Editor’s Note: Jonathon has adapted this article from a presentation he gave at the Australian Wind Industry Forum in Melbourne on Tuesday, 6th May 2025. In this article, Jonathon summarises the current price signals and curtailment challenges faced by wind projects, and shares key lessons learned from working with developers and owner-operators over the past decade.

It was great to speak at the CEC’s Australian Wind Industry Forum on Tuesday, discussing revenue opportunities with the other speakers. Having a focus for the last 10 years between the ‘Pre-FID’ and ‘Commissioning/Operations’ stages of the project life cycle, GVSC brings a unique and useful perspective that has been valued by both developers and owner-operators.

Added capacity, price signals, and curtailment

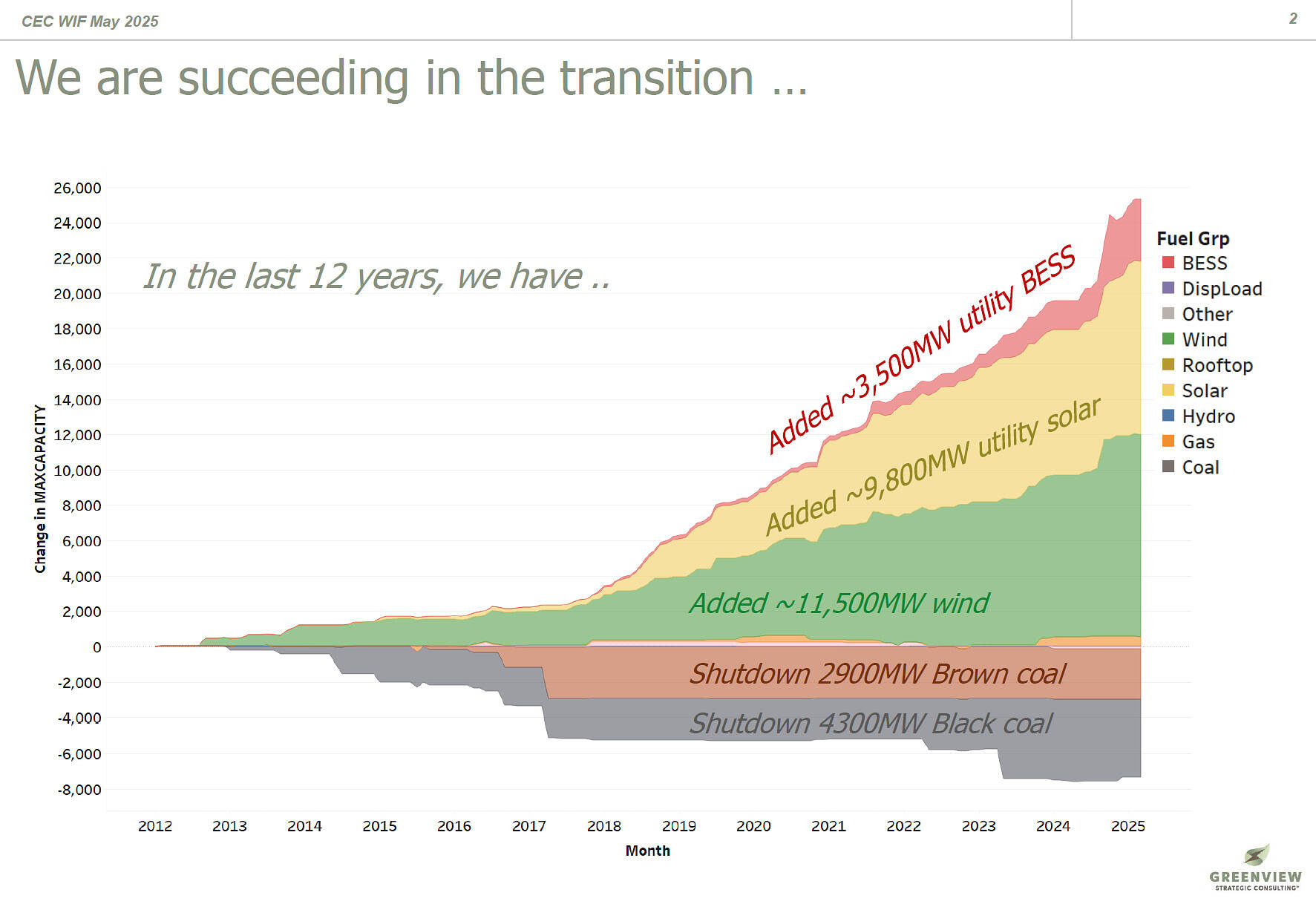

We have certainly been adding lots more utility-scale wind and solar over the last 12 years, with the last 8 years also including additional BESS. Of course, there is more rooftop PV (~24GW) and CER BESS (who really knows how many MW?) that could be added to this chart, but we think it shows the key trend.

