Amidst the excitement yesterday of the new peak (sort of) reached in Queensland’s electricity demand, I did notice this article in the Fin Review quoting Bruce Mountain – speaking about the need for capacity payments in the NEM.

I don’t have much time today, but wanted to list several aspects of this multi-faceted issue that I have been puzzling about, as time has permitted.

1) Why has this argument emerged?

It should be noted, at the start, that any calls for capacity markets now (with the NEM having survived 16 years without one) revolve around each individual’s forecasts for the future – and it follows that the only thing that’s certain is that every forecast for the future will be wrong, each in different ways (especially in such a time of technological and social change).

I’ve previously written about doomsday predictions for security of supply here.

It is because of concerns about such a “doomsday” arriving (i.e. where the sun does not shine, the wind does not blow, but demand is still there – whilst thermal generators, starved of revenue opportunity, have been effectively run into the ground – so the lights go out) that we now see discussions about capacity markets. I have a vague recollection that prior energy market reviews (like Parer and ERIG) concluded no need for capacity markets at the time.

In my doomsday article, I noted the irony about how some in the NEM are calling for the introduction of capacity markets (to avert looming supply/demand challenges) whilst in the WEM there are calls for its abandonment (due to concerns for value-for-money).

These two counterposed arguments, to me, sum up the for-and-against case for capacity markets in general terms – i.e. you would not ordinarily need them (as the energy-only market works) but we’ve messed with the market to such an extent (a “messing” which is scheduled to continue into the future) that they now look, to some, as a reasonable (though expensive) proposition.

Calls for, and potential designs for, a capacity mechanism need to take place with reference to an individual’s forecasts for the future.

1a) There’s the “what might be” cases…

In one corner, there’s a plethora of different scenarios that might unfold – with these scenarios dependent on new technologies (and service models) emerging.

For instance, we’re hearing a lot about the possible “rise of storage” – and its likely that we’ll hear much more in future. Much of the commentary I have seen has involved various projections about how the cost is coming down rapidly, to the point where storage can be ubiquitous.

However the current status is that storage is not being widely used to balance supply and demand at present. Perhaps ironically, the introduction of a Capacity Market (for some, the lever to ensure continued operation of sufficient thermal capacity) might actually turn out to be one of the levers that helps with mass roll-out of storage capacity across the market. Nor is wave generation, or tidal power, or solar thermal, or nuclear (in Australia), etc….

1b) … and there’s the “based on current trends” case

The only prudent course of action seems to be that a capacity market, were it to be implemented, should be designed such that (as a “base case”) it could work with a continuation of the three most dominant existing trends working in parallel:

i. Large-scale wind (incentivised by the LRET) locating in locations of highest wind intensity (but not necessarily with much thought to what effect this will have on the wholesale market, and hence prices there). In other words, in the south-east of the NEM as discussed here.

ii. Distributed small-scale solar PV (incentivised by the SRES and avoided network charges) continuing to maximise production when the sun shines, hollowing out what used to be the traditional period of peak demand.

iii. Existing thermal plant, increasingly asked to run cycling operations and ramp quickly over time, needing to recover more than a more volatile spot price might otherwise provide in a smaller number of hours run, on average, each day.

Coincidentally, today I noticed this very interesting analysis by Opower of this type of issue, referenced to Germany with an upcoming solar eclipse.

Having designed a market such that it might work in a scenario that we know is plausible (as it’s just a continuation of existing patterns) the more hypothetical alternate scenarios become sensitivities that the market should also provide for, where possible.

2) How can Capacity Markets be efficient, and effective?

My sense is that there are a number of challenges that would need to be resolved to make capacity markets efficient, and effective. Some of these follow (note that they are inter-related, so apologies for some circular commentary):

2a) Who has responsibility for buying the capacity?

Let’s start with the consumer of this “capacity”. Who should have responsibility for its procurement – and (as a related issue) what happens if they get it wrong?

Option 1 = It seems clear to me that, in a perfect world, the consumer (or consuming entity) should have responsibility for ensuring they have enough capacity for that they require should be the person (or entity) that actually uses that capacity. After all, they are the ones who are most likely to know what they actually want. In this ideal world, the market would work such that a person’s consumption could rise to that procured capacity level and then no more. For instance, fuses could be set to the level of capacity procured.

However the world is far from perfect, and it does not take long to understand why such an approach has many barriers:

i. Firstly there’s the various technological and societal/cultural barriers to such an approach working, enmasse (picture the technologically-challenged Grandma at home trying to understand that concept).

ii. Perhaps a bigger issue is, though, who’s responsibility would be to procure capacity, in advance, for the people (and organisations) that don’t yet exist as customers in the NEM, or even a particular region of the NEM?

