Hello and welcome to my second blog post. As mentioned in my first post, I have been working on picking apart all the things which caused the price events in Queensland over the summer.

Along the way, I have decided to write about topical issues as they come to light. After describing the history of tariff price setting in Queensland, I will look over the border to our neighbours in New South Wales. It is now over two years ago that the State sold its retail load and the dispatch rights to most of its generation. This blog post will look at what has happened to the market in the two years since the sale.

TRU Energy and Origin Energy took over the retail load in New South Wales and the dispatch rights to most of the State owned generators just over two years ago.

In Queensland, Peter Costello delivered a report recommending Queensland sell its electricity assets and Tasmania announced that they will introduce full retail contestability in 2014 (following the sale of the Aurora retail business).

This makes it a good time to review what has happened after the NSW asset sales.

Sale of NSW assets

From 1 March 2011, TRU Energy took over the retail business of EnergyAustralia and the right to trade the 2,400 MW capacity of Delta West. TRU Energy decided to rebrand to EnergyAustralia.

Origin Energy took over the retail business of both Integral Energy and Country Energy, as well as the trading rights for Eraring Energy which has a capacity of 3,210 MW.

NSW market feature after asset sale

Small customer share

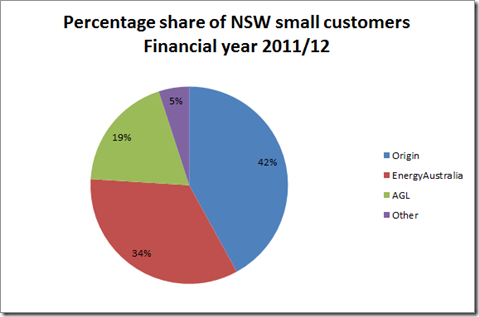

The asset sale increased EnergyAustralia’s market share of small customers from almost nothing (as TRU Energy) to 34% and Origin Energy’s share went from 6% to 42%. Most of the rest of the market for small customers has contracts with AGL. The market for large customer is a similar picture, where Origin Energy and EnergyAustralia combined have 77% of the large customer market.

Generation Capacity

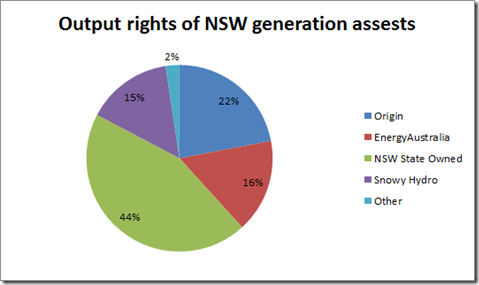

The total generation capacity of Origin Energy and EnergyAustralia has gone from 1,124 MW to 5,610 MW. This means that although the two companies have76% of all small customers and 77% of all large (by number), they have less than 32% of the installed capacity.

The rest of the generation is largely Government owned. The NSW Government has 44% of the market through Macquarie Generation and Delta Coastal. The Federal Government jointly owns Snowy Hydro with the NSW and Victoria State Governments which represents about 15% of the capacity.

Financial characteristics of a vertical integrated retailer

The motivation of a retailer with a large amount of generation is to keep the prices high enough to make a return on their generation assets without having too many price spikes. This is because of the unpredictable nature of energy consumption.

A retailer doesn’t know in advance how much energy their customers will consume – which means that they cannot know how much it would have to contract or generate to cover its load. In order to insure against losses, a retailer would have to generate more than their predicted load to have a high chance of not being exposed to the volatile spot market. This means that overall a retailer would tend to generate more often than if the sale plant was owned by a generator.

At the same time the retailer cannot allow the prices to remain too low. If the average price was much less than the cost of generation, other retailers without generators could enter the market and provide cheaper electricity prices by purchasing from the spot market.

Market outcomes

The spot prices from 1 March 2009 to 28 February 2011 (the two years prior to the asset sale) averaged $41.12/MWh. This included 162 trading prices above $300/MWh (the price of a standard cap contract which is considered a volatility product).