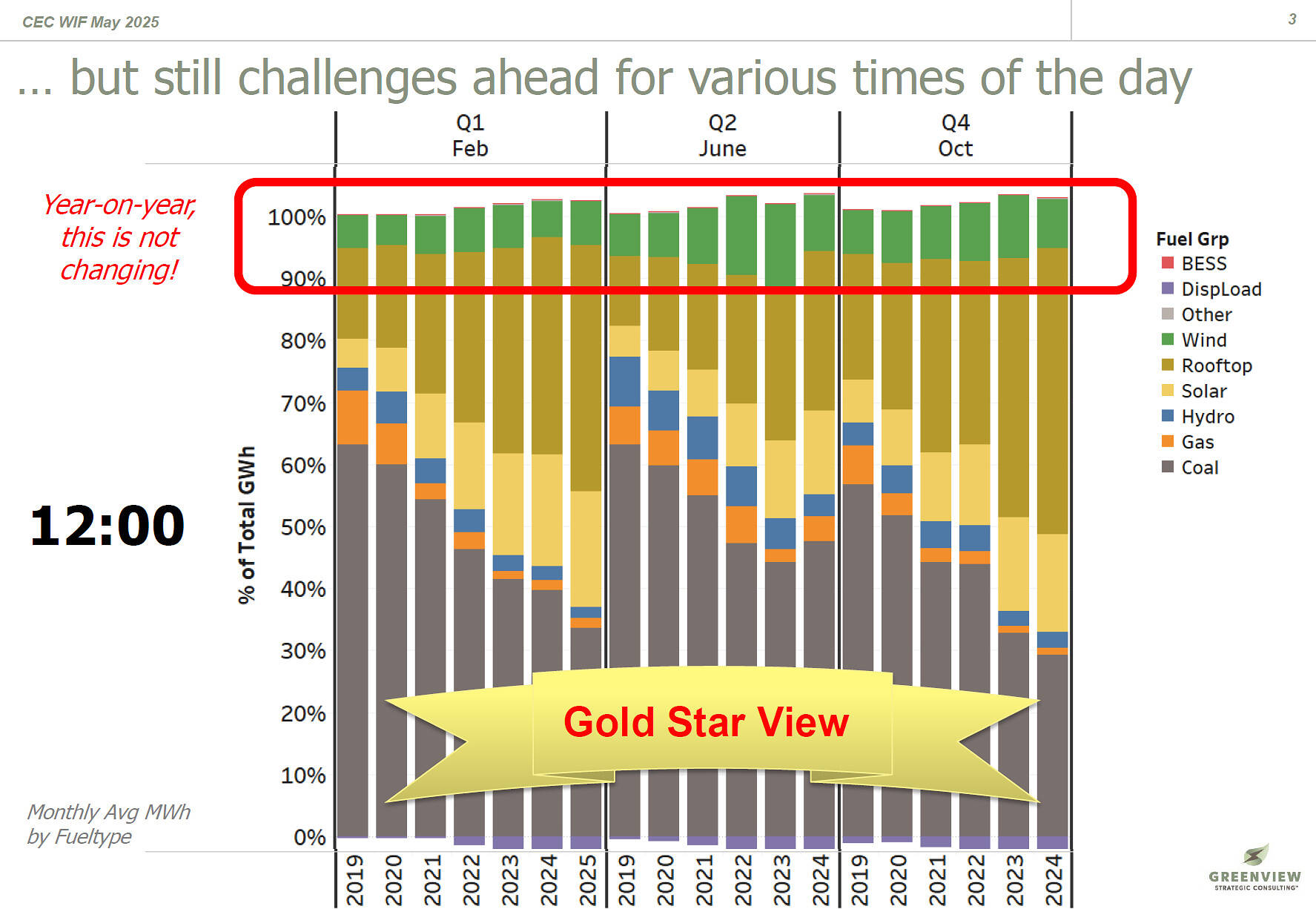

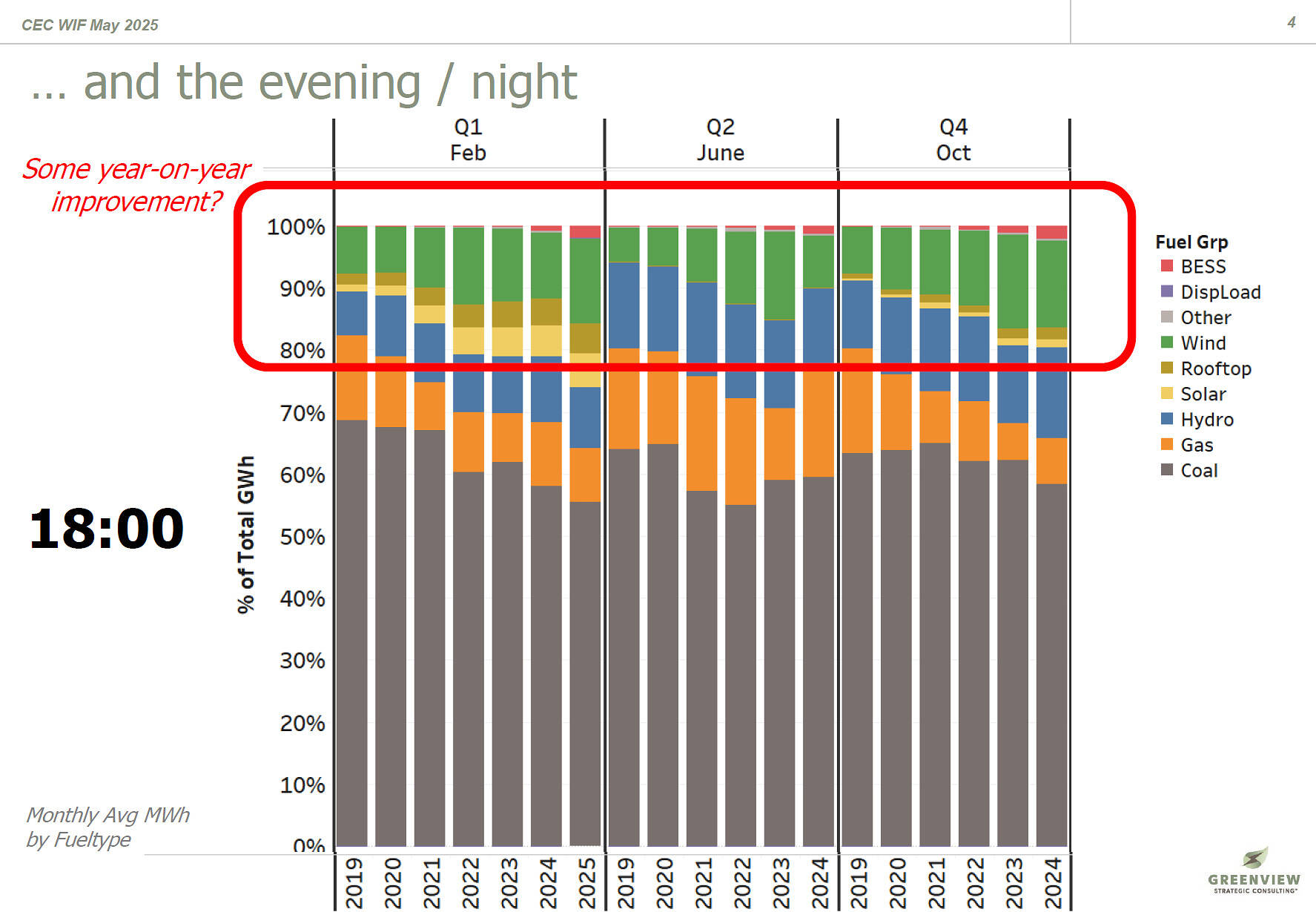

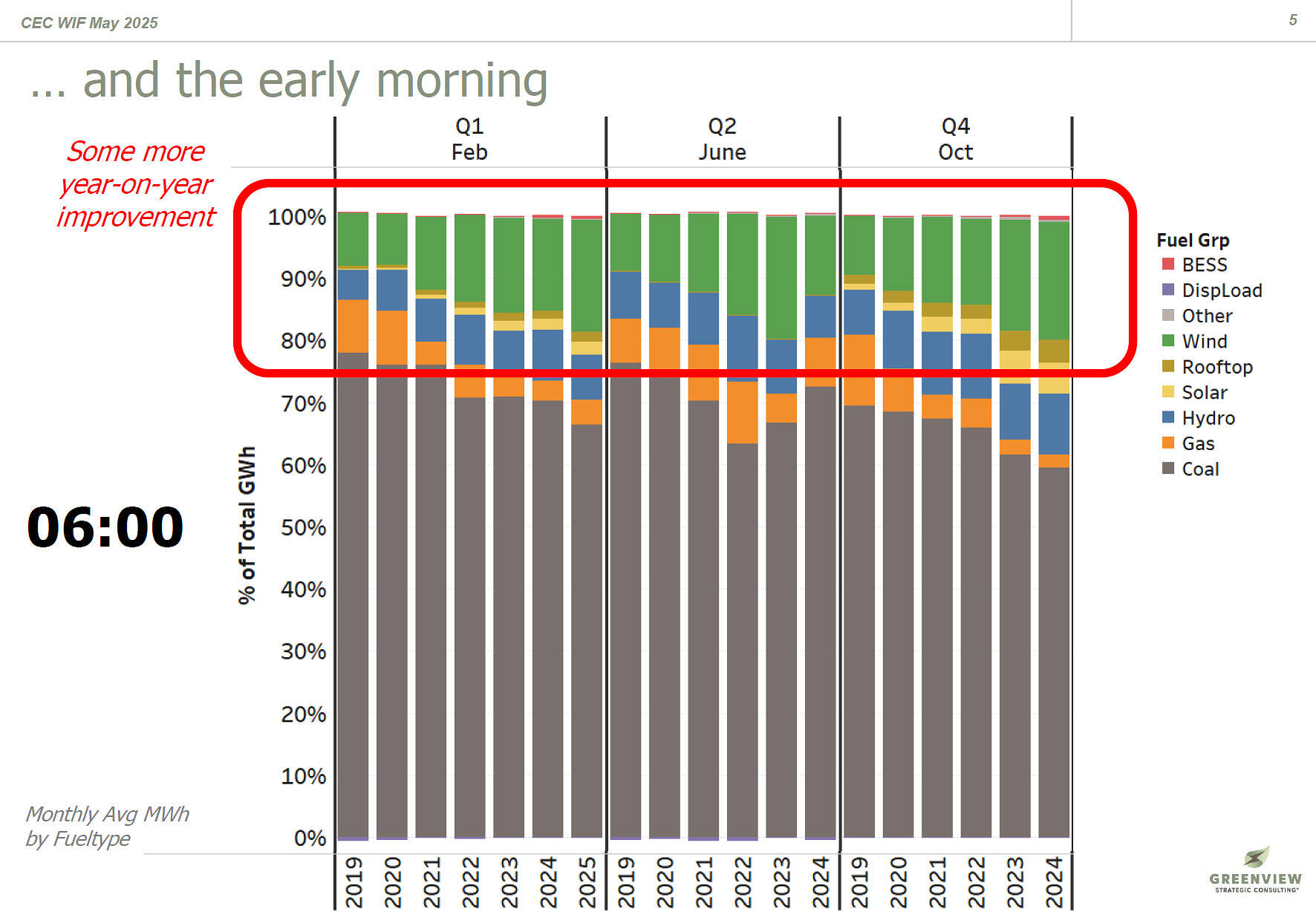

However, with the growth of the rooftop and utility-scale solar in the past 5 years, we can see that the penetration of wind generation has not moved much, particularly at 12:00 pm during the day – the solar is curtailing the wind (and hydro). Similarly, if we look through 18:00 and 06:00, while we see some increases in the penetration of wind, the average monthly amount is not more than 15-16% in any of the given months, and only when rooftop solar is not dominating the generation stack.

