Increased energy costs are well and truly back on the national agenda. Below, I briefly talk about the issue at hand, the political ramifications, and some of the regulatory options on the table.

News today is that the Prime Minister, Malcolm Turnbull, has called another meeting with the nation’s electricity industry chiefs. This latest meeting is said to be in response to a finding that more than one million households are paying more than they could be paying (presumably they are on standing offers).

According to The Australian, ‘Mr Turnbull will require them [retailers] to outline how they will help more families get on to a better deal and what measures they have put in place to make it easier for customers to switch providers.’

With a less ambitious timeline, the ACCC is conducting a review of the industry and price increases. The ACCC review is examining the structure of the retail industry, the nature of competition, the representation of prices to consumers, and other factors influencing the price paid. The ACCC’s final report is due by 30 June 2018. It is clear that we are going to see a lot happen between now and 30 June 2018.

Energy prices back on the agenda

Concern about energy pricing follows a reasonably predictable pattern each year. Energy pricing increases often occur during mid-winter. For the month prior and four months following, media scrutiny increases, ombudsman complaints roll in, followed by political and regulatory action.

Price increases do nothing to increase the popularity of energy retailers and most people equate price increases with price gouging. There is plenty of conjecture about how much profit retailers make. A retail bill is made up of a number of components with retail profit being one, but by no means the most significant component. Regardless, the customer facing businesses in this supply chain are retailers, and consequently, they are facing the greatest scrutiny.

Generally, it is a difficult time for energy retailers (not that they will get any sympathy) with a focus on energy pricing, ever increasing competition, new energy sellers, and regulatory and political angst.

What can be done

The Prime Minister is reported to be calling for “… immediate action to reduce energy prices. It is not good enough that some customers cannot afford to turn their heating on in winter and their air-conditioning on in summer.”

There are a range of regulatory options on the table, and they can be categorised into one of the following:

a) More regulation, or re-regulation

The ‘promise’ of deregulation and other measures taken to increase competition was that consumers would have more choice and would enjoy cheaper electricity. Despite these measures, we still see the dominance of the large three retailers and price increases.

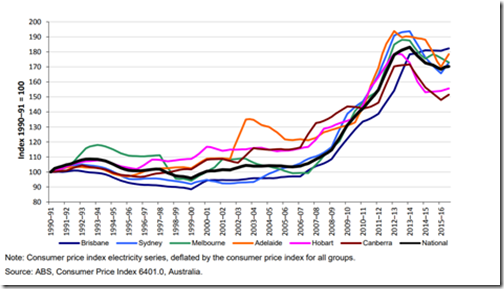

Figure used in the ACCC inquiry into retail electricity supply and pricing, Issues Paper 31 May 2017

Re-regulation is an obvious, although very unlikely regulatory response.

Essential Services Commission chairman Ron Ben David has noted that re-regulation of pricing is an option but one that should only be considered if other regulatory responses fail:

“I call re-regulation the ‘nuclear option’ because once you regulate a market, you remove the incentive for the service providers to be innovative.

“I think we should try and maintain that incentive for as long as possible but if in the end we can’t make it work in the interests of consumers then we have to look at the options, and that would be re-regulation.”

As expected, the industry is concerned about this possibility. The Australian Energy Council’s Chief executive Matthew Warren is reported in The Australian as responding:

“We’ve seen re-regulation in the UK makes conditions worse for consumers because it kills competition, it flattens prices, and everyone gets the same cookie cutter outcome…”

b) Trying to prompt consumers to switch

In his previous meeting with retailers, the Prime Minister noted:

“We need a better deal. We know that, for example, the gap between the best and worst offers that a household can have can range from $900 to $1,500 a year depending on the household. And even within a particular company, with an individual company of yours, the gap can be between the best and the standard offer up to $400 a year.”

An energy retailer cannot switch a customer from one market contract to another without explicit informed consent. Fines of up to $100,000 apply for each contravention, and there are a number of examples of retailers receiving significant fines where they have failed to obtain explicit informed consent.

Various measures have been put in place to encourage consumers to find and take the best deal available. The include standardisation of offer information (in the form of Energy Price Factsheets), government comparator websites (such as energymadeeasy.gov.au), and limitations on when a retailer can charge an early termination fee.

Despite these measures, we continue to see consumers who either don’t realise that they could be saving money or who are not incentivised enough to pick up the phone and take up a better offer.

In the 9 August 2017 ‘deal’ (resulting from the first meeting with the Prime Minister), retailers (only those at the meeting?) agreed to tell customers “in plain English” that their discount period is ending and that they will move onto the standard rate. Under the ‘deal’ consumer will be told how much extra this will cost every bill and will be informed of alternative offers.

This is another measure aimed at encouraging consumers to switch but will it be effective?

The pressure energy prices are placing on households and businesses is real, only time will tell if an appropriate and measured regulatory response can be found.

About our Guest Author

| Connor James is Principal of Law Quarter, a law firm, and founder of Compliance Quarter, provider of compliance and regulatory software.He works with energy retailers, embedded network operators, and distributors with a focus on regulatory compliance.

He can be contacted: . |

There seems to be minimal innovation in retail pricing agreements. For example at present there are substantial price declines in the futures market. An innovative retailer should be able to offer a lower price for say 2 years, but with a switching fee. This way the retailer could purchase on the futures market.

I who’s interest is that ?

energymadeeasy eh? Now I’m pretty good at maths but trying to feed in a service charge, various charging tiers for summer and winter along with off-peak and to cap it off solar FIT scheme credits and the retailer solar bonus credit and on top of that split charging a couple of times a year with price rises part way through the 90 day billing periods and it’s a hulleva task trying to compare offers.

Did it once with a pushy door to door salesman I finally convinced to leave me his you beaut pricing/savings and it was $10 annual difference over my non-contract price with timely settlement discount. Complete waste of time when no domestic contract will guarantee you won’t get a price increase anytime after you sign up.