We’ve already written a couple articles about the lengthy unplanned partial outage of the Waratah BESS. Since those earlier articles, we’ve been continuing to wonder about a few things … hence this article today.

A two-year history

We’ve already published two tabulated records to some key events in the history of the Waratah BESS:

- On 7th November 2025, we’d published ‘An updated longer term trend (and tabulation) of operations at Waratah BESS’;

- Which updated and extended the record from 8th August 2025 in ‘‘Recapping operations at Waratah BESS (including enablement for SIPS) … to August 2025’.

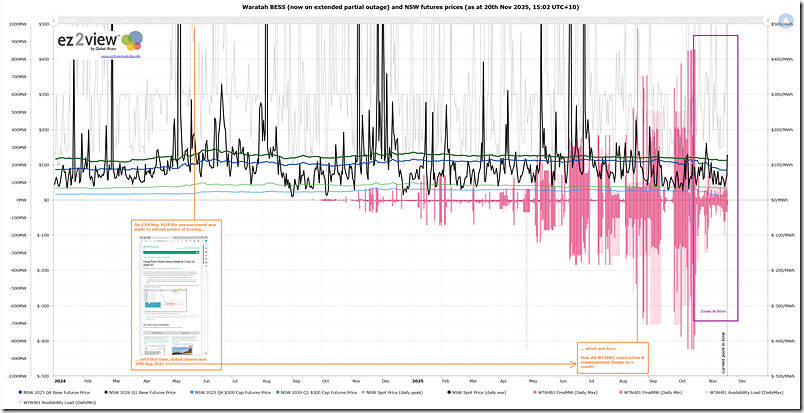

To augment those records, (during Thursday 20th November 2025) I utilised the ‘Trends Engine’ inside of ez2view to produce this updated trend stretching back ~2 years to the start of 2024:

The chart above is similar to that included in both of the articles highlighted above, with a few key additions:

- I’ve extended back to 1st January 2024 (i.e. almost 2 years before):

- Even though we see that predates any operations at the battery by ~8 months

- Because it’s probable that the 23rd May 2024 decision to extend operations of Eraring fed into some decisions made at Akaysha (and associated parties) in terms of the pace and timing of construction and commissioning of the battery

- i.e. I have vague recollections of reporting … but can’t remember where … about the ability to ‘take foot off accelerator’ and not push so hard to deliver in a compressed timeframe (especially given external challenges, like the collapse of Powin).

- if any reader can help us out by pointing to articles, please do in the comments below?

- I’ve also added in trends of prices for 4 x NSW-focused hedge contracts that might have been affected by the problems experienced onsite at Waratah:

- These were the following:

- For 2025 Q4 the Base Futures and Cap Contract end-of-day prices

- For the 2026 Q1 the Base Futures and Cap Contract end-of-day prices

- In general terms:

- we can see movements

- following the announcement of extension to Eraring (ironically upwards, not downwards)

- and also within 2025 Q4 balance of quarter (given prices have been more less volatile than might have been thought – at least to Thursday!)

- but it’s difficult to see any particular movement to the troubles at Waratah (at this helicopter level view).

- we can see movements

- These were the following:

A two-month recent history

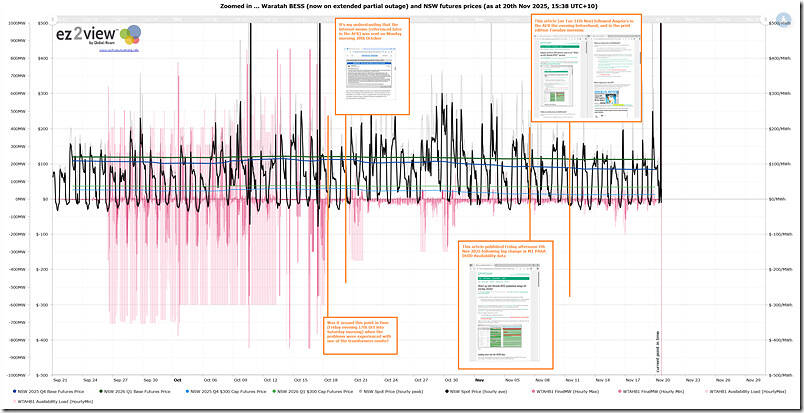

With this 2-year view in mind, let’s then zoom into the most immediate ~2 months:

