This article was originally posted on LinkedIn, where there are other comments.

This week two things happened related to rule changes on losses. The AEMC released a draft determination, rejecting the proposal to move to Average Loss Factors (ALF). They also held a working group for COGATI which proposes dynamic marginal loss factors.

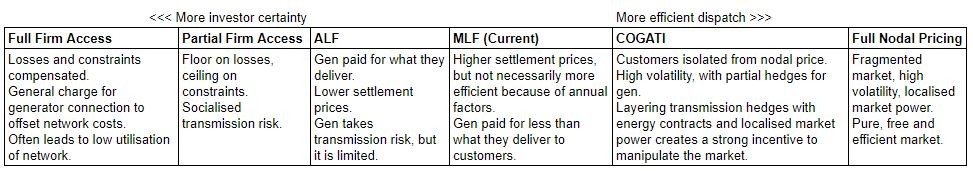

A little context on these conflicting proposals: ALF was proposed by investors to simplify losses and increase certainty. These are the companies solely responsible for building the new generation which is reducing our supply shortfall and wholesale prices. The same investors labelled COGATI as overly complex and uninvestable. The AEMC says they recognise that projects could not obtain long term debt as COGATI currently stands.

The AEMC saw ALF as a wealth transfer from customers to generators, and said that it dampens signals to build assets in good locations. They hold dispatch efficiency and locational signals above other considerations and believe that COGATI addresses these goals.

Let’s dig into the options.

Background

Generators in the NEM have a Marginal Loss Factor (MLF) applied to their settlements and bids in dispatch. This factor is an annual weighted average and reflects the loss from that generator to the load centre from that would occur if they increased output by 1 MW. For example an MLF of 0.95 means that only 0.95 MW would make it to customers for that generator’s last MW produced. The benefit of a marginal loss factor is that it better represents power flows in dispatch allowing for more efficient dispatch of generators, e.g. selection of a more expensive generator with low losses over a cheap generator with high losses.

There are several downsides to the current approach however.

- An annual factor can often misrepresent a generator’s losses in real time diluting any potential efficiency benefits.

- Marginal losses consistently underpay generators, as the total losses divided by total generation is much lower than the sum of marginal losses. This was less of an issue when losses were consistently low. Now it is becoming a significant wealth transfer from generators to customers.

- Marginal loss pricing is higher than the average cost of delivery

- Marginal losses amplify the impact of localised changes in power flows and the present volatility in factors has cost some generators dearly. The uncertainty about loss factors, and a declining number of strong connection points is stifling investment in new generation.

The Alternatives

Average loss factors as proposed by the first rule change use the total losses divided by total generation. This results in a lower loss figure compared with marginal losses (approximately half). This option allows for fairer payment to generators for the actual volume of their product that was consumed by customers. The impact on price is to lower it as generator bids are divided by a higher factor. This option still doesn’t solve the dispatch efficiency issue that annual loss factors introduce. The absolute error is reduced though, and the reduced risk to generators is conducive to more investment which also lowers price.

Dynamic marginal loss factors as proposed by the AEMC would have a new factor for each generator for each 5 minute interval. In COGATI this is combined with a separate price for each connection point that effectively amplifies locational risk. Dynamic factors solve the efficiency problem that annual factors have, and allows AEMO to dispatch most efficiently. It’s worth noting that this doesn’t mean lower prices, just more accurate selection of who’s cheapest at the margin. Often nothing will seem different to now with large price setting generators who’ve got stable loss factors setting the price within cents of what they are doing now. The main disadvantage of dynamic losses is the increase in volatility. Investors will have even less certainty over what they will be paid over decades when their loss factor changes every 5 minutes. Price too should become more volatile as generators at the margin swing in and out of profitability based on power flows elsewhere in the network. Rebidding for “change in loss factor” will become commonplace. Again it’s worth noting that these are marginal losses so in settlements generators will continue to be paid for less than what the customer consumed.

Dispatch Efficiency

This is supposed to be the main benefit of MLFs, especially dynamic ones. I suppose in economic theory this is true, but in the real world the benefits are demonstrably minuscule. This is because price is not distributed on a smooth curve like in theory. Bids are stepped and non-contiguous. Generators don’t necessarily bid their short run cost either. This means for almost all intervals there is no difference in dispatch outcomes and marginal generation for any loss factor methodology. For the intervals where we can detect a change in marginal price setter the price is likely to be very similar – two similar bids with two similar loss factors means a negligible change in price.

I would expect very little difference in dispatch whether we use dynamic, ALF/MLF or simply a fixed value for everyone as fuel cost is 97% of the marginal price. As we move to higher renewable penetrations and more frequent periods of $0 bids setting price the accuracy benefit of whichever loss factor methodology we choose becomes even less relevant.

Locational Signals

This is a big part of both the AEMC’s rejection of ALF and their pitch for dynamic factors. The thinking goes that accurate loss factor representation provides a signal about where to build new generators. Unfortunately dispatch outcomes provide no leading indicator for investors. The potential increase in losses for a new generator is not at all obvious just by observing historical loss factors. Broken Hill solar farm is a great example: upon construction they had an MLF well above 1.0 (their generation reduced flows from the east and associated losses), after other generators connected nearby their loss factor fell spectacularly ~50 percentage points over 2 years as the reverse flow on the line was now creating losses as it travelled east. Their spot revenue fell about 40% in that time purely because of loss factors. If you had invested after seeing their first year’s MLF you would have merely added to the problem that had not yet emerged.

The sensitivity of MLF to changing flows means investors are at greater risk that their revenue drops by 10 or 20% because of the decisions of other generators. For a heavily geared and contracted generator a swing like this takes them from a healthy return into loss making territory. The current locational signals we are providing are simply saying “do not invest in the NEM, unless it’s right next to a capital city”

The only thing that helps here is power flow modelling. The COGATI proposal reduces certainty in modelling outcomes because it converts volume risk into price risk. It seeks to overcome this by offering unfirm, short term hedges open to purchase by entities other than the generator that needs them.

