How did we come to this position? The introduction of the competitive electricity market was supposed to provide the mechanism for removing (or at least making transparent) cross-subsidy, for eliminating free-riders.

Instead, it seems we’re hearing an increasing volume of chatter about this-or-that group not contributing their fair share in terms of this-or-that service.

Whilst attempts to “privatise profits whilst socialising costs” are probably as old as capitalism itself (and energy sector has not been immune to proposals for perpetual motion machines, and transmission lines to nowhere), I cannot help but wonder if we’re currently seeing an increased incidence in Australia’s energy marketplace.

A massive oversupply of capacity resulting from declining demand, but a continued build-out of capacity spurred by incentives on top of market prices, has forced these concerns to a head.

I have been grappling with point and counter-point about manifestations such as the following, striving to see the wood from the trees. In this post I’ll start to outline some of the points I’m grappling with – and will continue on WattClarity in the coming weeks, as time permits.

Perhaps some of our readers can help me with these?

Please note, in the discussion below, any reference to external analysis should NOT be read as our endorsement of what’s contained within those references. See FULL DISCLOSURE 1 about how we strive to remain technology agnostic.

1) Black vs Green (or Carbon vs Clean)

The current RET Review seeming to come to its end, and many had been expecting the outcome that had been forecast at its commencement – though there are some sensational headlines today. As such, we’re currently operating in a climate of very vocal “black vs green” debate at a wholesale level.

The “modelling consultants at 20 paces” I noted here was also mentioned last week at an industry forum on a potential rule change. However that’s only one manifestation of a growing schism that appears to be clouding ability to drive towards the National Electricity Objective (section 7 here), which is to:

“promote efficient investment in, and efficient operation and use of, electricity services for the long term interests of consumers of electricity with respect to –

(a) price, quality, safety, reliability and security of supply of electricity; and

(b) the reliability, safety and security of the national electricity system”Perhaps a start would be to recognise that pretty much everyone’s guilty, in various ways, of socialising costs whilst privatising profits:

1.1) Socialising costs of coal and gas

In what I have read of the claims and counter-claims being made about costs of coal and gas, there seems to be two main ones:

1.1.1) Socialising, globally, the cost of carbon

Let’s start off, firstly, with the elephant in the room (at least for many) – about the externalised cost of carbon emissions.

The carbon tax is but a recent memory, but there is still (officially, at least?) bilateral support for our 2020 emissions reduction target. We’re all yet to see what form (if any) Direct Action might eventually take – and, given that it’s only slated to be an interim arrangement, what comes after that…

Most people seem to believe that there is some (socialised) cost imposed by carbon emissions – though from here opinions seem to differ, quite markedly, about what Australia should be doing about:

(a) The carbon we emit in our backyard; plus

(b) The carbon we inherently consume in imports of goods that come in from elsewhere; plus

(c) The carbon emissions some see we play a role in fostering through some of our exports of energy fuels (coal and gas – but not uranium).The trickier aspects of climate policy seem to revolve around questions such as:

(a) Calculating the cost (especially because of the lag between when emissions happen and when their effects are felt + uncertainties about what will actually unfold in the future)?

(b) How much of this cost should be paid now, and how much later – based on assessments that technology costs will decline, and calculations about net present value using a variety of discount rates?

(c) Whether to pay the cost (by adaptation to its forecast effects) or to mitigate these eventual costs (by incurring other costs to change behaviours now)?

(d) How to apportion costs between each country (and by industry sector, by income group etc…)?Until such questions are answered (if they ever can be) it seems that we will only ever have an incomplete resolution – and, as such, the fossil-fuelled generation sector of the National Electricity Market will continue to socialise the cost of carbon whilst privatising the profits from the burning of such fuels.

1.1.2) Socialising the cost of fossil fuel development

Australia is a large coal and gas exporter (one of the largest in $ terms) – and these fuels still do facilitate the lion’s share of electricity across the country.

For these reasons, governments have seen it fit to support the development of these industries in a number of ways.

Queensland’s 13% Gas scheme (disbanded at the end of 2013) was one example of direct support. By some measures (one being the development of a new export LNG industry, the second being its temporary nature) some might see this scheme as being successful.

Other groups have prepared analysis (such as this by the Australia Institute) of areas in which they see that the broader mining sector has received significant government support (i.e. the recipients have benefited from socialised costs).