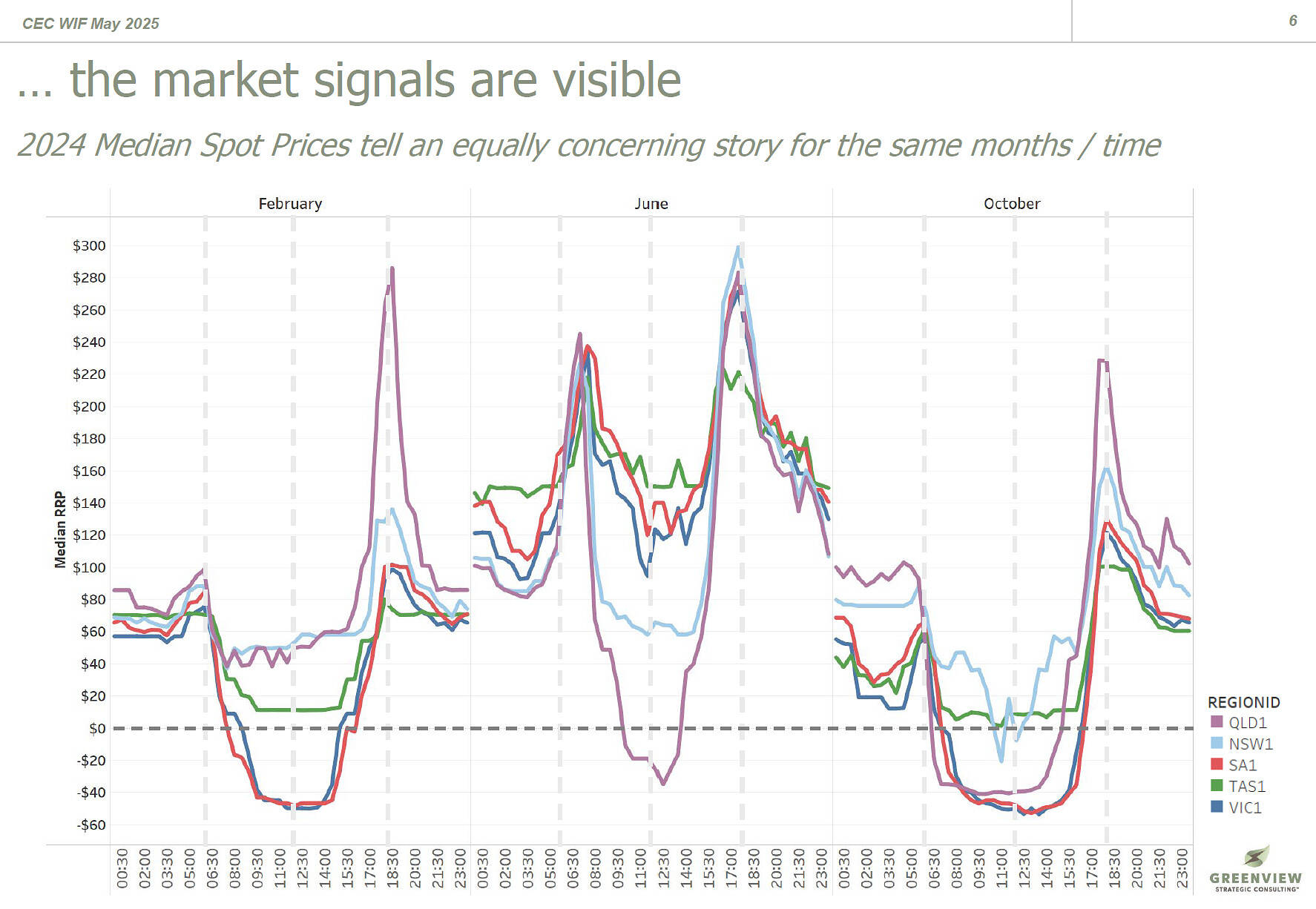

The price signals that the market is out-turning are also showing us when the generation is required (and when it is not), which is again outside the high rooftop PV periods. The chart below shows the median regional price for each of the regions.

