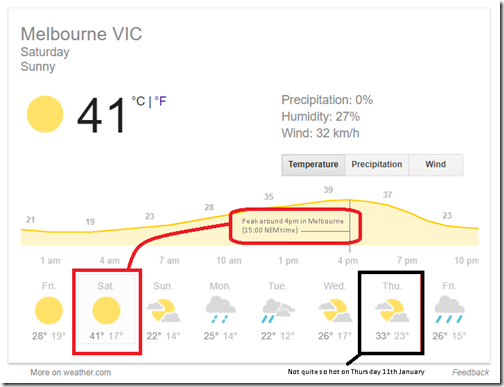

The weather forecast is for some pretty extreme temperatures tomorrow in parts of the NEM – such as in Melbourne as shown here in the weather forecast thanks to Weather.com and Google:

Given the strong correlation between temperatures and electricity demand, and heightened general awareness of the complexities of balancing supply and demand across any electricity grid (in part because of the train wreck that’s been part of this mismanaged energy transition), it’s no surprise to see some media reports on expectations for Saturday.

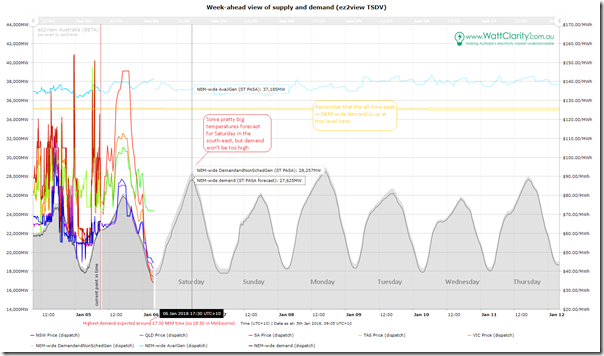

Out of interest I dialled up this pre-prepared trend of NEM-wide demand and available generation that forms one of a growing number of web widgets in ez2view (clients can access the live updating NEM-wide template here, and so modify for their own purposes) to see what the AEMO is forecasting will happen through Saturday, and through the coming week:

It’s too early in the day today for AEMO’s predispatch forecast to look through the whole of Saturday (especially through to the evening peak in demand, which is the bit of particular interest). For the same reason, AEMO’s predispatch price forecasts for each region are not yet available.

Hence the demand forecasts incorporates AEMO’s 50% POE demand forecast from ST PASA, which currently extends out till early Friday.

The most obvious point to make, in relation to this chart, is that a NEM-wide demand forecast of only 28,000MW is pretty modest indeed – but is expected for two main reasons (with another factor thrown in for good measure):

| Major Reason #1) | Tomorrow is a Saturday.

Weekend days will typically have much lower demand than during weekdays because of lower commercial and industrial load (remembering that C&I load is the lion’s share of consumption in the NEM). |

| Major Reason #2) | It’s very early in January.

To compound the weekend effect is the well-established effect of the holiday hangover from the Christmas and New Year period. |

| Minor Reason #3) | Solar PV (which is predominantly small-scale currently) is pushing peak Scheduled Demand later in the day.

As discussed before (here and here), the current crop of solar PV has had the effect of eating into Native Demand (combined with other factors) leaving a smaller residual for the AEMO to meet in dispatching the market Scheduled Demand. On Saturday the forecast (at least for Melbourne, shown above) is for low cloud cover, which will mean higher solar PV harvest and more of that “eating away” effect – hence both: 1) A lower Scheduled Demand; and 2) The peak in Scheduled Demand occurring later in the day (17:30 NEM time as shown in the chart). |

The second point to make is that there is plenty of surplus generation capacity on hand across the NEM – so no concerns for the supply and demand balance, unless something startling happened in a few places.

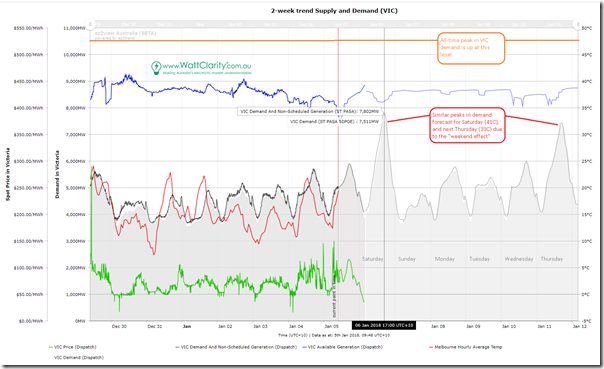

Given that I’ve included the weather forecast for Melbourne at the top, I thought it might be useful to also include this similar trend in demand for Victoria (clients can access the live updating VIC template here) – in this case including more of the history and (because we can drop the prices for the other regions) also including hourly average apparent temperature in Melbourne:

As noted on the chart, the Scheduled Demand peak currently forecast for tomorrow (7,511MW at 17:00 NEM time, so 18:00 in Melbourne) is about the same as that forecast for Thursday – despite the fact that it’s forecast to be only 33 degrees on Thursday (illustrating the “weekend effect”). I also note that Thursday is forecast for a few more clouds, so would expect that AEMO’s forecasts of solar PV output might be a little lower on Thursday than they would be for tomorrow (notwithstanding the significant challenges still to be overcome in longer-range intermittent generation forecasts).

Finally, I note this article from Samantha Hutchinson at the Australian – who seems to be a little too trigger happy to talk of the need for AEMO to activate its emergency reserves of a certain form of Demand Response.

1) As explained in the various pages linked off this Demand Response site here, there are a number of different forms of Demand Response (and I’ve already commented on how it’s sometimes erroneously reported to be non-existent in the NEM).

2) It’s important to remember that the AEMO’s “Emergency Reserve” is exactly that – for Emergencies only. Were the AEMO to become as trigger happy as some journalists seem to be becoming to trigger these emergency (i.e. outside the market) responses to tight supply and demand, it would seem inevitable that faith in the “normal” dispatch process for price establishment would quickly drop, leading to a wide range of unintended consequences.

Stay tuned for more in the weeks of summer ahead on WattClarity.

Leave a comment