This article has been prepared as one part of a more general summary of the Opportunities & Threats to energy users in Australia’s National Electricity Market (NEM).

Note that my focus is primarily towards large Commercial & Industrial (C&I) energy users – such as those who would be eligible for membership of the Energy User’s Association of Australia (EUAA) – however the concerns would be generally valid for all types of energy user, including small businesses (such as ours) and “mums and dads at home”.

I’ve split this analysis into a (growing) number of parts to enhance readability (i.e. so you can focus on what you’re interested in). It’s also helping me to put this analysis together progressively (in between by normal job)!

The general post is linked here, for your reference.

For any thermal plant (which represents a significant proportion of energy supplied in the NEM), fuel costs are a significant proportion of long-run marginal cost. The percentage is less so for brown coal plant, but still significant.

Hence the following comments made at EUAA events over the course of the past 12 months are informative.

.

A. Costs of Coal

I can’t recall it being specifically mentioned in recent EUAA seminars, but it is certainly still a potentially significant driver placing upward pressures on wholesale electricity prices.

With respect to recent takeover offer made by Thailand’s Banpu for Centennial Coal (the dominant coal supplier to NSW generators) the price disparity between export thermal coal and current domestic thermal coal prices was cited as one of the compelling drivers. I posted about this recently here.

It is obvious that there is an expectation that domestic thermal prices will rise, as current contracts roll off, to narrow the gap with export coal prices. Note that this expectation is not unique to Centennial Coal – it is known that other miners are more focused on export markets currently (this is to be expected, given the price difference).

The extent to which the price difference flows through into domestic thermal coal prices is still to be seen.

It’s important to note that this driver won’t be felt across the board, because the brown coal stations in VIC and SA don’t compete for their coal supplies against an export market – and nor do some mine-mouth black coal stations in QLD and NSW.

However it will still be a factor supporting higher prices over the longer term.

B. Costs of Gas

As he has done for each of the past 10 years, Paul Balfe (of consulting firm ACIL Tasman) provided delegates at the EUAA’s EPMU his “National Gas Market Outlook”. For the audience, this presentation is relevant with respect to both types of energy consumption:

1) Gas directly used in industrial processes; and

2) Electricity used in industrial processes, supplied through gas-fired generation.Both these potential applications for gas will have an impact on the supply/demand dynamics of gas – and hence prices.

As Paul Balfe outlined, there are two significant looming factors that would each have massive impacts on the volumes of gas required to be supplied in eastern Australia:

1) The potential for some form of carbon mechanism to provide a clear incentive towards the development of combined cycle gas turbine plants, combined with the closure of older coal-fired plant:

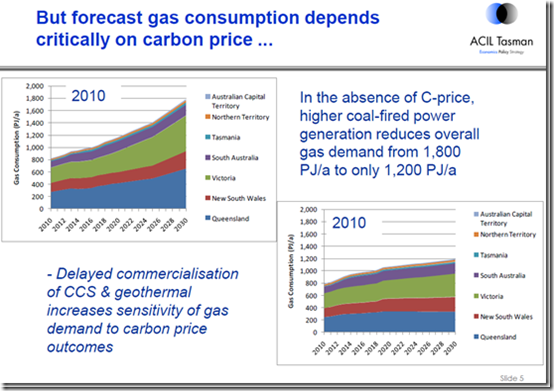

Paul Balfe notes that, under a carbon price corresponding to a –5% scenario, we could see 1,000 PJ p.a. annual demand for gas for power generation by 2030 (in total consumption of 1,800 PJ p.a.) – compared with a usage of only 400 PJ p.a. in a non-carbon scenario.

This can be seen below in the slide from ACIL Tasman:

Hence it seems that ACIL Tasman has assumed an annual requirement of 600 PJ p.a. for coal substitution as a result of a carbon policy.

Assuming this additional gas was utilised in combined cycle plants with heat rates of 7GJ/MWh, this would equate to production volumes of just below 100,000GWh p.a.

Reference to our additional analysis highlights how:

1) Annual production from coal-fired plant typically exceeds 175,000GWh each year.

2) Overall demand growth rate has averaged just over 4,000 GWh p.a. from 1999 to 2009, counting the effects of the GFC. Extrapolating forward from this (and assuming no great gains in energy efficiency) shows that the annual energy demand (under BAU) might be of the order of 80,000 GWh higher in 2030 than it is today.Hence what ACIL Tasman has proposed for a –5% carbon reduction target would represent most new production capacity being gas-fired (except that supported under the LRET), plus some limited change-out of old coal plant.

This would be a challenging target but not at the upper limit of what would be required for complete substitution of coal technology for gas (if this was desired, from a policy perspective). Were that required, the volume of gas required in the power industry would be

2) The potential for one (or more) LNG export facilities near Gladstone

Paul notes that, if only one of the proposed projects were to proceed (at 4 x 4Mt p.a.) the gas consumption would need to be higher again by another 1000 PJ p.a. once the project was operational.

It is less likely that more than one project will proceed – if this was to happen, the volumes required would be still higher.

In the intervening period, were such a project to receive the “go-ahead” the market would be supplied with significant quantities of ramp-up gas associated with the proving of CSG wells – this might be of the order of 100-200 PJ p.a. over 5-6 years whilst the facility was being constructed, and would be .

Whilst there does not seem to be much concern that such volumes of gas supplies will be available (physically), there does seem to be an element of concern about the cost at which such volumes could be supplied – and the extent to which these dynamics will drive costs of gas for power generation higher.

C. Costs of Water

As we know, the impacts of the drought were felt significantly in 2007, but have abated somewhat since that time with the rains that have fallen, particularly in the north of the country – though we have seen that spot prices have not fully recovered to pre-drought levels.

Looking longer-term, what the drought has done is opened our eyes to the limitations on water supplies available for power generation, and hence the increasing impact that this will have in the future in areas such as:

1) Reduced availability of water from natural sources, and hence the impacts of rationing during periods of drought;

2) Implementation of higher-cost water creation or distribution systems – such as the recycled system now supplying Swanbank and Tarong, and possibly desalination plants supplying power generation in future.

3) Installation of dry-cooled stations (such as Kogan Creek) with the resultant capital cost increase and decrease in thermal efficiencies that result.

I’m speculating whether a privately owned power station would not have found alternate methods for cooling, if it meant that in doing so, they would not have to shut down due to drought inflicted water restrictions.