Option 2 = So we could crawl up the value supply chain to the retailer and mandate that these guys have responsibility for procuring capacity that meets the needs of the energy users they serve. These organisations are, at least, relatively close to their customers – and are supposed to understand the customer’s needs for other commercial purposes.

However here, also, we encounter significant barriers to effective implementation:

i. Keeping in mind that we’re talking about procurement some period in advance, in a market where (in Victoria for instance) the churn rate is something like 30% annually, what hope does a retailer have of predicting how much capacity will be required to service its demand at some future point in time.

ii. Layered on top of that bigger issue is the emerging challenge of embedded technology “behind the meter” that has the potential to eat the retailers lunch – as discussed here. First solar, then storage, then “the next big thing”

Option 3 = Perhaps we conclude that Option 2 is not a real option, either. So we crawl up the chain further and give that hospital pass to the poor market operator (the AEMO). We ask them to correctly forecast how much capacity is going to be required at some point in future (which is, some might say, what they already do) but then we layer into that significant financial cost on getting the answer right (or, more accurately, degrees of wrong-ness).

Sounds to me like it’s similar, in some ways, to all the argy-bargy going on about “gold plating” in the transmission and distribution networks in recent years. There are certainly other factors at play in the network debate, but with reference to thoughts about capacity market for energy, there are some similarities:

1) Collectively we (through the rules in place at the time) asked the NSPs to forecast how much capacity would be required to serve us, and build to meet the need.

2) We then – directly and through government reviews such as the “2004 Electricity Distribution and Service Delivery (EDSD) Review” in Queensland – made it clear that the “lights going out” scenario was not a scenario we were prepared to talk rationally about, in terms of cost-benefit trade-off.

3) We, as energy users, are allowed to be very vague in terms of our plans to plug in more appliances (or build more energy-intensive industries) and yet assume capacity will be there to meet our needs at that future point in time; and

4) At some future point in time, we’re surprised when the cost for serving us in this way is so high. Go figure!

Someone wise is reported to have once said something along the lines of “doing the same thing – again-and-again – and expecting a different result, is not very smart”. So why is it that it seems to me that calls for a capacity market have some elements of this same issue?

2b) How much capacity is required?

In the process of determining who has responsibility for procuring the capacity, we also need to determine how much capacity is required. There’s a couple aspects to this – as follows:

i. We need to start with Actual Demand. Whilst this is known in real time, it’s not known with certainty any time ahead of now (and the level of this uncertainty is greater further out into the future).

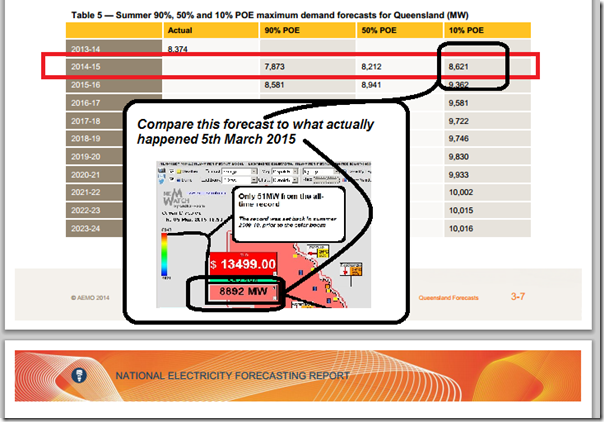

To illustrate this, I have included an excerpt of AEMO’s 2014 NEFR highlighting one table containing some forecasts for Queensland’s maximum demand through summer 2014-15 which, you will recall, we watched quite closely yesterday here:

The above image provides a comparison that’s not apples-to-apples, strictly speaking, but it does illustrate the type of issue that’s being discussed here.

Now forecasting is, naturally, a thankless task – how much more fraught with dispute would it be if there was a large amount of revenue (or loss of load) riding on the result, in terms of firm procurement of capacity reserves?

ii. An allowance on top of demand. The difficulty does not just stop there, however. Even if we can forecast demand perfectly (which we can’t) we also need to add an allowance on top in the procurement of capacity to take account of inevitable instances of plant not being available.

In the old paradigm this did, in most times, just reduce to forced outage rates for plant – though there was the addition of energy limitations during the drought of 2007 as well. In the emerging new paradigm, this allowance will also have to take account of other variables such as sunshine intensity and wind speed.

