This week produced several noteworthy developments:

1) On the physical side, there was the record production levels from wind farms that we posted about on Wednesday, as did a number of others this week.

2) On the political side, Clive Palmer’s announcement appears to make it more likely that the carbon tax will be rescinded sooner, rather than later.

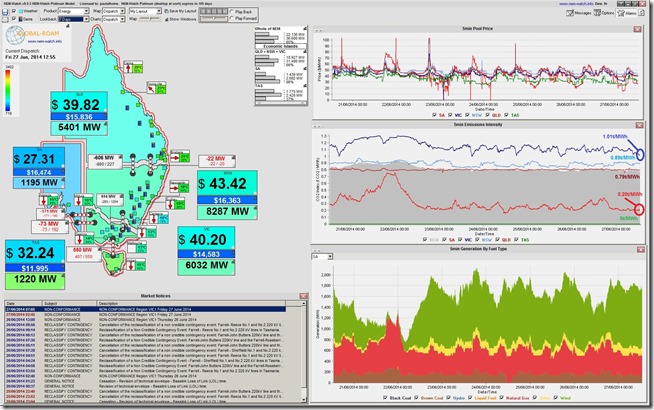

In this context, we noted today that the daytime spot prices in SA had dropped into the $20’s – something that we can’t recall seeing too often (see below) since the carbon tax was introduced a couple years ago. The following snapshot from NEM-Watch from this afternoon (12:55 dispatch interval) highlights such low prices in South Australia (with the SA dispatch price of $27.31/MWh being a dark blue, being down the bottom of the colour-range configured by this user).

The low prices today did raise questions in the office about how low the price might have been, had the carbon tax have already been rescinded.

(a) What the dispatch price might have been (sans carbon)?

The dispatch price for each region (or groups of regions) is set by the marginal generator in each region (i.e. not by the average of dispatched costs in the region) – and this is not known until the following day.

Even when bids are known for all generators, it’s not possible to be definitive about how these might have varied in the absence of that significant additional cost of production (for thermal plant). Bidding behaviour depends on other factors including, but not limited to, short-run marginal cost of production (i.e. where carbon factors). Other factors include long-run costs, amount of hedge cover, technical parameters, the extent of (transient, especially in an over-supplied market) market power, short-term and long-term commercial drivers, etc….

(b) What the cost of carbon was for each region?

It is possible to estimate, from the data shown above in NEM-Watch, the total cost of carbon paid collectively by generators in each region – and then (from this) to calculate a volume-weighted average effect of this carbon uplift for each region. It’s important to note, though, that this estimate should not be read as a indication of the carbon-exclusive spot price.

NEM-Watch provides live updates of estimated average emissions intensity by region – and, in the image above, we have highlighted the figures updated for the 12:55 dispatch interval shown above. With these we able to produce the following rough calculations, which can be used as a high-level guide, but which should not be assume to be perfectly accurate:

SA

TAS

VIC

NSW

QLD

Current spot $27.31

$32.24

$40.20

$43.42

$39.82

Approx effect of carbon 0.20 t/MWh x $24.15/tonne = $4.83/MWh

0 t/MWh x $24.15/tonne = $0/MWh

1.01 t/MWh x $24.15/tonne = $24.39/MWh

0.89 t/MWh x $24.15/tonne = $21.49/MWh

0.79 t/MWh x $24.15/tonne = $19.08/MWh

Indicative average carbon-exclusive cost $22.48/MWh

$32.24/MWh

$15.80/MWh

$21.93/MWh

$20.74/MWh

Note for South Australia there are not many thermal plants running currently (Northern at part load, Torrens – though barely, Pelican Point – again part load, and Osborne) – seen through our ez2view software (not shown here). Each of these will be incurring carbon costs – though, averaged over South Australia’s scheduled demand target shown in NEM-Watch, this equates to a small relative cost uplift (mainly because the wind is blowing so strongly).

The uplift on spot prices could be very different than this, as noted above….

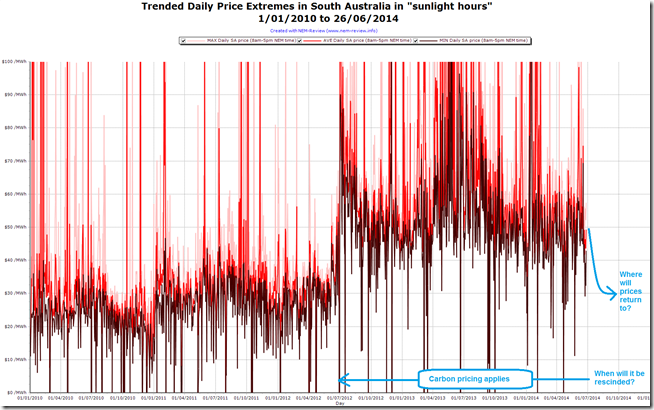

To answer our own question about how often the South Australian price had dropped below $30 (during daylight hours) over the past couple years, we ran a query in NEM-Review looking at the daily price extremes, and have suppressed the axis to look just between $0/MWh and $100/MWh:

In this chart, the period of the carbon pricing is an obvious excursion from the prior norm. Over this period we can see very few days where the trading (30-min) price has dropped below $30 – and even fewer instances of pricing in the $10-$30 range (whereas prices below $0 will have been caused – at least on some occasions – by more transient issues).

With the rescinding of the carbon tax looking more likely now, soon after 1st July (now only next week) we will be watching the colour-coded price boxes in NEM-Watch to see how soon they turn a deeper shade of blue… (especially if the wild winds continue).

Be the first to comment on "Windy week blows in change in Canberra"