In the two years* following the sale (1 March 2011 to 28 February 2013) the average spot price was $37.83/MWh. During this period there were only three trading prices above $300/MWh.

* This includes a period of eight months with carbon at a price of $23/tonne. If we assume the cost of carbon is passed through to the spot prices at the intensity of NSW plants, carbon would add $20.54/MWh for the eight months. This means that over the two years carbon has added an average of $6.83/MWh to the spot price. If carbon is removed from the prices, the average price would be $31.00/MWh.

| Period | Average Price | Number of Prices Above $300.MWh |

| Pre-sale | $41.12/MWh | 162 |

| Post-sale | $31.00/MWh* | 3 |

*Effective price without carbon

Impact on retailers

The price outcome fits in well with the strategy of the vertically integrated retailer.

The Australian Energy Regulator refers to these as Gentailers (Generators and Retailers) but a more accurate word is currently Supplygens (Suppliers and Generators) due to their retail dominance. Other retailers would also benefit from reduced risk as the price spikes are largely removed.

Impact on generators

The immediate effect on the base load generators will be minor.

If the lack of spot volatility means less contracting by the retailers, they may face a more uncertain future but with the average prices being largely the same, they are no worse off in the spot market than before. Plant with a higher fuel cost which relies on the market price increasing would have a more difficult time and it would be difficult to get dispatched without further dampening prices.

The volatility products (caps) would also lose their value making it difficult to hedge the plant.

Impact on customers

There is little difference to small consumers in the short term. The average prices will not change much as the tariff prices in NSW are set by the long run cost of building plant, not current prices.

The opportunity to save money by curtailing load will be less for customers who have spot exposure as there will be fewer spikes.

There may be a small discount to other contestable customers as the retailers face less risk and therefore can accept smaller margins.

In the longer term, vertical integration could become a barrier to entry for new retailers and there is very little new investment in generators without the company owning retail load which could increase prices in the future if this causes shortages of generation.

About the Author.

Thomas Dargue has worked with both private and publicly owned generators as well as for Ergon Energy over the last seven years.

Feel free to posts comment on this page or email directly to Thomas@global-roam.com. He is also on LinkedIn

.

Editor’s Note: Pre-Order your copy of our QLD Market Review before 24th May and save

Our detailed review of what happened in Queensland over summer (and into Q1), that Thomas has been heavily involved in preparing, will be released at the end of May.

For those who want to have their copy delivered as soon as it is released, you can pre-order today and save 16%. Justfax back this order form (an offer just for WattClarity® Readers) with your details.

Thomas

Thanks for this – a useful addition to the market intelligence (or is that an oxymoron?)

One aspect you did not seem to investigate is that the demand in NSW has been falling for the past few years and this would have had a significant impact on prices.

The fewer incidences of exercise of market power would also be related to the fact there have been fewer demand spikes due to the milder weather conditions in the past couple of years

Regards

David Headberry

Hi David

Great comments.

Market intelligence is a big beast, we aim to provide some insight.

The demand will have a factor. Paul has already written a couple of blogs here on the falling demand (linked here).

A quick recap shows that the average metered demand decreased by 410 MW over the period (from 1 March 2009 – 28 Feb 2011 compared to 1 March 2011 – 28 Feb 2013) and maximum demand fell by 828 MW. This reduction in demand will have an effect on the opportunities for price spikes to occur and we agree that the NEM is a complex place.

There are always many reasons for prices being different. The Analytical Report that we will send out with our QLD market review is going to be over 100 pages and only covers four months!

The reason I am highlighting the change in ownership is that surplus capacity is not a lot higher than have seen in the past but the lack of price spikes is new. Since 1999, NSW has never had fewer than 53 prices above $300/MWh in any two year period. A lot of things have happened since then but the timing of the reduction in spikes points to the asset sale.

In summery: Agree market intelligence is a noble but difficult goal, and there are many temporary factors such as demand which plays into actual outcomes in the short term.

Regards

Thomas