2c) When is it required?

Wedded to the question of how much capacity is required is the question about when it’s required to be delivered.

Are we talking about a single capacity payment to ensure sufficient capacity for a peak (assumedly summer) demand – or are we talking about capacity payments that trickle each day throughout a year depending on the expected peak demand for a given month, or day?

Are we talking about procuring today for tomorrow, or procuring today for next summer (i.e. which does not allow enough time for new capacity to be built – which might be fine now, in an oversupplied market, but what about in a number of years time after the fleet of existing thermal plant has been retired)?

Each approach has its own challenges.

2d) How does the market operator ensure this capacity is available when required?

It’s almost 20 years ago now when I worked there, but my vague memory is that the flawed design of the capacity market that operated in the original electricity market of England and Wales was one of the reasons why the review of “the Pool” was launched back in 1997.

My recollection is that the capacity payments were set a day ahead of delivery, based on the product of two metrics – LOLP (loss of load probability) and VOLL (value of lost load). These payments the generators effectively banked day-ahead – with then no penalties for not actually turning up the next day to deliver that capacity. My recollection of this situation in EPEW was that this was a double-bounty for (portfolio) generators as they were then able to achieve higher prices on the spot market on the day of delivery because of less capacity being available. Perhaps one of our readers can confirm this for me?

Regardless of whether this specific recollection is correct, or not, my sense is that it illustrates the 2nd vexed issue with respect to capacity payments – capacity is an intangible commodity. The only way to “prove” that capacity is actually available is to dispatch the capacity – but the nature of capacity procurement is such that the buyer needs to procure some percentage more than they actually need at any given point in time.

Hence the energy user (who inevitably ends up paying) is left paying for a service they don’t even know is there, and can’t even know is there. What’s more, if it turns out not to be there (oops, my boiler tube has a leak – or the clouds are covering my sun – or …) then it’s the energy users that end up carrying the can for that as well.

There would be different methods for working within the constraints of this issue – with each plausible option invariably involving some aspect of “socialising cost or risk”, for the alternative (opening discrete generation units up to damages for not delivering) would probably prove a very expensive option as this risk would be priced into the offers provided.

3) If a Capacity Market was introduced, could Demand Response also participate?

If a capacity market were to be introduced, it seems logical that Demand Response should also be allowed to play a role in providing capacity reserve.

* Note that we have been active for more than a decade in facilitating this form of Demand Response in the NEM.

A growing number of energy users are operating in this manner (some with our help, some independently). Some have become very sophisticated in their operations, fine-tuning their curtailment decisions with respect to such parameters as:

(a) The size of their order book; and

(b) Their production lead time.

The proposed design of the confusingly-named “Demand Response Mechanism” (discussed here and here previously) arose as a compromise solution because the NEM was designed, and has operated to date, as an energy-only market (i.e. without capacity payments), notwithstanding the effect of the RET (thus far, at least). Having not heard more about the status of this proposed reform for some time, I wonder where it is at?

Should a capacity market be introduced, and Demand Response able to play a role in that space, it’s clear that the role for the DRM goes away.

However the challenges noted above (in terms of “proving” that purchased capacity is available) are just as present – perhaps even moreso – with “negawatt” demand response than they are with physical “posa-watt”(?) capacity. As discussed at the bottom of this article my sense is that this stems from a conflict between what is (commercially) non-firm consumption and assumed firm (but actually non-firm) reductions from that non-firm consumption amount.

4) How might this fit in with RET payments?

As noted above, the call for the introduction of capacity markets has arisen only because of the effect that an external revenue stream (the Renewable Energy Target) is having on the operation of the broader National Electricity Market. Whilst the addition of a third revenue stream into the mix (in the form of Capacity Payments) might “solve” the issues created with the addition of the second revenue stream (the RET payments), what other issues might arise due to the interaction of all three revenue streams together in an increasingly complicated energy market?

My concern is that moves in this way might be described as “jumping from frying pan into the fire”…

I wrote previously about how the RET does have the effect of layering into a market that’s already complicated other aspects of “socialising costs whilst privatising profits”. That’s the reality – though (as noted in the same article and in this follow-up) it’s far from the only example of such cost-shifting.

Please refer again to our FULL DISCLOSURE 1 about how we strive to remain technology agnostic.

Our role is just to make the complexity in the energy market more understandable – whatever its rules of operation just happen to be. We hope that, by doing this, negative unintended consequences of policy choices that governments choose to make on behalf of their constituents can be reduced.

