Wednesday evening 11th June 2025 was a period of tight supply-demand balance, hence energy price volatility – and so this article reviews the response of the demand-side.

We’ve already provided this ‘Brief summary of outcomes (Price, Demand and IRPM) for Wednesday evening 11th June 2025’ after noting the event as it was unfolding in High prices and tight spare supply, as NEM-wide IRPM drops down to 11.48% on Wednesday 11th June 2025.

Following on Paul posted An initial walk through bidding during the volatility on Wednesday 11th June 2025.

In assessing responses of the demand side, we firstly need acknowledge that not all responses will be visible in the data we have access to.

This article reviews consumption levels of large loads and dispatch of wholesale demand response.

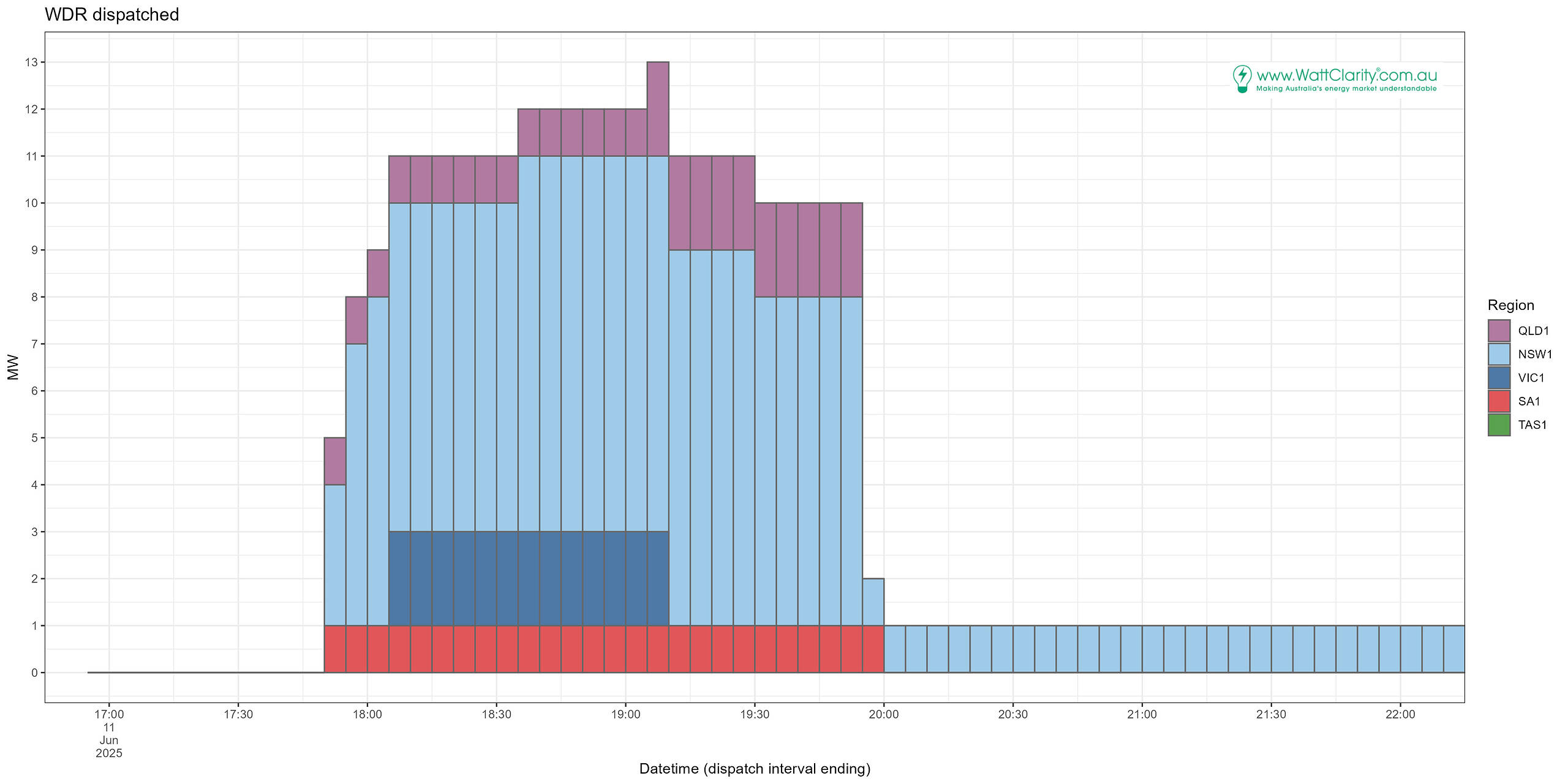

WDR Dispatch

From what we can detect, some Wholesale Demand Response (WDR) was dispatched.

At the peak level of dispatch, 19:10, there were contributions from all mainland regions:

- 2 MW in QLD1,

- 1 MW in SA1,

- 2MW in VIC1,

- and 8 MW in NSW1

totaling 13 MW.

The dispatch of NSW WDR at a level of 1MW went into the evening, beyond our review window.

WDR is currently under review with the AEMC.

Reliability and Emergency Reserve Trader (RERT)

No RERT intervention was observed.

Large Loads

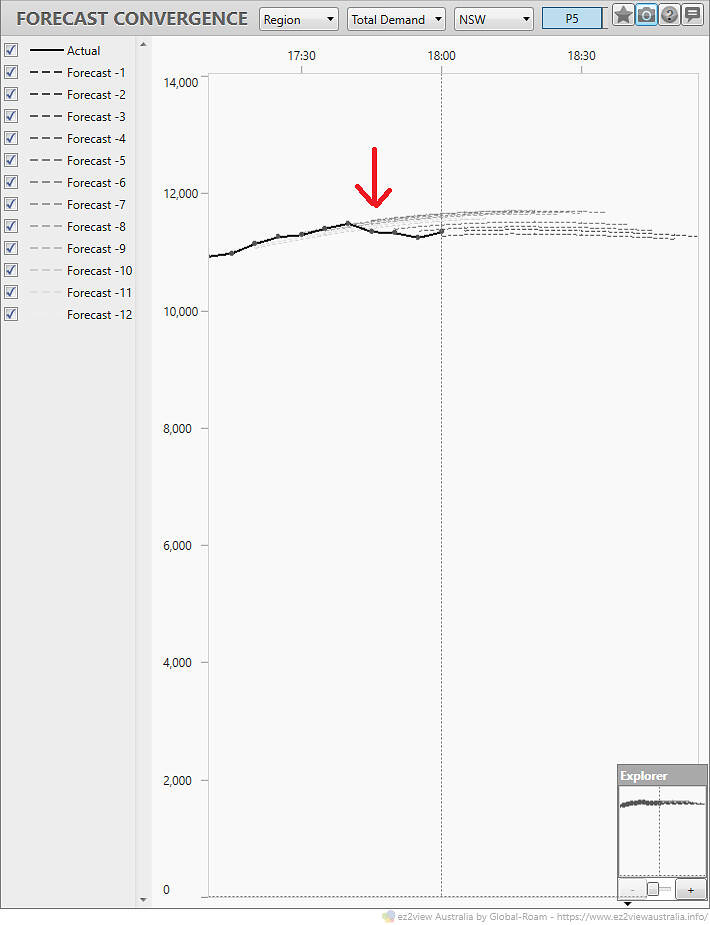

There was a sudden change in demand. This was observed in the P5-minute NSW region demand forecasts by interval 17:45.

ez2view’s Forecast Convergence widget captures the drop:

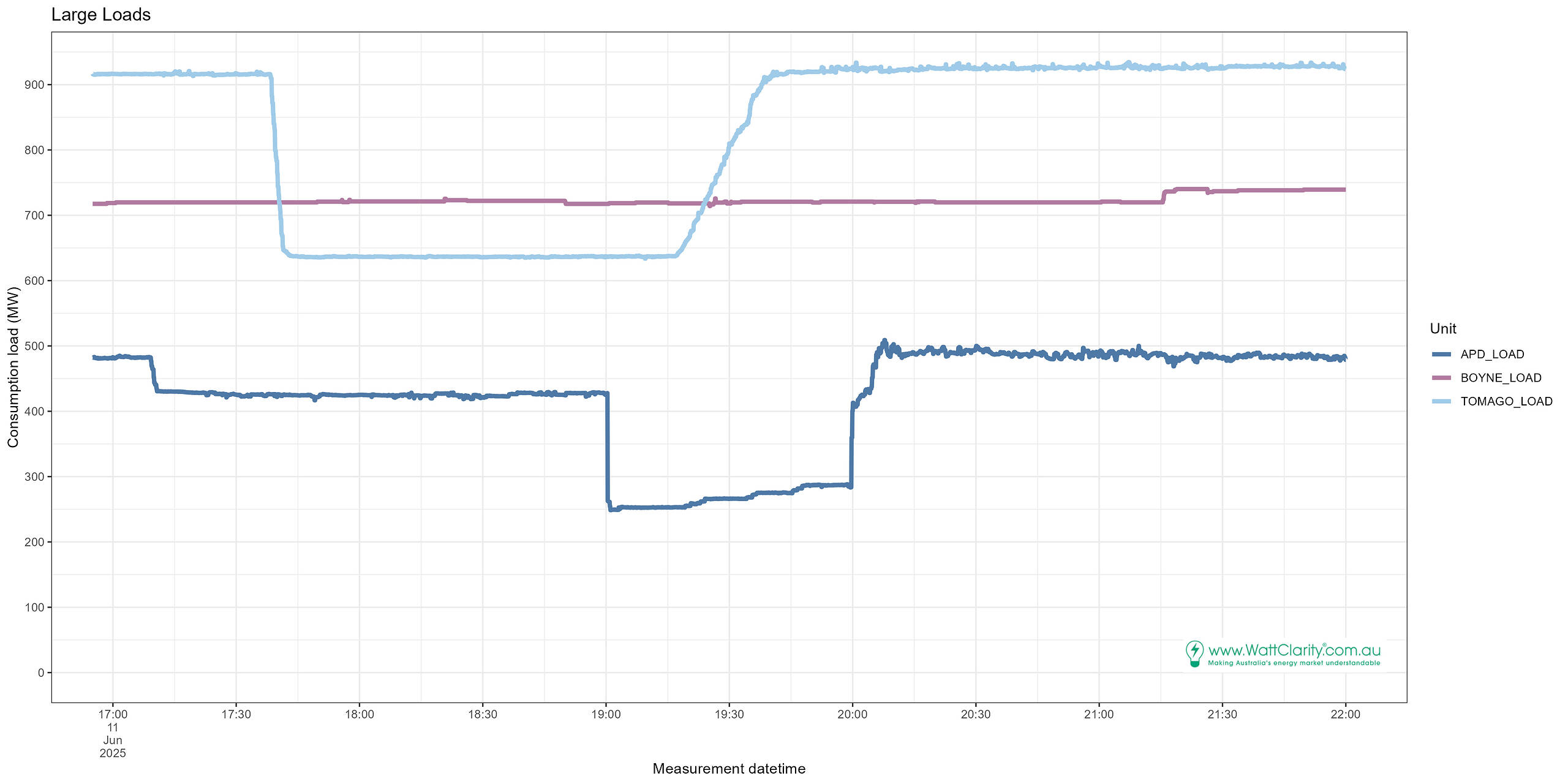

This led us to inspect large load consumption to verify if this was the driver for the change in NSW regional demand, using the next-day public 4-second data.

We observed a reduction in the order of 250 MW at Tomago aligning with the change in regional NSW demand, lasting about 2 hours.

In QLD, no material change in demand at Boyne is observed.

In VIC, a small (relatively) drop in APD’s (Portland) consumption when prices first started to be elevated is observed. A later and larger reduction in consumption followed at 19:00, lasting 1 hour.

