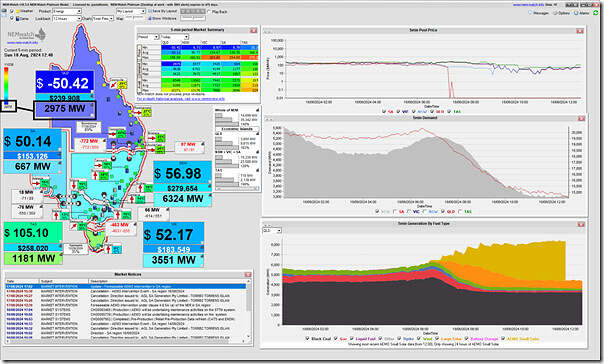

A short note with this snapshot from NEMwatch at 12:40 showing the ‘Market Demand’ in the QLD region down at 2,975MW … which is the lowest point it’s been for over 20 years:

We see in the snapshot above that:

1) The ‘Market Demand’ at this point is down in the dark blue range … but not quite the ‘lowest ever’ based on the long-range statistics held in the background within NEMwatch to set the minimum (dark blue) and maximum (red) colour range for each region.

2) We also see that the rooftop PV yield is going gangbusters at this point (AEMO estimates are delayed but earlier estimates were ~4,000MW production from rooftop PV systems … readers should remember that they are estimates only because production is actually invisible!)

Let’s briefly consider…

(A) Records for QLD at both ends of the spectrum … within 8 months!

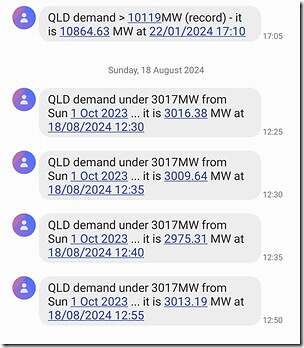

The series of SMS alerts triggered by our ez2view software (beginning in the 12:30 dispatch interval, at 3,016.38MW) alerted me to the fact that the demand had dropped lower than the 3,017MW level seen on Sunday 1st October 2023, a day that saw a number of different milestones reached (as noted in that collation of articles):

Ironically, the last time I received a demand-related alert (for any region) was back on 22nd January 2024 when QLD smashed the prior record for all-time maximum. Having records at both ends fall within an 8 month period is a sign of the increasing challenge in making this energy transition work.

(B) The unavoidable challenges of rooftop PV

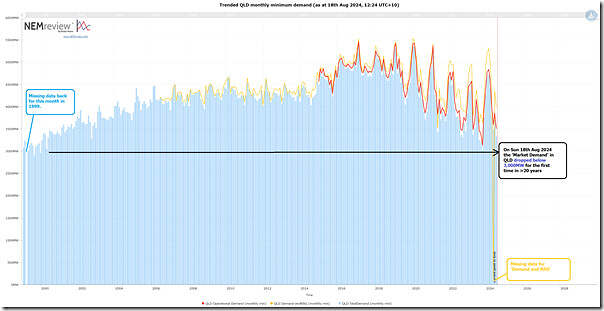

Using a pre-configured query from NEMreview v7, we quickly see the long-range trend of monthly minimum demand looking back 25 years and including several different measures:

It’s not really a coincidence that we’re seeing an increasing number of articles speaking to the underlying challenges that the rooftop PV juggernaut is delivering to the ongoing functioning of the grid. Some articles are more considered than others (just as the arguments of various energy-sector stakeholders) … here’s just two examples:

1) On Friday 16th August 2024 (in the AFR) Matthew Warren wrote ‘Five reasons the power grid needs a major redesign’, including rooftop PV as 5th … though he wrote:

‘Finally, the biggest disruption to the current market is rooftop solar PV. It’s a huge regulated solar engine outside the market which sends wholesale prices crashing every sunny day, undermining the commercial case for utility-scale renewables, and everything else too.

Rooftop solar PV is going to keep growing because it’s hugely popular and untouchable politically. We need a market that works with it, or at least stops different types of renewables from cutting each other’s lunch.’

Let’s hope the Productivity Commission is up to the challenge!

2) Then there’s this (more sensationalist?) article by Blake Antrobus on the News Corp platform that I read earlier this morning:

Too much of a good thing?

There have been a few papers published by Griffith University regarding Australian energy, most interestingly, P. Simshauser, 09/2021, “Rooftop solar PV and the peak load problem in the NEM’s Queensland region”. It is definitely worth a read in my opinion.

This one, Freddy?

https://www.sciencedirect.com/science/article/abs/pii/S0140988322001748

yes, that’s the one

is there anyone actually taking full advantage of the negative prices during the day? or are we relying entirely on batteries being built?

at this rate it looks like the price is going to go negative near daily for the next 6 months

Energy storage is probably the only way it could be taken advantage of. Unless there is another way to short the NEM?

Buy electricity from the NEM during the day for cheap to charge batteries etc, and then sell it back to the NEM when it’s more expensive.