It had not been my intention for it to take so long to return to the theme of socialising costs whilst privatising profits following my article over 3 months ago – such is the busyness of the changing energy industry/market landscape at present (coupled with the ever-present need to keep our diverse group of paying customers happy). I would also have hoped to have more time to delve into this particular area of the NEM more thoroughly – so I would ask for your understanding when you point out (in comments below) what key insights I have missed in the following.

In that initial article, I had outlined some of the areas in the wholesale market I’ve been puzzling over, where there has been claim and counter-claim being made about some parts of the wholesale sector subsidising others.

In this second (though not the last) in the series, I’ll try to explain something I have been puzzling over with respect to the retail market – though I wonder even whether labelling it as (small “r”) “retail” is appropriate. Perhaps this is part of my confusion?

Clarification = with all the buzz about network pricing this week (with the AER draft decision for NSW and ACT networks businesses and the AEMC rule change on distribution pricing arrangements), it might be useful to clarify that I have been puzzling about the retail side, not networks recently (something for a later article perhaps).

Caveat = With respect to the following, that I spend much more time watching, and thinking about, the wholesale sector – and, as such, understand that it’s entirely plausible (indeed, may even be likely) that there’s something significant that I am missing in what follows. Especially if you see that this is the case, please share with me in the comments below.

1) What’s prompted my questions

There’s been several things that have prompted my questions about the retail market.

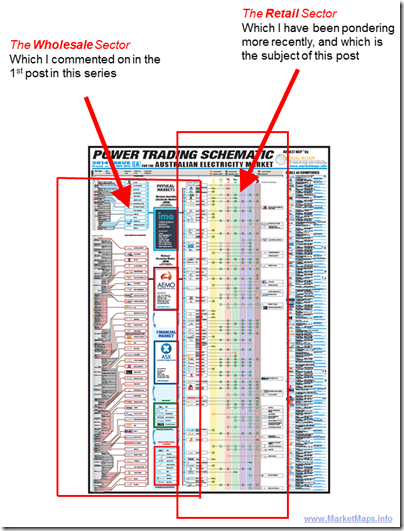

In September we commenced development of our updated “Power Trading Schematic” Market Map™ wall chart for 2014. This development has now been completed – the wall chart (shown here) is at the printers, and will be delivered to our customers shortly.

As shown above, this large wall chart highlights the commercial structure of the two main Australian electricity markets (the NEM on the east and the WEM in the west). Because of the proliferation of new businesses that have sprung up over the past 12 months exempted from the requirements of obtaining an electricity retail licence, we made significant changes to this issue of the chart to keep pace with the times.

Also significant, over the past couple, has been the significant number of new entrant retailers starting up (what might be called the “old fashioned way” – though some with quite innovative business models), registering a retail licence, to have a go in competing with the big guys in the retail space. These new guys are also featured in the chart.

Hence this has prompted two different types of questions:

Q1) We wonder if it’s just something in the water, of if there are more significant reasons why now is the time when we see a new wave of new entrant retailers having a go – coincident with a time when “big bad” energy companies have assumed the infamous role that “big bad” banks once had the ignominy of filling (as noted here)?

This is a question some of our readers might help to answer – and could make for interesting reading in another post (though perhaps one better written by a guest author who has more background in electricity retailing than I)?

Q2) What I am pondering, now, is whether the emerging divide between “in front of the meter” and “behind the meter” is another case of “privatising profits whilst socialising costs”?

This is where I will focus in this post…

2) Are there unpriced (and unpaid) options being assumed?