Thinking outside the NEM numbers game for a moment – where should we put generators? Surely building wind and solar where the resource is strong, where land is cheap, and where it benefits the community the strongest is the best option. Developers today are only looking at loss factors which means higher project costs and less new generation.

Certainty

Hazelwood closed 3 years ago and in 3 years Liddell will close. We haven’t built enough new generators and prices remain high; they’ll go higher again in NSW. Uncertainty is at an all time high and the economists want to make things worse to make them better.

So what’s the benefit of certainty?

Debt is cheap right now. This is great for electricity consumers because newly financed generators (particularly capital intensive ones like wind/solar) can offer very cheap prices. In a negligible interest rate world the risk premium on debt and equity is a major component of energy costs. I argue this is a strong incentive to socialise transmission risk as generators cannot manage this risk themselves and conservative assumptions will drive up costs. However we don’t have adequate measures for transmission augmentation to ameliorate these risks. If it’s no-one’s responsibility the risk falls to the consumer one way or the other. I’ve segued – back to losses.

Can Everyone Have What They Want?

The AEMC have really only considered locational pricing and dynamic loss factors, but there’s a spectrum of options. Whatever we choose will be a compromise though.

- Generators want to have settlement based on average losses, and they want these losses to be stable over a long time. They want irrational investors not to arrive after they build.

- Economists want efficient dispatch of generation, based on dynamic marginal losses. They want generators to have signals to invest in the most rational locations. They should also want no wealth transfers.

Here’s my compromised solution:

- Dispatch is run based on dynamic marginal losses to allow AEMO to select the most efficient combination of generation with respect to power flows.

- The marginal bid price is divided by the dynamic average loss factor of the marginal unit resulting in a lower dispatch price compared to using MLF.

- Settlement is based on dynamic average losses or (1-(1-MLF)/2)

E.g. the marginal unit has a SRMC and bid price of $50. Their dynamic loss factor is 0.95. The spot price for the interval will be $50 / (1-(1-0.95)/2) or $51.28. The marginal unit will be paid based on their MW * (1-(1-0.95)/2) or 0.975*MW. Multiplying price and production gets us to MW*50.

For a cheaper generator with a dynamic marginal loss factor of 0.8 the results are:

Revenue = $51.28 * MW * (1-(1-0.8)/2) = $46.15*MW

OK, so we’ve erased the wealth transfer and got more efficient dispatch. What about stability and signals not to invest?

In terms of stability the absolute range of average losses is smaller which limits generator risk. The AEMC ask whether this just drives the generation equilibrium to more generation in congested areas and a higher average loss. There is a floor on MLF/ALF though; at some point the line will be running at rated capacity and any further generation addition simply results in curtailment. This floor appears to be at about 15% average losses. Again, the locational signal is only revealed though flow modelling. We can hope all investors are now doing proper curtailment studies, but it would be good to have a more explicit way to discourage construction in congested areas.

We still have no coordination between transmission and generation investment, but none of the access options do this. Let’s solve that with another mechanism and at least put loss factors to bed. Ideally the investment tests for transmission would fully value the benefits but that’s another topic altogether.

Let me know your thoughts in the comments

——————————————-

About our Guest Author

|

Tom Geiser is a Senior Market Manager at Neoen and is currently based in Sydney.

You can find Tom on LinkedIn here. |

First class note. Still not sure it needs to be that complex.

Hi Tom, a few thoughts.

– on your point about the broken hill solar farm I would argue that despite the initial MLF being above 1.0 that was not a good investment. The risk of that MLF being downgraded significantly was always high, when it was built there was no plans for upgraded transmission or greater load near the source so any addition near them would undercut them. I don’t think it is unreasonable that they should have assessed this risk. I would liken the Broken Hill solar farm to investing in a mining town in the boom.

– on your point on building where resources are best, I agree that would be ideal. The establishment of REZs and adequate transmission will assist this. But development of projects that are better located to supply that electricity, I would argue, is just as important as locating them to generate the most. No point having a perfect spot if you just waste a heap in losses and get curtailed all the time.

This is what happens when you let accountants out of the box and give them control of technology. They forget that the initial intention was to drain the swamp. The financially most efficient place to build any generator RE or fossil fuel is where the recourse is optimal. This applied when we were building thermal power station, near coal deposits, and the grid was reinforced to cope no one applied loss factors. The obvious place to build RE generators is where there is either a lot of sun or wind. These areas are readily identified and measures should be taken to reinforce the network to handle the increased generating capacity. RE generators in these places have the following economic benefits, more local employment, lower marginal cost of generation and reduced carbon foot print all good outcomes for the economy and the environment. Unfortunately we have a mob of twits in charge who cannot see this

I would like someone to explain how the Big Battery has such a high MLF, can it really deliver its power to a end user at a high MLF. What loads are around the battery that can take instant 30MW off and on day and night?. Or can it and does its load go long distances?.

By looking at its output, its pretty obvious its being run to make money, Mainly, not to deliver power, although at times it does, but thats mainly with the reserve.

How far can its power actually go within the grid is I suppose my question, say compared to a coal power station.

Hi John,

The lines in SA were built to take coal power from the north down to Adelaide with limited losses.

Multiple high voltage, parallel lines makes for a great place to connect generators. The wind resource just happens to be excellent too! Nearly all generators between Adelaide and Port Augusta have good MLFs.

Hi Tom,

I thought there were also other factors such as voltage that played a role?

I wonder if the battery is say being charged at the same time as suppling?

I wonder if maybe some of that is in essence going around in a loop?