Yesterday, we noted ‘Administered pricing for FCAS in South Australia from 05:20 on Sunday 17th August 2025’ … a ‘part 1’ article:

1) about the commencement of Administered Pricing for all 10 x FCAS services in South Australia;

2) which was driven by the Lower 1 second (i.e. FFR) service running at Market Price Cap for many hours and driving the Cumulative Price (for that service) to the Cumulative Price Threshold.

Today it’s worth adding a couple extra things:

(A) Administered Pricing continues into Monday 18th August

Early this morning there were a series of market notices on this subject – including MN 128562 as follows:

——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 18/08/2025 03:55:18

——————————————————————-

Notice ID : 128562

Notice Type ID : ADMINISTERED PRICE CAP

Notice Type Description : Administered price periods declared.

Issue Date : 18/08/2025

External Reference : [EventId:205] AP STARTED for market ancillary services in SA1 at 18 August 2025 0355

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE

Issued by Australian Energy Market Operator Ltd at 0355 hrs on 18 August 2025

ADMINISTERED PRICE PERIOD DECLARED in SA1 region.

AEMO has determined that the rolling sum of the uncapped market ancillary Lower 1 Sec services prices for the SA1 region over the previous 2016 trading intervals has exceeded the cumulative price threshold (CPT) of $1,823,600.00.

In accordance with Clause 3.14.2(b) of the National Electricity Rules, AEMO has determined that an administered price period will commence at the trading interval starting 0405 on 18 August 2025 and will continue through to the end of that trading day.

An administered price cap (APC) of 600 $/MWh will apply to all trading intervals during this administered price period. This APC will apply to all market ancillary service prices in the SA1 region.

AEMO will continue to monitor the rolling sum of the uncapped market ancillary service prices and issue further Market Notices as required.

This is an AEMO autogenerated Market Notice.

——————————————————————-

END OF REPORT

——————————————————————-

(B) Bidding of Lower 1 second FCAS in South Australia

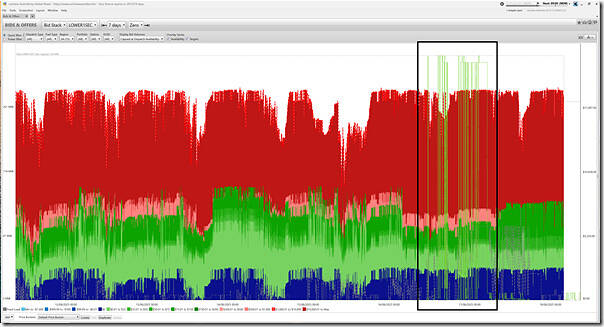

Firing up the ‘Bids & Offers’ widget in ez2view we take a quick look at bidding of Lower 1 second service into the South Australian region over the past 7 days:

I’ve overlaid the South Australian price (for Lower 1 second FCAS) on the chart and highlighted the time period of most interest. With this we can clearly see:

1) That there’s no enormous change in bidding behaviour over that period;

2) But rather, the main driver for the increased price is the increased enablement levels required across the units that bid into the market.

Out of interest, however, I just wanted to flag three particular things further…

B1) Bidding of Lower 1 second FCAS in South Australia by Loads

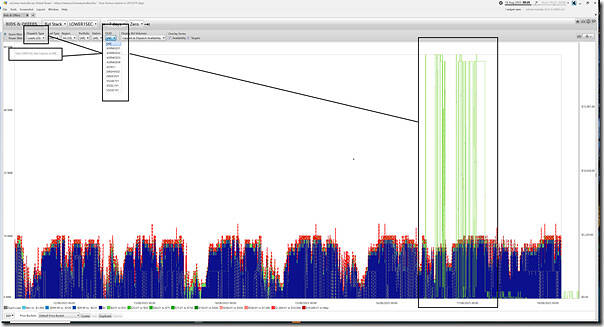

Here’s a snapshot of the same ‘Bids & Offers’ widget in ez2view, but filtered down to just the bids from the Loads:

With this screenshot we can see that:

1) Though the aggregate capacity registered with these units was 62MW, only ~16MW or so (~25%) was offered into the market through this period at any price.

2) Note that these prices were offered at blue (i.e. $0/MWh at the RRN) pricing.

… which brings to mind some comments made in the article ‘Battery bidding is reshaping FCAS — But Demand Response remains a strategic asset’ by Paul Moore at Viotas.

B2) Bidding of Lower 1 second FCAS in South Australia by Batteries

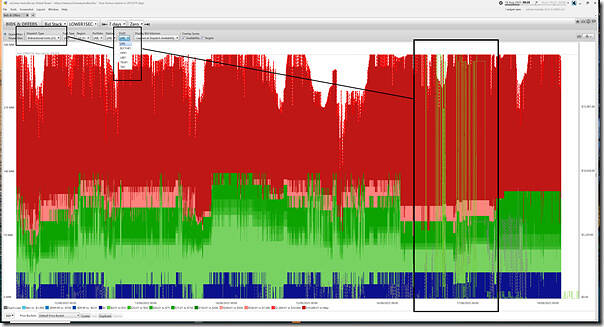

The only other technology bidding Lower 1 second FCAS in South Australia is batteries. Here’s a similar trend:

In contrast to the bid stack trend for Loads above, we can see that:

1) All of the registered capacity was offered into the market;

2) Though well more than half of the volume was offered in pink and red (much of it way up towards, or at, the Market Price Cap).

