Network outage events have become more frequent in the NEM and have attracted increasing attention, particularly as they have driven volatility in several regions. BESS revenue is heavily influenced by the level of volatility an asset can capture, meaning network outages present both significant opportunities and significant risks. The key risk is that a BESS may be curtailed during an outage, leaving it unable to participate in — or benefit from — the resulting volatility.

We’re increasingly seeing BESS developers (particularly owner-operators), investors and off-takers asking the same core questions:

- “Are system normal constraints going to limit the BESS discharge?”

- “How are they going to impact the BESS charge?”

- “If system normal is ok, what about post outage curtailment?”

- “How do we capture network outage impacts in our off-take agreements?

Through seeking to answer these questions, we have sought to develop our ability to assess the impact of network outages in our market models for customers. But firstly, why is modelling the network in such detail necessary?

Take a step back… system normal constraints, wind lulls and gas?!

Wind lulls, renewable droughts, dunkelflaute — whatever term you use, there’s been growing discussion about the need for gas or long-duration storage to bridge these periods. The industry is actively considering this challenge and preparing for it.

If we look at this from a capacity forecast point of view, we see some interesting insights. Most forecast models, in both capacity expansion modelling and dispatch modelling, ignore constraints for different reasons, mostly blaming the computational time added in modelling when network constraints are applied.

For some, constraints are seen only important in the congestion assessment for asset specific studies, not price analysis, nor MLF impacts, and definitely a “no no” for long-term capacity expansion forecasts.

