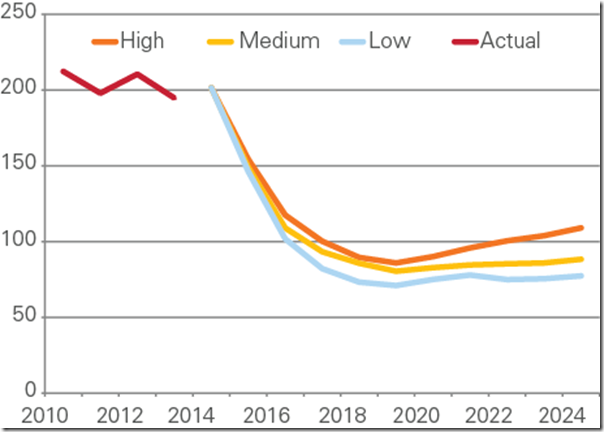

Analysis by Paul Taliangis and Zhi Oh at Core Energy Group shows that the gas powered generation sector (GPG) in the NEM has reached its peak and is poised to enter a steep fall in consumption from over 200 PJ in 2014 to 100PJ or below by 2018.

In September 2013, Core Energy published an article “The Changing Role of Gas in the NEM” which presented a view that gas is likely to transition from a combined base, intermediate and peak role, to an increasingly upper-intermediate and peak only role in the NEM.

This article provides an update on the changing dynamics of the GPG segment of the NEM.

Recent GPG Consumption Near Peak

In 2014, (utilising data from NEM-Review) GPG gas consumption was approximately 215 PJ, an increase of almost 30 PJ from the previous year. The growth in GPG gas demand observable in Queensland is largely attributable to unusually low gas prices associated with short term LNG production (so called “ramp gas”). This has resulted from in gas prices of approximately AUD1.00/GJ in the Wallumbilla STTM.

Recent year consumption by the major NEM GPG generators is summarised in the following table.

Table 1.1 Major Generator Historical Gas Use, Generation & Projections

| Generator | State | Historical Gas Use in 2014 |

Historical Generation in 2014 |

Projection Gas Usage in 2018 |

Projection Generation in 2018 |

| Tallawarra | NSW | 17 PJ p.a. | 2.4 TWh p.a. | ||

| Braemar 1 | QLD | 25PJ p.a. | 2.1 TWh p.a. | ||

| Braemar 2 | QLD | 25 PJ p.a. | 2.1 TWh p.a. | ||

| Darling Downs | QLD | 27 PJ p.a. | 3.5 TWh p.a. | ||

| Swanbank E | QLD | 17 PJ p.a. | 2.3 TWh p.a. | ||

| Osborne | SA | 12 PJ p.a. | 1.4 TWh p.a. | ||

| Pelican Point | SA | 12 PJ p.a. | 1.5 TWh p.a. | ||

| Torrens B | SA | 16 PJ p.a. | 1.3 TWh p.a. | ||

| Mortlake | VIC | 20 PJ p.a. | 1.6 TWh p.a. | ||

| TOTAL | ALL | 171 PJ p.a. | 18.2 TWh p.a. | 85 PJ p.a. | 9 TWh p.a. |

Sources: NEM-Review & Core Energy Group

Editor’s Note – corrected transcription error (TWh not GWh) following Tim’s comment

Core believes that GPG gas consumption has passed its peak and will enter a steep downward consumption curve as coal fired power and renewable energy edge it out of the base and lower to mid-intermediate load market.

The key factors bringing about this change is the repeal of the Clean Energy Act and associated removal of carbon tax, and the massive increase in absolute gas prices from an existing weighted average of approximately $4/GJ to a marginal cost $8/GJ (ex gas processing plant) by 2018.

Competition from Alternative Fuel Sources

At marginal cost of AUD8.00/GJ, the cost of gas-fired generation is estimated at approximately AUD60/MWh, with some variation depending on the generator efficiency. Coal-fired generation, without the carbon tax, is in the range of AUD10/MWh for brown coal and AUD20/MWh for black coal. Coal has an evident cost advantage over gas, rendering gas uncompetitive for base load generation.

Gas also faces competition from renewable energy, with increasing renewable capacity, mainly wind power that services the base load demand. The penetration of solar PV systems with energy storage pose as a potential competitor to GPG in the peak electricity segment in the medium to long term. The ability to store electricity would enable households to change consumption patterns by charging batteries during off-peak and using stored electricity throughout peak period. This would see falling demand for grid-electricity during peak times.

