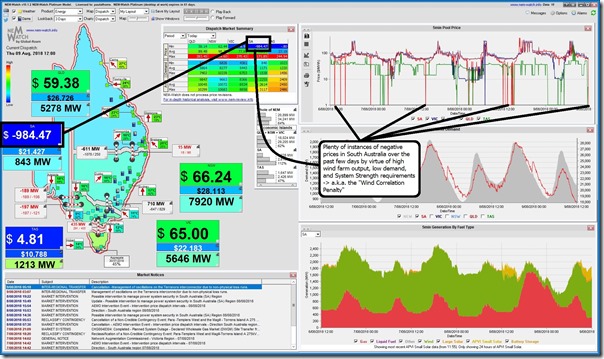

An hour ago today I tweeted this snapshot from NEMwatch v10 at the 12:00 dispatch interval to highlight another instance of the “wind correlation penalty” striking all generation output in South Australia over the past couple of days:

This is a phenomenon we’re taking an increased interest in, as we are helping a growing number of new entrant generators in the NEM (even – as I noted at our first Quarterly Highlights session a weeks ago – down to some relatively small ones that are well below the threshold for being scheduled, but still have some merchant exposure so have us helping them to turn off when the price is negative – reverse demand response, if you like).

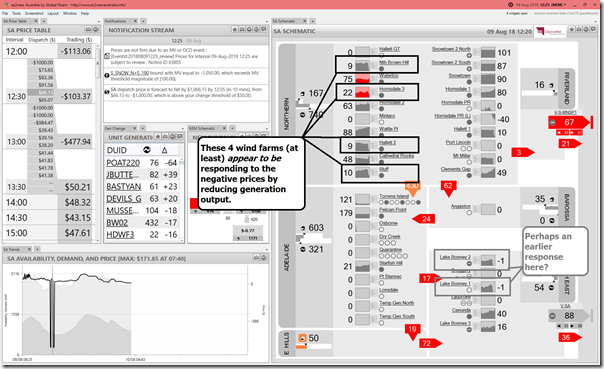

Taking a closer look at our way-more-powerful ez2view dashboard focused on the South Australian region a little while later, I noted a sharp drop in output at a number of the wind farms in South Australia coincident with successive trading periods down around the Market Price Floor. Seen here intentionally paused at the 12:25 dispatch interval we see the 12:05 dispatch price was –$1,000/MWh (to follow the –$984.47 captured for 12:00 above), meaning 2 trading periods in a row with price below the recovery price of an LGC:

Remembering that it is not possible to know a participants motivation when you’re sitting on the outside looking in like we do, it does seem that there are a couple wind farmers who are beginning to blink in this painful game of chicken. More on that later…

It’s no time to be courting Villain #4 in developing new generation projects in the National Electricity Market…

Paul

It may be less a case of the windfarms _actively responding_ to negative prices, than simply having capacity offered (bid) into the market at prices well above the -$1,000/MWh price floor. In cases like today where there is low demand, a strong constraint on exports – due to yet another 275kV transmission line outage in SA – plenty of wind, and the system strength constraint requiring fixed levels of thermal generation to stay online, economic market dispatch will necessarily reduce generation from the “higher priced” windfarms to keep supply and demand balanced.

Effectively the windfarms in question would have set up their offers so that their output is automatically reduced by AEMO if the spot price is lower than some threshold, which may be related to the value of LGCs, or the bundled price of energy & LGCs. Not that different to how other generators bid except that for contractual reasons these price thresholds tend to be negative for windfarms.

Allan

Will have a look tomorrow, Allan. Thanks for the reminder that there might be simpler actions!

It is a pity the SA/Vic boundary wasn’t moved from Heywood to Tailem Bend for the duration of the works. What is the point of curtailing the SE wind farms when the transmission restriction is between Tailem Bend and Tungkillo, and there would be more than enough capacity on the Heywood interconnector to export all their output to Victoria.

Good question Malcolm. I haven’t looked but if the SE windfarms are being curtailed by the Tungkillo-Tailem Bend outage (rather than just dispatched down on price), then that will be due to a transient stability constraint not a thermal limitation on exports to Vic. The issue is that if the remaining 275kV line in SA trips, the SE generation remains connected to SA on the much weaker 132kV network, and if that generation is running too hard at the time the sudden change in impedance leads to transient issues impacting those generators. The constraint’s generation limitation effectively controls what is flowing back into SA from the South East rather than what is exported to Vic.

Won’t there be even greater problems of managing the generation/load balance within the SE SA region if it is part of the SA market than moved to the Vic market for the duration of the works? For example, if SA prices turn negative and the SE wind farms turn off, AEMO needs to quickly find perhaps 200MW to support the SE load, while the capacity from north of Tailem Bend is limited to 100MW. So it would have to find the balance from the Heywood interconnector. According to an AEMO diagram, there are 3 lines from Tailem Bend to Adelaide

– a 275 kV line to Tungkillo (which is being worked on)

– a 275 kV line to Mt Barker

– a 132 kV line to Mt Barker, which has a likely thermal rating of 100 MW

The latter line is no doubt the limitation, so if the Mt Barker 275 kV line trips, there is still 100 MW of capacity via the lower voltage link.

Malcolm

As Ben says below, location of the regional boundary is really just a settlement issue. The dispatch algorithm loads generators according to least-cost principles consistent with all constraints, regardless of which region they are in.

In the scenario you paint, the “missing” 200 MW would simply be provided by increasing loading on other generators (including possibly in Vic / NSW / Qld) and network flows (including across Heywood interconnector) would adjust accordingly.

Also note that it’s not only the thermal capacity of the 132kV network that is the limiting factor on flows to / from SE SA, it’s the much shorter term transient impacts of a trip on the remaining 275kV line that have to be protected against.

Allan

The dispatch system should still dispatch the generators downstream of the constraint correctly assuming they are bidding below the marginal cost of supply in Victoria.

The constraint orientation should recognise the generators’ locations OK.

The regional boundary affects settlement, but should not directly affect the efficiency of the dispatch process. Sometimes generators will rebid to avoid being run and settled below running cost, but probably wouldn’t occur in this case.