Yesterday I noted how a new all-time record had been reached for wind production, aggregated across the NEM.

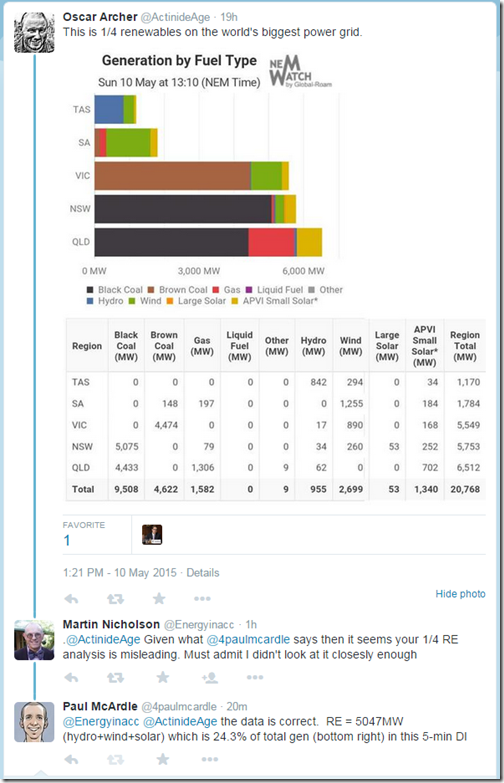

It was also noted by others, on Twitter, that the NEM reached 25% of its total generation supply being delivered by renewable energy (hydro, wind and solar) on Sunday afternoon – at least for the 13:10 dispatch interval highlighted. Note that the image provided comes from the NEM-Watch widget we’ve developed for RenewEconomy (it’s static in the image below but live in the link).

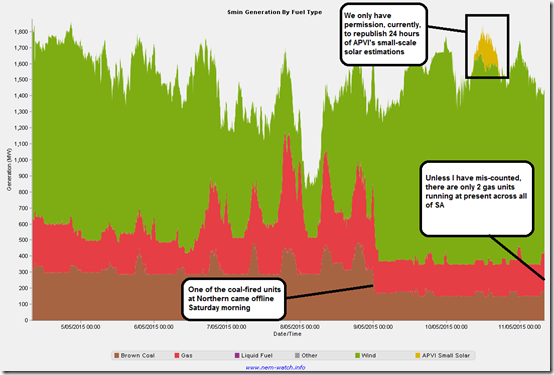

The windy weather down south has been persisting for a number of days now – and has continued into this morning.

Frequent readers of WattClarity will understand that we do strive to remain generation source agnostic.

Our role is just to make the complexity in the energy market more understandable – whatever its rules of operation just happen to be. We hope that, by doing this, negative unintended consequences of policy choices that governments choose to make on behalf of their constituents can be reduced.

Judging by the fact that I’ve been accused (by some) of being a front for wind farm developers, and also (by others) in the pocket of “big bad coal” I’m inferring that we’re not doing too badly at that (though, of course, there is always room for improvement).

Naturally, the South Australian region contributes a sizeable percentage of the total wind supplies in the NEM – see the following chart (focused on South Australia and) extracted from our NEM-Watch software this morning:

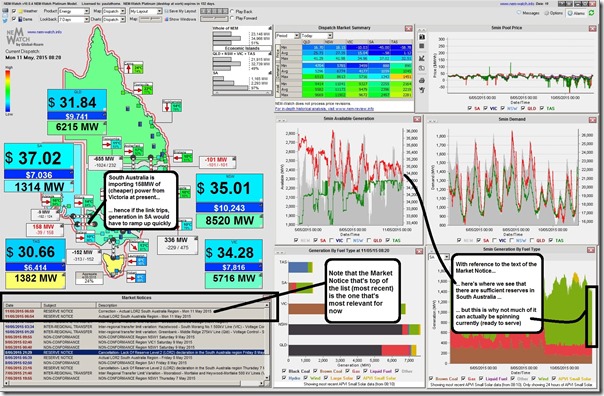

Part of the value of NEM-Watch is that it allows people (participants, spectators and commentators) to gain a clear view of how variables such as the above are integrated into the broader scope of what’s happening in the market – so they can more easily understand the implications of such events as high wind in South Australia.

