected by stakeholders. That leads to a follow on problem – the Australian government department looking after climate and energy is also smitten with timestamping and wants to tag along with the EU’s mistake.

Intuitively the timestamping sounds like an intrinsic component of the accounting so a lot of people are just going along with it. Let’s discuss why it is inferior to the classical accounting method for real-time renewables.

Timestamping is bad for trade

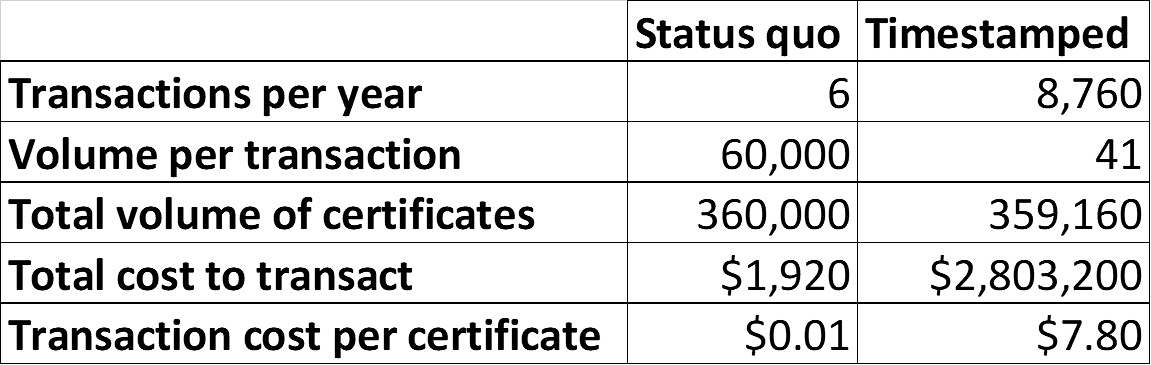

Currently RECs are traded on an annual basis. Buyers and sellers have a good idea of how many they are going to trade within a contract, over longer time periods. This makes them comfortable signing contracts because they have greater certainty of the volumes little exposure to spot prices. Compare this to hourly timestamping which breaks the year into 8760 tradeable products. A buyer of a regular PPA will have no idea how many certificates they will receive each hour, and the potential price variations when they have to buy extra when they are short or sell extra when they are long. The buyer has no idea what their future costs are and this creates deal friction, and therefore is an impediment to renewable energy deployment.

For the renewable energy producer, they suddenly need many more certificate traders as they need to line up many small amounts of certificates in the right places. Rather than trading 20,000 certificates in one lot they need to make thousands of tiny transactions. The cost of all these traders needs to be recouped from the buyers in the end.

Timestamping reduces accuracy

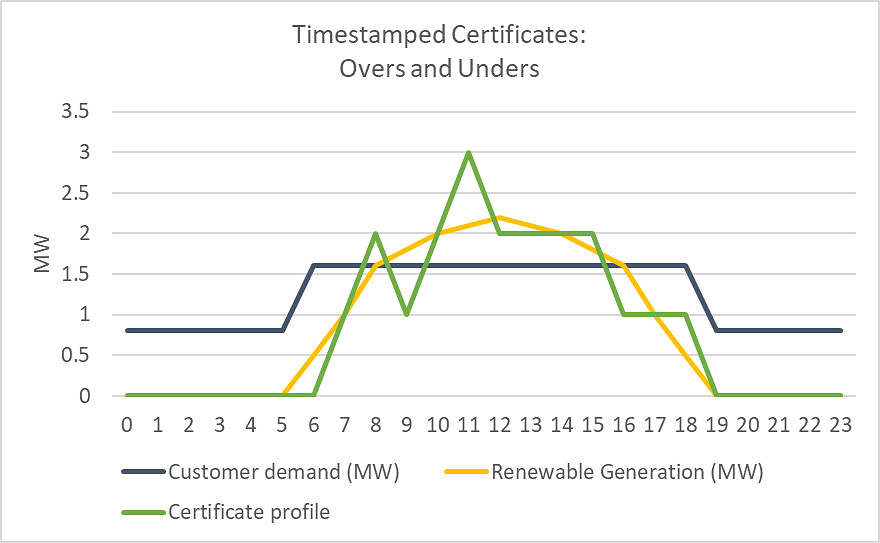

Generators produce non-integer amounts in each interval. This means there will be overs and unders across intervals as certificates can only be issued for whole megawatt-hours.

The calculation in each interval will be inaccurate compared to the decimal consumption data. This inaccuracy becomes ridiculous at smaller scales. If you have a 101 kW solar system you get a certificate every 2.4 days – how can that line up with consumption? In the example below timestamping measures 55% real-time renewable, whereas it was actually 59%.

Note that if one is aiming for large renewable fractions, timestamping will always underestimate real-time renewable fractions. This will discourage voluntary use of this method compared to decimal calculations.

Increasing the resolution of the certificates simply worsens the liquidity problem to preposterous levels.

Timestamping facilitates greenwashing

If there is no differentiation in certificate pricing, companies can buy 100% real-time renewables without putting any effort into creating a portfolio. This defeats the purpose of the philosophy. E.g. if only Google cares about real-time certificates and just buys whatever they need without crafting a rational portfolio of contracts.

