How can we make sure everyday consumers benefit from the radical changes that are taking place in our electricity grid? That was the fundamental question we started with when we founded Amber Electric.

Increasing renewable penetration is coincident with increased intra-day volatility in market prices, and increased volumes of distributed energy assets is enabling customers to participate more in the market. Combining these 2 factors together creates an opportunity for households to participate more in the electricity market, and to actually benefit from the transformation occurring. This is what Amber set out to enable.

Working with licensed retailer Energy Locals, we’ve brought to market an electricity plan that passes through wholesale electricity prices directly to everyday households, both for electricity consumed from the grid and for electricity exported. Within this relationship, Energy Locals are focused on providing the traditional retailing functions for customers (including billing and concessions), while Amber is focusing on maximising the customer benefit from wholesale prices. This benefit for customers comes through by shifting their usage to cheaper wholesale electricity times. And for those customers with DERs, they can also benefit by providing power to the grid during peak events – and earn high wholesale rates for doing so.

Amber operates on just a flat $10 a month margin, with all other components passed through at cost – this means Amber’s interests are aligned to customers’, since there’s no profit from selling more electricity.

Amber launched in NSW (Ausgrid distribution area) in August 2018, and expanded to SA in November. This means the 2018/19 summer period has been our first chance to see how a residential wholesale product works in the market, and the summer certainly threw out some challenges and opportunities for us.

Lesson 1: Wholesale prices enable customers to save (most of the time)

The first lesson, probably familiar to readers of WattClarity, is how consistently wholesale prices enable customers to save compared to traditional fixed prices. This might be even more true for residential customers than businesses (who have had access to wholesale prices for years) as customers use a proportionally higher load during weekends, when wholesale prices are consistently cheap.

We definitely see different load profiles by different customer types, with customers who use large but controlled amounts of electricity typically seeing the cheapest rates (e.g. customers with pools or electric vehicles). Additionally, customers who use more power earlier during the day, or on weekends, tend to see better prices than those who consistently use the most from 6-9pm on weekdays.

An endorsement of the savings from one of our early customers

Overall, we consistently see usage prices for customers in NSW equal to the best retail products on the market, and in SA ~20% lower than the best prices on the market. This is a substantial savings for those customers who are comfortable with a higher level of volatility. One this point, it leads clearly to the 2nd lesson

Lesson 2: SA is a very different market than NSW

In NSW wholesale prices has given customers access to rates equal to the best in the retail market, and over summer these prices stayed pretty stable. In SA the savings from moving to wholesale prices are significantly larger, but that comes with increased volatility. For SA this summer, this volatility essentially came down to 1 event over the summer – the price spikes of January 24th, when the market stayed at the price cap for 5 hours in a row.

This presented the biggest test of the Amber model that we’d yet seen. In the morning, our system notified Amber customers about the potential price spike , although we were a little sceptical as we’d seen a number of false alarms over the summer. Based on this notification, we did see about 50% of Amber customers engage in some sort of demand response. Anecdotally this ranged from raising the temperature set-point on their air-conditioner by a 3 degrees, through to choosing to spend it with friends/family instead of at home.

The upside of this event was for solar customers, most of whom actually profited overall from the spike (by exporting solar and receiving high wholesale rates). Our highest earner received almost $150 from their solar in the window, which is pretty incredible.

Solar Exports and Earnings from our most important customers in SA – my parents

On the flip side, events like this really make the trade-offs of the wholesale pricing model particularly acute: if you were able to reduce your usage during this 5 hour window you enjoyed low wholesale prices for the month (and potentially a nice bonus if you exported during the period). However, many of those customers who weren’t able to reduce usage reached our monthly average price cap (set to 40c/kWh in SA). This could wipe out 2-3 months worth of accumulated savings from wholesale prices, so it’s a significant trade-off.