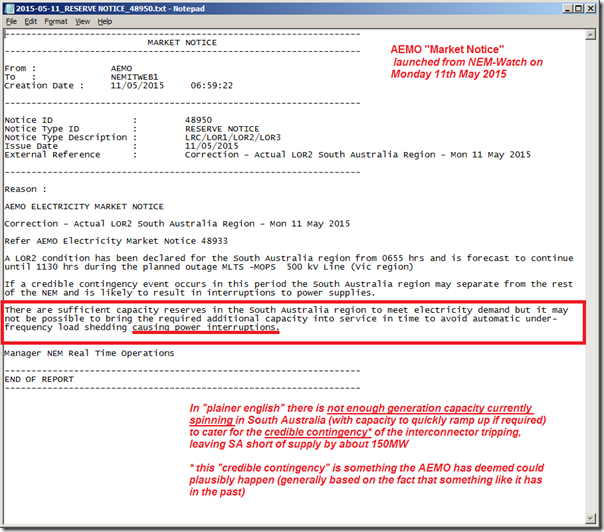

This morning I noted that AEMO has, once again, flagged a “LOR2 warning” for the South Australian region in its Market Notices – as highlighted in the following snapshot from NEM-Watch (and triggered through SMS alerts to my phone):

I’ve annotated this display to help readers understand a few of the significant variables. Double-clicking on the Market Notice in NEM-Watch launches the full text of the market notice, as follows:

Astute readers will notice, in the window of Market Notices within NEM-Watch, that similar Market Notices were issued last week. Readers in South Australia will be aware that this “credible contingency” did not happen last week (i.e. so the lights did not go out).

1) Hence we can (and should) conclude that – just because AEMO says it might happen, does not mean it will happen.

I have previously commented, for instance, on doomsday predictions for security of supply.

2) However the converse is also true – just because it did not happen last week, does not mean it won’t happen today (or at some stage in the future).

(a) Indeed, probabilistically speaking, it is almost guaranteed that it will actually happen on one (or more) occasion when AEMO issues a Market Notice such as this at some stage in the future – if the market does not respond. That’s why it’s deemed a “credible contingency”.

(b) The key take-away here is that the South Australian region is operating in a less secure state than the Market Rules would like it to be at present, due in part to:

i. maintenance works on transmission (which are being incentivised, under the rules, to schedule these works when they don’t ordinarily have a market impact – so times like now!); and

ii. high wind production in South Australia.

Unfortunately, in this case, I’m not aware of too much that the market might actually do in this case, given that windy conditions in South Australia are making it uneconomic for most thermal generation to start up, at present. It would be possible to shift the maintenance outages away from windy periods – but there would be costs associated with this, as well.

Longer term, if further renewables were to be added to the grid particularly in South Australia:

1) This might give weight to the business case for augmentation of interconnection capacity between South Australia and the east (but to do so in a way to reduce the risk that these credible contingency events might happen – which might mean not augmenting along the identical flow path).

2) It might also provide an added boost to Demand Response – at a 150MW potential shortfall in South Australia today (if the “credible contingency” event were to occur) there would be a number of our customers involved in providing this Demand Response, as the price would spike to the Market Price Cap if load shedding occurred.

3) Needless to say (especially with recent press coverage) there will be many who will view battery storage as the panacea in this case. I am interested to learn what the response rates might be in this respect (i.e. in response to rapid frequency drops should the link be lost) – perhaps one of our readers might elaborate?

That’s all I have time for today…

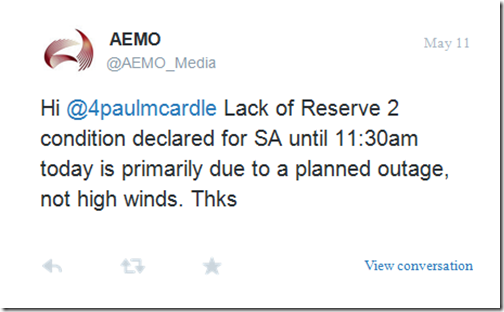

PS – in the interests of completeness, readers should note that the AEMO Media Twitter account provided these details about this LOR2 notice today:

My apologies for any readers who might have missed my reference to the transmission outage in this post.

