As the proportion of electricity generation shifts from largely dispatchable technologies to an increasing amount of intermittent supply sources, such as wind and solar, new products and services will emerge in the wholesale market to manage price risk.

ERM Power recently released an innovative set of derivatives into the market that provide both price transparency and facilitate the risk management of solar generation. With the rise of new generation companies entering the National Electricity Market, and the heightened interest from corporate customers considering asset backed renewable energy procurement strategies, it became apparent that a need existed for both ‘firming products’ and for a greater understanding in the difference between non-firm and firm pricing.

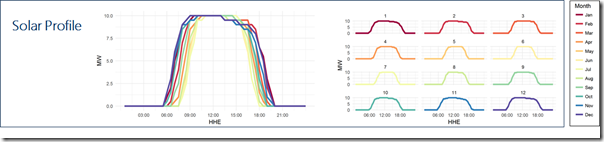

(1) Solar Profile Product

The solar profile product pairs a monthly profiled electricity swap with a forward settled large-scale generation certificate (LGC). Each month has a pre-defined half-hourly profiled swap that replicates the typical production of a single-axis tracking farm. Profiles will vary month to month to reflect changing generation output throughout the year. Put simply, the profile will be wider in summer and narrower in winter. LGCs are matched to the swap on a one LGC for one MWh basis. Each calendar year that equates to 34,288 LGCs (as there are 34,288MWh in the profiled electricity swap each year), per 10MW of capacity.

Besides the benefits this product delivers for hedging purposes, it also provides useful price information on the trend of ‘sunlight hour’ electricity swaps. Currently parties can easily access the price of flat and peak swaps, however the price of the sunlight hours is quite opaque. Buyers and sellers will both benefit from the increased price discovery this product brings, particularly those considering negotiating a power purchase agreement.

Naturally the price of a ‘firm volume’ swap, such as the solar profile product, will be priced at a premium to a non-firm run of generation meter product.

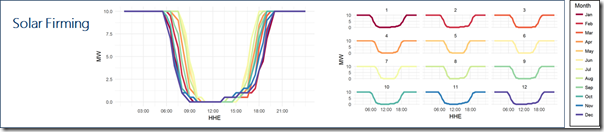

(2) Solar Firming Product

The second derivative, known as the solar firming product, is an electricity swap for all hours in a year that are not included within the solar profile product. LGCs are not paired with the second product. A transaction for 10MW of capacity for this product would amount to 53,312MWh per annum.

It is anticipated that the most popular use for the solar firming product will be as a complimentary hedging strategy for solar generators. Solar generators could sell flat swaps on the open market, and buy back the solar firming product therefore leaving themselves exposed to pool prices for only the few hours that their solar generation does not correlate with the firming product. This residual risk maybe mitigated through insurance strategies, battery storage, contractual agreements with peaking generation, or alternatively held on their books as an open risk position.

At the time of writing, environmental market brokers TFS Green had pricing in Qld, NSW, Victoria and South Australia on a number of these products. Organisations wishing to transact these products would have generally entered into standard market agreements with brokers and other wholesale counterparties, such as retailers and generators.

These new product concepts have been well received by the market and while liquidity has initially been focused with TFS Green, we anticipate other similar product innovations will continue to emerge across the market.

About our Guest Author

|

David Guiver is EGM Trading at ERM Power.

David has worked in the energy sector for more than 18 years, including with ERM Power since its inception and growth to an ASX-listed energy company operating electricity sales, generation and energy solutions businesses. The Company has grown to become the second largest electricity provider to commercial businesses and industrials in Australia with operations in every state and the Australian Capital Territory (and also has operations in several parts of USA).You can view David’s LinkedIn profile here. |

mmmm…lets not have reliable dispatchable power, lets have an innovative set of derivatives. Typical of rent seekers circling this mess.

I would say the Author will be nailed to a cross for saying that wind and solar and not reliable energy.

Quite a lot of people believe it’s the other way around. Coal and Gas are intermittent and wind and solar are predictable. Due to the weather being able to be forecast so accurately. Yes I am a fond boater and the forecast for boating weather is so broad and covers all most every possible out come, yet my experience is that they still have a very poor accuracy.

Strange comments.

In reply to yarpos:

The purpose of derivatives is to make solar power more reliable and dispatchable. Who are the rent seekers? Perhaps you are also against lending money by banks.

In reply to Shilo:

Solar and wind power is predictably intermittent, but not controllable. Coal and gas are controllable. The proposed derivatives will bring more private funding into solar and wind forecasting. This should also improve your boating experience.