1.2) Socialising the costs of renewable generation

That’s not to say that the “green side” has been immune from socialising some of its costs, however. As the renewables’ share of energy consumed has risen, so have concerns about its socialised costs – including:

1.2.1) The cost of subsidies

Large-scale renewable development in Australia has been directly supported by the MRET scheme (more about small-scale below) – initially by RECs followed by LRETs (when the scheme was split).

These traded certificates help to bridge the gap between a (too low) wholesale electricity price and the revenue a renewable generator needs to earn to support their (high capital cost) investment in building the asset.

It’s understandable, then, that an average member of the general public (and naive politicians) might see this subsidy and assume that this MUST force up the cost of power paid by energy users. It seems that much of the fog of the debate in the RET Review has revolved around this mistaken assumption.

It’s also understandable, then, that the Clean Energy Council and others in the renewable camp have sought to dispel this simplistic assumption. The essence of their argument is that the LRET subsidy has been helping to suppress wholesale prices (per all MWh) by more than the effect of the subsidy (per green MWh only):

(a) A term has been coined to describe this – the “Merit Order Effect”;

(b) Meridian has even produced this very polished animation to illustrate what’s been happening on a dispatch interval basis.However, whilst these contributions have helped to raise the public’s level of understanding, I do wonder about the extent to which the arguments of some have (also) been incomplete and/or disingenuous…

It seems to me that, just as it’s (understandable but) wrong to assume that the RET must force up the overall cost of power, it’s also (understandable but) wrong to assume that the RET must drive spot prices down.

I noted in these earlier thoughts about the RET Review a number of things, including these two points:

Point #1) The costs of this subsidy are real – but are not currently being paid by energy users, and instead currently manifest in reduced (volume and) revenue for pre-existing generators.

In other words, the oversupply of capacity that the RET has (at least in part) brought about is currently delivering a wealth transfer from existing generators to energy users. That’s not to say that this will continue…

Point #2) What happens into the future is, in reality, impossible to predict:

(a) so people who treat modelled outcomes in the literal sense are always going to be on shaky ground.

(b) a wiser approach is to look at scenarios modelled, and assess the relative difference in modelled outcomes between various scenarios (always keeping in mind the limitations of the input assumptions made in each particular scenario).To the extent which pre-existing generators retire assets to reduce the market oversupply and bring wholesale supply & demand back into balance, the costs of subsidies will translate from a drain on revenues to both:

(a) a hit on the balance sheet of those generator, and

(b) a reduction in the price suppression effect represented by this “Merit Order Effect”.

With asset retirement, the cost of the subsidy becomes increasingly socialised.It seems to me that the argument boils down to this:

(a) To the extent that generators were (at some stage in the past) achieving windfall profits, the added competition from multiple players (whether they be renewable or otherwise) will help to reduce these windfall profits; however

(b) To the extent to which pre-existing generators were not achieving windfall profits (i.e. that they have seldom made back their cost of capital) then the oversupply of capacity will trigger a churning of assets but release no productive value – leaving aside environmental considerations.

My short post last week about EnergyAustralia provides some data points here.However such asset retirement would not be a like-for-like (MW-for-MW) swap – because of …

1.2.2) The cost of intermittency

There’s been much written about this, as well – of which I have only had time to read a small percentage.

In simple terms, because supplies of electricity from solar and wind are intermittent, generation “Reserves” are required – to cover for these intermittent supplies when they can’t generate.

That’s not unique to renewables – all electricity systems are designed to operate with adequate reserves to cater for the inevitable occasions when units (or – less frequently – whole stations) either:

1) Trip instantaneously (in which case fast response reserves are required – some of which are “spinning”); or

2) Just have to come down for some kind of (planned, or non-planned) maintenance activity (in which case reserves have to be available to supply at that notice period).Sometimes, in very rare (systemic) events, it affects more than one conventional station at the same time. Here are some examples:

Example 1 = Japan 2004 <<oops 2011!>> to 2014+

We’re probably all familiar about the shutdown of all nuclear plant in Japan after the Fukushima incident:

(a) Since shortly after the earthquake and tsunami of late 2004 <<oops 2011>>, the entire fleet has been taken offline for a safety review – with some reports saying that they might start returning to service soon (that’s an outage period of 10 years << not that long, but still significant >>);

(b) A quick scan of the web revealed this report claiming additional (fossil) fuel costs of US$35b annually as a result.