To me, in (roughly) this time-range, there are a few time periods of particular interest (as follows):

- Time period 1 (during the stepped-up commissioning, up until the transformer issue)

- Time period 2 (the weekend of the transformer issue)

- Time period 3 (before my first article about the issue)

- Time period 4 (with more awareness dawning)

- Time period 5 (since that time).

In what follows, we’ll start to explore each of the above – with the intent being to leave some questions that we might come back to later (and/or some readers might be helpful in answering in the meantime) …

Time period 1 (26th Sept to Friday 17th October)

I don’t have time to explore now here today, but will just point readers to what was noted here in this second tabulated history.

Time period 2 (Friday 17th October to Monday 20th October)

For this article we’ll start at the weekend that’s of particular interest … which we now know (based on the internal Akaysha memo Angela surfaced in her 1st article) was ‘ground zero’ for the ‘catastrophic failure’.

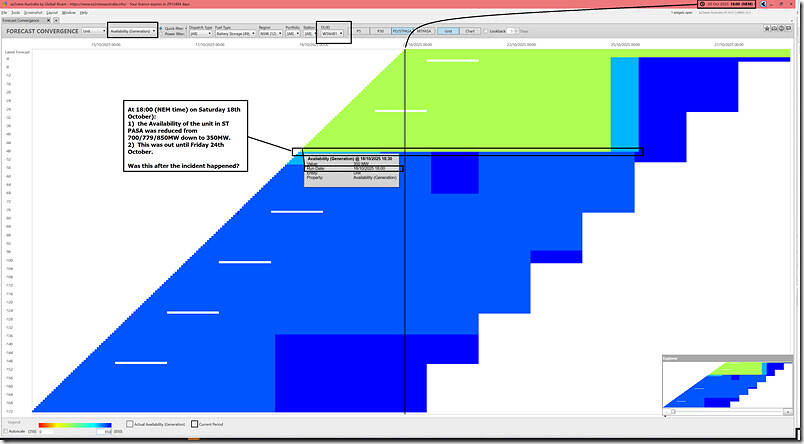

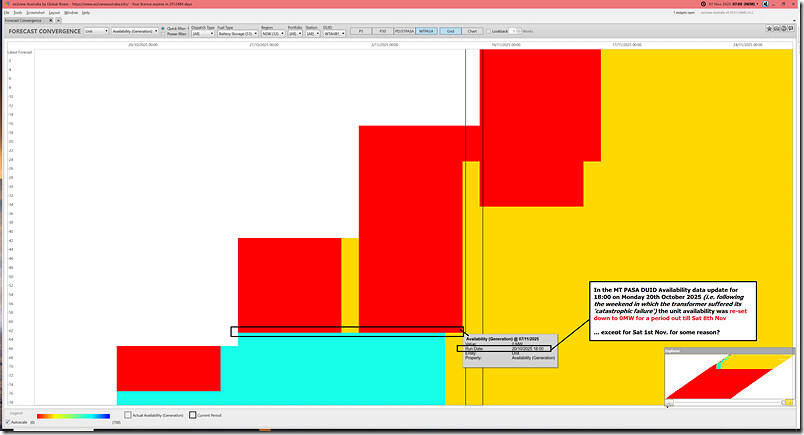

Let’s start by utilising ‘Time Travel’ in ez2view, we’ll start with the ‘Forecast Convergence’ widget focused on the (recent addition of unit-level) ST PASA data set:

1) I’m interested to see if we can narrow down when (in that weekend) the incident happened;

2) and what the organisation’s response was as a result.

We’ve set the ‘now’ point at 18:00 on Monday 20th October 2025 (which you’ll see is relevant to Time period 3 below), and this is what we see:

Remember that:

1) With this widget is designed such that one can ‘look up a vertical’ in order to ‘see that other dimension of time’

2) You can click on the image to open a larger-resolution view of the same.