In completing the background research for the preparation of the “Power Trading Schematic”, it became clear that the latest wave of retail exemptions is not the first that the AER (and prior state-based regulators) has seen. There are quite a number of others, which we did not have space to show in the chart, from companies that have been operating embedded networks of some form (some for significant number of years). I have been cognisant of this in pondering what follows…

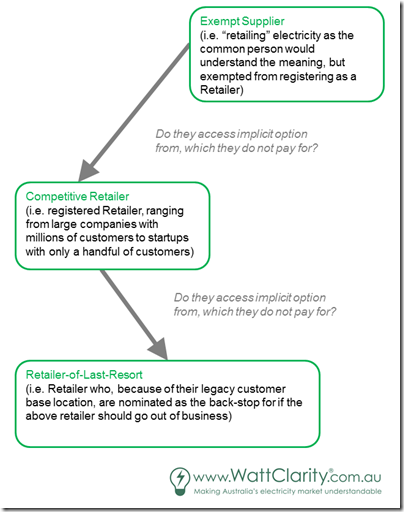

At its core, I am puzzling over what seems to be a series of nested options that are assumed in the current way that the retail market works (or at least my understanding of how the retail market works). I have tried to describe this in the following diagram:

We’ll start at the top, as this is much more topical at present.

2a) Between Retailers and Exempt Suppliers?

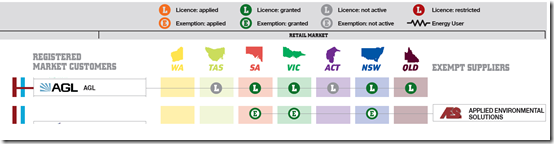

If we zoom in on an excerpt of the wall chart, this might illustrate what I’m grappling with:

Here, I have highlighted two of the companies towards the top of the alphabetical list to illustrate one of the most obvious recent changes in the structure of commercial operations in the NEM.

On the left-hand side we have licensed retailers (with AGL shown here) whereas on the right-hand side we have exempt retail suppliers (highlighting Applied Environmental Solutions here) who are growing in number. The columns highlight that the two companies compete against each other in NSW, VIC and SA (but not in other locations).

Over the course of the past 6 months or more, we’ve seen plenty of applications at the AER for retail exemptions from the companies listed in the right-hand column of the chart above. Most of those shown in the chart are proposing (or using) some permutation of a solar lease-back model whereby:

1. The customer (most often a household) gets a no-money-down solar PV system installed on their rooftop;

2. The cost of the solar system (+ a profit, we presume) is recovered over some period (say 15 years) on a c/kWh charge;

3. The customer is required to retain a contract with a licensed energy retailer, for when the sun does not shine, or the solar system is not working, etc…

4. At the end of the lease term, the customer either gets to keep the system at no extra charge, or has to pay some residual.

5. I can’t recall reading much about who pays any decommissioning cost, if there is one.These new exempt suppliers are allowed by the AER to sell power “behind the meter”, so long as the customer maintains a separate connection to the market through a licensed retailer.

Faced with this change in the market, the AER:

1. published this this “Statement of Approach: Regulation of Alternative Sellers under the National Energy Retail Law” in December 2011; and

2. then (following some consultation) published some “Industry Guidance: solar power purchase agreements” in June 2014.In that second document, the AER notes:

“The AER considers that energy sold through SPPAs is discretionary and additional to the

energy sold to customers by an authorised retailer. Both retailer and SPPA provider sell

energy, but the nature of the service is different, as is the relationship between these energy

sellers and their customers. A key difference is the impact that disconnection of energy

services would have on a customer. Disconnection by a retailer means discontinuing network

distributed energy to that customer and leaving them without energy supply. In contrast, a

customer whose supply from an SPPA provider is disconnected will still have access to

network distributed energy and hence, will still have reliable energy supply”

(my emphasis added)I’m not sure that I really understand the purpose of this distinction, which leads me to my question…

(i) My question

My question revolves around two things:

1) Firstly, there is the “so long as …” condition that the AER seems to have imposed on all of these exempt suppliers as a condition on granting exemption. This seems to imply that the customer is gaining some value from being (commercially) connected to a licensed retailer that the exempt supplier is not able (or not willing?) to provide. I wonder if this is not some commercial protection in addition to the physical protection inherent in still being connected to the grid.

2) Secondly, there are statements made by a number of companies in applying for exemptions along the lines of “we’re small and unable to meet all the criteria for being registered as a retailer”. I remember one application, in particular (but can’t recall at the moment which exempt supplier it came from) that was very direct in this sort of “please, we’re small & not well funded & have no knowledge of wholesale & we need special treatment” argument.