This Powershop video does a great job of explaining how a single dispatch interval works in the NEM, but does not talk about any of the inter-temporal effects that are inherent in each dispatch interval. My sympathy for anyone who tries to explain more complex nuances such as this in a similar pithy way!

The additional layering of a capacity payment into the mix, whilst making visible a “cost” that is now largely hidden in the balance sheets of incumbent generators, has the potential to make any discussion about “cash paid out by energy users” of any particular measure even more difficult to describe clearly.

——-

Should any of our readers be able to point to substantial pieces of thinking about any of the above, please do note them below (or even just let me know of them, offline) in order that I can add them to the mix as well?

My concern is that moves in this way might be described as “jumping from frying pan into the fire”…”

I agree 100%. And I agree with your comments about the RET. Simplifying enormously (for clarity in a blog comment), the rational answer seems simple. It’s to dump the RET and allow Direct Action to work to buy abatement at the least cost (based on reverse auction processes)..

However, as ACIL-Allen pointed out in their commissioned report to the RET Review Expert Pannel, simply dumping the RET and repealing the legislation sends a message of heightened regulatory risk in Australia (no worse that what some advocate to shut down coal power stations of course, and probably less economically damaging because all repealing the RET would do is to remove the guaranteed sales of all the RE generators produce and the subsidy of the RECs. UIf they are cheaper than fossil fuels, as some claim, they don’t need any production subsidies. Let’s see.

ACIL-Allen suggested that closing the RET to new projects would be preferably and gandfather the exisiting projects. I am persuaded this would be the best approach. Let’s give the Direct Action approach a chance: Reasons to support Direct Action (and close the RET to future projects) are:

1. It’s much lower cost than the Labor-Greens CO2-e emissions restraint policies

2. It’s highly flexible – so it can be adjusted to fit with whatever policies the world agrees to

3. Carbon pricing is highly unlikely to succeed [1], [2], so its a totall waste of time energy and resources continuing to advocate for it

4. The US is implementing direct action, and has no intention and not realistic prospects of implementing CO2-e emissions pricing

5. Direct action has demonstrated it is by far the best way to reduce emissions – e.g. France’s CO2-e intensity of electricity is 10% of Australia’s and it has near the cheapest electricity in EU.. That’s not due to CO2-e pricing. Its due to direct action policies – as are virtually all the countries that have nuclear power substituting for fossil fuels.

6. Countries with the highest proportion of renewables have the highest cost electricity and high emissions intensity from electricity. The countries with the most nuclear have the lowsest cost electricity and lowest emissions intensity of electricity [3]

References:

[1] ‘Why carbon pricing will not succeed Part I’ : http://catallaxyfiles.com/2014/10/26/cross-post-peter-lang-why-carbon-pricing-will-not-succeed-part-i/

[2] ‘Why The World Will Not Agree to Pricing Carbon II’ ; http://catallaxyfiles.com/2014/10/27/cross-post-peter-lang-why-the-world-will-not-agree-to-pricing-carbon-ii/

[3] ‘How much does it cost to reduce carbon emissions? A primer on electricity infrastructure planning in the Age of Climate Change’ (see especially slide 10 and note the irony in slide 14) ; http://canadianenergyissues.com/2014/01/29/how-much-does-it-cost-to-reduce-carbon-emissions-a-primer-on-electricity-infrastructure-planning-in-the-age-of-climate-change/

On your post [1], you are assuming that the cheapest options are excluded first which isn’t necessarily so. Electricity is a sector with low abatement costs and is easy to measure.

Both direct policies and taxes have their benefits. I previously worked on an energy efficiency scheme where businesses wouldn’t accept money to upgrade their equipment. As soon as the threat of the carbon tax came along those same businesses were desperate to upgrade even though the rate of return was lower without rebates. People are more afraid of loss than they are excited for gain 🙂

Direct action nuclear takes capital costs out of the electricity sector and puts them on the tax payer. You could just as easily do that with renewables and have free energy.

Your point 2d) is why I’m against capacity credits. The benefit of a high market cap is that the rewards for actually delivering are high and the rewards for not delivering are zero.

You could probably justify building a OCGT if you could capture 10 hours of $13k per year. If supply was an issue people would knock up some peakers in no time.

Alternatively, if the Market Price Cap actually reflects the value of lost load than there will be a greater incentive to bring capacity to the market, make available additional ramping capacity and extend asset life. Unfortunately, there are strong political reasons not to allow the MPC to reflect VOLL that are counter to the markets and consumers long term interests.