Example 2 = UK in 2014

This month we’ve seen that EDF has had to close 4 nuclear units in the UK, due to safety concerns – and because all 4 are of similar design.

(a) In this case, the outage of its 4 units represents 2,335MW of base-load capacity, and is expected to last 8 weeks (more info on the EDF site here)

(b) It was not unexpected that RenewEconomy pronounced “wind to the rescue” as a result.

Example 3 = In the NEM around 2007

In Australia, we had our own stresses during the drought period around 2007, when available supplies from a number of hydro and thermal stations were simultaneously affected.

See here for what this meant in terms of uplift on the simplified EnergyAustralia portfolio revenue.

Hence, reserves of spare capacity have been required in the NEM since its inception – and beforehand.

Something that does seem unique to wind and solar PV (the two main commercially available technologies at present), however, is the regularity at which output does drop to close to zero.

1) From 2030 onwards

I understand that AEMO provided this study looking at what a future grid look like (then) 19 years into the future.

It’s been often quoted since that time as proving that such a concept would be possible.

2) About a transition to that world

What interests me is the ways in which (if the Government, and/or the market, decides that is where we want to aim) we might transition from where we are now to this possible future scenario. Especially in the context of this post – whilst avoiding socialising costs whilst privatising profits (where possible).

3) Where we are now

Currently, fossil fuels supply a (declining but) dominant proportion of energy consumed in the NEM – as can be seen in this post and in NEM-Watch in real time.

It is likely that this will continue for many years to come.

We have previously completed some back-of-the-envelope calculations about how much wind supply could (theoretically) contribute to the NEM. That magic number was 37% in that case.

As noted in that article, under this scenario the NEM would require a significant amount of other installed capacity that would:

(a) sit idle when the wind was blowing a gale; but

(b) be called on to operate at various rates at anything under full wind loading.

However our calculations have many limitations. For instance, I only looked on a day-by-day time-slice. If I’d looked 5-minutes-by-5-minutes, it would have come up with a different number.

The key point to remember is that reserves are required on different time horizons.

1.2.2.1) “Immediate” response, for frequency control

In the NEM we have the FCAS markets providing for sufficient reserves available at short notice (within the 5-minute dispatch interval) to ensure the system continues spinning at 3000rpm (50Hz).

In the NEM it has been pointed out (don’t have a reference at hand) that the total requirement for FCAS has not changed markedly over the past several years.

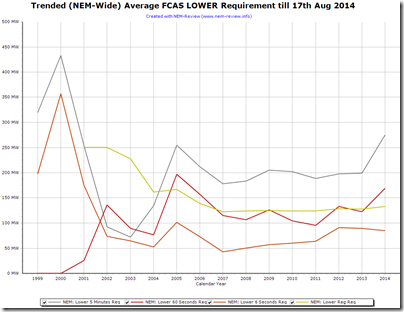

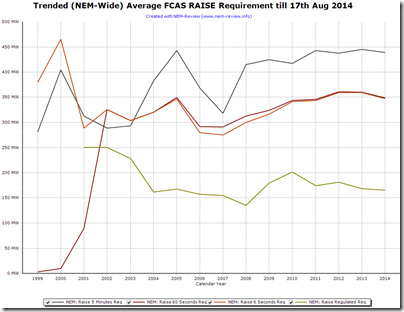

Here’s two quick charts of annual average, NEM-Wide, FCAS requirement from NEM-Review:

LOWER Requirement, shown above, is used when frequency suddenly spikes – such as when large loads trip, or perhaps if a large amount of wind suddenly appeared on the system within a dispatch interval.

RAISE Requirement, shown above, is used for the inverse, such as when large generators trip, or perhaps if the wind should suddenly stop blowing.

As we see, there’s been no marked rise in requirement in recent years.

1.2.2.2) Dispatch interval timing

Others have pointed out that wind output is being forecast accurately by AEMO – the inference being that there are no surprises here causing the market to incur additional costs.

This seems to suggest that wind farm (and solar PV) output does not change wildly within a 5 minute period – at least not enough to markedly change the amount of FCAS required.

1.2.2.3) Capacity offered to the market

There are those that claim that no new plant has been built to deal with the challenge of intermittency – hence there must be no cost of intermittency.

