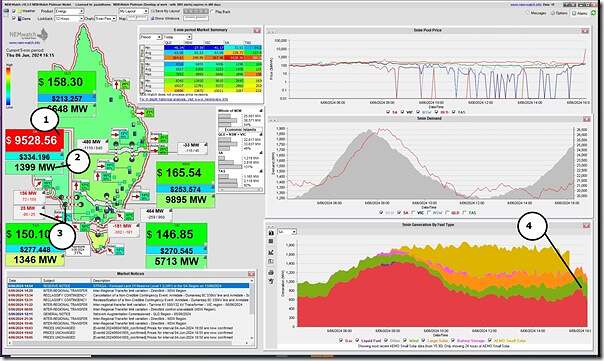

Another bout similar to what Linton noted here for Tuesday 4th June 2024, with volatility Thursday afternoon 6th June such as captured in this NEMwatch snapshot at 16:15:

With reference to the numbered notes:

1) Spot price in this dispatch interval up towards $10,000/MWh for this dispatch interval

2) ‘Market Demand’ relatively modest, in the green zone

3) Restricted ability to import from Victoria

4) And the gas-fired generators running, with:

(a) relatively modest wind generation and

(b) solar trending down from its earlier peak.

5) Not annotated, but visible in the chart, we see that prices in SA have been elevated the whole day.

There was an unusual drop in Pelican Point output from 490 MW at 1600 to 81 MW at 1620 before resuming full output around 1800. Bolivar, Snapper Pt and Hallett all responded immediately to the change.

Yep, PP clearly had a very significant wobble (technical term) as its output was running up towards full capacity and that together with the 50 MW import constraint across Heywood, which is here every day for the next week and bit, drove the $9.5k/MWh spike.