We recently released the Generator Statistical Digest 2019 (GSD2019) to some moderate fanfare, an event that was very quickly overtaken (and rightly so) by the events on the Vic-SA interconnector on 31 January, and subsequent events in SA. As many have noted, SA has performed admirably as an electrical island, due in no small part to the relatively mild weather, excellent unit performance and very importantly, adequate FCAS provision. Although energy prices have been quite volatile, FCAS has been extremely volatile and incredibly sensitive, indicating some of the true requirements around ‘reserve management’.

Since writing one of WattClarity’s most viewed articles in 2017, ‘Let’s talk about FCAS’, ancillary service market and power system events have continued to occur at a seemingly increasing rate. It was for this reason, that we decided to spend a large amount of time developing and analysing the FCAS costs and revenues at a DUID or unit basis in the GSD, with a view to presenting information that rarely gets attention outside #energynerds. With over $90m changing hands already since the event (nearly as much as energy) in the last 2 weeks in SA alone – FCAS does not only matter … it is critical EVERYONE understands it, not just us energy nerds!

Therefore, in the GSD 2019, we included estimates* in the ‘B Page’ amongst other things;

- FCAS Revenue earned by participants in 2019; and

- FCAS Contingency Costs incurred by generators and loads; and

- FCAS Regulation Costs by generators and loads.

* We say estimates because the actual number for each participant is confidential and based on metering/settlement information that is not available.

To the best of our knowledge, this type of DUID/Participant-level breakdown information has rarely been made public, especially to this level of detail, predominately because of the complexity around calculating it.

So, what does the information look like?

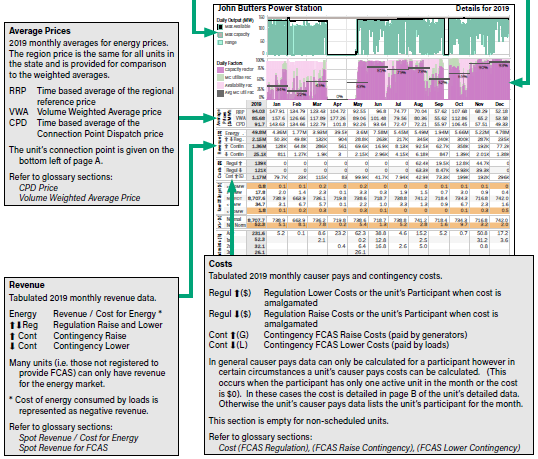

Describing the information on the page

As with the GRC, the GSD includes a guide on how to read the information, describing what can be seen on each page, along with a glossary of information.

The FCAS revenue numbers are relatively straight forward, with any generator who is an FCAS provider identified in our A page, providing FCAS in a dispatch interval, shown in these columns. These aggregated numbers are available from AEMO as ‘Ancillary Service Payments’ on their website. Note, it is not just generators that earn FCAS revenue; some scheduled loads and frequency-sensitive loads earn revenue here too.

The key point here is that, if the service is provided, someone has to pay for it, and AEMO has used the same basic methods for nearly 20 years to recover the payments to suppliers; this is called recovery by AEMO, and this is where it starts gets complicated. By the way, the weekly values are also included at the above link on the AEMO website.

All raise contingency services are recovered from generators, with the general theory being that raise services are generally required when generators trip, or when transmission elements trip (thereby not allowing generation to get to market). Conversely, all lower contingency services are paid by loads or consumers. With regulation services, a causer pays procedure is used that allocates a percentage of the total cost in the week, based upon an assessment period several weeks earlier. It is for these reasons, that we separate out the costs into Contingency Lower and Raise, as well as Regulation.

However, because Regulation recovery can be shared under portfolio arrangements governing each participantid, AEMO only provide a single number for participants based on the registered ACN.

So what does the information tell us?

A look into the FCAS Revenue results

For the year we analysed (2019), there were a number of key observations.

