This week, the sun has been very central to our thoughts for a number of reasons:

1) At least in part because of the different ways we’re helping a diverse range of people deal with the opportunities, and challenges, of solar PV in the broader NEM;

2) But also because Brisbane’s (almost) winter sunlit hours are magical in any case;

3) This Tuesday (15th May) was also an opportunity to be at the CEC’s well-attended “Large Solar Forum” (they have helpfully made the presentations publicly available here). Incidentally, nice to see a couple different references to ways we serve different clients in the slides.

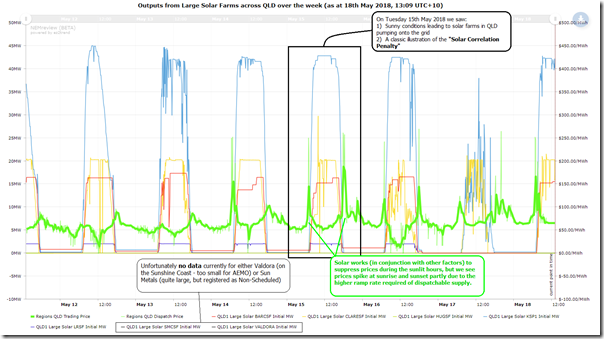

Prompted by questions received about the influx of new solar entrants into the space (which we’re tracking in our Generator Catalog) we took at look at output over the week and share it here with you today:

Note that NEMreview clients can access the Trend Template here, in order to see updated data and proceed to their own analysis.

What immediately jumped out to me was the effect that these solar plants (and the much larger volume currently coming from aggregate small-scale rooftop PV) is having on the shape of pricing in these shoulder months. I’ve particularly highlighted Tuesday 15th May to note the irony that the CEC Forum heard of the 30 projects that Powerlink has at connection application stage followed by a much larger number at enquiry stage – and yet we’re already seeing the effect of a “Solar Correlation Penalty”.

The way the high degree in correlation of solar output is suppressing spot prices through the day will pose some challenges for all generation sources that operate during those periods – including solar ones (both existing, and also this steady stream of new entrants). Coupled with this, the escalation in ramp rates required for dispatchable supply seen during the sunrise and sunset periods is also already (through the price spikes at these times in the chart above)sending pretty clear signals to the market of the type of investment required for the future.

I’ve already written on WattClarity before about the increasing “Wind Correlation Penalty” driven by the high degree of correlation across all major operational wind farms in the NEM (currently spread across SA, VIC, TAS and NSW). Welcome to its rapidly growing sibling ….

It is good to read about some of the cost/price implications of significant PV and wind feeds. I have contended for a long time that generation cost comparisons of renewable and non-renewable energy have been very misleading. As the sales opportunities for traditional generation become impacted by renewable feeds the consequences of these changes should applied to the renewable side of the ledger. The cost of generation of what ever flavor is still largely the repayment of the capital costs. These capital cost need to be met even if there is no product sold. A cut of 50% of the product almost exactly double the unit cost. Even if a renewable feed was zero, for example, because there still remains the need for standby generation then about the same number of dollars need to flow to run the standby plant for it to remain viable. Cost comparisons seems to imply that when renewable feeds are less than traditional feeds the total cost of generation will drop. It will not. Even if renewable feeds were zero the cost of product will be almost the same because of the need to pay back capital on the standby plant. It will never be that cheap. Good to see some discussion about this very badly presented subject.

Wivenhoe pumped storage (500 MW) could be used much more for balancing, and questions need to be asked as to why it is used so sparingly. So far this month one of its generators has been used 6 times at between 60 and 100% of capacity, and the other has not been used at all. For comparison the Shoalhaven pumped storage has generated 23 times. Wivenhoe is operated by State-owned CS Energy, which also operates several coal-fired power stations. It has a conflict of interest in despatching Wivenhoe because this would reduce its income from the coal-fired stations within its portfolio. But as an asset owned by a State government with a target of increasing renewable energy, its management by CS Energy seems to be detrimental to implementing government policy.

The graphs show a typical power price of $70/MWh, apart from price spikes and daytime troughs when there was an excess of solar. With current steaming coal prices an operator competing for potentially seaborne coal needs to recoup at least $47/MWh just to cover the cost of coal. Furthermore the power stations near Rockhampton and Gladstone get paid a 5% discount on the State price because of line losses. So there’s little margin to cover the other costs, show both a return on capital, as well as profit. Hence their reliance on price spikes.

Paul, interesting, thanks. Not sure I like the title though – its pejorative and ideological. There is nothing terrible special here: production increases when the sun shines. We have seen the same thing repeated whereever solar becomes significant – Italy’s main trasmission has been recording peak demands at night, not day, since 2011. This provides incentives to switch load into the day time period.

I would love to know where the $70 per mwh is needed to break even for power stations comes from.

Somehow over the last 15 years they have operated for up to 4 consetive years where the average spot was around $30!!!!!!!!!!.

To anyone who wants to debate the cost of coal fired energy, I would first like to level the field, and allow to discussion to be around, coal fired plants being able to be built as easily as wind and solar and the bidding for power being filled in order of lowest bid, as it used to, not renewables first.

I am quite sure in Queensland if that were the case the $70 per Mwh, would quickly become $30 again.

Remembering that coal generation has not sat still and has advanced a huge amount over the last 15 years.

The constraint to coal is simply the belief that co2 is a problem, there is no cost problem where renewables are cheaper.

With the cost of solar components continuing their global descent coupled with the move towards storage and the increasing awareness/consciousness of the “average” Australian, these trends will continue and magnify over time. Will they in fact help with reduction in grid electricity prices? Time will tell. Interesting article, thank you!

Quite interesting article!