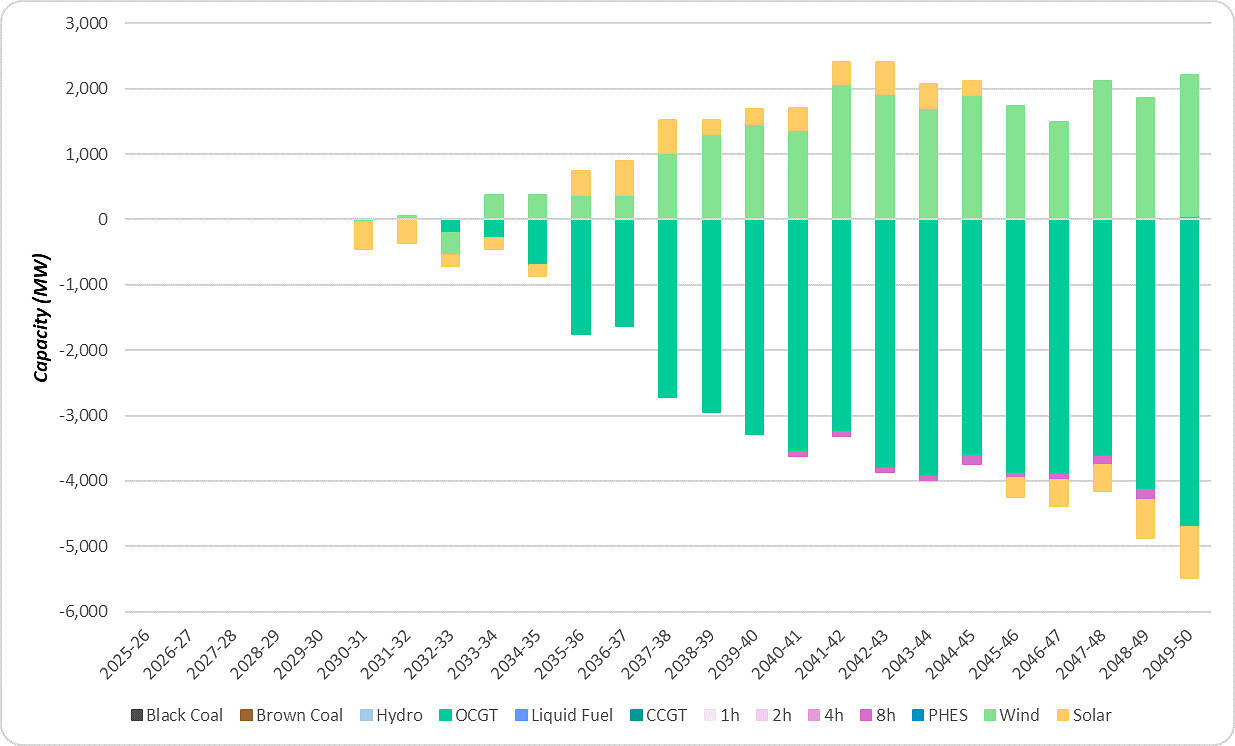

The chart below compares NEM capacity outcomes from a capacity expansion model without network constraints to one that includes them — and the difference is substantial.

It tells the story!

- With no network constraints (above X axis), wind is seen a lot more favourably (on top of what a reasonable forecast shows)

- Whereas when we include network constraints in the capacity expansion model (below X axis), additional gas is required to meet the load at the load centre when the network is at its limits. Is this misleading business cases?

The chart highlights the importance of network constraints in capacity forecasts. But now let’s have a look at short-term operation and network outages.

July 2029: A case study

Below we’ve conducted a series of three simulations using our combination of market and network modelling techniques. We’ve run three simulations for a four day period in July 2029.

- unconstrained dispatch,

- dispatch considering system normal network constraints,

- and dispatch considering constraints post outage of Woolooga to Palmwoods 275kV line in Queensland.