To me, I am struggling to understand the distinction between what seems to be two different types of electron:

Type A electrons = the traditional type, where the registered Retailer

Type B electrons = this new type, where the non-registered (small r) retailer seems to “lean on” an implicit option provided by the Retailer (i.e. to pick up supply if they cannot supply, for whatever reason).

In parallel with this, however, every extra kWh supplied of Type B electrons would seem to decrease the ability of the registered Retailer to recover the cost of this implicit option through the c/kWh charge charged for Type A electrons.

In the same way as there are concerns about a “death spiral” on network charges, does this not mean that there is the same possibility in terms of retailing – i.e.:

1. The exempt supplier gains an implicit (non-funded) option of reliability from Retailer, and charges the customer X c/kWh

2. The retailer pays the cost of providing this option (which would seem to be somewhat fixed per customer, in terms of capability), and recovers this from their share of the energy in some way at Y c/kWh

3. As Type B electron supply increases, the price Y c/kWh must increase to recover this fixed component, which incentivises more Type B, and so on….

Note that I understand that a customer won’t generally continue adding panels to keep adding to this Type B supply, but these sorts of considerations for the two suppliers would presumably feed into the initial pricing offered.“Snipping the wire?”

Perhaps my confusion might be more easily easily solved if the customer did just “snip the wire” and disconnect from the grid. At least in this case it would be clearer about the extent to which they are (now) still “leaning on” retailers in the NEM without paying any option fee for that.

However I agree with the reasoning provided by Tim Sonnereich here about why it’s unlikely that energy users will – en masse – leave the grid entirely (think about the technology adoption challenges that were analysed well in 1991 through the book “Crossing the Chasm”). Nor would it seem to be economically rational to abandon investment that has already sunk entirely (though asset-value write-downs are another question for later).

Hence, it does seem that we all have an economic and social interest in working out an equitable solution (i.e. if my confusion is correct, and there is actually a problem in the first place).

I can understand where the above might seem to have one answer when the comparison is between an old, established “big, bad AGL” and a nimble start-up on the right-hand side – as shown here:

(i.e. an argument along the lines of “well, the big guys can afford to subsidise the little guys starting up”). But what happens when the comparison changes, as follows:

Now Powershop seems to have become quite the darling of the renewables sector, in terms of it’s rating as the greenest retailer earlier this year. Yet (if my logic above is correct?) I would think that Powershop would also be subsidising their new direct competitors selling power “behind the meter” and eroding their volume.

Maybe the argument still stands that a bigger Powershop (now with 50,000 customers or so, I think) can still afford to subsidise their smaller direct competitors? So we extend the argument smaller still…

Now these guys (Locality Planning Energy) were selected as they are the ones with the most newly minted retail licence, and are (as much as I understand) genuinely a start-up. Yet (again, if my logic is correct?) we are still saying that they have been made to jump through all the hoops (incurring the costs involved) of gaining their retail licence – yet the people they compete with on the other side of the meter have been exempted from this requirement.

I am grappling with the question – is this this is fair & equitable (and sustainable, over the longer term)?

(ii) The AER’s new question

Coincidentally, a week ago (on 18th November) the Australian Energy Regulator has recently published this Issues Paper on “Regulating innovative energy selling business models under the National Energy Retail Law” that speaks to the same question, and builds on their review from 12 months previously.

Submissions are due by Thursday 15 January 2015 at the AER. Perhaps, if we have time (and if readers can help with extra insights below) we can make a submission?

2b) Between Competitive Retailers and the Retailer-of-Last-Resort?

If the above is a true example of “socialising costs whilst privatising profits” then there is also a longer-standing example:

Since the NEM started, there have only been two cases whereby retailers have “gone bust” (with my understanding being that this was) as a result of inadequate hedging strategies implemented to manage the risk inherent in the wholesale market. On both occasions, the customers who had been served by these defunct retailers were just handed back to the respective Retailer of Last Resort, with the ROLR having to pick up the can for customers that might have been “poor quality” (e.g. poor load shape, poor payment history, etc…).

Perhaps something to cover in a different post?

As with a number of aspects about the changing environment in the energy sector, I will continue pondering – and will post when we can.

Leave a comment