I was recently talking to the management team of a data centre business and was interested to hear that they pass through energy costs to their customers. I thought this was particularly interesting given that they are part of a growing load globally due to the significant growth in internet traffic, crypto-currency mining and the use of Artificial Intelligence, and because there has been much attention in the media about data centres contracting with both renewable and nuclear power sources.

In the Australian energy context, especially in the National Electricity Market (NEM), data centres have been and will continue to be a desirable load to manage for energy retailers for two key reasons:

- They usually have a very flat load, so it is easier to hedge and offer competitive energy prices.

- There is additional value in utilising the uninterruptible power supply and back-up generation for market participation for high energy prices and ancillary services.

Also, as the portfolio of data centres becomes large enough for some businesses, it may be worth consideration of being an energy market participant, where they are directly involved with the energy market. Potentially, they may then sell different energy products to their customers as part of their data services if they have a licence to do so. I thought if worth exploring some potential scenarios so we could examine the potential complexities of managing such a business. Firstly, we need to understand the nature of renewable energy and carbon emissions.

Understanding Renewable Energy

Without delving into extensive detail, in Australia, at present, eligible renewable generators such as wind, solar, new hydro and others can create renewable energy certificates for each MWh of renewable generation under the Renewable Energy Target[1] which was established in 2001 and runs until 2030. Since 2020, the annual mandatory component has peaked and stayed at 33,000 GWh for the large sale scheme (excluding rooftop solar), roughly equivalent to around 20% of annual electricity consumption, for which retailers and most large energy users must acquit certificates equivalent to roughly 20% each year (or specifically the Renewable Power Percentage[2]). Liable entities can also choose to voluntarily surrender more certificates above that level to achieve greater levels of renewable energy use in the mix. Apart from earlier times when some Renewable Energy Certificates (REC) which were created from timber waste that may have included old growth forest, all REC’s are usually valued the same regardless of the technology or year of creation.

From 2030, it is proposed to grandfather the renewable energy scheme, without mandated levels but to support those who wish to surrender REC’s to support sustainability goals. This program is likely to be called a Renewable Energy Guarantee of Origin (REGO)[3] scheme and may include other proposed changes such as:

- Inclusion of existing hydro power stations built before 2000 such as the Snowy Scheme, Hydro Tasmania etc.

- Potentially time stamping of REC’s by half-hour and day

Time Stamping

Time stamping of renewable generation may potentially allow businesses to match their consumption against renewable generation and may also be important if green hydrogen projects need confirmation of green energy matched to their hydrogen creation. It’s an issue that European electricity markets[4] are considering and businesses such as Google[5] have committed to 24/7 carbon free matching by 2030 and Microsoft has inked a 20-year deal with the owner of the Three Mile Island nuclear power station to supply carbon free energy for its data centres.[6] Formal frameworks around time stamping are still being developed which are expected to consider how renewable generation can be stored in energy storage and used when required, whilst dealing with the challenges of measurement and verification. It’s a complex issue, beyond the scope of this short article but I suggest you look at another Watt Clarity article by my industry colleague, Tom Geiser[7] who identifies a few of the challenges that it presents.

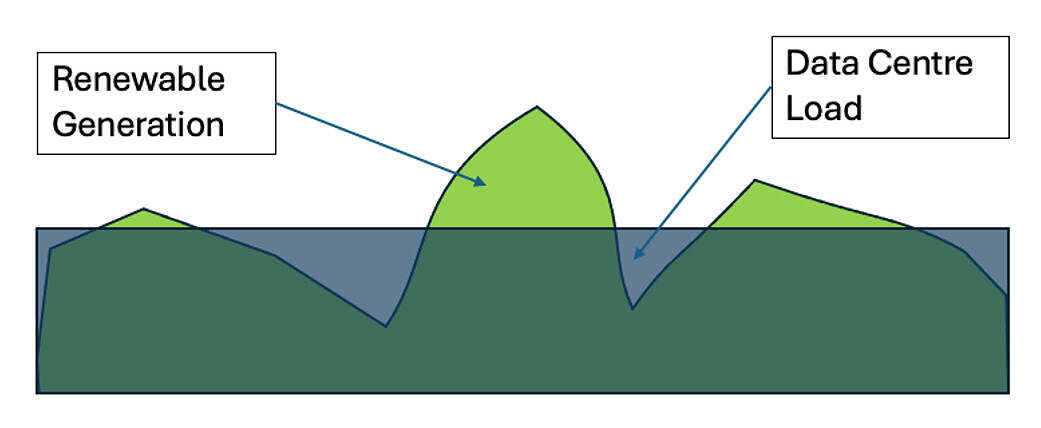

Some companies managing data centres already source renewable energy, such as Amazon which achieved its 2030 goal of 100% renewable energy sourcing in 2023[8]. This means that they purchase REC’s or other credits equivalent to their electricity consumption but there is almost always a mismatch between consumption and when renewable electricity is generated. An illustration of how the energy totals match but not necessarily the power in each period is shown in figure 1. At present there is no formal procedure or standard for time matching renewable energy to load in Australia, so verification may require an independent audit.

Figure 1 – Representation of renewable generation 100% energy matched to load

Carbon Emissions

Businesses are usually responsible for carbon dioxide emissions or their equivalent (i.e. other greenhouse gases such as methane, which are given relative multipliers against CO2) are known simply as carbon emissions. Some of these can be reduced or even avoided by changes in business activities but unavoidable emissions may be offset by the purchase of credits generated by activities of third parties which remove or reduce carbon emissions. Again, I won’t delve into all the complexity here of carbon emissions and credits except to highlight that there are many potential sources of carbon credits available globally of varying sources and reliability but the main carbon credits available in Australia are Australian Carbon Credit Units[9] (ACCU) created mainly by reforestation, land use changes and energy efficiency.