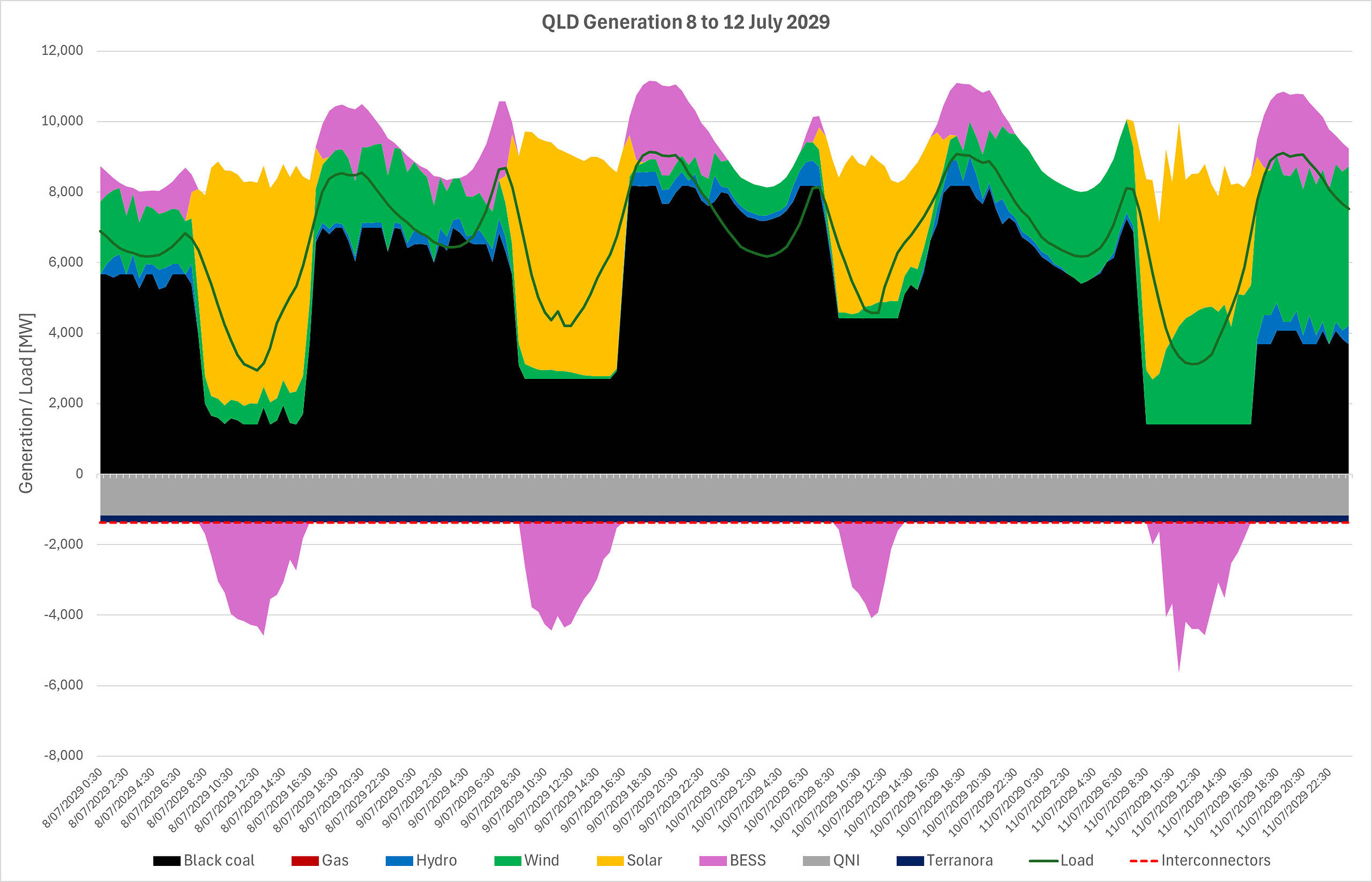

An unconstrained dispatch

The first chart shows Queensland’s dispatch outcomes between July 8th and 12th, 2029 using our unconstrained model.

Everything is expected to go smoothly, central Queensland coal is still there and with some help from BESS, it is able to fill the gap during a minor wind lull on the 9 – 10th of July.