However I struggle to see the logic in this argument, as we’re already awash with capacity.

Perhaps the current state – where we have plant costed and built on the basis that they would have “base-load” capacity factors forced to run mid-merit operations in an over-supplied market – would be evidence of another transferred cost?

Whilst returns for all existing generators (even wind farms not hedged with PPAs) would suggest significant retirements are warranted, the intermittency of wind and solar PV will require that some of that plant that might be closed needs to remain open for an indefinite transitionary period to this new world. Hence the risk of an emerging conflict.

Should the percentage of the energy mix continue to increase, it seems likely that there will be a increasingly vocal portion of the market calling for capacity payments to be introduced – for, without them, revenues to the thermal plant could drop to the point where it does not pay for them to stick around and wait for the wind to stop blowing – but what then happens when it does?

[on that note, I do recall RenewEconomy copying this article, possibly as a pre-emptive “shot across the bows” on possible future calls for capacity payments to be introduced to the NEM]

To be continued…

I’ll continue this theme, with respect to issues I’m grappling with, as time permits.

I’d especially welcome your comments, below, to help me work these through – or give us a call on +61 7 3368 4064.

“How much of this cost should be paid now, and how much later – based on assessments that technology costs will decline, and calculations about net present value using a variety of discount rates?”

If you take a discount rate larger than your rate of growth the right time to solve a problem will always be right before it’s about to happen. This is the problem with economists like Bjorn Lomborg saying that we should be dealing with the problem later. The size of the issue is too large for any one generation to deal with alone, the costs have to be spread out over many decades.

Also note that technology costs are declining because of scaling not research. Solar and wind technology is virtually unchanged since the 80s. Some improvements have been made with research, but most of the improvements are due to building a bigger factory, getting normal financing rates, and experience with installation.

Thanks, Tom

At the high end of the scale some might want to use commercial target rates of return – which would tend to favour deferral. At the other end of the scale, my vague recollection is the Stern report used a discount rate of 0?

Just one part of “a diabolical problem”.

Paul

Paul

Outstanding work. I commend the approach of always looking for an agnostic position and (although I am inherently biased) I have strived to remind readers that the energy industry is not evil per se. We need each other and your point on “what happens if” is most valid; the merit order effect is not perpetual! Good on you for sharing your incredible depth of knowledge to this important debate.

The issue at hand (IMHO) is quite simply are the non renewable sector (and consumers) simply being “gamed” by the incumbents because they can?

Clearly, the entire energy sector needs a tweak and a tune but in the meantime, its hard to know which mechanic to believe.

Thanks Nigel

Nice to hear that you find it useful.

Paul

Great outline of the issues. I would just note that the NEO is not adequate to define what Australia needs from its electricity sector. That’s not to say the NEO should necessarily be expanded to include carbon reduction goals but that we need to recognise that carbon reduction is central to electricity policy and therefore can’t be ignored if we want long-term policy stability. The question that needs to be answered, or at least discussed more fully, is – how much carbon reduction do we need from electricity? And following from that – when, how, and who pays?

Some useful references on the “social cost of carbon” (SCC) are:

– The US government’s interagency working group, which ended up recommending four different price paths in recognition of the debates around discount rates, quantification of impacts and scientific uncertainty. “Three values are based on the average SCC from three integrated assessment models (IAMs), at discount rates of 2.5, 3, and 5 percent. The fourth value, which represents the 95th percentile SCC estimate across all three models at a 3 percent discount rate, is included to represent higher-than-expected impacts from temperature change further out in the tails of the SCC distribution.” The average 3% price is generally used as a central estimate. See also the US EPA’s page that looks at how the SCC is incorporated into regulatory impact analysis. http://www.epa.gov/climatechange/EPAactivities/economics/scc.html

– “Omitted Damages: What’s missing from the social cost of carbon” which provides more accessible information on what’s in and what’s out of the integrated assessment models used to calculate the SCC. http://costofcarbon.org/files/Omitted_Damages_Whats_Missing_From_the_Social_Cost_of_Carbon.pdf

– closer to home, the Climate Change Authority’s report on Australia’s carbon budget and emission reduction targets. This gives a thorough explanation of the long term emission reductions needed internationally and nationally, the role of the power sector in contributing to this, and a carbon price path that can deliver appropriately. http://climatechangeauthority.gov.au/reviews/targets-and-progress-review-3

Thanks Olivia

In case you were not aware, Keith Orchison has picked up on your comments here.

