As noted yesterday, I’ve been away and otherwise focused for a while and am progressively fitting a bit of ‘catch-up’ in between other tasks … will see how far I manage to get in the coming days.

One point of curiosity for me, given how frequently it happens and how central to various market outcomes, is the behaviour of the VIC1-NSW1 interconnector … so what follows are two trend charts configured in the ‘Trends Engine’ within ez2view and posted here for my future reference …

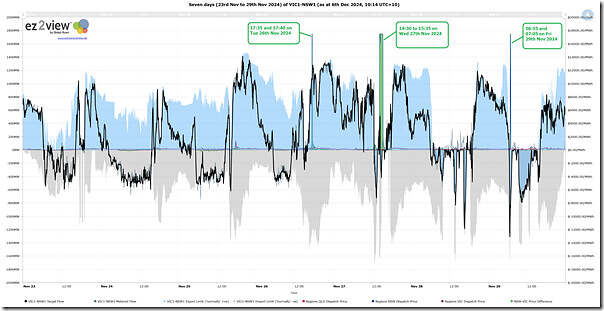

First week (Saturday 23rd November to Friday 29th November)

Here’s the first 7-day duration look at flows across VIC1-NSW1 interconnector:

We’ll come back to this later, but we see three periods of significant price separation between VIC and NSW:

1) There were two particular dispatch intervals highlighted in a broader run, on Tuesday 26th November 2024.

… Linton had written afterwards ‘NSW energy prices less volatile than anticipated on 26 November 2024’

2) There was a long run of volatility on Wednesday 27th November 2024.

… many articles already written about that day, with others still to come.

3) There was a period of volatility coincident with strong counter-priced flow on Thursday 28th November 2024.

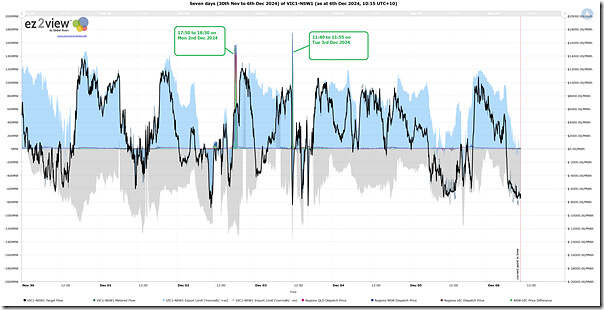

Second week (Saturday 30th November to Friday 6th December)

Here’s the second 7-day duration look at flows across VIC1-NSW1 interconnector (i.e. to Friday morning 6th December):

In this case there are two periods highlighted:

1) On Monday evening 2nd December 2024 there was a period in the evening as noted in ‘(Afternoon and) Evening volatility in NSW and QLD on Monday 2th December 2024’.

2) On Tuesday 3rd December 2024 there were 4 dispatch intervals in the middle of the day – as Dan noted in ‘High prices in NSW eventuate early, and briefly, on Tue 3rd Dec 2024 as Collector-Marulan 330kV outage invoked’ on the day

Thank you for drawing attention to this issue. I think it is a matter of great concern, not just now, but into the future. There are many very large VRE projects under construction and announced for Southern NSW, plus EnergyConnect plus a likely VNI-West. While HumeLink has been announced, the capacity of it just doesn’t seem any thing like sufficient to meet the needs of the future, let alone what additional announcements of VRE are likely for Southern NSW.

I am surprised that we have not had any announcements for a tender for one or more batteries to provide virtual transmission capacity on the existing transmission and plans for virtual transmission for HumeLink.