Last night we posted about the likelihood of a tight supply/demand balance across SA and Victoria today (Thursday 18th January) and on Friday 19th January. It’s an evolving story today but (to hopefully make it clearer) I have posted separately about:

1) events pertaining to Thursday 18th January (article, and LINK TO COME); and

2) actual events and forecasts (as at 17:40 on Thursday) pertaining to Friday 19th January (in this post).

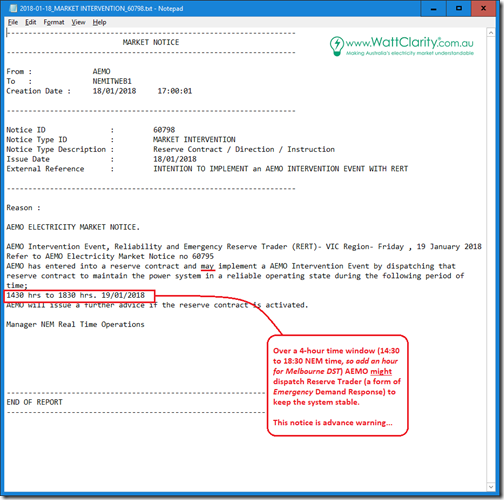

At 17:00 the AEMO issued this Market Notice, giving the market advanced warning that (if the situation does not improve by tomorrow) they might intervene in the market by dispatching the “Reserve Trader” to balance between supply and demand in Victoria (and, by close association, South Australia as well), with the market notice included here via NEM-Watch v10:

Reserve Trader is a grab-bag of emergency measures, including a particular (emergency) form of Demand Response incorporating prior capacity/availability payments in the lead up to expected events (such as a tight supply demand balance this summer).

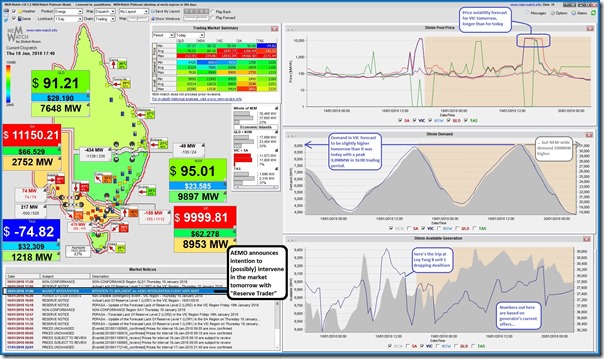

Here’s a current look (as at 17:40 dispatch interval) at AEMO’s “base case” P30 predispatch forecast for tomorrow, via NEM-Watch with the charts toggled to show “Trading” data:

If time permits, will add more later…

Why is the negative price in Tasmania associated with the high prices in the mainland?

I thought the link would cause prices in Tasmania to rise …

What you are doing is essentially applying logical thought and reason to a situation. The way things are done since AEMO stated has never been logical or even according to so called market forces. It is mish-mash undergraduate 101 economics, that is fundamentally flawed. Some things make some sense if you think of the workings of vested interest but not much.

Sorry to spoil a good conspiracy theory, Ken, but there are valid reasons why the prices separate. Too much to go into here, but to do with co-optimisation of 9 commodities (Energy + 8 x FCAS) across 5 regions simultaneously.