As noted in yesterday evening’s article (about one big ‘wrinkle’), I was off to the Brisbane session of the Nelson Review today.

Two slides we might refer back to later

Without much explanation (at least at this point) I’m going to drop in two slides that particularly jumped out to me – starting with these ‘top 10 themes’:

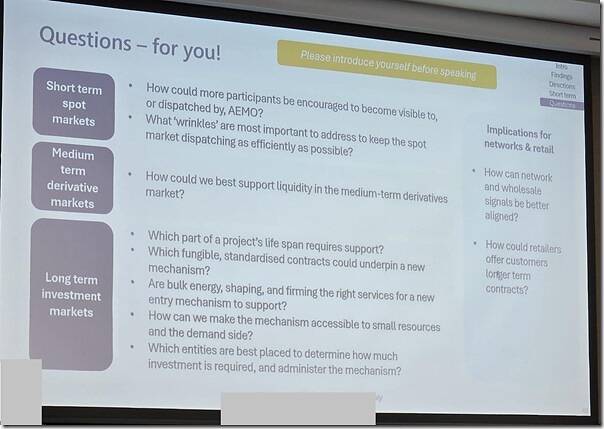

Second was this ‘Questions for you’ slide:

Note that the ‘wrinkle’ I mentioned yesterday evening is not just about ‘keeping the spot market dispatching as efficiently as possible’. In my view:

- It’s about keeping the lights on; and

- It also feeds into capability development, which would assist in the medium and long term, as well…

I understand that article has stimulated some discussions elsewhere. More to come later on that theme …

Other quick points

One of the Panel members, Phil Hirschhorn (who I’d spoken with earlier this month at the EUAA conference):

1) referenced yesterday evening’s volatility, and how he made $40 on the side from automated triggering of his household battery as an example of some invisible price response (i.e. one of the ‘missing’ market participants noted as #4 above).

2) I wonder how he went in the volatility this evening?

Margi Johnson from the Australian Aluminium Council was also there, and shared a snippet here on LinkedIn.

For those who’ve not been along to any of these in-person sessions, there is an online one next Tuesday with registration details now linked into Dan Lee’s article here about the publication of submissions, and the forums.

Leave a comment