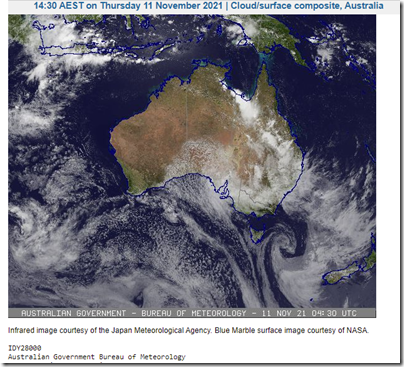

Another short article to follow Part 1 earlier today, with a snapshot from here on the BOM site at 14:30 NEM time to highlight the widespread cloud cover today:

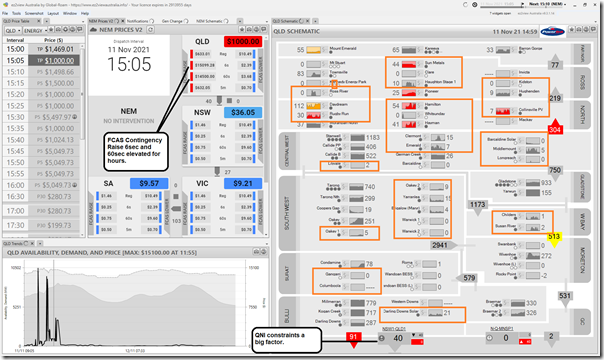

Coupled with this I’ve added this snapshot from ez2view at 13:05, with the Large Solar Farms highlighted, to provide some indication of how widespread the impact has been through today:

Note that FCAS Contingency Raise prices have been sky-high in the QLD region for hours … driven significantly by constraints on the QNI interconnector amongst other things.

Leave a comment