Change is Underway

The signs of change are already evident in the NEM and in Core’s view this will accelerate during 2015-2017.

Announced changes include:

› Stanwell’s mothballing of the 385 MW Swanbank E CCGT late 2014. Stanwell plans to redirect gas and has started up coal-fired Tarong Power Station to replace Swanbank E generation capacity.

› AGL’s announced plans to mothball the 480 MW Torrens Island A in 2017.

The key changes will be focused on generators which have provided significant base or intermediate load to date – as observable in the Table above.

GPG Consumption to Nosedive

Core’s view of GPG’s declining trend is broadly consistent with the recently published AEMO 2014 NGFR – a marked downward revision from AEMO’s historical scenarios.

Table 1.2 GPG Annual Gas Consumption Forecast – Eastern Australia | PJ

Source: AEMO 2014 NGFR

Concluding Comments

In a high gas price environment, compounded with challenging competitive forces in the electricity sector, GPG is expected to halve by 2018. As previously stated, gas will continue to play a key role in upper intermediate and peak generation in the short term, due to operational flexibility advantages and lower price sensitivity in this segment of the load curve. Its role in the upper intermediate and peak generation could also face growing competition due to technological advances in the medium to long-term future.

About our Guest Authors

| Paul Taliangis is Managing Director, and Zhi Oh is Senior Analyst, at Core Energy Group.

Core Energy is a boutique energy industry advisory firm providing specialist services in the areas of:

Core Energy services the complete energy value chain from resource to end market. Connect on LinkedIn with Paul here, and with Zhi here. |

>”Gas also faces competition from renewable energy, with increasing renewable capacity, mainly wind power that services the base load demand. The penetration of solar PV systems with energy storage pose as a potential competitor to GPG in the peak electricity segment in the medium to long term. The ability to store electricity would enable households to change consumption patterns by charging batteries during off-peak and using stored electricity throughout peak period. This would see falling demand for grid-electricity during peak times.”

Does Core Energy’s projection of solar PV systems assume the massive subsidies (and hidden cross subsidies) will continue indefinitely? What is Core Energy’s projection for the scenario where the subsidies ceased (as clearly they should be if policy was based on rational analysis)?

Peter this is an area of material uncertainty. If solar becomes competitive without support mechanisms and storage becomes a cost competitive reality then gas faces a major challenge in the water heating and room heating space. It is simply too early to make an informed call. It is an area Core is analysing closely as it is has major implications across the energy chain.

If? PV is the cheapest domestic fuel, subsidies or not. You can get a system for $2.3/W before STCs these days. With 5% interest you’re laughing as long as you consume at least a third of what you produce.

If gas stoves weren’t nice to cook on domestic gas would be dead.

Paul,

I don’t know what figures you are using, but I cannot understand why people advocate solar power. It doesn’t seem rational to do so. not only is it many times more costly than fossil fuel or nuclear generated electricity, it is also not sustainable – that is it requires fossil fuel of nuclear to support it. If you add the cost and energy required for energy storage it is even further from being sustainable. The fact it is not sustainable is a slam dunk.

If the issue is GHG emissions reduction then why not advocate fro nuclear. It is far superior against all the important requirements: energy security, reliability of supply, cost, health and safety and environmental impacts?

Peter,

A typical offgrid system has an EROI well over 10. How is that unsustainable?

Solar is now cheaper than nuclear*. Rooftop is much cheaper as you save on distribution costs. You can’t just go out and buy a 10 kW reactor.

*Hinkley C $180/MWh, Chinese new reactors $100/MWh, Saudi Solar $60/MWh, undiscounted unsubsidised Aussie rooftop solar $100/MWh

Thanks for the insightful article and analysis. However I think your conversions in table 1.1 might be out. Total gas of 171 PJ equaling 18.2 GWh doesn’t feel right. Should it be 18.2 TWh?

Thanks for picking that up, Tim

We corrected the transcription error above for ease of readability.

Paul McArdle

One area where more analysis is required is whether solar will be effective in meeting winter heating needs in the residential and commercial sectors. Has anyone seen quality research/analysis addressing this topic?

It depends on your system, climate, and insulation. Offgrid systems often tilt their panels up towards the winter sun to give a more uniform annual profile.

With respect to gas, does it matter? A reverse cycle aircon at peak rates is still cheaper than gas.

Related fun fact: German domestic gas is half the price of Australian domestic gas. Their wholesale price is about twice ours.