When considering net zero goals, it is not usually sufficient to simply source renewable energy as some renewable sources still have carbon emissions and activities outside electricity use contribute to emissions. For a business identifying its carbon emissions it is important to understand what businesses are responsible for and how these are categorised. The following table briefly describes the different emissions categories.

| Category | Definition |

| Scope 1 | Emissions from where a business has direct control such as burning fuel in its operations |

| Scope 2 | Indirect emissions such as the consumption of electricity sourced from fossil fuelled generation |

| Scope 3 | All those not in scope 1 or 2, created in a company’s value chain supplied by a 3rd party |

Many businesses can reduce scope 1 emissions and to a lesser extent scope 2 emissions as there is often measurable data for them to assess these emissions, perhaps change some business practices such as fuel sources or materials used in their business activities. Scope 3 emissions are often harder to assess due to the complexity and opacity of identifying emissions from a third-party supplier.

Data Centre Energy Offers

Businesses that have their own ESG (Environmental, Social and Governance) ambitions may choose to have data centre contracts where the energy component is supplied by renewable energy, time-matched energy or possibly a net zero solution. Also, the data centre owner would need to consider how they price the underlying energy; as a fixed price, market exposed or a combination of both. To explore the potential offerings, both now and from 2030, I’ve summarised the products that a data centre may potentially offer and the high-level details behind each.

| Energy Offering | Present -2030 | 2030 onwards |

| Energy only | – Energy (either fixed or market exposed)

– REC’s to meet RPP (~20%) |

– Energy (either fixed or market exposed)

– No renewable certificates |

| Green Energy sourced | – Energy (either fixed or market exposed)

– REC’s (LGC’s) surrendered to meet renewable share (i.e. >20% up to 100%)

|

– Energy (either fixed or market exposed

– Surrender of REGO’s (consideration of source such as wind, solar, “old” hydro) with no preference for time |

| Green Energy time-matched | – Not presently readily verifiable | – Energy (either fixed or market exposed

– Surrender of REGO’s (consideration of source such as wind, solar, “old” hydro) time matched – Will require time matched energy storage eligible under REGO

|

| Green Energy sourced and net-zero | – Energy (either fixed or market exposed)

– REC’s (LGC’s) surrendered to meet 100% renewable 100% – Participation in a scheme such as the Australian government supported Climate Active[10] – Consideration of complex climate accounting i.e. LGC’s can only be claimed under a market-based methodology not location-based for Climate Active

|

– Energy (either fixed or market exposed)

– Surrender of REGO’s (consideration of source such as wind, solar, “old” hydro) with no preference for time – Consideration of complex climate accounting methodologies

|

Table 1 – Sample of potential energy offerings to data centre clients

Network Charges

Another consideration in passing through energy costs to customers is network costs. Distribution networks charge users daily standing charges, energy throughput (usually in peak, shoulder and off-peak times) and in some case, peak demand charges. Most data centres are connected to the distribution network, but some may be connected to the transmission network, which has a similar charging scheme but with more emphasis on peak demand contribution. Passing through these charges to customers would require the data centre to develop a methodology to apply these costs by calculating a customer’s share of these charges.

Solar Power

Rooftop photovoltaics are an on-site generation source that may reduce local consumption for a data centre and possibly export energy. It would be anticipated that any system be a least 100kW to be eligible for LGC’s and because most data centres would use far more than 100kW. Small scale certificates (STC’s) from solar under the renewable energy target cannot be used for renewable energy claims or Greenpower accreditation.

Self-consumption of solar would not generate renewable energy certificates but it is a zero emissions source of power and may potentially reduce network charges for a data centre. Exports can create additional REC’s but these may produce at times of low energy market prices making it financially less attractive.

Conclusion

Data centres are experiencing growing demand in Australia as businesses and government have more need for their services and because international security concerns drive the need for these services to be procured locally. Sustainability and net zero aims of their clients may create demand for more bespoke products from data centres that manage their own energy portfolio. Moving forward, managing both energy and emissions goals for a data centre in Australia and its clients is going to become far more complex.

[1] https://cer.gov.au/schemes/renewable-energy-target

[2] https://cer.gov.au/schemes/renewable-energy-target/renewable-energy-target-liability-and-exemptions/renewable-power-percentage

[3] https://storage.googleapis.com/files-au-climate/climate-au/p/prj291cc9979281a4ffc59d8/public_assets/Guarantee%20of%20Origin%20Scheme%20design%20paper.pdf

[4] https://www.nordpoolgroup.com/49b69a/globalassets/download-center/whitepaper/whitepaper-may-2023.pdf

[5] https://www.google.com/about/datacenters/cleanenergy/

[6] https://www.theguardian.com/environment/2024/sep/20/three-mile-island-nuclear-plant-reopen-microsoft

[7] https://wattclarity.com.au/articles/2023/04/timestamping-renewable-energy-certificates-is-a-bad-idea/

[8] https://www.aboutamazon.com.au/news/sustainability/amazon-meets-100-renewable-energy-goal-seven-years-early

[9] https://cer.gov.au/schemes/australian-carbon-credit-unit-scheme/australian-carbon-credit-units

[10] https://www.climateactive.org.au/sites/default/files/2023-08/Climate-Active-Electricity-Accounting%20-%20PDF.pdf

Leave a comment