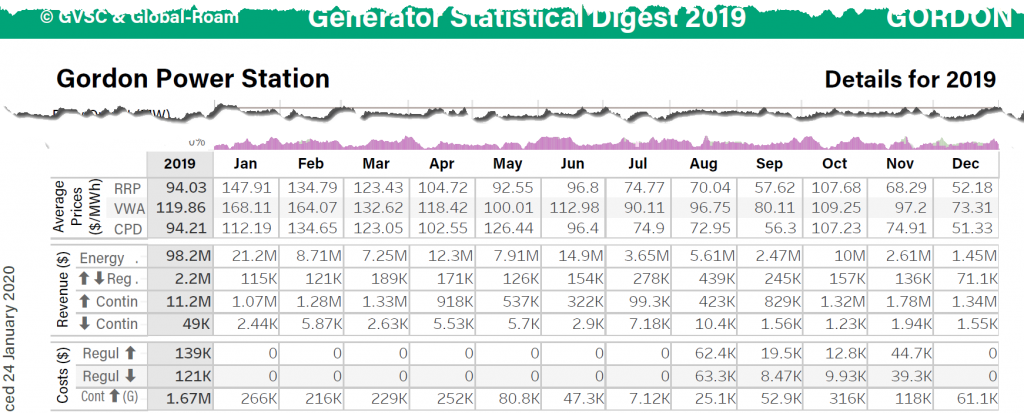

Firstly on the revenue side of the equation, the top 5 providers of FCAS Raise Contingency service are:

- GORDON (TAS1): $11,244,812

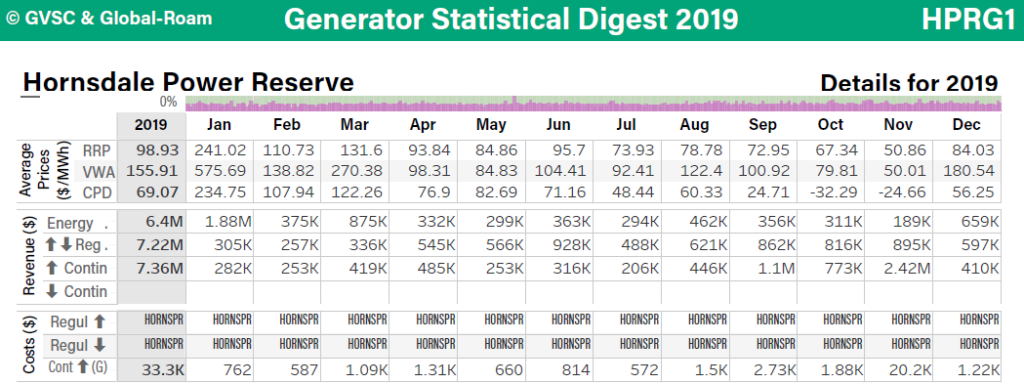

- HPRG1 (SA1): $7,362,389

- DALNTH01 (SA1): $4,376,876

- ASNENC1 (NSW1): $4,189,034

- APD01 (VIC1): $2,556,657

The GORDON unit/s in Tasmania top the list for revenue generation in Tasmania, not surprisingly, when it is the primary unit that provides FCAS in the region. Interestingly, it generated in 2019 5 times as much revenue as the next Tasmanian DUID’s (Tungatina and Reece), highlighting the criticality of Tasmania on the Gordon units.

Notice batteries in the position of 2 and 3 (from SA), with Demand Response (ASNENC1 is aggregated unit for Enel X in NSW (formerly EnerNoc) and Vic smelter (Portland) in positions 4 and 5.

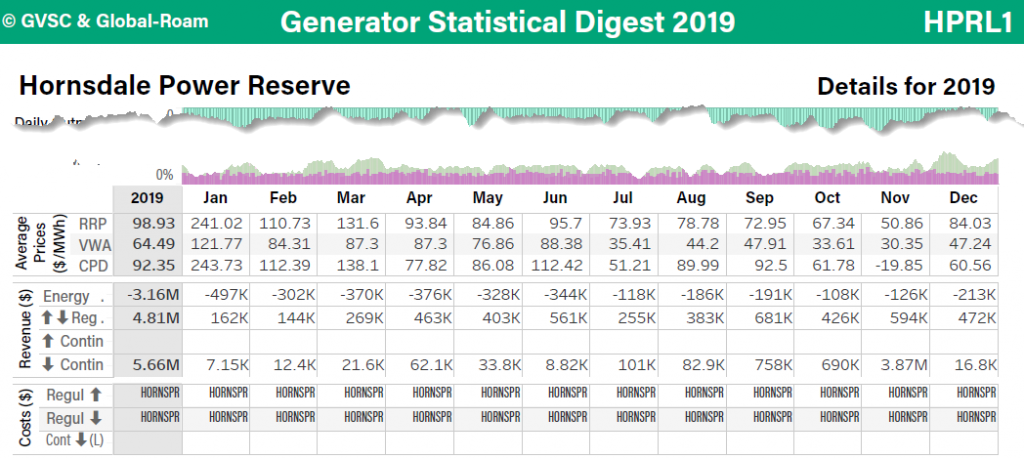

When we look at FCAS Lower Contingency, a similar few names appear, all based in SA1:

- HPRL1 (SA1): $5,660,270

- TORRB4 (SA1): $2,367,829

- PPCCGT (SA1): $1,876,842

- TORRB3 (SA1): $1,848,755

- DALNTHL1 (SA1): $660,121

When we turn our attention to regulation services for 2019, HPR tops the list again, with the Torrens units in SA and Bayswater units in NSW covering positions 2-5:

- HPRG1 (SA1): $7,217,159

- BW01 (NSW1): $4,994,876

- BW02 (NSW1): $4,853,311

- TORRB1 (SA1): $3,453,620

- TORRB4 (SA1): $3,297,569

Although some previous market commentators have noted revenue as it is relatively straight forward to calculate, it is only part of the equation, as many providers of FCAS contingency in particular also have to pay for that service, as the FCAS contingency recovery mechanism is based on the total energy generated in the trading interval.

Similarly, with only 15% of registered units providing FACS service, with this number continuing to reduce as more new entrants come online without providing FCAS services, it is vital to understand who is paying what and where. As the non-FCAS providing SA generators are finding out, if you don’t provide the service (and even if you do), someone must pay for it. Therefore, in true #energynerd fashion, we delved into the rarely talked about area of FCAS recovery.

A look into FCAS Contingency Recovery

For the year of 2019, the FCAS Recovery mechanism resulted in some very interesting results across all regions. Around $220m need to be recovered, with most of that associated with Regulation service provision.

As noted above, the biggest suppliers are also generally the biggest payees with respect to FCAS contingency services given they generally generate the most energy in the region, with AGL and Hydro Tasmania the biggest payees at over $22m each (although between them that is across nearly 100 DUID). So although their revenues are high (AGL, Hydro Tasmania and CS Energy all total in excess of $30m), their total costs do consume a large portion (generally greater than 50%) of that revenue. The rare exception to this is the Hornsdale Battery, which has very small cost elements (<$100k) compared to contingency revenue (> $12m).

Given the FCAS contingency payment requirement, in regions where there is a high wind and solar generation (with no provision of FCAS services), this cost needs to be added to the overall operational costs of the unit, in a similar fashion to short run marginal cost of fuel, completely dispelling the myth that wind and solar are free! Yes, there may be no charge for the wind or solar ‘fuel’, but that does not mean there is no cost associated with turning it into electricity.

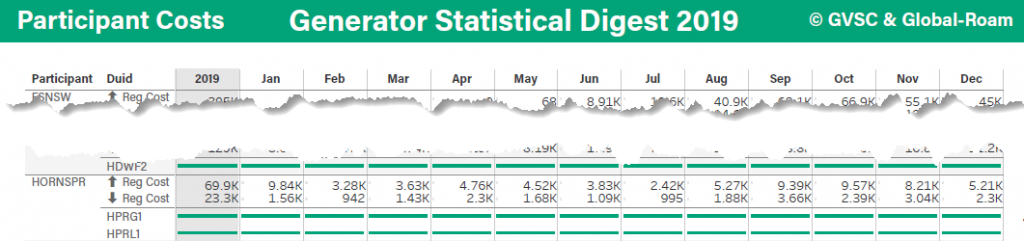

FCAS Regulation Costs

Whilst much has been written over recent times on FCAS Regulation Costs, the key item for consideration here is to note that the individual cost item per unit is difficult to definitively breakdown, so an a ParticipantID value was the lowest level of aggregation we were willing to go in the GSD 2019. To that end, we have shown the estimated FCAS Regulation costs for each individual ID where possible, and where an aggregation of units has occurred, we have used the ParticipantID, as shown above with HPR.

In the final pages of the GSD, we have included a section showing the breakdown of units in the ParticipantID throughout the year (because yes, DUID’s do move between ParticipantID’s), such that a participants costs can be observed, as shown below for HPR.

