“Over the next three year period we are likely to witness a fundamental reshaping of the role of gas in the NEM generation mix – transitioning from a combined base, intermediate and peak role to one which is increasingly peak only” according to Core Energy Group.

This move can be measured in several ways but for the purpose of this paper we will focus on the projected change in generation fuel use and generation capacity utilisation.

Less than two years ago industry analysts and the market operator, AEMO, were projecting a significant growth in gas powered generation over the period to 2025, driven in large part by carbon policy which was expected to impact the relative cost of coal and gas powered generation (GPG). One nationally-recognised consulting firm was projecting gas fuel use in the order of 500PJ by 2020.

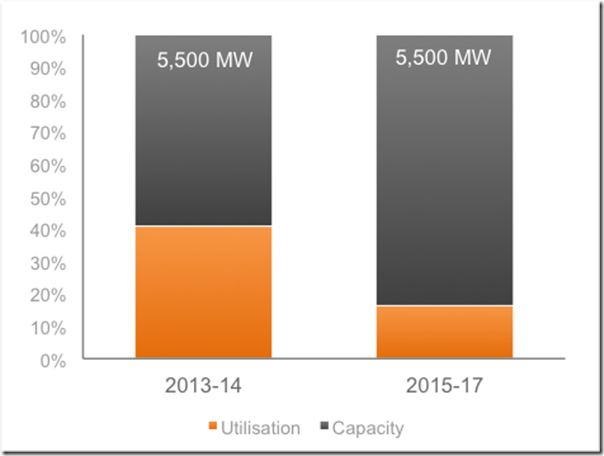

Today the situation is quite different. In 2013, (utilising half-hourly data from NEM-Review) approximately 170-200 PJ of gas is likely to be used to generate electricity within the NEM. By 2017 Core expects this level to fall below 100PJ, potentially as low as 80 PJ. Based on a fixed GPG capacity of approximately 5,500 MW, capacity utilisation will essentially halve as illustrated in Figure 1.1 below

Figure 1.1 GPG Capacity Utilisation Outlook (MW capacity and % utilisation)

|

||||||

|

||||||

A range of factors will drive this change, in the absence of a carbon price close to or above AUD40/tonne:

- An ability to redirect gas to the emerging, higher value LNG market, centred at Gladstone

- A material increase in gas prices as legacy contracts mature, making gas less competitive

- A compounding growth of wind and solar generation and its concentration in gas-intensive generating regions such as S.A.

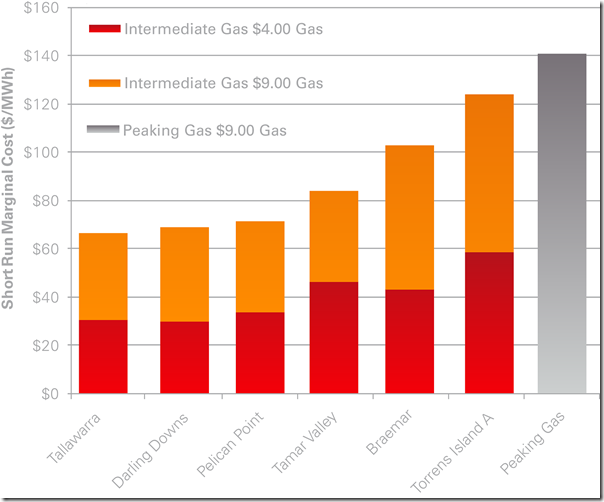

Perhaps the most significant factor will be the increase in the SRMC of GPG. The following Figure illustrates the approximate short run marginal cost (SRMC) of a range of gas generators

Figure 1.2 SRMC of GPG at Potential AUD9/GJ Delivered Gas

Source: Core Energy; AEMO; AGL.

Note: Gas SRMCs are averages weighted by capacity.

Gas will, naturally, continue to play a key role in upper intermediate and peak generation due to operational flexibility advantages and lower price sensitivity in this segment of the load curve. However the lower utilisation of gas generating capacity as a whole must translate to higher costs per unit of output.

About our Guest Author

|

Paul Taliangis is the Adelaide-based CEO at Core Energy Group.

Core Energy Group is a specialist energy advisory firm with a particular focus on gas, LNG, power and infrastructure elements of the Australian energy industry value chain. Further background to Paul can be found on Paul’s LinkedIn profile. |

Thank you. Interesting analysis. It makes sense.

An outcome I see is that, when we get over our infatuation with solar and wind, peak and intermediate gas generation will fit perfectly with baseload nuclear power. It is easy to envisage a future with 75% of electricity generated by nuclear (as in France), 6% hydro, minor renewables and the remainder by gas.

This would be the least cost way to generate electricity with low GHG emissions, as the CSIRO eFuture scenario analyser shows: http://efuture.csiro.au/#aboutsite

CSIRO reference BREE who state a LCOE of $100/MWh without considering disposal or decommisioning costs. They also assume it can be built in 6 years rather than the 12 that is the norm overseas. Pretty unlikely for a first of a kind build. They also assume a 60 year life span which certainly reduces the LCOE. What if it only makes 50 years? or 45?

Nuclear is great if you have cheap labour or no local resources. Both wind and coal-CCS are cheaper and more socially palatable.