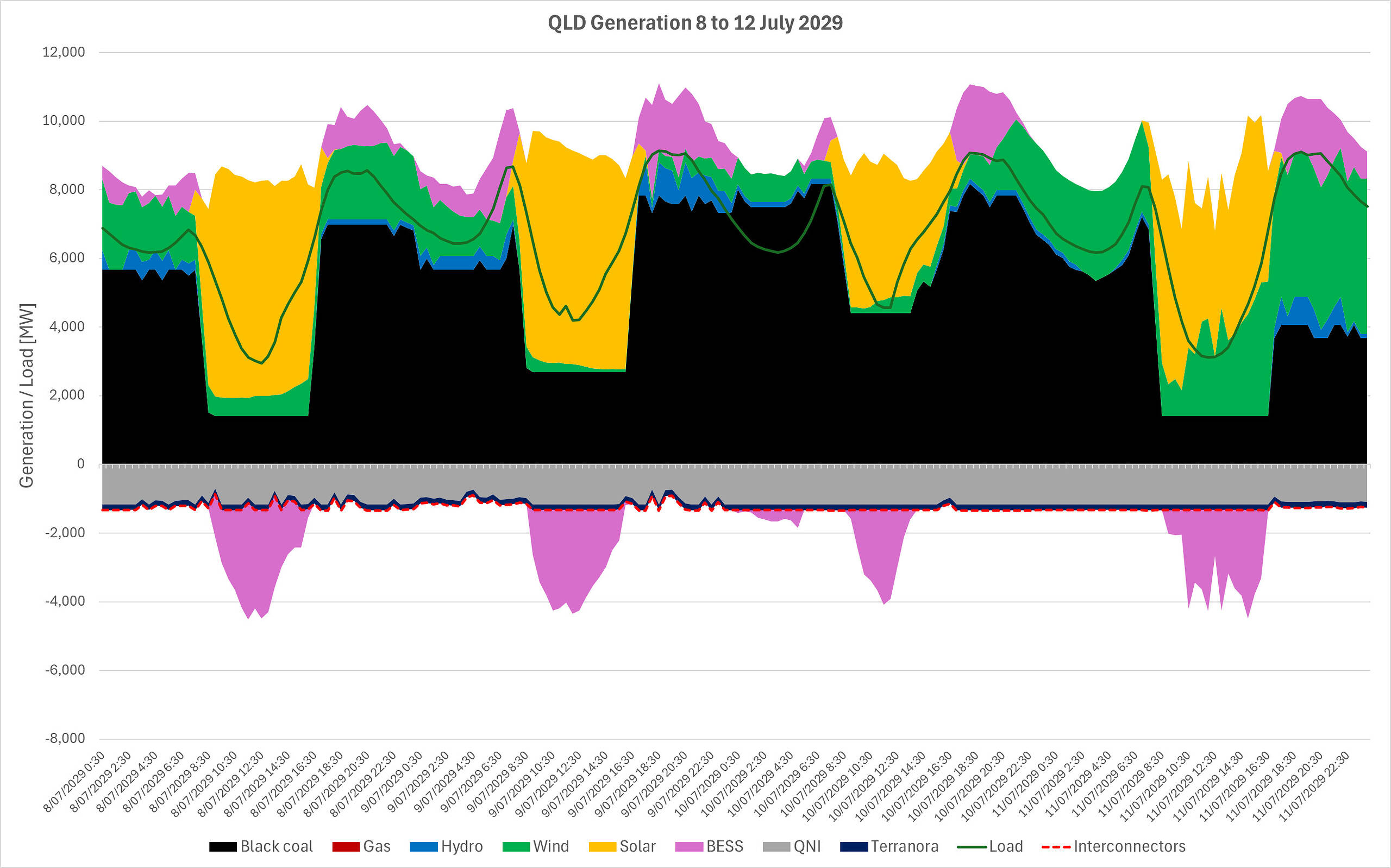

A system normal constrained dispatch

In the next chart, we see the outcome when NEM-wide system normal constraints are modelled.

Queensland dispatch during this period is not that different to the unconstrained dispatch.

Some constraints in central & north Queensland, Gladstone and south, particularly around Middle Ridge, bind, impacting generation dispatch of some generators and BESS, but we are not expecting too much pressure on Queensland’s demand supply balance. This is even the case during the wind lull period.

