On Friday 20th July I named the growing deficit in required “Energy Literacy” as Villain #4 in our evolving energy sector train wreck. My sense is that we’re all contributing to the deficit in our own ways – for instance:

- those of us who have operated in the energy sector the way it used to be are sometimes slow to learn of the rapid emergence of alternative technologies, and/or the steep progression down the cost curve for some of these; whereas

- we’ve seen evidence that suggests some new entrants are blissfully unaware of some of the complexities of operating generation plant in the NEM (sometimes even blaming it on some grand conspiracy when reality comes home to roost).

My post about Villain #4 triggered conversations with a range of people – some of them being about the large element of surprise that seemed to greet some large changes in Marginal Loss Factors (MLFs) for generation plant in some locations. Like me, a number of people I spoke with were shocked that this seemed to blindside some new entrants.

(A) Marginal Loss Factors have varied over time, and will do so in future

In conversations about northern Queensland (an area that has probably only just seen the start of major changes to Marginal Loss Factors, and also transmission congestion as well), we wondered why these new entrants had not used the twenty-year history of MLFs in the NEM as a guide to understanding the variability that might emerge over the coming 20 years.

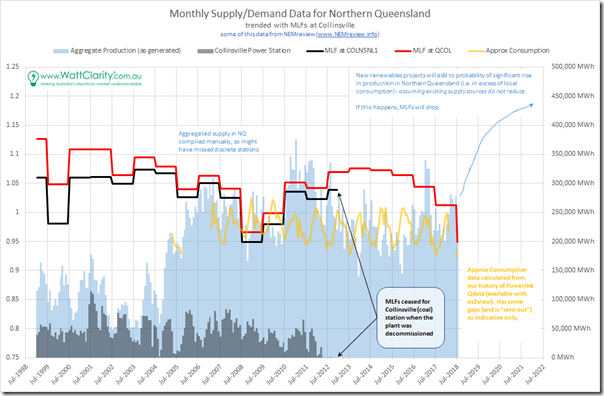

During one conversation about northern Queensland over coffee during the week, we spoke about the location of Collinsville given its special history – it had formerly hosted a coal-fired power station (since retired), and will shortly feature a couple new solar farms in the vicinity. The conversation prompted me to crunch a few numbers and put together the following trend showing monthly and financial year data for northern Queensland featuring Collinsville:

Now the loss factor (in black) for the connection point for the old Collinsville Power station ceased being published by AEMO when the station was retired. However I’ve also included (in red) the loss factor for the nearby load connection point which (whilst not identical, because of its own local issues) is directionally consistent with the black line.

Question 1) In our conversation earlier this week, we mused why developers had not taken the step of perusing the 20-year history of marginal loss factors at locations like these to ascertain that there has already been a fair variability in MLF over that history – hence it should be expected there would be variability in future.

Question 2) Coupled with this, the large influx of new generation sources into northern Queensland from many solar and some wind generators could well mean a significant surplus of generation in the area, leading to a significant “penalty” to all generators in the area due to long electrical distance to the Regional Reference Node. In the chart above I have assembled monthly aggregate production from generators for which AEMO has data, and compared it to (approximate) aggregate consumption in the same area using our historical record of the Powerlink Qdata set available as an optional extra with ez2view. In a very rough projection out 18-24 months into the future, we see that the aggregate supply increasing significantly, with not much change in consumption patterns. This should flag the risk of a big drop in MLF for generators in the zone.

We’re working to make this history of MLFs more easily accessible to our clients – for instance, it’s being introduced as another set of data series into NEMreview v7, and also via the Trend Engine into ez2view (please call us on +61 7 3368 4064 if you want to speak with us about this process, referencing our internal job number TFS-10282). It’s currently queued up behind a couple of higher priority jobs.

(B) How are they calculated?

You can find more of the gory details about Marginal Loss Factors in the documentation linked to this page on the AEMO website. I just want to flag a few big factors:

| They are forward looking | Loss factors for each financial year are calculated and published by AEMO a couple months prior to the start of the financial year. They are sometimes updated during the year in the light of new data, or occasionally for corrections.

They are based on the expectation of what will happen in the year ahead, in terms of demand and dispatch patterns, and hence network flows and losses. Given that they are forward-looking, this naturally means that they will involve projections (complete with all the challenges that this entails). This means that there is not a perfect match between loss factors in the chart above and what actually happened in a given financial year, for instance. |

| They are Marginal | At all times of each day, in an electricity supply system there is electrical energy “lost” (i.e. converted to heat) in the delivery process. These losses vary as a function of energy injections, energy withdrawals, and the topology of flows.

In line with the fact that the pricing is set based on the marginal unit of energy (reference coming), losses are also attributed to connection points based on marginal units of energy. |

| They are calculated with respect to a Regional Reference Node (RRN) | Each region has its own Regional Reference Node (which is generally some substation in the capital city* representing, electrically, the center of that network). In simple terms, the closer you can be (electrically) to that Regional Reference Node, the lower your Marginal Losses.