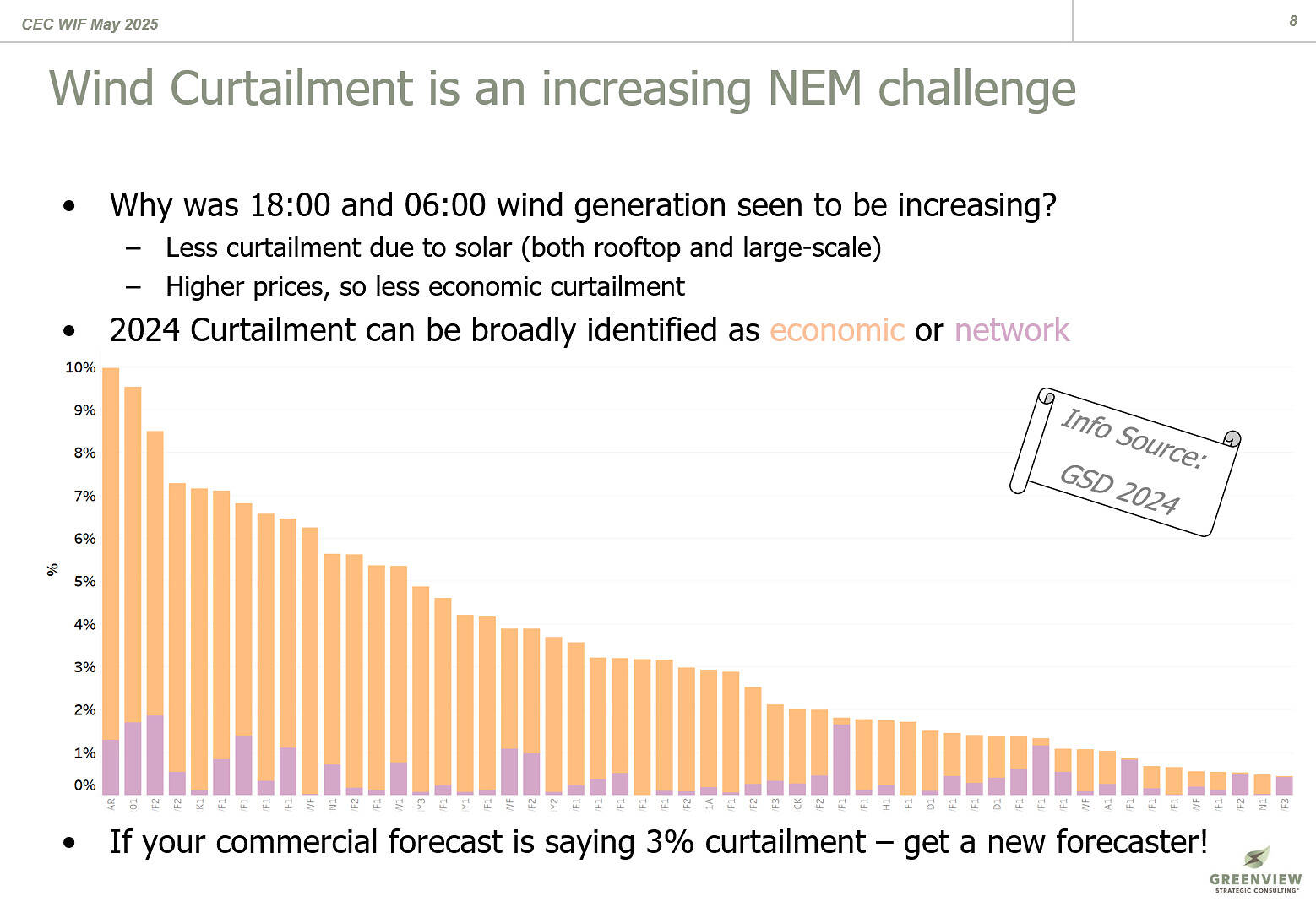

The above prices and competing generation is leading to significant curtailment of wind (and even more so for utility-scale solar), that has been trending up in recent years for many sites, as highlighted previously on WattClarity. In the below chart, we can see the curtailment of some NEM wind farms (names hidden to protect the innocent!), with the colours showing curtailment by network and economic reasons. To understand that sites are now annually facing curtailment at these levels, the standard commercial forecaster showing ‘3% curtailment’ under system normal conditions cannot be continued. Most wind (and even more so for solar) are facing many hours a day under semi-dispatch caps, as the ever-expanding network continues to operate and expand, often with outages occurring 6-7 days a week when considering the entire network.

So, how to solidify your business case?

There are two different parts of the life cycle where things can be done:

Solidify your ‘Pre-FID’ Revenue Case

- You are a power station first!

- Voltage and reactive power matter … work in solid areas of the grid.

- Ensure the right equipment (and configuration) for the current and future operating regimes.

- PPA’s are important, but not all PPA’s are created equally!

- Land is important, but the wrong location will lose more money in the long term and choose wisely, as it’s not just the $/m2 of the land.

- MLF and transmission connections remain critical issues.

- ‘System normal’ includes network outages ‘6-7 days a week’ now .. make sure your forecasters allow for reality.

- ‘Optimised for Revenue Operations’ is different from ‘Minimise Cost to Install’

- Is your physical setup consistent with your commercial setup?

- What constraints will appear as you connect and into the future?

- When constrained, what is the nature of the constraint (economic or network)?

- If network constrained, what sort of constraint is it likely to be (voltage, transient, oscillatory stability, system strength) — your remediation options will be different!

- Hybridisation, FCAS and other ‘System-security services’ must be assessed

- Plan for 15-25% curtailment going forward (remember it is 5-10% now and the pipeline is continuing to increase!)

- When there is curtailment, what else can we do (ie store the energy, do FCAS, etc.)

Once you are operating… the hard work begins!