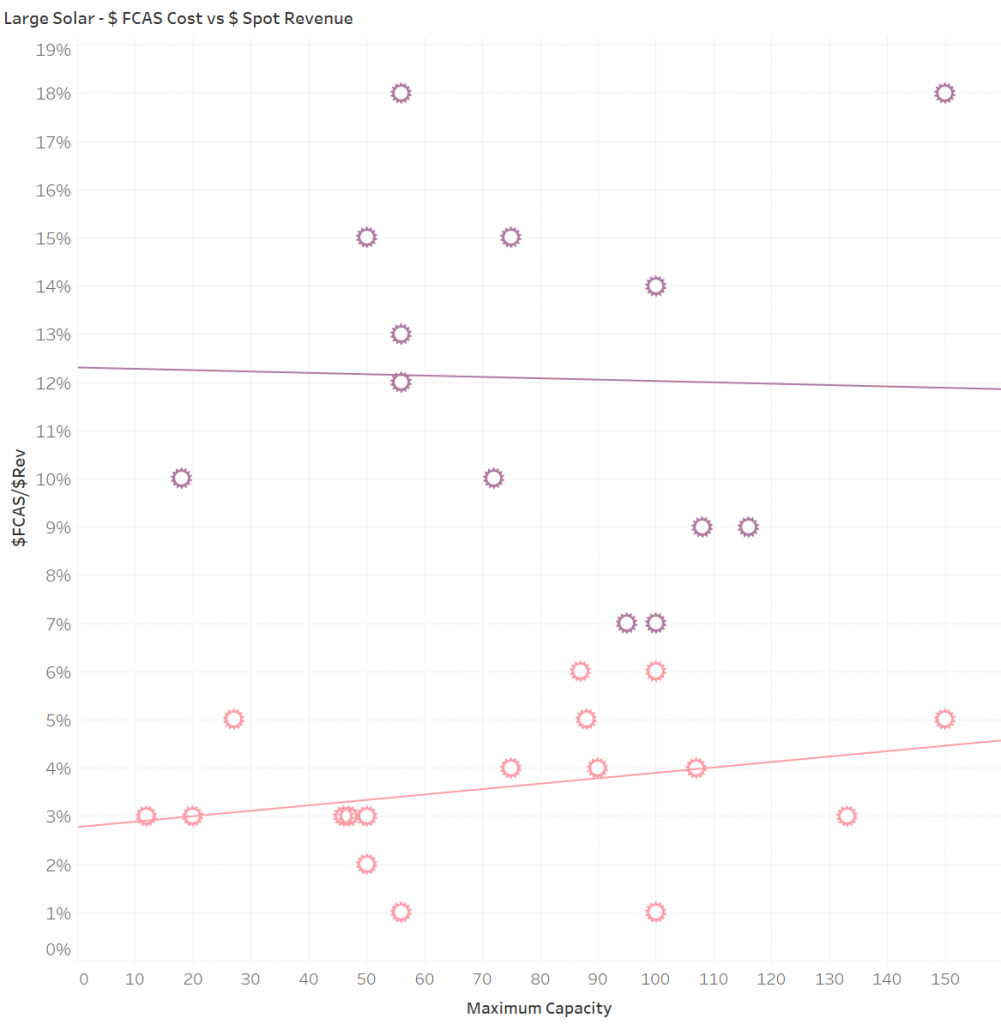

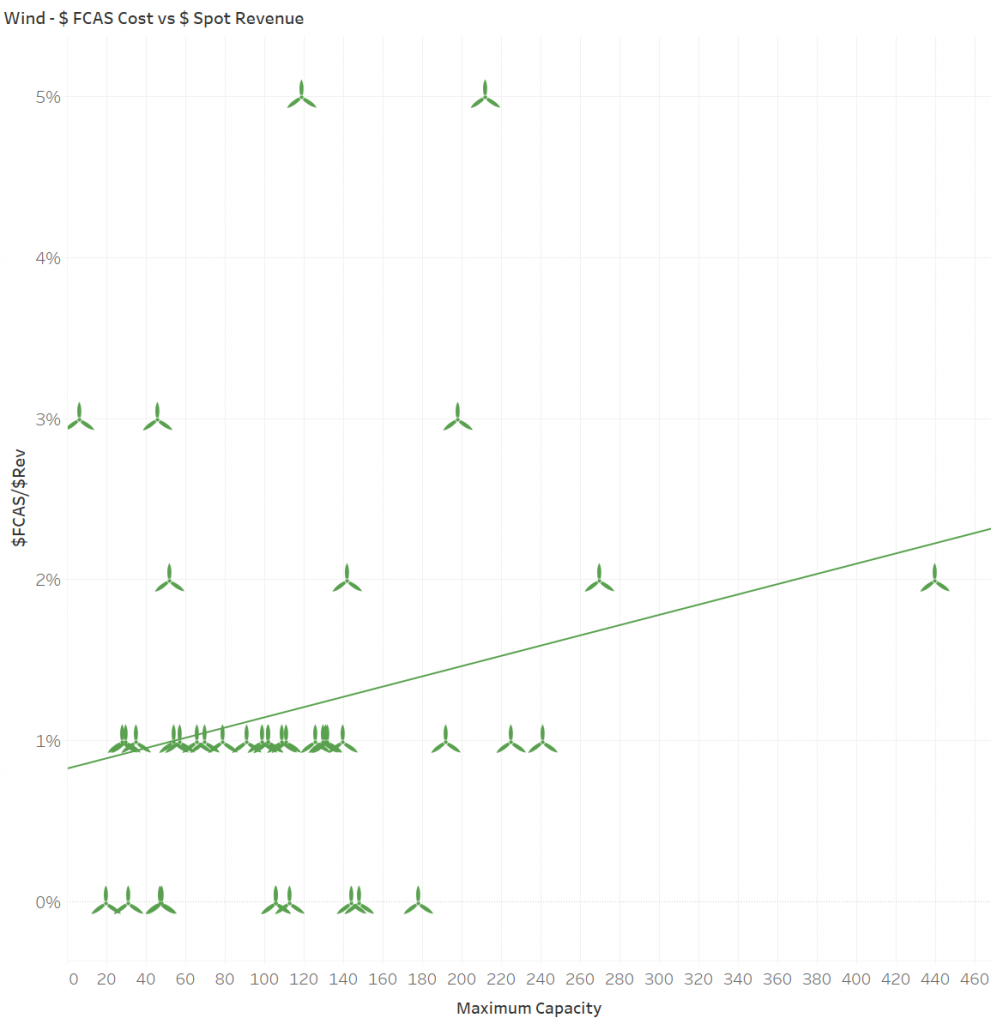

Using all of this energy and FCAS revenue, as well FCAS cost information, we started to analyse the $FCAS/$Energy ratio’s to see what the numbers for each fuel type looked like, whereby the lower the ratio, the lower the FCAS costs compared to FCAS energy revenue.

FCAS$/Energy$ Ratio

For single unit or single fuel portfolios, when the total amount of FCAS costs being incurred for wind and solar plants are divided by the total energy revenue, we start to see an alarming trend particularly at solar sites which show some plants averaging 10-13% FCAS costs to energy ratio (purple) versus other plant which are averaging closer to 3-4%. Remembering these are just for single asset/single costs sites, these values would be far above the 1-2% for FCAS costs most projects would have estimated (if at all), placing further pressure on the projects.

The trend is not as dramatic in Wind, with values closer to 1% that, albeit significant in total spot revenue terms, is perhaps not as detrimental to project success.

What can we learn from this?

As we noted at the start of this article, FCAS Matters – Now more than ever! And albeit a difficult subject to get your head around, whether it be as an experienced operator or brand new development, any participant who assumes FCAS is nothing because that is what has always been the case, risks not only incurring significant and enduring costs for their project/projects, but also risks being left holding the proverbial can as more learned operators start taking this area of the market and power system more seriously, as we transition to a different operating power system. The GSD 2019 provides an invaluable guide to this formerly scant area of the market, an area ignored for too long.

————————————–

