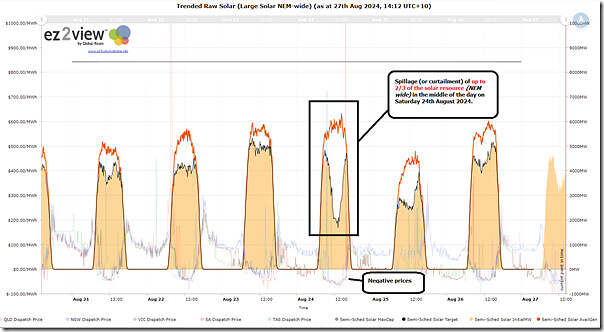

In a conversation with someone this afternoon we checked a dashboard we have compiled (utilising the ‘Trends Engine’ within ez2view) looking at various metrics for Aggregate Solar Farm yield across the NEM, we noticed the large amount of curtailment that occurred across the solar farm fleet NEM-wide on Saturday 24th August 2024, and thought it might be of interest to readers here:

Today it’s Tuesday 27th August 2024 and (in Brisbane, at least) :

- It’s technically still winter

- Though it feels like spring at present (as it did on Saturday 24th August 2024 as well).

- And, by the weekend, may well be feeling like deep summer.

During times like these, there’s plenty of solar resource … but less market opportunity for it to be produced (and I’ve not looked at network curtailment).

Nothing further, at this point.

I think we are unlikely to see many, if any, new utility scale solar farms announced that don’t have a matching battery of roughly 4 hours at the rated output of the solar system. Even with all the storage announced there is still going to be an excess of solar production on the weekends at this time of the year. What is more important is to look at the levels of curtailment on week days and how that compares to the capacity of the existing and announced storage.

So what does that do to LCOE (seeing that is the metric everyone loves to use) given it is the same amount of energy produced now servicing a lot more capital? From an owner’s perspective it is probably cheaper to simply forgo the revenue and work on a slightly lower capacity factor when making the FID. If the marvelous capacity investment scheme is underwriting things…..who cares? Certainly not the investor…..

An acid test of the CIS will be whether it underwrites any utility PV or focuses on wind/batteries/PHES for now. If the former, we’ll know it is flawed. There’s no need for more utility PV until a few more coal plants have exited and even then it’s likely rooftop PV will have already filled the gap since it’s competing against retail prices not wholesale.

Thanks Kieran

In the recently released GenInsights Quarterly Update for 2024 Q2 we pose a question about whether the Capacity Investment Scheme should only support VRE additions if they are fully integrated hybrid units.

Unfortunately, that’s not my understanding of the way that it’s structured at present…