Two times within two weeks!

Guest author Allan O’Neil wrote about ”Out of the blue, an LOR2” in exploring some of what happened on Friday 20th December. Today we seem confronted by a similar situation, in which AEMO has published three Market Notices almost simultaneously, as noted below. But first some quick context

(A) It all seemed relatively calm…

I posted this article early this morning when, at the time, the forecast for the NEM later this afternoon looked relatively calm (despite the extreme temperatures forecast, and some pretty dire bushfire warnings).

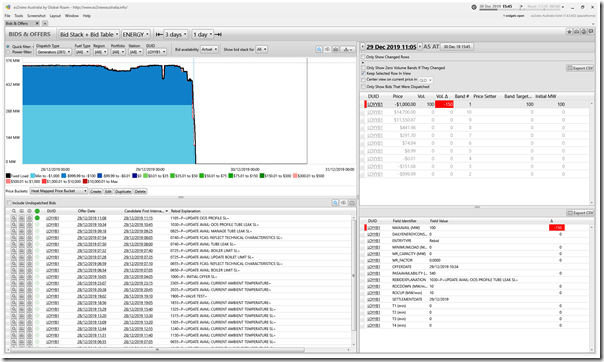

In his comment on that article, guest author Allan O’Neil also drew attention to the fact that Loy Yang B1 had come off for a tube leak on Sunday morning – as seen here in a snapshot from ez2view ‘Bids & Offers’ widget looking back at that time:

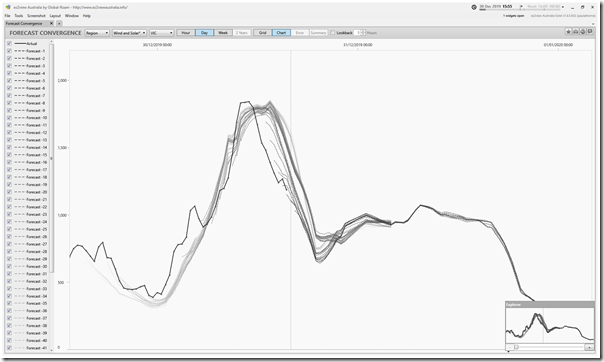

Through the day, we also watched as aggregate production from Wind and Solar generation in Victoria declined – though notably there was not such a startling gap between ‘actual’ and ‘forecast’ as we saw on the 20th December:

(B) … until something changed

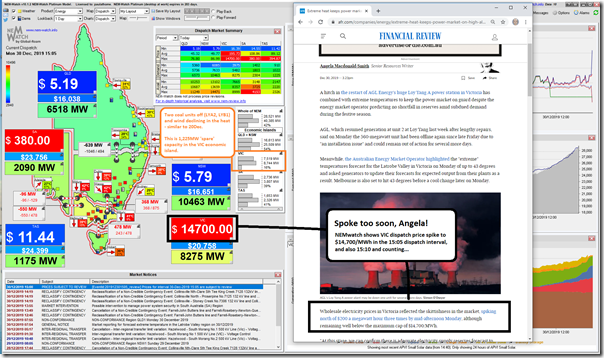

Early this afternoon I noticed that Angela MacDonald-Smith had posted an article “Extreme heat keeps power market on high alert” in the AFR, which included this line:

… which is another one to tag with the ‘spoken too soon’ label given the price volatility that began in the 15:05 dispatch interval shown in this image I tweeted shortly afterwards.

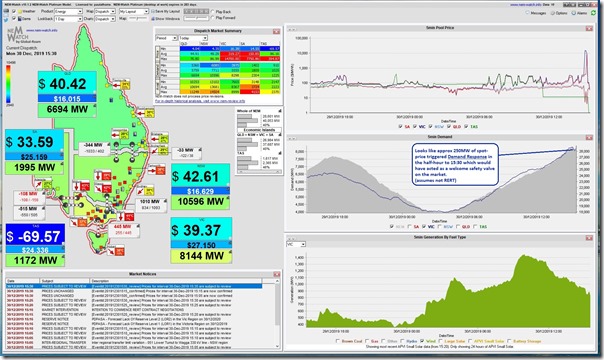

The 15:10 and 15:15 dispatch intervals also saw high prices in VIC (at 15:15 also in SA). Here’s 15:10 via NEMwatch:

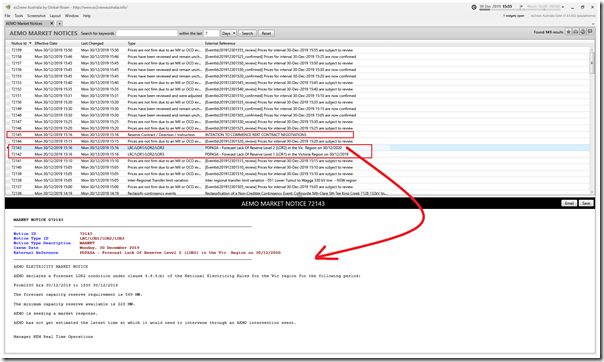

For the 15:20 dispatch interval (i.e. at 15:16) the AEMO had published 3 Market Notices of interest, as shown here in the ‘Market Notices’ Widget in ez2view:

This does raise the same underlying question – what changed so quickly to trigger another LOR2 (Low Reserve Condition) Notice, essentially out of the Blue?

