Over the past couple days, we’ve posted a number of article – including these three that have resonated externally for various reasons, and which we’ll reference further in this article:

Article #1) On Sunday afternoon we posted ‘‘Minimum Demand’ point for NSW drops 226MW from last year’s low point (on Sunday 1st September 2024)’

Article #2) On Monday morning we posted ‘High wind yield in recent days … but *not* a new all-time record’.

In that article we’d noted the cyclic nature of wind farm production in recent days and pondered the extent to which it was related to any a number of factors, including:

Factor #1) Economic curtailment during peak daylight (i.e. rooftop PV yield) hours;

Factor #2) Network curtailment;

Factor #3) Possible high-speed wind cut-out on wind farms;

Factor #4) We wondered whether (perhaps) the wind actually dropped (but later in the article, using the ‘Forecast Convergence’ we showed the underlying UIGF and ruled this option out as a possible factor)?

Article #3) Also Monday morning, we posted ‘Curtailment of Solar Resource from (Semi-Scheduled) Large Solar across the NEM reaches 79.2% on Sunday 1st September 2024’.

Following from which we’d also referenced this article:

(a) In this update on LinkedIn … but note it was referenced in plenty of other places as well.

(b) In several updates on Twitter including this one

In addition to the social media buzz about Article #3 yesterday afternoon we saw Angela MacDonald-Smith had written ‘Wild winds blow up solar farm profits’, referencing some of the content in that article – and the other market outcomes mentioned in Article #1 and Article #2 as well.

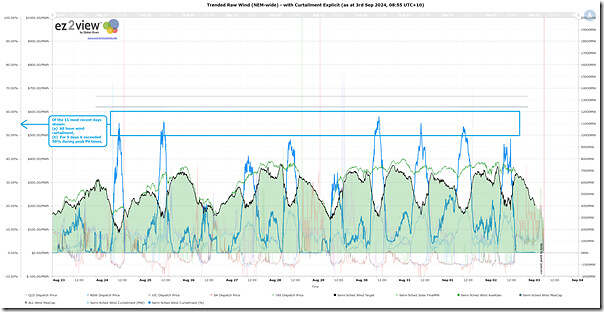

In writing her article, Angela asked me about the extent to which there had also been wind curtailment, but I did not have time to give a detailed answer until this companion article this morning, via a similar trend from ez2view (except not Large Solar, but instead all the Semi-Scheduled Wind Farms across the NEM):

In reading the chart above, remember Marcelle’s very relevant note of caution that ‘Not as simple as it appears – estimating curtailment of renewable generation’. We see that:

1) This shows the most recent 11 days completely (i.e. from Friday 23rd August 2024 through until Monday 2nd September 2024), and into this morning (but not yet with ‘Next Day Public’ data);

2) Across all 11 days (in the blue line) we can see a trend of the instantaneous curtailment of the aggregate Wind Resource (i.e. the UIGF) across all Semi-Scheduled wind farms;

3) Across 5 days in particular, we see that this level of curtailment peaks above 50% during peak rooftop PV yield times:

(a) Saturday 24th August 2024;

(b) Sunday 25th August 2024;

(d) Saturday 31st August 2024;

(e) Sunday 1st September 2024;

4) Remember those factors could be at play here:

Factor #1) It seems highly likely that there would have been strong economic curtailment during peak daylight (i.e. rooftop PV yield) hours, given the negative prices shown in the same chart at the same time;

Factor #2) Also possible is some network curtailment … perhaps also due to the all the steps AEMO took to secure different network elements with the Severe Weather

Factor #3) We’ve wondered about the possibility of high-speed cut-out on wind farm

(a) noting that Ashleigh Madden wrote ‘Have the fierce winds in Tas caused wind farm cutouts?’ for Weatherzone

(b) if time permits, we’d like to take our own look at some point.

So will leave this article here, for now, and potentially explore in more depth in subsequent articles in the coming days and weeks…

Leave a comment