About our Guest Author

|

|

Jonathon has nearly 20 years practical experience in the Australian NEM, having held senior operational and trading roles in participant organisations and now as the Director of a specialist market consulting organisation, with a specific focus on renewable energy integration. Current clients include some of Australia’s largest integrated utilities, market regulatory organisations, transmission system operators and not-for-profit market observers. Jonathon has spent considerable time working with AEMO, Australia’s energy market operator.

As a former member of the NEM’s Dispatch and Pricing Reference group, Jonathon’s intricate knowledge of power system dispatch and security, coupled with practical, on-site experience with power system operations across all forms of electricity generation, allows him to bring operational and energy trading realities to strategically significant policy discussions. Jonathon has degrees in Engineering and Management, and is a member of the Australian Institute of Company Directors, CIGRE and IEEE You can find Jonathon on LinkedIn here. Jonathon, and his team at Greenview, are also co-authors of the Generator Statistical Digest (released on the 28th January, 2020). |

What drives the difference in FCAS between different solar farms?

Given renewable projects typically have contracted their output via PPA and thus don’t have spot exposure, wouldn’t it be more informative to show the FCAS cost they have incurred divided by their output?

Thanks for the feedback HR … could do. As time permits, we might issue an update

I see the ESB is worried-

https://www.abc.net.au/news/2020-02-24/solar-power-means-cheaper-energy-but-grid-instability/11993776

There certainly are a lot of acronyms in the power field nowadays but they seem to spell out the same message.