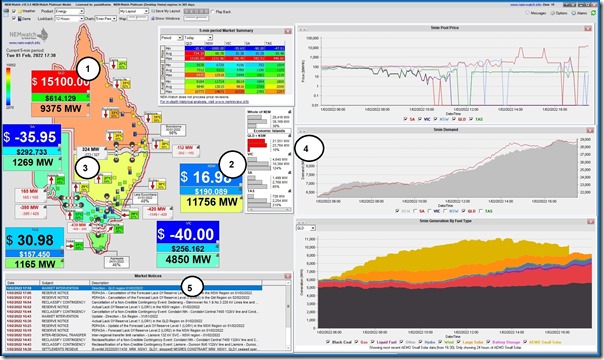

It’s the 17:30 dispatch interval and the QLD dispatch price is at the $15,100/MWh Market Price Cap (MPC) … which is really no surprise, given what’s been going on. This is shown in the snapshot from NEMwatch here:

With respect to this image, note 5 things:

1) The QLD price is up at the $15,100/MWh Market Price Cap, as noted above.

2) Yet the NSW price is under $20/MWh …

3) Which takes a bit of head scratching, because the QNI interconnector is unconstrained:

(a) In the majority of cases, pricing would separate between regions only when interconnectors are constrained (i.e. and then local generators have local market power);

(b) It turns out that the answer might have a bit to do with Intervention in the market;

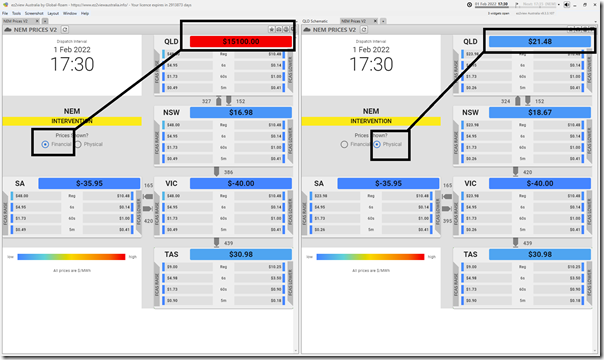

(c) In this snapshot from ez2view we include 2 copies of the ‘NEM Prices v2’ widget at the 17:30 dispatch interval, with a slight difference in each:

i. The widget on the left is showing ‘Financial Run’ prices … i.e. the ones that will be paid to everyone and produced in the ‘what if’ NEMDE pricing run; and

ii. The widget on the right is showing ‘Physical Run’ prices … i.e. the ones produced in the second NEMDE run that takes account of whatever instructions AEMO has given participants to do certain things to keep the system stable.

4) In other news, the IRPM for the ‘QLD+NSW’ Economic Island is down at a very low 10% level

(a) really red alert level, based on historical range

(b) On the supply side there is 23,764MW of generation capacity available at any price across the QLD and NSW regions;

(c) On the demand side, this capacity needs to meet a 21,551MW aggregated ‘Market Demand’ in the QLD and NSW regions, plus the 420MW being exported to Victoria at this time.

(d) That leaves 2,213MW spare, which divided by the 21,551MW demand number gives a 9% ratio

(e) Typically a 15% RPM is considered ‘tight’ from a system planning point of view … so 10% on an instantaneous basis is very tight!

5) At 17:18:57 the AEMO issued Market Notice 94393 to flag that it had issued direction to one or more wholesale market participants ‘to maintain the power system in a reliable operating state’:

——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 01/02/2022 17:18:57

——————————————————————-

Notice ID : 94393

Notice Type ID : MARKET INTERVENTION

Notice Type Description : Reserve Contract / Direction / Instruction

Issue Date : 01/02/2022

External Reference : Direction – QLD region 01/02/2022

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE.

Direction – QLD region 01/02/2022

In accordance with clause 4.8.9(a) of the National Electricity Rules, AEMO has issued a direction to a participant/s in the QLD region.

The direction was necessary to maintain the power system in a reliable operating state.

AEMO may issue or revoke additional directions in order to meet the current requirement, unless sufficient market response is provided. A further market notice will be issued when all directions related to this requirement have been cancelled.

The issue of the direction commences an AEMO intervention event. AEMO declares all trading intervals during the event to be intervention trading intervals, commencing from the interval ending 16:45 on 01/02/2022.

Intervention pricing does not apply to this AEMO intervention event.

Manager NEM Real Time Operations

——————————————————————-

END OF REPORT

——————————————————————-

The way these directions go, we have little chance of working out the nature of the direction in real time, and only a partial chance of working it out on a day-after basis with the added ‘Next Day Public’ information that the AEMO will publish from 04:00 tomorrow.

The strange times continue…

‘It’s all happening….’

These would be the management costs they speak of would they?

https://www.msn.com/en-au/money/markets/aemo-calls-for-funding-hike-as-renewable-energy-levels-send-management-costs-soaring/ar-AATkOir