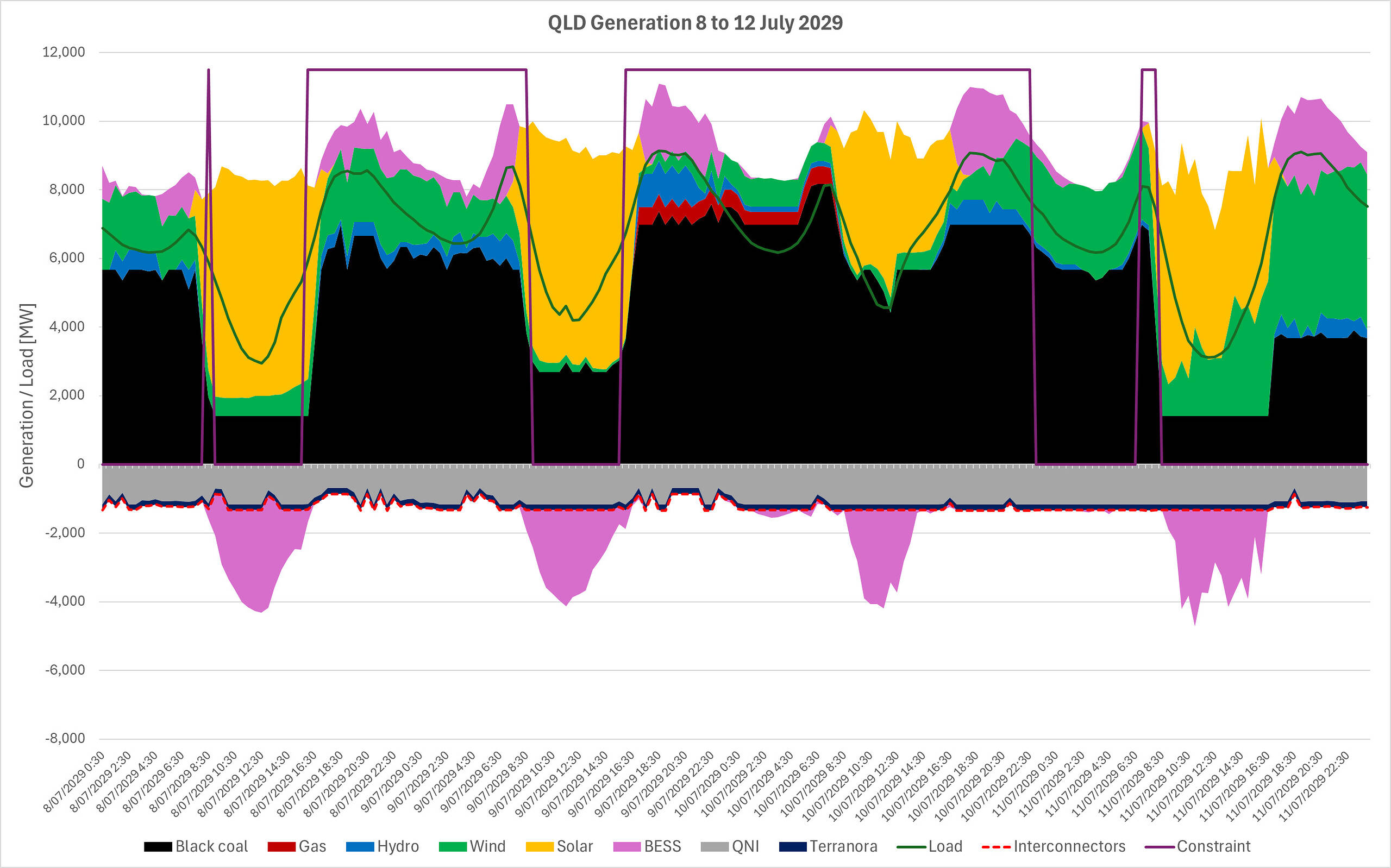

An outage constrained dispatch

Now, let’s look at the results of a simulation where the 275kV Woolooga to Palmwoods line experiences an outage over these four days.

A few insights are here:

- The Woolooga to Palmwoods line outage results in the constraint “Avoid overload of Woolooga to Gympie 132kV on trip of Woolooga to South Pine” to bind (pink solid line). This is a low voltage constraint that we typically might not pay much attention to.

- This low voltage constraint binds several times across the four days. We do not see a big impact on the first day or so given there is enough generation, particularly wind.

- However, with the constraint binding coinciding with low wind periods, it constrains the amount of central Queensland coal generation, and therefore we’ve got to ramp up gas generation in southern QLD (red area in the middle) to meet demand. With gas needing to come online, this could potentially increase the risk of volatility.

- Leaving all other implications aside, putting a BESS operator/developer/investor/off-taker’s hat on, considerations to the risk of significant lost revenue due to curtailment during this period is what needs to be taken.

- And lastly, is this just a rogue modelling outcome? The answer is no, the constraint has been there! “Out= Woolooga to Palmwoods (810) 275kV line, avoid O/L Woolooga to Gympie (748/2) 132kV line on trip of Woolooga to South Pine (807) 275kV line, Feedback”, “Out= Woolooga to South Pine (807) 275kV line, avoid O/L Woolooga to Gympie (748/2) 132kV line on trip of Woolooga to Palmwoods (810) 275kV line, Feedback”

About our Guest Author

|

Nadali Mahmoudi is the Director of Electricity Market & Network Modelling at EPEC Group.

He has more than 15 years of experience across consulting, academia and modelling in electrical engineering and electricity markets. He also holds a PhD in Electrical Power Engineering from the University of Queensland. You can find Nadali on LinkedIn here. |

Be the first to comment on "Why network outages matter for generator and storage revenue, risk and investment decisions"