An article recently in one of the main papers about increased flows down the Snowy River prompted the question, internally, about how much the La Nina pattern of the past 24 months had impacted on production volumes from the hydro facilities around the NEM.

Clearly, the La Nina weather pattern has been one of the contributing factors to the lower-than-expected demand across the NEM in recent times, with other contributing factors discussed here. We wondered how much hydro production volumes had increased, compared to previous years – and (if significant) how these increased production volumes would have also been a factor contributing to the low spot prices, and low volatility, experienced for a number of months.

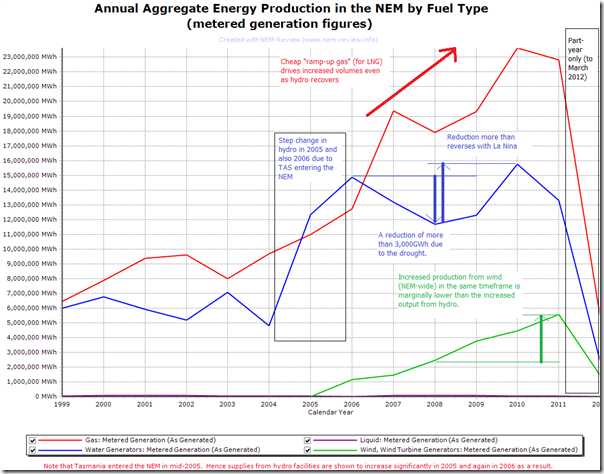

So we charged up our copies of NEM-Review 6 and generated the following trend:

In this view, we show the relative scale of production from the four lower-capacity factor sources (gas, hydro, wind and liquid fuels). Coal production is not shown, due to a difference in scale. Figures shown are aggregates across all regions for a particular fuel type.

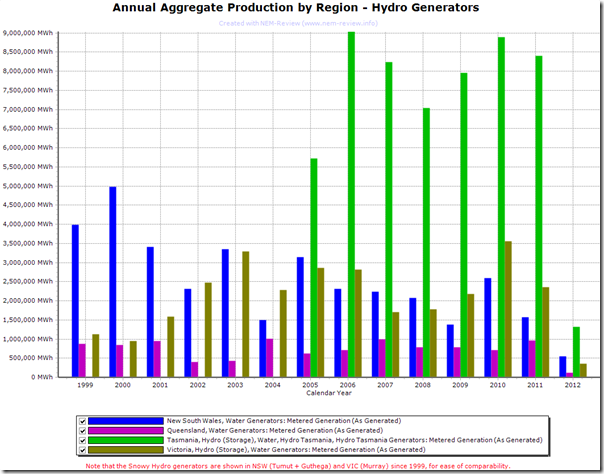

To see, more clearly, the increased output that La Nina has driven, we’ve focused specifically on hydro output for each region – and have drawn this chart:

As can be seen, the hydro generators in TAS provide the bulk of the power – and also contributed the bulk of the increase (from 2008 to 2010).

Some wind energy advocates have argued that it is wind that is driving down spot prices – they like to refer to the “merit order” effect. Paul would you like to comment on this?

Hi Martin,

Thanks for the comment.

When I have more time, I might post a bit more about this.

In the meantime, the simple answer is that everything that’s having an effect of either:

(a) reducing demand, or

(b) netting off any generation that bids above $0/MWh (i.e. thermal generation and other)

would be having some effect on lowering prices across the NEM.

My suspicion (without having looked at the numbers in detail) is that the volume of generation from wind is still too small to be having the most significant impact in this respect.

I suspect that any effect of wind might still be overshadowed by such greater impacts as:

1) Lower demand, which has been offset by a range of factors, including those linked to in the article above; and

2) The availability, for a couple years more, of cheap “ramp up gas” from coal seam gas fields in QLD, providing a cost incentive for open-cycle plant to run more heavily loaded than might “normally” be the case.

3) It’s possible (though I would need to check the data) that the higher production volumes from hydro, noted in this article, would be having more impact (because, through significant storage, hydro output can be targeted at times when prices might otherwise be high).

It’s my understanding that part of the enduring challenge with wind is that there is still a degree to which diversity patterns are not so great as to overcome the situation where localised wind patterns are independent of peak demand times, or peak price times. Interestingly, there’s some charts that surprised me for the UK here, showing less diversity than I had envisaged in that part of the world.

That said – through the remainder of the decade, as the increased MRET target continues to deliver more wind farms, the effect of wind on reducing peak prices will increase (all other things being equal).

However, if this was the sole objective of wind farm development, there’d be plenty of people who’d point out that there would be much cheaper ways of achieving the same goal – it would seem to represent a Pyrrhic victory, if done for just that reason.

Does this help?

Regards

Paul

Hi paul

we are studying the impact of the renewable wind and solar on WECC Western energy coordinating council and PJM e.g. the whole USA and N america. We see a big increas in CC generation and cycling to have 20-50% penetration of wind in the USA/ N america.

stay in touch

Thanks Steve

Your comment is not clear – are you saying that you’ve seen an increase in cycling of thermal plant attributable to increased penetration of wind & solar?

Paul

Thanks Paul for your response. It would be good if someone with your electricity market knowledge could write something on the effects of wind on electricity prices in Australia. A number of renewable energy advocates are pushing the line that wind is driving down wholesale prices. I would like to see an analysis from a less biased source.

Thanks Martin,

I have inferred from your comment that you do see us as a source of objective analysis and commentary. This is certainly what we strive to be.

I’ll add your suggestion to our list of “things to do”.

Regards

Paul