Now, frequent readers here on WattClarity® will know that I’ve always tried to make the point that we have a market, and part of having a market means that all participants want to earn a commercial return …

1) But others are having to grapple with the ‘what happens when the halo slips’ with the realisation that batteries (like anyone else) are in this market to earn a commercial return

2) Hence (for instance) Giles’ use of ‘bad’ in ‘Bad bidding behaviour ….’ here on 31st July with respect to a cohort that so many other times in the past had been seen to ‘save the day’.

(C) Network outage on Tailem Bend – Tungkillo 275kV line

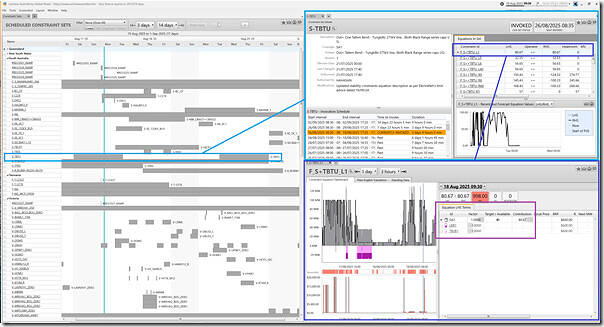

Here’s another snapshot from ez2view, this one with a collage of three different widgets focused on a specific Constraint Set (and one Constraint Equation within that):

I’m running out of time this morning, but briefly:

1) There’s an outage on one Tailem Bend – Tungkillo 275kV line that’s running currently:

(a) Which is reflected within NEMDE via the ‘S-TBTU’ constraint set;

(b) Which has an invocation schedule:

i. That commenced on Saturday 16th August 2025 and has it ending tomorrow (Tuesday 19th August 2025) at the end of the day;

ii. But is also slated to return next weekend!

2) As one of the (many!) constraint equations bundled into this set, we have highlighted the ‘F_S+TBTU_L1’ constraint equation …

(a) Which, as the Constraint ID suggests, speaks directly to the L1 FCAS commodity (and requirement in South Australia)

(b) The description (on the ‘Standing Data’ tab) is useful here:

Description = ‘Out = Tailem Bend to Tungkillo 275 kV line, SA Islanded for loss of parallel line, SA Lower 1 sec FCAS requirement for risk of islanding. Requirement capped at 100 MW’

Reason = ‘SAIT RAS scheme will separate SA for loss of remaining Tailem Bend to Tungkillo 275 kV line by tripping Tailem Bend to Mobilong 132 kV line. Lake Bonney BESS, Tailem Bend BESS and Ladbroke Grove outside SA FCAS island’

(c) But what’s more directly educational is to see that the left-hand side (LHS) of the constraint includes just three terms:

i. The requirement for local enablement of L1 FCAS; and also

ii. What’s happening at Lake Bonney Battery (noting the negative factor meaning that this might actually increase the requirement for L1 from units to the north of the outage cutset); and

iii. What’s happening at Tailem Bend Battery (noting the negative factor meaning that this might actually increase the requirement for L1 from units to the north of the outage cutset); and

So (referring back to the ‘Trends Engine’ chart in the Part 1 article) we can understand how the network outage commenced, requirement for local enablement jumped and (combined with relatively few suppliers) drove the price through the roof.

PS1 … corrections/clarifications about the ‘Loads’ supplying L1S, and the ‘F_S+TBTU_L1’ constraint equation

One of our more knowledgeable readers contact me (later on Monday 18th August) to suggest that I add clarification along the following lines.

I’ve transcribed and rearranged (so readers should note any errors in the following are sure to be entirely mine!)

With respect to the DUIDs offering to supply LOWER1SEC FCAS services, in the article we highlight Loads and Bi-Directional Units.

The ‘Loads’ are almost certainly all VPPs which means, if so, all supplied by smaller scale batteries.

With respect to the ‘F_S+TBTU_L1’ constraint equation (which we have seen recently before, such as on 24th July):

(a) the LHS terms shown in the ‘Constraint Dashboard’ widget represent the enablement levels (for L1sec) for Lake Bonney and Tailem Bend batteries.

(b) So the factors of “-1” mean that their enablement levels are just subtracted from the total SA region LOWER1SEC term (which includes the enablement levels for those batteries).

(c) as a result, the LHS calculates out to be the enablement for LOWER1SEC at all the other DUIDs in South Australia except for those 2 batteries (because they sit in the network south of the Tailem Bend to Tungkillo outage).

(d) so, what happens at those two batteries doesn’t increase the requirement from other SA sources … they just don’t count towards satisfying the constraint.

Many thanks for that!

Leave a comment