I’d add that these 6 enduring challenges still remain, though perhaps the first one now looks like “generation capacity retirement” instead of development, especially if the RET continues in force.

Paul

Great piece. Just one correction the Earthquake and Tsunami in Japan was 11 March 2011 not in 2004. 2004 was the Indian Ocean Tsunami which occurred 26th December 2004.

Paul

Thanks for the pick-up, Paul. Have updated above to avoid further confusion.

Hi Paul,

A couple of points. There is much discussion in this piece about spot prices but what is the financial impact of forward contracts? The discussion on the Merit Order Effect and the “very polished” animation seems to ignore them.

The “2030 onwards” discussion about the AEMO report, where indeed they suggested that 100% renewables was technically possible, but it came at considerable cost – between $219 to $332 billion plus land cost. I published a piece on this which might be of interest to your readers:

http://www.energyinachangingclimate.info/100 Per Cent Renewables Study Needs a Makeover.pdf

Sorry try this URL

http://www.energyinachangingclimate.info/100%20Per%20Cent%20Renewables%20Study%20Needs%20a%20Makeover.pdf

Thanks Martin

Some believe that the spot price will lead the contract price – and some believe the opposite. Reality is somewhere in between. Oversupply of capacity, and continued decline in demand, will drive both down – until the supply side responds (or new methods of demand – like EVs – are introduced).

I listed the AEMO 2030 study because someone else would have. Did not get into costs – thanks for your link.

Paul

Hi Martin,

I notice many have made mention of the potentially large additional land cost of the 100% renewable study from AEMO. Most of the land requirements from this study is related to wind generation. The leasing cost of the land for wind generation is tiny compared to capex costs for the turbine. ie, ~$10k per turbine per year leasing cost, compared to the ~$5 million capex cost of the turbine. It is pretty much in the noise band in terms of cost.

I suspect this will be true of most of the renewable technologies.

Further to David’s point:

The cost of leasing is part of the LRMC, it’s not an externalised cost. Also the turbines and roads take up a tiny fraction of the total land area.

Even for large scale solar the cost of land is minor.

Existing hydro investments could be used for much more generation balancing to complement the volatility of wind than it currently is, particularly the Tasmanian hydro stations. The Snowy stations and Dartmouth are used in this way, but while the carbon tax was applied Tasmanian hydro did little more than provide baseload power across Bass Strait, selling into what was at the time a higher priced market. In the process it has run down the hydro dams to one third of capacity, and now imports brown-coal power from Victoria, which is now cheaper without the carbon tax.

The NEM covers two quite different markets with different economic drivers. There is the SA-Vic-Tas cluster, which has the majority of the NEM’s wind and hydro capacity, and all its brown coal capacity. There is also the NSW-Qld cluster, which is driven by black coal, gas, and a relatively small amount of wind and hydro. The linkage between these markets has a capacity of little more than 1000 MW, so when it is maxed out, there is no further capacity for generation balancing. To accommodate the intermitancy of wind in the SA and Vic markets, better use could be made of Basslink and existing Tasmanian hydro stations. Basslink has a capacity of ~500 MW, but this could go from -500 MW (Vic to Tas) to + 500 MW (Tas to Vic), thus providing a potential buffer of 1000 MW. Unfortunately now that Tasmania have run down their dams they may have little capacity to export into Vic at times of high power prices, so until their dams recover we are unlikely to see this desirable market behaviour. There are also peaking gas plants in Victoria and SA that can also cover the volatility, but as gas prices increase they will need a higher power price before dispatching power from their plants.

To extend on this theme, some readers would be interested in the work published by the IMF in May 2015 – and linked here:

http://www.imf.org/external/np/fad/subsidies/?hootPostID=05f97b4cc6736d8be1eeea546bef6422

With some blog posts:

(a) http://blog-imfdirect.imf.org/2015/05/18/act-local-solve-global-the-5-3-trillion-energy-subsidy-problem/

(b) http://blog-imfdirect.imf.org/2015/05/18/global-energy-subsidies-are-big-about-us5-trillion-big/

(c) and a presentation http://www.imf.org/external/np/fad/subsidies/pdf/presentation.pdf