* Tasmania’s RRN is in the north of the state, not in Hobart, because that’s where the center of the network is |

| They are periodically adjusted, but not dynamic | For all connection points within a region (i.e. for all generators, and all bulk supply points) a loss factor is fixed for a given financial year – but adjusted from one financial year to the next.

This approach was a compromise made in the market design process (>20 years ago) – between:

|

| Loss factors are set around unity | The MLF at the Regional Reference Node is (by definition) 1.0

The higher the marginal losses required to supply to/from the RRN from a generator/load, the further away from 1.0 is that loss factor. These loss factors do vary significantly from location to location, because the network supporting the NEM is “long and skinny” and our population is sparse. They also vary considerably from year to year, because large changes in the supply/demand balance locally (in relative terms) have a significant effect on losses. |

| They are supposed to provide a locational signal | For instance, historically Central Queensland has had a surplus of local supply (i.e. from Stanwell, Gladstone and Callide) compared with local demand (Rockhampton, Gladstone and the CQ mining regions). For this reason, the generators have been “penalized” with a loss factor below 1.0

In the same way, historically there has been a deficit of generation in Northern Queensland (mainly peaking plant) relative to demand (Cairns, Townsville, Mackay and associated mining loads). For this reason, energy users have been “penalized” with a loss factor above 1.0 However, it is important to remember that these loss factors are a function of both:

Hence, in simple terms, if there is a local surplus of supply over demand, and the location is a long way from the RRN, a developer should expect a hefty penalty in the form of the MLF. |

Please refer to the AEMO documentation for more detail. In particular on that page, refer to this link to the AEMO document “Treatment of Loss Factors in the NEM” form July 2012 (flagged as a particularly good reference by one of our early readers). Thanks!

(C) Who wears the risk?

With the near certainty that MLFs will vary considerably over the life of a new entrant generator locating in northern Queensland (or any location that has a relatively small local demand, and is a long way from the RRN), it should be clear that there is a significant risk to the generation deemed to be generated by the plant, which flows through to revenue (and also, I believe, to the registration of LGCs).

Hence all parties related to such a new entrant generator need to be conscious of this, and be “eyes wide open” in terms of who wears the risk:

1) If you are the project proponent and are able to get off-takers who agree to take delivery “at the station gate”, then you have successfully transferred that risk* over to the off-taker but at what cost?

I mean this both in terms of the price you might have had to agree with to get the other party to wear a risk they can do even less than you to control, and also in terms of the chance that you have found an off-taker that was not aware of the risk, and have burnt them (and perhaps your reputation) in the process.

This second consideration will perhaps more come to the fore as the influx of corporates seeking renewables-backed PPAs ramps up (e.g. the session yesterday I attended with nearly 100 attendees), where the other party might not be as fully aware of these sorts of risks.

2) If you are the project proponent that has some form of off-take arrangement at the RRN (more common, I would think), or have merchant exposure, you are still wearing the risk. What can you do to manage this?

* note that, even if you (as a project proponent) have transferred the risk relating to MLFs, you will probably not have been able to transfer the (separate) risk of congestion (felt increasingly by semi-scheduled plant in South Australia, and likely in northern Queensland and other parts in years to come) and also risks relating to negative prices (with perhaps the risk increasing due to the emerging “solar correlation penalty”). They are food for future posts.

Paul,

Under Q2 you say “In the chart above I have assembled monthly aggregate production from generators for which AEMO has data”; this doesn’t seem to hang together for the only chart in the article. Am I missing something or is there meant to be another chart

Sorry for inadvertent confusion, Shane

Only one chart intended!

Paul

Hi Paul and thank you.

Why would the developper that has signed a PPA with an off-taker care about negative prices? I understand that the newer ACT reverse auctions have a -$20/MWh threshold, but are you implying that this is also the case in many other PPAs?

For the earliest wind farms built in the NEM, the initial PPAs (i.e. primarily signed with retailers back then) might not have had negative price clauses as negative prices were not common at the time, so not forseen as a risk.

Most, if not all, PPAs signed in recent years have negative price carve-out clauses where the strike price does not apply, but instead the generator wears the risk.

Sorry to double post but could you please explain :”If you are the project proponent that has some form of off-take arrangement at the RRN […] you are still wearing the risk.”.

My flawed understanding is that MLFs scale the spot price the generator gets, not the output it sells. If I already have an offtaker at a fixed price and if MLFs don’t impact the volume I sell, why do I care about the MLFs?

Danton,

You note ‘My flawed understanding’, and it is indeed flawed – the output is scaled by the MLF to calculate the MWh notionally delivered at the RRN, and it is this number that is used in the vast majority of commercial transactions – such as:

1) For all wholesale energy purchased by AEMO in the spot market; and

2) In most of the PPAs contracted between generator and offtaker (there may be some offtakers who, for whatever reason, have agreed to take the MLF risk … but this would be rare); and

3) Even in terms of the LGCs registered each year for renewable generation.

All of this makes sense on the principle that the MLF reflects losses in getting the product to market.

Thanks.