Lesson 3: Solar is a surprisingly effective hedge

One lesson that we ourselves hadn’t fully appreciated was how effectively rooftop solar works to provide a price hedge in the Australian market. Typically over summer we see the highest prices during times when solar is still generating strongly, and so our customers with rooftop solar saw significantly less volatility in their prices than those without rooftop solar.

We expected customers with batteries to show this behaviour (since they’ve essentially bought a physical hedge on the market), but the fact that solar-only customers saw such savings was an unexpected bonus. It really raises the question about how much the 20% households in Australia who have rooftop solar are currently “over-hedged” by traditional retail models, given this correlation.

Lesson 4: Manual demand response needs more engagement

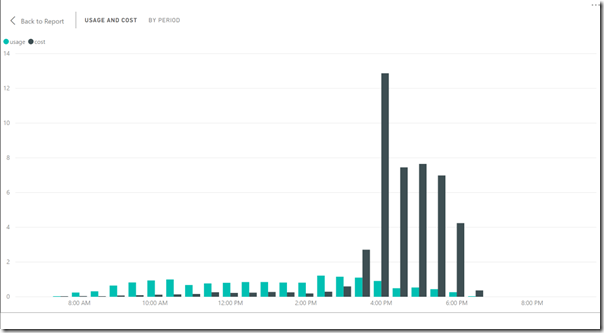

One area we don’t think we did as well during the summer (especially on January 24th) was keep our customers more informed about what was happening in the market. We saw a significant increase in demand during the last hour of the price spike, which potentially could have been avoided (and thus saved our customers money) if we’d been keeping people informed in real-time about what was happening.

It also raises the question about when to let people know about the spike happening. Ideally you’d give people plenty of warning so that they can best prepare, however this comes with the downside that you’re more likely to produce false-positives in this situation, which overseas experience suggests reduces the effectiveness of the demand response.

Either way there seems to be no downside to proactively engaging customers more during spikes (especially ones of extended duration).

Lesson 5: Automated demand response needs to be the model for the future

Ultimately the lesson for us from the summer is that to deliver all the benefits of wholesale pricing, we need to make it extremely easy for customers to be able to automatically respond to changes in prices. This includes existing appliances in peoples’ homes like electric hotwater systems, pool pumps, and airconditioners, as well us newer technologies such as home batteries and electric cars.

In our view, this is the necessary next step to enabling customers to participate more in our energy market, and benefit from the transformations that are happening. The good news is that we so far have an amazing group of engaged customers who want our help with this, and so that’s our challenge to prepare for the next summer!

————-

About our Guest Author

| Chris Thompson is CEO and Co-Founder of Amber Electric, behind the only product delivering electricity to Australian households at true wholesale prices.

He grew up in Adelaide and is a Law and Commerce graduate from The University of Melbourne. Prior to founding Amber, he worked at Goldman Sachs, Boston Consulting Group and was Managing Director of an eCommerce startup in Iran called Bamilo, where he grew the company to 350 employees. |

SA and VIC are set to experience another 5 hour price cap event this afternoon.

If this occurs it means that in just over a month there have been 2 events that will wipe out 6 months of predicted savings.

That assumes these events do not continue which is highly unlikely.

Residential customers are extremely unlikely to benefit from spot pricing.

SA and especially VIC are sitting on All time high for a year of energy. With SA, the question has to be why?. What has gone wrong with the planning for renewables? They have known about them and must have planned for them, and have had a long time to plan for them, but the price is SA just keeps going up.

John, the price is high because the penetration of renewables reached a tipping point forcing the closure of cheap coal generation.

With Hazelwood no longer operating, SA and Vic can’t reliably meet the demand in the afternoon/evening peak if we have a low wind day.

Just imagine what will happen when Liddel closes in 2022.

But, renewables are cheaper?. In every single study done from CSIRO, to banks, to industry.

It is more than just coal being shut down. It is a lack of control.

John.

Renewables are only cheaper when you exclude the capacity factor which is about 3-4 times lower than fossil fuel generation.

If you multiply that through the levelised cost you get a true cost comparison which shows renewables are way more expensive than coal and gas