Per the annotation:

1) At 18:00 (NEM time) on Saturday 18th October 2025:

(a) the Availability of the unit in ST PASA was reduced from 700/779/850MW down to 350MW.

(b) This was out until Friday 24th October.

2) Was this after the incident happened?

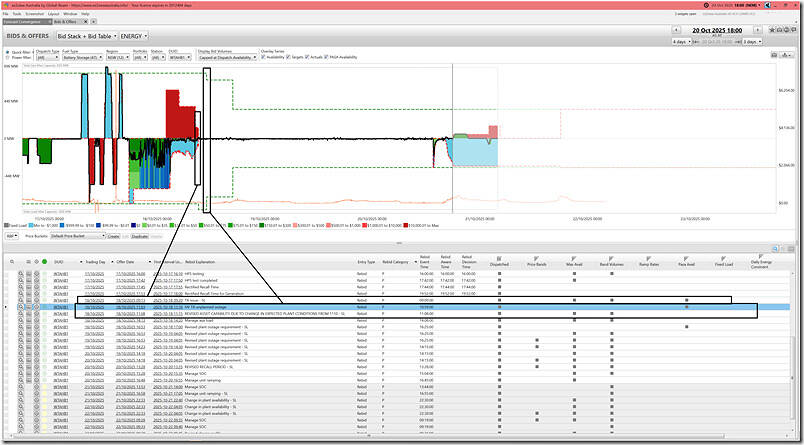

To take a step further we look at the ‘Bids & Offers’ widget in ez2view to try and cross-correlate this change on Saturday 18th October:

With respect to the above, note that:

1) On Saturday 8th November I’d posted this ‘… quick look at (plant-related) rebids for Waratah BESS to 19th October 2025 (during Hold Point 5 testing for full discharge)’ but, in that article, did not see any rebid reasons that particularly jumped out to me as particularly alarming:

(a) Rather, focusing on the (plant-related) rebids to do with hold point 5 testing that preceded the failure

(b) Part of the reason that I missed something big was …

i. (I am thinking now) that I did not really know where in time to look

ii. … given that it was only on 7th November that the lengthy outage appeared in the MT PASA DUID Availability data (so what turns out to be a few weeks after the actual trigger).

2) But now (with the benefit of hindsight … and is that not a wonderful thing!) I see three rebids on Saturday 18th October 2025 that speak to the transformer failure:

(a) These are highlighted on the image above.

(b) There was:

i. A rebid at 09:13 NEM time with a rebid reason ‘TX issue – SL’

… which we see now matches with a change in the output profile and volume in bid bands.

ii. And then, roughly 2 hours later (at 11:03 and 11:08) there were two rebids:

> the first saying ‘HV TX unplanned outage’; and

> the second saying ‘revised asset capability … etc’

So, all in all, perhaps we should have seen these as clues – especially when mixed with revised availability some days into the future in ST PASA?!

Time period 3 (Monday 20th October to Friday 7th November)

The period in between Monday 20th October and Friday 7th November 2025 (a period of ~3 weeks elapsed), I was certainly none the wiser about problems being experienced onsite at Waratah BESS … and I am curious:

1) how many others were unaware?

2) or, conversely (apart from those directly involved) was anyone aware … and, if so, how (e.g. through the clues we now see above)?

To clarify – whilst we’d seen output levels drop at the unit, we assumed that this was just related to the end of some commissioning work (e.g. hold point testing) and so did not think to look any further.

Utilising ‘Time Travel’ in ez2view, we’ll start with the ‘Forecast Convergence’ widget and a ‘zoomed in’ view of the MT PASA DUID Availability data to see changes in the data set for WTAHB1:

1) prior to 07:00 NEM time on Friday morning 7th November 2025

2) and ideally back to the Monday 20th October 2025 (i.e. after the weekend of the transformer failure):

As per the annotations:

1) We can see that there was a change in the MT PASA DUID Availability data update for 18:00 NEM time on Monday 20th October 2025

(a) Which is highlighted on the image (i.e. the difference between two horizontal stripes)

(b) This was the first day back after that fateful weekend

2) As noted on the Grid view, the Availability was dropped from 500MW to 0MW:

(a) extended out till Saturday 8th November 2025 (expected return to service)

(b) all except for Saturday 1st November 2025, for reasons unknown?