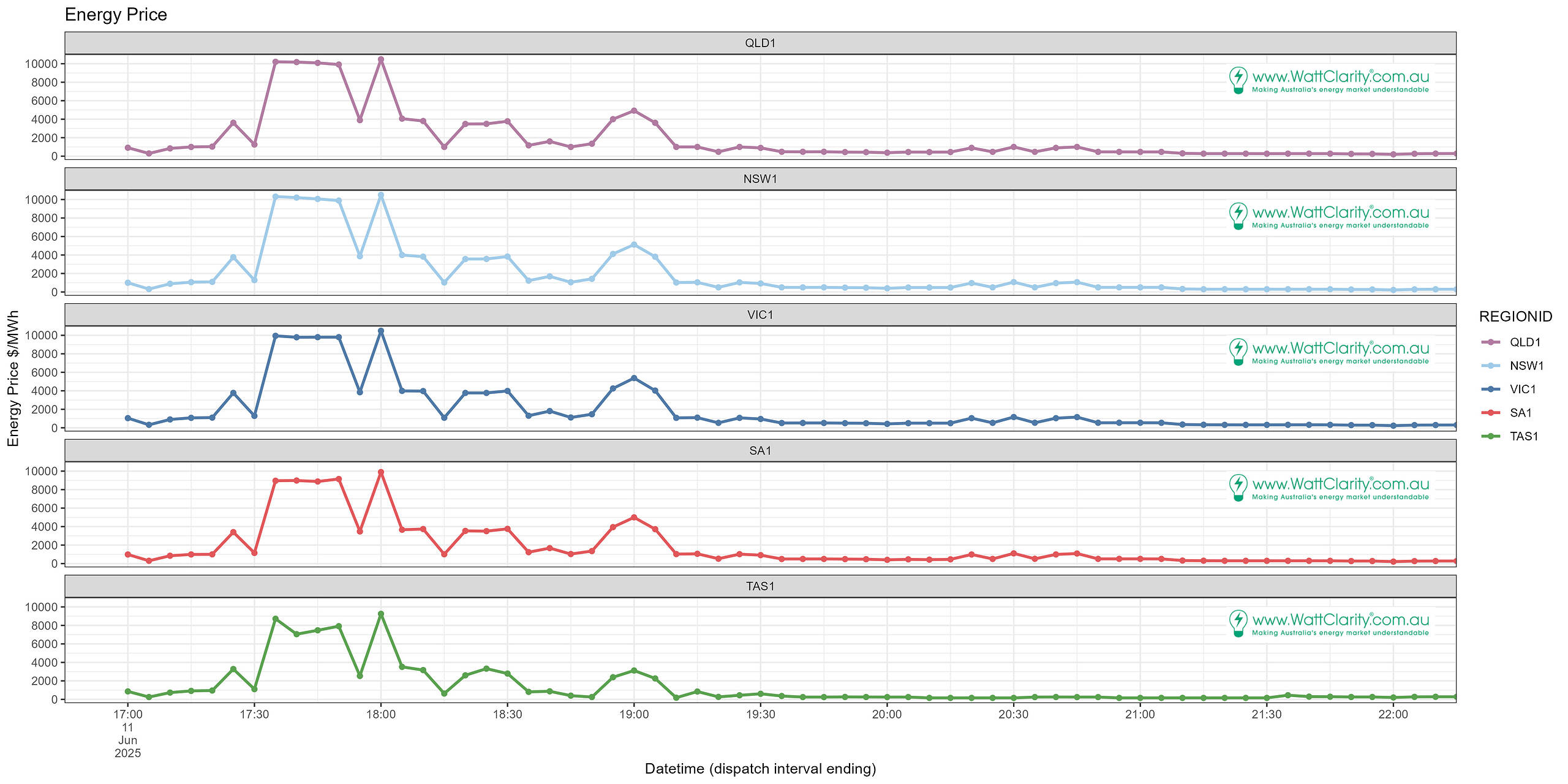

For reference, the energy prices over this timeframe are presented below.

Be the first to comment on "An initial review of demand response on Wednesday 11 June 2025"