It’s only November, and yet people in South Australia and Victoria are already experiencing temperatures pushing 40 degrees.

These temperatures have pushed regional demand levels up towards all-time maximums.

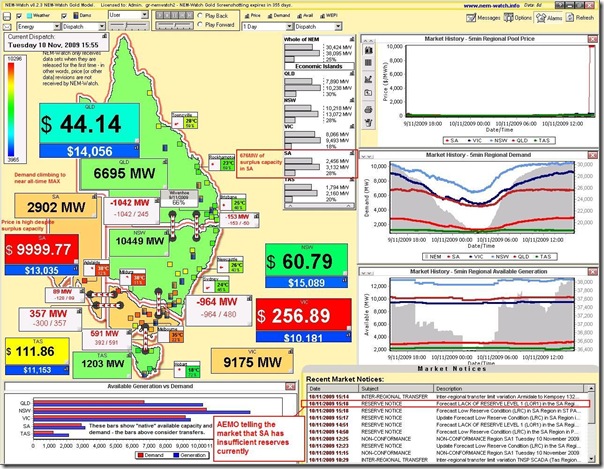

As can be seen in a snapshot from NEM-Watch at 15:55 this afternoon (market time) we can clearly see that the demand in VIC and SA is high (i.e. orange-ish), as opposed to the demand in QLD, NSW and TAS being very modest (i.e. green-ish).

Prices spiked to near VOLL in SA as a result, starting at 15:25.

Note that the SA “Economic Island” (so created because the interconnectors from VIC are constrained) is still enjoying 676MW of spare capacity. The surplus is this much because it is using on imports from VIC to meet some of its demand.

The AEMO Market Notice noted that reserve levels were below the level at which AEMO would prefer them to be – hence the LOR1 condition announced.

Why are prices spiking at a time when there is surplus capacity around (and a resultant Instantaneous Reserve Plant Margin of 28% in the SA Economic Island)? That’s a good question – quite possible that the commercial tactics applied several times beforehand (Torrens station bidding its capacity at VOLL when the /demand balance is tight).

Is it going to be a long, hot, volatile summer?

Not sure – but today was certainly another opportunity for demand side response in the market.

Leave a comment