- Once your project is operating:

- The operational team needs to know what they are doing, either on-site/remotely, and at your HQ. Training and education for site teams is an increasing requirement we have seen in recent years.

- Get an experienced trading operations team around you who monitor 288 dispatch intervals each day. This is where you can maximise your revenue once operating.

- There is no such thing as set and forget, for BESS, Wind or Solar as James Tetlow rightly pointed out last year! Do not let anyone tell you it can all be automated or subcontracted away. You need to have reasonable OPEX for operational expectations.

- Get a good self-forecasting tool (check out this recent article from WattClarity for further information), and

- For some sites (depending on financial arrangements), an auto-bidder may be useful and/or required, but it still needs supervision (and the AER states as much!).

- Setup and continuously monitor your Generator Compliance Management Plan

- It is more than just GPS testing every 3 years (like some would have you believe)!

- This is where we continuously refine your operation to the changing network around your site. Remember, there can be 2-3 connections a month now!

About our Guest Author

|

Jonathon Dyson has nearly 20 years of practical experience in the Australian NEM, having held senior operational and trading roles in participant organisations and now as the Director of a specialist market consulting organisation, with a specific focus on renewable energy integration. Current clients include some of Australia’s largest integrated utilities, market regulatory organisations, transmission system operators and not-for-profit market observers. Jonathon has spent considerable time working with AEMO, Australia’s energy market operator.

As a former member of the NEM’s Dispatch and Pricing Reference group, Jonathon’s intricate knowledge of power system dispatch and security, coupled with practical, on-site experience with power system operations across all forms of electricity generation, allows him to bring operational and energy trading realities to strategically significant policy discussions. Jonathon has degrees in Engineering and Management, and is a member of the Australian Institute of Company Directors, CIGRE and IEEE You can find Jonathon on LinkedIn here. |

Leave a comment