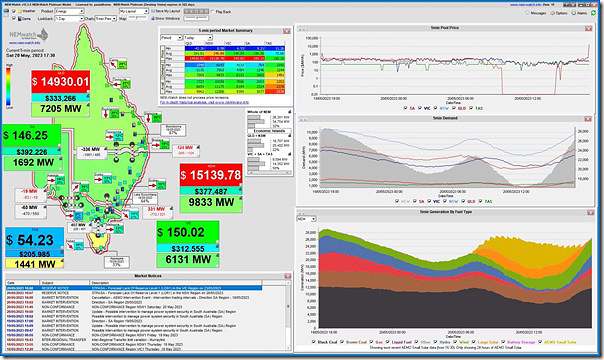

A quick note at the 17:30 dispatch interval with a snapshot from NEMwatch to mark the start of some volatility this evening:

Also visible in the Market Notice window are alerts from the AEMO of possible LOR1-level Low Reserve Condition for the coming week:

1) Victoria on Tuesday 23rd May 2023

2) NSW on Friday 26th May 2023.

The NSW volatility events on 17 and 20 May and on 16 March were characterised by constrained VNI flows and high (2000 MW) Tumut hydro output. Is the VNI constraint causing the high hydro output or is the high hydro output causing the VNI constraint? Is there a lack of capacity in the Snowy 330 kV network?