3) We can now deduce (again, hindsight!) that this could have been a response to the failure of the transformer.

———–

Now, readers might ask … why only* out 3 weeks into the future?

1) re (*) if it was such a ‘catastrophic failure’

2) To which my answer is:

(a) that this is reasonably common practice when some failure has ‘just’ happened, and the organisation is just getting their heads around the implications of what happened, why and repair time etc…

(b) in this case we see that (it appears) it took until Friday 7th November (i.e. 18 days after 20th October) for Akaysha Energy to understand the situation enough to update the MT PASA DUID Availability data with a more ‘realistic’ return to service expectation.

———–

In the image above we see that:

1) there were a couple later updates to the MT PASA DUID Availability data sets

(i.e. after 18:00 NEM time on Monday 20th October 2025 but before the big update at 12:00 NEM time on Friday 7th November 2025)

2) In these updates, we see the return to service date pushed back by another week.

So in hindsight we see that it was not quiet, on the information front from Akaysha (albeit nothing said here), prior to the major stir caused by the update we saw that kicked off time period 4…

Time period 4 (Friday 7th November to Tuesday 11th November)

It’s my understanding that the basic sequence of events over this period was as follows:

Step 1 = an update was made to MT PASA DUID Availability :

(a) in the data update for 12:00 NEM time on Friday afternoon (7th November 2025).

(b) to extend the period of the Availability = 0MW out until 3rd May 2026.

Step 2 = this made us stand to attention:

(a) as a result of which we wrote ‘What’s up with Waratah BESS (unplanned outage till 3rd May 2026)?’ on Friday afternoon (7th November 2025).

(b) and proceeded to ask some questions of people we knew

(c) along with posting 4 more articles over the weekend:

i. An updated longer term trend (and tabulation) of operations at Waratah BESS

Step 3 = it seems that Angela MacDonald-Smith in the AFR also became curious, because (following her own investigations over the weekend):

(a) on Monday evening 10th November 2025 published online the article ‘‘Catastrophic’ failure delays massive $1b Waratah super battery’;

(b) which made front page of the print version on Tuesday 11th November 2025.

Step 4 = It was Angela’s article that really set the snowball rolling…

(a) Notably with this ‘Update regarding the Waratah Super Battery’ from Akaysha on Tuesday 11th November 2025

(b) And also with our 6th article ‘Angela’s article in AFR answers some of our “What’s up with Waratah BESS?” question’ in the series.

(c) With plenty of other coverage in the snowball – with special note going to:

i. The article ‘‘Catastrophic failure’ at Waratah Super Battery in Australia’ published by PV Magazine Energy Storage in Europe spoke to the international attention being attracted (and a nice reference to the earlier WattClarity article!).

ii. Giles Parkinson’s article ‘Waratah Super Battery to take another revenue haircut as transformer failure causes more delays’ worth highlighting, given the considerations of a drop in revenue (at Akaysha).

iii. Colin Packham’s article ‘NSW’s $1bn Waratah Super Battery faces a year-long delay after major fault’ is worth highlighting given questions about the possible impact on power prices.

… albeit the futures prices shown in the charts above reveal that any impact is difficult to ascertain.

iv. Angela’s second article ‘Waratah super battery ‘failure’ reveals cracks in $1b contract award’ was one of a few who raised questions about the contract award process.

Time period 5 (Tuesday 11th November to now)

Another ~2 weeks have elapsed since the above.

I don’t have time to delve further on what’s happened since that time, but will hope to return to this topic in the coming weeks…

So that’s where we’ll leave this addition to the series.

It’s been useful for us to go back and review what was visible through this process (and we may well have missed things – please feel free to inform us of that!), and we hope it was useful to you.