Market Notice 72138 helps to explain one of the contributors:

————————-

MARKET NOTICE 072138

________________________________________________________________________________________________

Notice ID 72138

Notice Type ID Inter-Regional Transfer limit variation

Notice Type Description MARKET

Issue Date Monday, 30 December 2019

External Reference Inter regional transfer limit variation – 051 Lower Tumut to Wagga 330 kV line – NSW region

________________________________________________________________________________________________

AEMO ELECTRICITY MARKET NOTICE

Inter regional transfer limit variation – 051 Lower Tumut to Wagga 330 kV line – NSW region

At 1447 hrs there was an unplanned outage of the 051 Lower Tumut to Wagga 330 kV line in the NSW region

The following Constraint sets were invoked at 1500 hrs until further notice.

N-LTWG_RADIAL

V-DBUSS_L

V-DBUSS_L

The containt set contains equations with the following interconnectors on the LHS

VIC1-NSW1

V-S-MNSP1

V-SA

T-V-MNSP1

NSW1-QLD1

Refer to the AEMO Network Outage Schedule for further information.

————————-

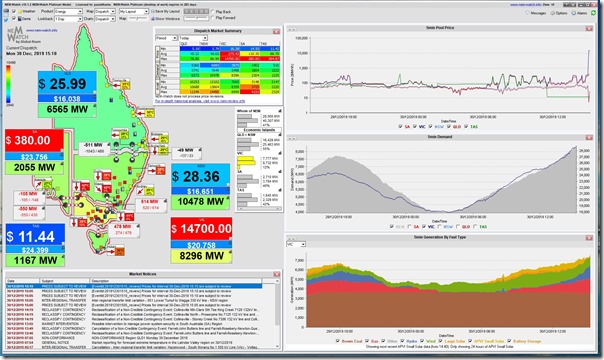

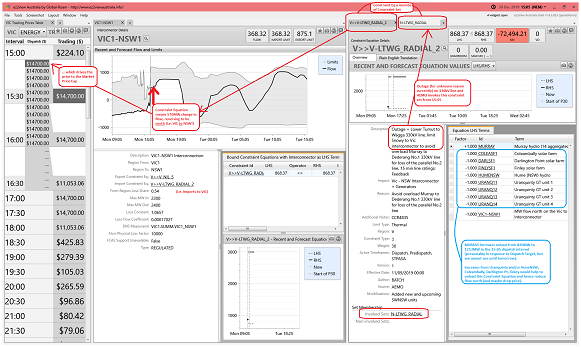

PS2 – With the benefit of Time-Travel in ez2view, and a bit more time to piece the following together, I’ve attached this mashup of several Widgets in ez2view focused on the 15:05 dispatch interval to explain some of what happened:

As noted in this snapshot, an increase in output from a handful of plant (Uranquinty GTs, HumeNSW Hydro, Coleambally Solar, Darlington Point Solar (when commissioned!) and Finley Solar) would each have helped to unload this constraint (i.e. because of the negative factors), hence allow reduced flow north, and perhaps lower prices.

An interesting follow-on question would be to understand why this did not happen … (food for some later analysis at some point).

In this later snapshot from 15:30 we see approx 250MW of what appears to be spot-price triggered Demand Response (looking like the type which we have helped facilitate for numerous clients across the NEM – including a number in Victoria – for many years) which would have helped to unload the tight supply/demand balance.

… that’s all I have time for now…

(C) PS – Reserve Trader Dispatched

Worth noting, as a brief PS, that Reserve Trader was dispatched for the half-hour ending 16:30 (NEM time) and forecast to apply until half-hour ending 23:00 (NEM time):

———————————-

MARKET NOTICE 072167

________________________________________________________________________________________________

Notice ID 72167

Notice Type ID Reserve Contract / Direction / Instruction

Notice Type Description MARKET

Issue Date Monday, 30 December 2019

External Reference RERT DISPATCHED

________________________________________________________________________________________________

AEMO ELECTRICITY MARKET NOTICE.

AEMO Intervention Event, Reliability and Emergency Reserve Trader (RERT) – VIC1 Region- 30/12/2019

Refer AEMO Electricity Market Notice no. 72143

AEMO has dispatched/activated reserve contract(s) to maintain the power system in a Secure and Reliable operating state.

The reserve contract(s) was dispatched/activated at 16:30 hrs 30/12/2019 and is forecast to apply until 23:00 hrs 30/12/2019

AEMO has implemented an AEMO intervention event for the duration the reserve contract(s) is dispatched/activated/

To facilitate the RERT process, constraints commencing with the following identifiers may be evident at various times in dispatch,

#RT_VIC1

Manager NEM Real Time Operations

———————————-

Geez, we’re not even (yet) at January…

I happened to be holidaying with family at Coobowie/Edithburgh in SA today in view of Wattle Point wind farm with its 55 turbines and for the last couple of days they appeared to be working well. Except for around 11.30-12.00 today when we happened to be returning from Troubridge Point in a dust storm with the car temp outside reading 40-41 degrees and the turbines had all shut down which you can see clearly here leaving only WPWF graphing-https://anero.id/energy/wind-energy

Not the only severe dip with the wind blowing strongly all day as you can tell by the wind farm output over 90% of installed capacity alongside the shut down. What is going on with these wind farms?