To quote hitchikers’ “Don’t Panic”. As you pointed out, possible LOR are common but actual LOR are not.

The key issue here is less wind and more the scheduled outage of an interconnector.

The issue of interconnectors to SA and Victoria was a key part extreme weather impact on the NEM study conducted as part of National Energy Security Assessment (NESA). The study identified SE Australian heat waves as the type of extreme weather event likely to stress the NEM. Interconnector failures are among the most significant power system risks during such events, with South Australia at risk for both being at the end of the NEM chain and heat driving demand.

The most recent january 2014 heatwaves pushed SE Australia to the limit, but while Reliability and Emergency Reserve Trader (RERT) contracts were formed they were not invoked.

A key issue is network congestion in Victoria affects what the interconnectors can carry to/from SA, and whether it is frequency synchronised. Each jurisdiction has its own preferences for responses to such challenges (ie how much political flak for large blackouts).

The rise of renewables has changed the paradigm of ‘spinning reserve’ – but the rise is gradual, and it is not the only possible response: already the NEM has a range of special schemes in both Tasmania and South Australia. As noted, demand response and storage are increasingly becoming economic options.

The short answer is that the future is likely to be a more complex mix of generation and demand tools than the historical ‘more of the same’, but ultimately it is very unlikely the lights will ever go out.

Thanks James

For everyone’s benefit you have referred to the National Energy Security Assessment, which is here:

http://industry.gov.au/Energy/EnergySecurity/nesa/Pages/default.aspx

Paul

Paul, my concerns with reporting that “1/4 of electricity was produced by wind” based on a 5 min DI is just the kind of story that the “greens” run with to suggest this is now the norm. I see it’s down to 8% in the current interval.

Martin

You’re a frequent reader of WattClarity, so will understand that:

1) I do try to remain objective; and

2) I have posted about the highs of various types of generation, along with the lows.

Paul

Paul,

As I mentioned on Twitter, I’m perplexed by the choice to focus on wind energy as a causal factor in this event, despite it playing a minor role in its occurrence. As you may know, a lot of people are regularly seeking to find reasons to lay the blame on wind farms for a very large range of adverse impacts – health, grid reliability, electricity price increases, mobile phone reception, etc.

Most of these are predicated on an inability (or an unwillingness) to consider causality – if something bad happens, and it happens at the same time that a wind turbine was generating electricity, that doesn’t mean wind turbine operation was a necessary or sufficient (or both) factor in that thing occurring.

I understand you’ve included AEMO’s correction at the bottom of this article, but someone motivated to implicate wind energy in problems that would have happened anyway would be well served by the headline in this article.

I might append a further example – Tony Abbott said in 2013 that ““renewable energy targets are also significantly driving up power prices right now”

The RET scheme contributes ~2% to 4% to residential bills at the moment. So whilst his statement of contribution is true, it’s not a reflection of the major cause of price increases – network infrastructure spending.

Numerically (or, qualitatively) accurate remarks about contribution can still misinform, without the inclusion of prominent and unmissable context. Headlines are easily the most striking and ‘stickiest’ component of any blog post or article – see: http://www.niemanlab.org/2014/02/4-headlines-that-will-restore-your-flagging-faith-in-journalism/

Thanks for the thoughts, Ketan

I will follow up further the comments made on Twitter and LinkedIn and investigate further. As my understanding increases, I will post more commentary here.

I do understand that there are different people who view wind farms very differently, just as there are people who view coal seam gas extraction very differently, just as there were many inquiries in years-gone-by about the effects of living in close proximity to high voltage power lines. Controversy is not a new thing in the energy supply industry.

Paul

Goodness me, there’s my name in lights!

I can certainly tell you, it’s been a windy week down here. Gloomy too, unfortunately.

As for what the market could do if the improbable occurred… I take it the abrupt loss of transmitted wattage from SA would potentially jeopardise the rest of the NEM? But apart from that, isn’t there a whole heap of Victorian and NSW hydro effectively on standby, judging by those generation numbers?

Paul,

You mentioned credible contingency. In cases like this the NIL_MAXG constraint will be active limiting wind farms and the interconnector and requiring other generators to increase generation. If the interconnector trips (or Northern/Pelican Point) both wind and gas can ramp up.