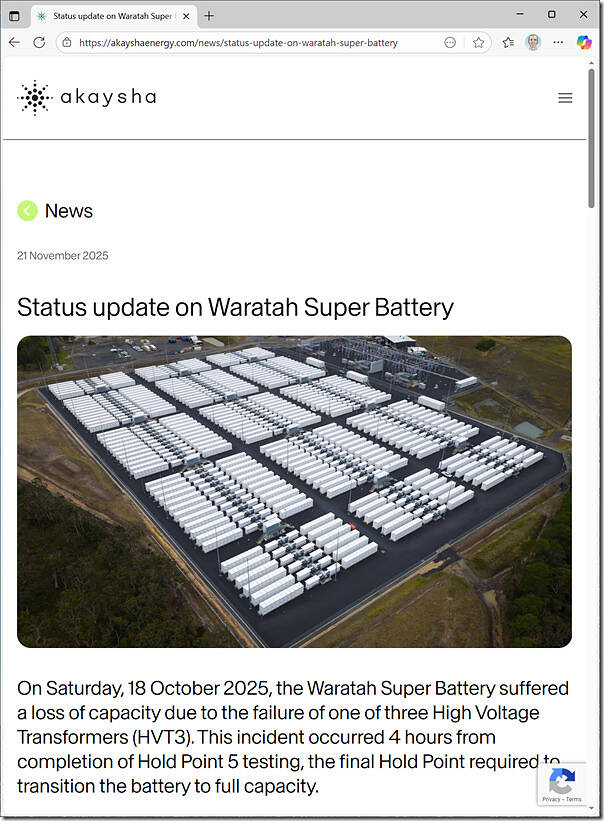

PS1 … coincident ‘Status update on Waratah Super Battery’ from Akaysha Energy

This article was first published at 13:34 (NEM time) on Friday 21st November 2025.

At that time, I let a few people at Akaysha Energy know of its existence – at least in part so they might flag any errors or omissions. Uncanny timing, it seems, because the company has now published this ‘Status update on Waratah Super Battery’ at ~14:30 (NEM time):

This update contains a number of useful pieces of information, of which I’d like to flag two:

About the failure and root cause analysis

The company notes:

‘The two affected transformers are undergoing detailed engineering assessments and investigations as part of the Root Cause Analysis. This is a complex, multi-stage process involving physical inspection, testing and analysis.

HVT3: We are unable to provide further details on the transformer failure until this analysis has concluded, and a determination is made, which may take several weeks or months.

HVT2: Remains de-energised whilst it undergoes testing.

HVT1: Has remained fully operational throughout.’

… and providing an explanation (earlier noted with respect to the AER’s PASA Compliance Bulletin and Checklist) about why the unit appears as 0MW available in MT PASA DUID Availability, and 350MW available in ST PASA.

About the (separate) upcoming (full) planned outage

The company also notes:

‘The Waratah Super Battery is scheduled to have a balance of plant shutdown from 20 November 2025 to 2 December 2025. This planned shutdown is part of routine maintenance and has been coordinated with AEMO and Transgrid for several months. During this time, the SIPS service will be unavailable, which was always anticipated by Transgrid, AEMO and EnergyCo.’

Renew Economy wrote on 4th August 2025:

“The original timeline for the project was for it to be delivered in full by May, although that timeline was allowed to slip after the decision by the NSW to underwrite a two-year extension to the Eraring coal generator, that is now expected to close in 2027, although it may stay open longer.”

https://reneweconomy.com.au/australias-most-powerful-battery-is-now-officially-operating-as-the-grids-biggest-shock-absorber/

More on the slow-down is here:

https://reneweconomy.com.au/australias-most-powerful-battery-charged-up-quickly-and-helped-keep-lights-on-but-progress-has-slowed/

The original GHD phasing of 2023:

https://majorprojects.planningportal.nsw.gov.au/prweb/PRRestService/mp/01/getContent?AttachRef=SSI-48492458%2120230220T015054.349%20GMT