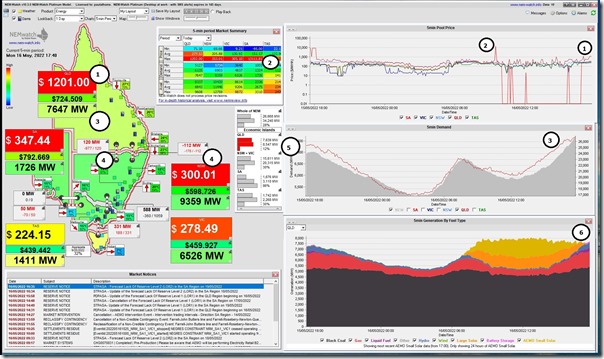

A short article this evening with the attached snapshot from NEMwatch in the 17:40 dispatch interval showing the QLD price again up:

With reference to the numbered annotations on the snapshot:

1) The QLD price is up at $1,201/MWh in the 17:40 dispatch interval – and it’s the fourth time this evening already its been above $1,000/MWh

2) There was an earlier (single) price spike to $13,111.81 in the South Australian region this morning … which is having its own tightness issues

3) Demand in QLD is a very modest 7,647MW … well in the ‘green’ zone compared to historical range

4) The interconnectors are limiting flow north:

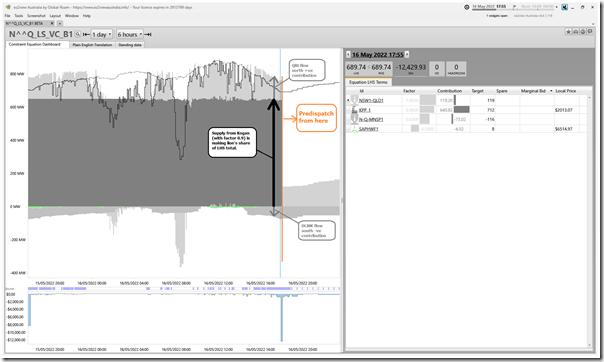

(a) The QNI Export Limit (i.e. flow north) is being severely limited by the ‘N^^Q_LS_VC_B1’ constraint equation – which is one of the ‘Kogan constraints’ as we can see here in the new ‘Constraint Dashboard’ widget in ez2view:

(b) Whereas Directlink is actually being constrained to flow south by virtue of the same ‘N^^Q_LS_VC_B1’ constraint equation .

5) As a result of this, the IRPM in the QLD-only ‘Economic Island’ formed by these constrained flows is at a low 12% level (i.e. ‘red alert’ level based on the NEMwatch alerting):

(a) Available Supply is only 8,547MW

(b) … which needs to supply 7,639 MW of local ‘Market Demand‘ (i.e. a little lower than QLD ‘Market Demand’ because of some small imports)

(c) … meaning a net margin of 908 MW ‘spare’ capacity at any price

(d) hence a 12% Instantaneous Reserve Plant Margin ( IRPM)

6) In the supply mix chart we can see:

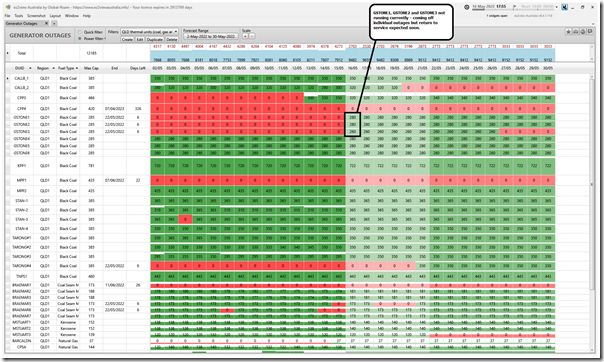

(a) coal unit aggregate capacity of under 5,500MW … with 6 units offline (of 22 in total), some of them seen in this ‘Generator Outages’ widget in ez2view:

i. As noted on the image, 3 units at Gladstone have been out but are expected to return soon

ii. Callide C4 is out on long-term outage

iii. Tarong unit 4 is out, as noted on the image above – and (as at last Saturday) was expected to return on 21st May

iv. Millmerran unit 1 is out, as noted on the image above – and (as at last Saturday) was expected to return on 7th June

(b) solar generation down to 0MW (both large and small) quicker this evening as we head towards winter, and with cloud cover and storms not helping as well.

(c) Unfortunately the lack of solar is coincident with supply from wind being at-or-under-10MW over the past hour

(d) supply of ‘peaking’ generation (from gas, liquid, hydro and battery) filling in the gap

This tightness was forecast in advance in Market Notices – including at LOR2-level Low Reserve Condition in Market Notice 96335 on Saturday evening 14th May at 19:43 as shown:

——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 14/05/2022 19:43:14

——————————————————————-

Notice ID : 96335

Notice Type ID : RESERVE NOTICE

Notice Type Description : LRC/LOR1/LOR2/LOR3

Issue Date : 14/05/2022

External Reference : STPASA – Update of the Forecast Lack Of Reserve Level 2 (LOR2) in the QLD Region beginning 16/05/2022

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE

The Forecast LOR2 condition in the QLD region advised in AEMO Electricity Market Notice No. 96312 has been updated at 1930 hrs 14/05/2022 to the following:

[1.] From 1700 hrs 16/05/2022 to 1900 hrs 16/05/2022.

The forecast capacity reserve requirement is 671 MW.

The minimum capacity reserve available is 572 MW.

[2.] From 1800 hrs 17/05/2022 to 1830 hrs 17/05/2022.

The forecast capacity reserve requirement is 702 MW.

The minimum capacity reserve available is 681 MW.

AEMO is seeking a market response.

AEMO has not yet estimated the latest time it would need to intervene through an AEMO intervention event.

Manager NEM Real Time Operations

——————————————————————-

END OF REPORT

——————————————————————-

Nothing further, at this time…

Leave a comment