If there is differentiation, then other companies can claim to be 100% renewable (but not real-time), by buying up all the cheap certificates available in a few periods per year. This is a greater threat to actual emissions reduction, and is not feasible without timestamping.

Timestamping is detrimental to storage economics

When certificate prices are stable, timestamping creates a new cost for batteries due to round trip losses. E.g. buying 100 certificates at $50, but only selling 85 certificates at $50.

Timestamping also creates basis risk because energy market bids are ex-ante and certificates are created and traded ex-post. The risk means that a battery must guess what certificates will be worth for the present interval but won’t find out for a month and can easily lose money. E.g. you think certificates might be cheap and bid into the energy market to charge up, but you made a mistake and have locked in a future loss.

If the scheme is voluntary, batteries will arbitrage the differences in certificate prices ex-post without any beneficial behaviour in the present. That is, batteries will operate relative to the energy market (which is the ideal anyway) and then backtrade on their activity after the fact to make additional profit on certificates without having created any value to society.

[I’m also philosphically against storage getting renewable certificates because it just isn’t renewable energy. By all means use it to measure real-time renewable fraction though, storage plays a part in a portfolio of assets.]

Timestamping distorts energy markets

We already have functional market signals to charge and discharge to maximise economic benefit. The energy market already incentivises charging at high renewable fractions and discharging at low renewables, so alignment is good.

Combining renewables certificates with storage distorts those signals and may create inefficient storage behaviours. E.g. discharging at 4 AM because certificate prices are high, then charging at 9 AM because they are cheap.

Timestamping does not facilitate independent verification

This is supposedly a major benefit of timestamping. [related to bitcoin fondling tech bros?]

Without publicising consumption data, it is impossible for a third party to verify claims. Corporations will not widely publicise consumption data as it is commercially sensitive. E.g. changes in consumption, or differences in efficiency leading to pricing power or stock market speculation.

Having publicly visible certificates is worthless if the related consumption information is private.

What do we use instead?

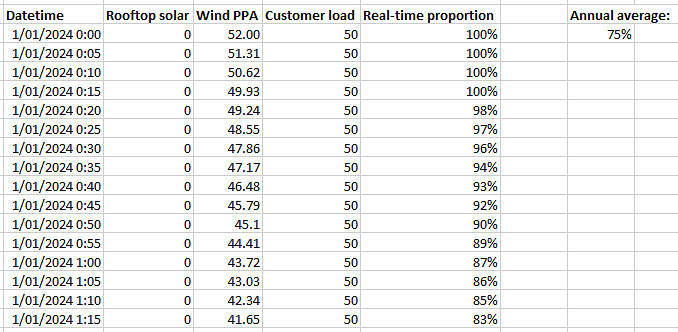

Accounting with a database or spreadsheet is established, cheaper, easier, more accurate, and has the same level of veracity. Real-time renewables accounting already uses this because timestamping doesn’t exist yet.

- None of the downsides of timestamping

- Better resolution, we can easily do 5 minute rather than the 1 hour resolution.

- Better accuracy with decimals instead of integers.

- Avoids the public infrastructure cost that would only be used by a few companies. [consider the high probability of cost overrun for government IT projects, see: How Big Things Get Done]

- Cheap and easy. With a pre-written query, you can load the answer from a database in 2 seconds. Manual collation in a spreadsheet takes less than 1 hour. No need to wait months for certificates to be settled and traded.

If corporations want a third party to verify their real-time renewable claims they will need to gather several datasets together. This could be done through external consultants, or even the Clean Energy Regulator.

The cost of half a dozen corporations paying the CER a verification fee is going to be many orders of magnitude cheaper than setting up a complicated market with some sort of blockchain nonsense. [let’s be honest, blockchain is just a crap database]

What if we have international obligations?

The EU is forging ahead with timestamping obligations by 2027. One argument is that Australia should be ready for this and prepare our own timestamping system.

I would argue that we should wait for the EU to abandon timestamping when the inevitable backlash comes. Japan and ISO have already explicitly rejected timestamping RECs.

Consider that in 2027 it will be impossible for all nations to have adopted timestamping and therefore the EU will have to accept other methodologies or just wave through imports if they do not want to be starved of resources and goods. Businesses within the EU will rightfully be annoyed that they have such an enormous regulatory burden compared to international competitors and will agitate for timestamping to be scrapped. They already have support from some EU parliamentarians who rejected it in the last round of legislation.

If my prediction comes true we saved $100m on useless IT systems and complex trading platforms, plus all the dreadful wasted human effort that could have done something productive. If I am wrong, we just implement once it becomes clear we need to. The EU cannot survive if it stops trade overnight, so it won’t do that.

EDIT: I forgot the other really important part of the Renewable Guarantee of Origin legislation – it displaces the deployment of 5 GW of new renewables before 2030 by creating an oversupply from old hydro from 2024. Please contact the department and tell them this is terrible!

About our Guest Author

|

Tom Geiser is a Senior Market Manager at Neoen and is currently based in Sydney.

You can find Tom on LinkedIn here. |

Be the first to comment on "Timestamping Renewable Energy Certificates is a Bad Idea."